Global Online Insurance Market: By Product Type (Life Insurance and Non- Life/ General Insurance (Health Insurance, Vehicle Insurance, Property Insurance, Gadget Insurance, Business Insurance, Travel Insurance, Others Insurance); Insurance Type (New Registration and Renewal); Tenure (Less than 1 Yr., 1- 10 Yrs., 10- 20 Yrs., 20- 30 Yrs., and More than 30 Yrs.); Distribution Channel (Banks, Insurance Company, eMarketplaces); End Users (Individual and Commercial (Healthcare, Real Estate, Businesses, Others); Region—Market Forecast and Analysis for 2024–2032

- Last Updated: 22-May-2024 | | Report ID: AA0723519

Market Scenario

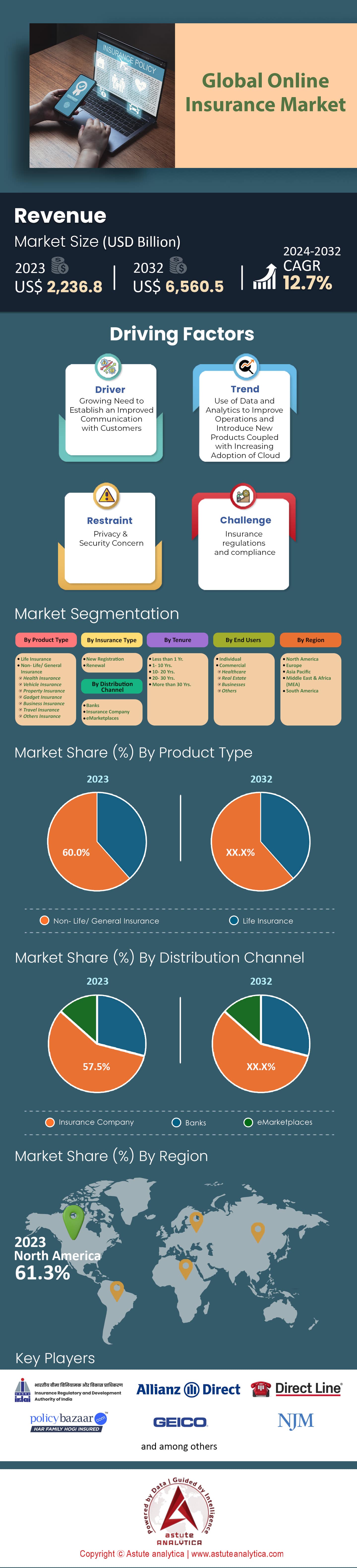

Global online insurance market was valued at US$ 2,236.8 billion in 2023 and is projected to reach a valuation of US$ 6,560.5 billion by 2032 at a CAGR of 12.7% during the forecast period 2024–2032.

The global online insurance market is witnessing a transformative phase with the shift towards digital platforms. The rise in digitalization across the globe is a significant driver in the growth of the online insurance industry. With the advent of mobile apps and AI technologies, consumers are finding it easier and more efficient to apply, manage, and claim their insurance online. These platforms not only offer convenience but also improve customer engagement with personalized services and instant support.

Online insurance platforms significantly reduce operational and administrative costs associated with traditional insurance systems. With less physical paperwork and more automated processes, online insurance providers are capable of passing these savings onto customers in the form of reduced premiums and better coverage. Additionally, online marketplaces have made it easier for customers to compare and choose the best-priced policies, thus fostering competition and better pricing for consumers.

There has been a noticeable shift in consumer behavior towards online services, driven by the need for convenience and faster service delivery in the global online insurance market. Millennials and Generation Z, in particular, prefer digital platforms due to their inherent affinity for technology. The ability to purchase insurance policies online, with a few simple clicks, has made the process more transparent and easily accessible, fueling market growth.

Online insurance companies are leveraging discounts to attract more customers. Heavy discounting on insurance premiums, multi-policy discounts, and promotional campaigns are some of the marketing strategies adopted by online insurers to sustain in this competitive market. These discounts are encouraging more customers to switch from traditional to online insurance services, thereby boosting market growth.

