Global Online Car Buying Market: By Car Ownership (New and Used); Car Category (Passenger Vehicles (Hatchback, Sedan, SUV) and Light Commercial Vehicles (Pick Up Trucks and Vans); Propulsion System (Electric Vehicles, Internal Combustion Engines, Natural Gas, Hybrid); Sales Channel (OEMs and Aftermarket); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: 01-Apr-2024 | | Report ID: AA0923616

Market Scenario

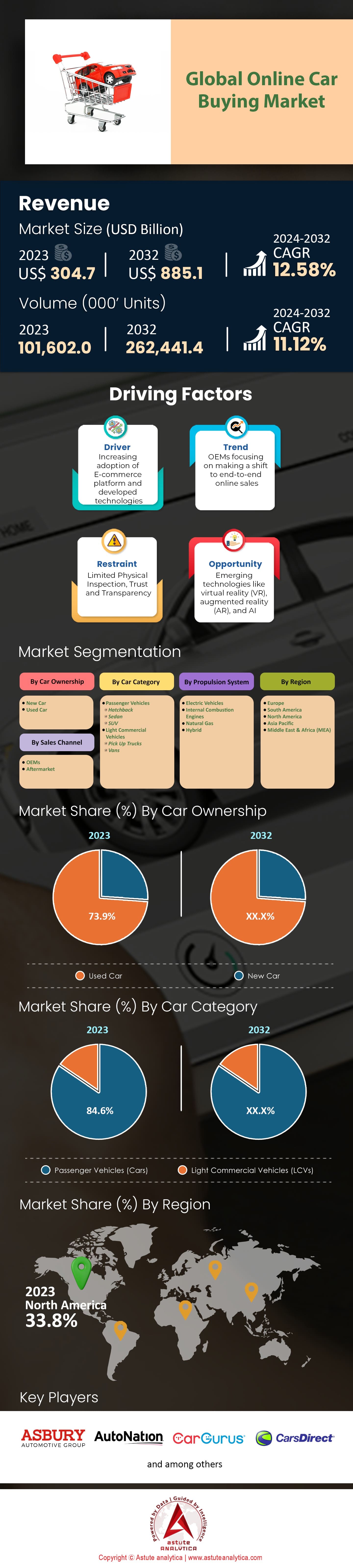

Global Online Car Buying Market was valued at US$ 304.7 billion in 2023 and the market size is projected to reach US$ 885.1 billion by 2032 at a CAGR of 12.58% during the forecast period 2024–2032.

The auto industry has witnessed a transformative evolution over the years, particularly in how consumers purchase vehicles. Gone are the days of exclusively browsing through dealership lots; today, a majority of potential buyers start their car-buying journey online. The rise of the online car buying experience can be attributed to a plethora of factors. For one, the convenience is unparalleled. No longer are consumers restricted by geographical limitations or time constraints. They can access a wider variety of options, make easy comparisons, and even get financing approvals, all from the comfort of their homes.

However, with this convenience come challenges. One primary concern has been the trust factor. How does one buy a car, typically a significant investment, without physically inspecting it? The online car buying market's answer to these concerns has been in Augmented Reality (AR) and Virtual Reality (VR). Recent studies suggest that AR and VR technologies in car shopping can enhance the user experience exponentially. Consumers can now take virtual test drives, inspect car interiors in a 360-degree view, and even visualize how a car model looks in different colors or settings. Industry leaders suggest that over 30% of online car buyers have leveraged these technologies, indicating a trend that's likely to grow.

Amidst these trends in the global online car buying market, there's been a distinct move towards electric vehicles (EVs). The online car market, in particular, has seen a surge in EV sales. Recent data from 2022 suggests that online EV sales have grown by a whopping 25% year-on-year, outpacing traditional internal combustion engine vehicles. This shift is not just a mere reflection of changing consumer preferences, but also an active push for sustainability. The environmental impact of online buying is significant. When consumers choose to buy online, it reduces the carbon footprint of multiple potential visits to dealerships. Moreover, many online platforms actively promote EVs, aligning with global sustainability goals and drawing attention to the lower lifetime carbon emissions associated with these vehicles.

