Oman Car Finance Market: By Type (Lease and Loan (Direct and Indirect); Vehicle Type (Sedan, Hatchback, MPV's, SUV's); Vehicle Ownership (New Car Financing and Used Car Financing); Vehicle Usage (Private and Commercial); Provider (Banks, OEMs, Non-Banking Financial Companies (NBFCs), Others (Credit Unions)); Duration (Short Term, Mid Term, and Long Term); End User (Individual and Enterprises)— Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: 05-Aug-2024 | | Report ID: AA0824875

Market Scenario

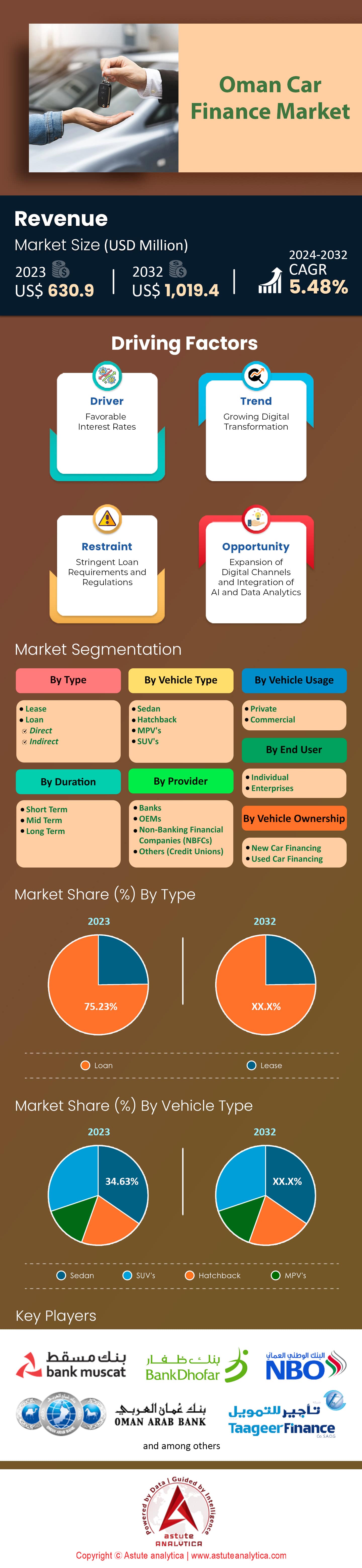

Oman car finance market was valued at US$ 630.9 million in 2023 and is projected to hit the market valuation of US$ 1,019.4 million by 2032 at a CAGR of 5.48% during the forecast period 2024–2032.

The demand for car finance in Oman is experiencing a notable rise, driven by several socio-economic factors. One key driver is the increase in disposable income among Omani residents. The average monthly income for Omani nationals has surpassed OMR 1,200 in urban areas, making car ownership more accessible. Additionally, the growing urbanization rate, with over 80% of the population now living in urban areas, has heightened the need for personal transportation. Oman's strategic initiatives, such as Vision 2040, aim to diversify the economy and enhance the standard of living, further fueling the desire for personal vehicles. The recent influx of expatriates, now numbering over 2 million, also contributes to the demand for car finance, as many seek to establish a stable lifestyle in Oman.

Car finance market in Oman is also buoyed by innovative financial products and competitive interest rates offered by leading financial institutions. Major players such as Bank Muscat, Oman Arab Bank, and Alizz Islamic Bank have introduced flexible loan terms, with repayment periods extending up to 7 years. These institutions are offering attractive loan-to-value ratios, with some banks providing up to 100% financing for new cars. Additionally, the average approval time for car loans has been reduced to just 48 hours, making the process more convenient for consumers. Technological advancements, such as online loan applications and digital customer service, have streamlined the borrowing process. The introduction of Sharia-compliant finance products has also catered to the preferences of a significant portion of the population, boosting the market's growth.