Several government bodies have initiated measures to promote digital insurance. For instance, the European Insurance and Occupational Pensions Authority (EIOPA) has been advocating for the adoption of Insurtech (Insurance + technology) to streamline the insurance industry. Moreover, trends such as peer-to-peer insurance, on-demand insurance, and usage-based insurance are gaining momentum in the online insurance market. These innovations are transforming the insurance landscape, making it more flexible and consumer-oriented.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Growing Integration of Advanced Technology into the Insurance Sector

The integration has given rise to an innovative subset of the industry known as Insurtech, which involves the application of technology innovations designed to enhance efficiency and competitiveness in the insurance industry. The onset of AI, machine learning, blockchain, and IoT technologies are offering unprecedented opportunities for online insurance providers to improve their services and attract more customers. These technologies have revolutionized the way insurers interact with their customers, making the process more personalized, efficient, and hassle-free.

Artificial Intelligence (AI) and machine learning algorithms are being used to process and analyze large volumes of data to generate insights that can help in risk assessment, policy pricing, fraud detection, and claim management. For instance, AI-powered chatbots are used to offer 24/7 customer support, providing instant responses and resolving queries, thereby significantly improving customer service and satisfaction in the global online insurance market.

The advent of blockchain technology is also playing a vital role in ensuring transparency and security in online insurance transactions. Blockchain's decentralized nature allows all transactions and data to be recorded securely and verifiably, reducing the chances of fraud. Moreover, the Internet of Things (IoT) is reshaping the insurance industry by providing real-time data. For example, in auto insurance, IoT devices like telematics allow insurers to track driving habits and usage, thereby enabling them to offer personalized and usage-based insurance policies.

Challenge: Data Security and Privacy Concerns

While the transition to online insurance offers numerous benefits such as convenience and cost-efficiency, it also presents significant challenges. The foremost among these is the concern for data security and privacy. Insurance companies store large amounts of sensitive customer information, making them prime targets for cyberattacks.

Data breaches not only result in financial losses but also severely damage the reputation of insurance providers, leading to a loss of trust among customers in the global online insurance market. Ensuring robust cybersecurity measures is a substantial challenge for insurers, as they must continually update their systems to counter evolving cyber threats.

Additionally, there's also the challenge of maintaining customer privacy. With increasing regulations like the EU's General Data Protection Regulation (GDPR), insurance companies must ensure that the collection, storage, and processing of customer data is done in compliance with these regulations. Violations can lead to heavy penalties and further loss of customer trust.

Trend: Rise of Peer-to-Peer (P2P) Insurance Models

Major emerging trend in the online insurance market is the rise of Peer-to-Peer (P2P) insurance models. P2P insurance is an innovative approach that directly connects a group of individuals with similar insurance needs, allowing them to pool their resources and share the risk.

This trend is primarily driven by technology and the increasing consumer desire for transparency, simplicity, and fairness in their insurance coverage. Traditional insurance companies operate on a model where premiums are collected from policyholders, claims are paid out, and any remaining funds are considered as profit. However, consumers often find this system lacking in transparency, and the impersonal nature of large insurance companies can lead to mistrust.

In contrast, P2P insurance leverages the power of digital platforms to bring together a group of policyholders with similar insurance needs. Each member contributes to a shared pool, and claims are paid out from this collective fund. At the end of the policy period, if there are remaining funds in the pool, they can be returned to the policyholders or rolled over to the next period. This model not only promotes transparency and trust but also incentivizes members to minimize unnecessary claims, leading to lower costs in the online insurance market.

P2P insurance models have been particularly popular in niche markets and for specific types of insurance coverage. Companies like Lemonade, Guevara, and Friendsurance have achieved success in this emerging market by delivering more customer-centric insurance experiences.

Segmental Analysis

By Product Type

The global online insurance market can be segmented by product type, with general insurance holding over 60% revenue share. It is projected to grow at a CAGR of 12.47% during the forecast period. General insurance includes various policies like automobile, property, liability, and travel insurance. The growth of this segment is driven by the increasing adoption of digital platforms, rising awareness about insurance, and the flexibility offered by online policies.

The convenience of comparing policies, obtaining quotes, and making purchases online has contributed to the segment's dominance. As technology advances and digital transactions become more popular, the online general insurance market is expected to thrive.