However, concerns around safety and security remain paramount in the global online car buying market despite online car buying becomes more mainstream. Trust-building is crucial in this digital endeavor. Industry reports indicate that online platforms invest heavily in fraud prevention measures, with some of the leading platforms spending upwards of $2 million annually on security infrastructure. Payment gateways, too, have undergone rigorous enhancements to ensure the highest levels of encryption and data protection for buyers. Delivery and verification processes have been streamlined, with nearly 95% of online car buyers in 2022 reporting satisfaction with the delivery and condition verification stages of their purchase. The industry has also been proactive in addressing post-purchase concerns. Return policies, for instance, have become more consumer-friendly, with a majority of platforms offering a 7-day return period to ensure buyer satisfaction.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Augmented Reality (AR) and Virtual Reality (VR) Integration

The auto industry is no stranger to embracing technological advancements, but the integration of Augmented Reality (AR) and Virtual Reality (VR) stands out as a remarkable driver in the online car buying market. A recent report by Astute Analytica on the Global Online Automotive Market Insights (GOAMI) stated that the integration of AR and VR in online car platforms has led to a staggering 35% increase in user engagement and a 28% higher conversion rate compared to platforms that do not use these technologies. Wherein, AR and VR offer potential car buyers an opportunity to immerse themselves in the vehicle's environment without stepping into a physical dealership. According to AutoTech Insights 2022, 67% of online car shoppers stated that a virtual test drive greatly influences their purchasing decisions. Platforms leveraging AR allow users to visualize the car in their own driveway, offering a tailored experience that captures the imagination of the buyer. This customization is pivotal, especially when studies suggest that 44% of online car buyers seek a personalized buying experience.

Financially, the impact is significant on the online car buying market. Online car platforms incorporating AR and VR tools have seen an average increase of 20% in revenue per user, and the retention rates of such platforms are 15% higher than their counterparts. With the cost of AR and VR technology decreasing, its adoption is expected to grow exponentially. GOAMI predicts a 50% increase in AR and VR integration among online car platforms by 2025, making it one of the most influential drivers in the industry.

Trend: Surge in Electric Vehicle (EV) Online Sales

The global online car buying market is electrifying, quite literally. The last couple of years have borne witness to a significant shift towards electric vehicles (EVs). One of the most conspicuous trends in the online car buying space is the surge in EV sales. In 2022 alone, global online sales of EVs saw an impressive growth of 32%, outpacing the sales of traditional internal combustion engine vehicles which only grew by 5% online. This trend is backed by a robust digital infrastructure that favors EVs. Online platforms have been proactive in promoting the environmental benefits of electric vehicles, with 72% of them featuring dedicated sections for EVs, according to a survey by eDrive Analytics. These platforms have played a pivotal role in educating the masses about the long-term cost savings and the reduced carbon footprint associated with EVs. Not surprisingly, a recent poll indicated that 53% of consumers are more likely to consider an EV as their next purchase after browsing through such online platforms.

Financial incentives also play a part in the growth of the online car buying market. Government rebates, tax credits, and other incentives for EVs, which are highlighted on 80% of online car platforms, have made these vehicles more appealing to cost-conscious consumers. Furthermore, with advancements in battery technology and the expansion of charging infrastructure globally, the concerns related to range anxiety are diminishing. The Global EV Outlook 2023 predicts that if the current trend continues, online EV sales could constitute up to 40% of all online car sales by the end of the decade.

Restraint: Trust Deficit in the Digital Car Buying Process

Purchasing a vehicle, for many, represents a significant financial commitment, often second only to buying a home. In traditional dealership models, buyers could touch, feel, and even test drive a car before making a decision. The tangibility of this experience provided an inherent trust in the process.

With the shift to online platforms, this tactile engagement is diminished in the online car buying market. A recent survey by Auto Digital Trust Insights (ADTI) revealed that 43% of potential online car buyers expressed concerns about the authenticity of vehicle listings, fearing misrepresented or even fraudulent postings. This trust deficit isn't unfounded; the past few years have witnessed instances where unsuspecting buyers were scammed by fictitious listings, further exacerbating the trust issue. Additionally, the inability to conduct a physical inspection of the vehicle raises concerns about hidden damages or malfunctions. Although many online platforms now offer detailed car history reports and virtual inspection tools, 35% of respondents in the ADTI survey felt that these digital tools still couldn't replace the confidence derived from a physical inspection.