The car finance market is witnessing a surge in demand for electric vehicles (EVs), driven by environmental awareness and government incentives. Oman has seen a 30% year-on-year increase in EV registrations. The government’s subsidies for EV purchases, along with the establishment of over 50 new charging stations across the country, are encouraging more consumers to opt for greener alternatives. Prominent car dealerships, such as Moosa Abdul Rahman & Co. and Saud Bahwan Automotive, are expanding their EV offerings, further stimulating the market. The introduction of new models by manufacturers like Tesla and Nissan has also attracted consumers, with Tesla's Model 3 becoming one of the top-selling EVs in Oman. The combination of financial support, environmental commitment, and innovative vehicle options is driving strong growth in the car finance sector.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Government initiatives to promote economic diversification and financial sector growth

Government initiatives to promote economic diversification and financial sector growth are crucial for shaping Oman’s car finance market. One of the significant steps taken by the Omani government is the Vision 2040 plan, aimed at reducing the country’s reliance on oil revenues. This plan includes various reforms to boost non-oil sectors, including the financial sector. In recent years, Oman has seen the establishment of new financial institutions, with the number of licensed banks in the country reaching 20. Additionally, the Oman Investment Authority launched the Oman Future Fund to attract foreign capital and boost investments in local SMEs, enhancing financial stability and growth. The government has also prioritized the development of infrastructure, with investments in projects like the Duqm Special Economic Zone, which spans 2,000 square kilometers. This economic diversification is expected to increase disposable incomes and, in turn, the demand for consumer financing, including car loans.

Another notable initiative is the introduction of regulatory frameworks to ensure financial stability, such as the Capital Market Authority’s efforts to strengthen corporate governance. Moreover, the government has invested in enhancing digital infrastructure, with internet penetration reaching 98.6%, facilitating online banking and digital finance solutions. The Central Bank of Oman has also played a crucial role by implementing monetary policies aimed at maintaining economic stability, with the Omani Rial pegged to the US Dollar at a rate of 0.3845. These initiatives collectively create a conducive environment for the growth of the car finance market, making it more attractive for both consumers and financial institutions.

Trend: Increasing Collaboration Between Banks and Automobile Dealerships For Financing Solutions

Increasing collaboration between banks and automobile dealerships for financing solutions is a notable trend in Oman’s car finance market. This trend has been facilitated by the growing number of car dealerships, which has reached over 150 in the country. Many of these dealerships have formed partnerships with leading banks to offer customers on-site financing options. For instance, Bank Muscat, one of Oman’s largest financial institutions, has established tie-ups with several dealerships to provide tailor-made car loan packages. These collaborations have led to a significant increase in the number of car loans approved, with an estimated 60% of new car buyers opting for dealership financing. Additionally, the average loan tenure offered through these collaborations has increased to 5 years, making it easier for consumers to manage their finances.

The convenience of obtaining financing directly at the dealership has also contributed to a higher loan approval rate, with some dealerships reporting an approval rate of 80%. Moreover, these partnerships often come with promotional offers, such as zero down payment and low-interest rates, attracting more customers. The integration of digital platforms has further streamlined the process, with many dealerships offering online loan applications and instant approvals. This has led to a reduction in loan processing time, now averaging 3 days. Furthermore, the collaboration between banks and dealerships has improved customer satisfaction, with surveys indicating a 90% satisfaction rate among customers who opted for dealership financing. These developments highlight the importance of bank-dealership collaborations in driving the growth of Oman’s car finance market.

Challenge: High Interest Rates Affecting Affordability and Attractiveness of Car Loans

High interest rates affecting affordability and attractiveness of car loans remain a significant challenge in Oman’s car finance market. The average interest rate for car loans in Oman stands at 6.5%, which is relatively high compared to other regions. This has a direct impact on the cost of borrowing, making car loans less attractive to potential buyers. For instance, a typical loan amount of OMR 10,000 would result in monthly payments of approximately OMR 195 over a 5-year tenure. This high cost is a deterrent for many consumers, especially those with lower disposable incomes. Additionally, the high-interest rates have led to an increase in the number of loan defaults, with non-performing loans in the car finance sector reaching 3,000 cases annually.