By Insurance Type

The renewal segment holds over 67% revenue share in the global online insurance market and is projected to grow at a CAGR of 12.93%. This segment refers to the renewal of insurance policies for subsequent coverage periods. Factors contributing to its dominance include the convenience of online renewal processes, customer loyalty, and the stability of insurance contracts.

As individuals and businesses renew their policies to maintain continuous coverage, the online renewal segment benefits from their trust and familiarity. Increasing awareness and improving digital capabilities will drive the demand for online policy renewals, supporting the growth of this segment.

By Distribution Channel

The insurance companies' segment holds over 57% revenue share in the global online insurance market and is projected to grow at a CAGR of 12.93%. This segment involves direct distribution of insurance products through the online platforms of insurance companies. The convenience, transparency, and customization options offered by these platforms have attracted customers. By eliminating intermediaries, customers can interact directly with the insurance company, resulting in streamlined processes.

User-friendly online platforms and comprehensive customer support further enhance the appeal of this segment. As insurance companies invest in technology and customer-centric enhancements, the insurance companies' segment is expected to experience sustained growth.

By End User

The individual segment in the global online insurance market is projected to grow at a CAGR of 12.82%. This segment includes individual customers seeking personal insurance coverage such as life, health, motor, and travel insurance. The increasing awareness of insurance benefits and the convenience of online platforms have fueled the demand for individual insurance. Online platforms allow individuals to research, compare, and purchase policies at their convenience.

The flexibility and customization options offered by online insurance platforms have also attracted individual customers. With the growing adoption of smartphones and online payment systems, more individuals are expected to access and purchase insurance products online. As insurance companies focus on enhancing the digital customer experience, the individual segment is poised for significant growth.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

The North America online insurance market exhibits significant potential for growth and development due to several key factors. This analysis explores the regional dynamics of the market, considering internet penetration, economic development, digital adoption, and the robust insurance industry.

North America boasts a high level of internet penetration, with approximately 90% of the population having access to the internet as of 2021. This widespread connectivity enables insurers to reach a vast number of potential customers online. With a large portion of the population actively engaged in online activities, such as research, shopping, and communication, the online insurance market has a favorable environment for expansion and customer acquisition.

The United States and Canada, the two primary economies in North America, demonstrate well-developed economic systems. The population in these countries possesses the financial resources necessary to consider insurance purchases. The stability and affluence of the region provide a fertile ground for insurance companies to tap into a substantial market for online insurance products and services. This economic strength supports the potential growth and profitability of the online insurance sector.

North America showcases a high rate of digital adoption among consumers. In the United States and Canada, many individuals are comfortable conducting various transactions online, including purchasing insurance. The population's familiarity with digital platforms and willingness to engage in online activities presents a favorable climate for the online insurance market. Consumers are increasingly seeking convenient, user-friendly, and accessible solutions, making online insurance a compelling option for tech-savvy individuals.

The insurance industry in North America is well-established, mature, and highly competitive. Numerous insurance companies operating in the region have recognized the potential of online platforms and have made substantial investments to enhance their online capabilities. These efforts aim to effectively reach and serve customers in a rapidly evolving digital landscape. The competitive nature of the market encourages innovation, customer-centric approaches, and the provision of personalized insurance solutions through online channels.

Top Players in the Global Online Insurance Market

- Aegon Life Insurance Company Limited

- Allianz Direct

- Direct Line

- GEICO

- Girnar Insurance Brokers Pvt. Ltd. (InsuranceDekho)

- NJM Insurance

- Policybazaar

- Progressive Casualty Insurance Company

- Other Prominent Players

Market Segmentation Overview:

By Product Type

- Life Insurance

- Non- Life/ General Insurance

- Health Insurance

- Vehicle Insurance

- Property Insurance

- Gadget Insurance

- Business Insurance

- Travel Insurance

- Others Insurance

By Insurance Type

- New Registration

- Renewal

By Tenure

- Less than 1 Yr.

- 10 Yrs.

- 10- 20 Yrs.

- 20- 30 Yrs.

- More than 30 Yrs.

By Distribution Channel

- Banks

- Insurance Company

- eMarketplaces

By End Users

- Individual

- Commercial

- Healthcare

- Real Estate

- Businesses

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)