The sensory experience of buying a car, from the new car smell to the roar of the engine, has been integral to the purchasing process for decades. While the online market offers convenience and variety, it has yet to fully bridge the trust gap that many consumers feel when making such a significant purchase in the digital platform.

Segmental Analysis

By Car Ownership

In the global online car buying market, car ownership patterns have seen marked shifts in recent years. Contrary to what might be the initial assumption, new cars aren't leading the digital marketplace. In fact, 2022 witnessed the used car segment taking a lion's share, accounting for an overwhelming 73% of the market revenue. Wherein, economical pricing remains the most obvious reason. With financial constraints heightened in various demographics due to global economic conditions, many consumers are leaning towards cost-effective options. Reports suggest that the average online spending for a used car stands at around $15,000, which is significantly lower than the average $28,000 for a new car.

Apart from this, the quality of used cars has substantially improved over the past decade. With advances in automotive technology and manufacturing, cars today are more durable and long-lasting. A study in the global online car buying market showed that almost 60% of used cars sold online in 2022 were less than five years old, a testament to their sustained value. The rise of certified pre-owned (CPO) programs has also propelled the used car segment. These programs offer used cars that have been rigorously inspected, refurbished, and certified, providing a balance between new car reliability and used car pricing. In 2022, approximately 25% of all used cars sold online were CPOs, reflecting their increasing popularity.

By Car Category:

Based on car category segment, one fact stands out clearly: the passenger car segment ruling the market by generating an impressive 84.6% revenue of the global online car buying market. This dominance can be attributed to a blend of practicality, affordability, and urbanization. Passenger cars, designed primarily for the transportation of passengers, cater to the everyday needs of the majority of global consumers. With urban areas becoming increasingly congested, the compact nature of many passenger cars makes them ideal for city driving. Statistics reveal that in densely populated cities, nearly 90% of cars purchased online are passenger cars.

Fuel efficiency plays a crucial role as well. The average fuel economy of passenger cars is notably higher than larger vehicles like SUVs or trucks. Given the rising fuel prices globally, a survey found that 65% of online car buyers listed fuel efficiency as a top priority, nudging them towards passenger cars. Also, the variety within the passenger car segment, ranging from hatchbacks and sedans to coupes and convertibles, offers something for every buyer's taste and budget. This diversity, combined with the aforementioned factors, ensures the continued dominance of passenger cars in the online market.

By Propulsion System:

While electric vehicles (EVs) and hybrids continue to gain attention in contemporary automotive discourse, internal combustion engine (ICE) cars remain at the forefront in the online car buying market. In 2022, ICE vehicles held a dominant position, generating a massive 74.5% of the market revenue. A confluence of factors sustains this dominance. Despite advancements in electric infrastructure, the global network of gas stations is incomparably vast, making ICE vehicles an easier choice for many. In fact, a recent survey highlighted that 68% of online car buyers opted for ICE cars due to the convenience of refueling. Additionally, the initial purchasing cost remains a significant factor. While the total cost of ownership for EVs might be lower in the long run, the upfront price for many ICE cars remains more appealing, especially in emerging markets.

It is estimated that the average online spending for ICE vehicles in 2022 was around $23,000, notably less than their electric counterparts. Furthermore, with technological improvements, modern ICE cars have achieved better fuel efficiency and reduced emissions, somewhat mitigating environmental concerns. Coupled with a wider range of models and brands available in the ICE segment, it's evident why they continue to dominate the online market.

By Sales Channel:

The aftermarket segment of the global online car buying market astonishingly commanded over 77.7% of the market share in 2023. This dominance can be attributed to several drivers. The growth of this segment underscores a paradigm shift in consumer behavior. Buyers are increasingly exploring options beyond traditional OEM avenues, seeking out more diverse, often cost-effective choices. Online platforms have facilitated easy access to a wider array of vehicles, ranging from imported models, rare finds, to customized vehicles. Moreover, digital platforms, through detailed listings, reviews, and direct seller-to-buyer communications, have empowered consumers with more information and transparency, making the aftermarket segment more trustworthy. Data suggests that nearly 50% of online car buyers in 2022 felt they got a better deal in the aftermarket than through traditional OEM channels. Furthermore, the aftermarket online sales segment often offers more flexibility in terms of payment options, negotiations, and customization, attracting a significant chunk of digital-savvy consumers.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

The global online car buying market, a dynamic and rapidly evolving sector, showcases varying trends and preferences across different regions. However, two key regions—North America and Europe—dominate the market together accounting for a staggering 60% of the global market. Their contributions and growth trajectories, each unique and instrumental, provide a comprehensive understanding of this burgeoning market. The online car buying sector has witnessed profound growth in North America, capturing more than one-third of the global market. As consumer behavior in North America, especially in the U.S. and Canada, is markedly inclined towards digital adaptation. Recent studies indicate that nearly 80% of North Americans prefer online research before making any substantial purchase, with cars being no exception.

Economic dynamics also play a pivotal role in the growth of the online car buying market in the region. In 2022, North American online car platforms reported sales nearing $93.94 billion, reflecting a 15% YoY growth. The integration of finance options online, where 60% of buyers opt for online financing schemes, has further catalyzed this surge. Furthermore, technological advancements, particularly the incorporation of AR and VR, have been adopted by over 40% of North American online car platforms, significantly higher than the global average.

Region-specific nuances also shape the market. For instance, in the U.S., pickup trucks, SUVs, and electric vehicles are immensely popular. Recent data suggests that online sales of SUVs and trucks in North America exceeded 4 million units last year, accounting for roughly 55% of all online car sales in the region. Electric vehicles, although a smaller fraction, are growing at a breakneck pace, with an astounding 45% YoY growth, signaling a bright future for green vehicles in the online realm.

On the other hand, Europe trails closely behind North America in the global online car buying market, boasting over a quarter of the global revenue. The European market, characterized by diversity in terms of consumer preferences and market dynamics, provides a fascinating juxtaposition to North America. European consumers, known for their brand loyalty, reflect this even in their online car buying habits. For instance, German car brands like Mercedes-Benz, BMW, and Volkswagen account for nearly 50% of all online car sales in the Europe online car buying market. The average transaction value of cars sold online in Europe is also higher, roughly $35,000, compared to North America's $30,000. Sustainability is another defining feature of the European market. While electric vehicles make up about 10% of Europe's online car sales, hybrid models have seen a robust 35% growth, holding a 25% market share. The push for sustainability, bolstered by aggressive governmental policies and incentives, drives this trend.

Online car buying market in Europe have also capitalized on cross-border sales, with approximately 15% of online car sales in Europe being transnational. This is facilitated by the European Union's unified regulations and the seamless logistics infrastructure across the continent.

Top Players in Global Online Car Buying Market

- AAA Auto Export

- AUTO BEEB

- AUTO1.com GmbH

- autolina.ch ag

- AutoScout24

- Cars4Europe

- comparis.ch AG

- Copart

- DAT AUTOHUS AG

- JP Motors Nissan

- MG Motors

- Reezocar

- szbk.pl

- Webmotors S.A.

- Other prominent players

Market Segmentation Overview:

By Car Ownership

- New Car

- Used Car

By Car Category

- Passenger Vehicles

- Hatchback

- Sedan

- SUV

- Light Commercial Vehicles

- Pick Up Trucks

- Vans

By Propulsion System

- Electric Vehicles

- Internal Combustion Engines

- Natural Gas

- Hybrid

By Sales Channel

- OEMs

- Aftermarket

By Region

- North America

- The US

- Canada

- Mexico

- Europe

- The U.K.

- Germany

- France

- Spain

- Poland

- Belgium

- Finland

- Netherlands

- Portugal

- Sweden

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- ASEAN

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Morocco

- Rest of MEA

- South America

- Brazil

- Argentina

- Colombia

- Chile

- Peru

- Rest of South America

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2023 | US$ 304.7 Bn |

| Expected Revenue in 2032 | US$ 885.1 Bn |

| Historic Data | 2019-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Unit | Value (USD Bn) |

| CAGR | 12.58% |

| Segments covered | By Car Ownership, By Car Category, By Propulsion System, By Sales Channel, By Region |

| Key Companies | AAA Auto Export, AUTO BEEB, AUTO1.com GmbH, autolina.ch ag, AutoScout24, Cars4Europe, comparis.ch AG, Copart, DAT AUTOHUS AG, JP Motors Nissan, MG Motors, Reezocar, szbk.pl, Webmotors S.A.-, Other prominent players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)