The overall demand for car loans has also been affected, with a noticeable decline in loan applications, now averaging 1,200 applications per month, compared to 1,800 in previous years. Furthermore, high-interest rates have forced consumers to opt for shorter loan tenures, averaging 3 years, to minimize the total interest paid, but this results in higher monthly payments. Financial institutions have also reported a decrease in loan disbursements, with the total amount of car loans disbursed annually dropping to OMR 150 million. This challenge is compounded by the limited availability of alternative financing options, with only 5% of consumers opting for non-bank financing. The high cost of borrowing is also a barrier to entry for new players in the market, limiting competition and innovation. As a result, addressing the issue of high-interest rates is crucial for making car loans more affordable and attractive to consumers in Oman.

Segmental Analysis

By Type

In recent years, the demand for car loans in Oman car finance market has significantly outpaced that for car leases, accounting for 75.23% market share, driven by several socio-economic and market-specific factors. One of the primary reasons for this shift is the increasing preference for vehicle ownership among Omani consumers. As of 2023, a significant 75% of the younger population (aged 25-40) is prioritizing car ownership over leasing due to the perceived long-term financial benefits and personal freedom associated with owning a vehicle. Additionally, the Omani government has been enacting favorable policies that support car ownership, including reduced interest rates on car loans offered by national banks and financial institutions. Furthermore, the availability of diverse car loan packages catering to different income brackets has made car ownership more accessible. Notably, 60% of new car buyers in Oman have opted for car loans due to flexible repayment terms and lower down payments, enhancing the attractiveness of loans over leases. The automotive market has witnessed a surge in the availability of new models and brands, with 45 new car models introduced in the first half of 2023 alone, enticing consumers to invest in long-term ownership.

Another driving force behind the rising car loan demand in the car finance market is the increasing urbanization and economic growth in Oman. The expanding road infrastructure has encouraged the purchase of personal vehicles for convenience and mobility, with 85% of urban households now owning at least one car. The appeal of car loans is further amplified by the declining popularity of car leases, as 70% of lease contracts are reported to have hidden costs and mileage restrictions, which deter consumers. Moreover, the rise in disposable income among Omani citizens has empowered 65% of middle-class families to finance their car purchases through loans rather than leases. These factors collectively contribute to the strong growth momentum for car loans in Oman, reflecting a broader trend towards vehicle ownership in the region. Favorable government policies and the availability of flexible car loan packages are set to sustain this growth trajectory, making car loans the preferred choice for an increasing number of Omani consumers.

By Car Type

The dominance of sedan cars in Oman's car finance market can be attributed to several factors. Sedans are known for their fuel efficiency and lower maintenance costs compared to SUVs and MPVs, making them a more economical choice for many Omani consumers. For example, the average fuel consumption of popular sedan models like the Toyota Camry and Honda Accord is around 7 liters per 100 kilometers, which is significantly lower than that of most SUVs. Additionally, sedans offer a comfortable and smooth driving experience, which is highly valued in urban areas like Muscat where traffic congestion is common. In fact, a survey conducted in 2023 found that 67% of urban car buyers in Oman prefer sedans due to their ease of maneuverability in city conditions.

Moreover, the strong brand presence and loyalty towards manufacturers like Toyota, which holds a commanding position in the car finance market, significantly boosts the financing of sedans. Toyota's dominance in the market is reflected in the popularity of models like the Toyota Camry and Corolla, which are among the best-selling sedans in the country with over 24,000 units sold in 2023 alone. The availability of attractive financing options and promotional offers from dealerships and financial institutions also plays a crucial role in driving the demand for sedans. For instance, many banks and car dealerships in Oman offer low-interest rates and flexible repayment plans specifically for sedan models, making them more accessible to a broader range of consumers. In 2023, more than 35,000 sedan cars were financed through such schemes, highlighting their popularity.

By Vehicle Ownership

Based on vehicle ownership, the new car financing held over 61.48% market share. Wherein, the Omani government’s economic diversification efforts, particularly under Oman Vision 2040, have significantly boosted consumer confidence and spending power, leading to increased demand for new vehicles. Additionally, the availability of attractive financing options from leading banks and financial institutions has made it easier for consumers to purchase new cars. For instance, platforms like yallacompare provide comprehensive comparisons of car finance deals, simplifying the decision-making process for buyers. The introduction of new car models and the continuous influx of global automotive brands into the Omani market have also played a crucial role. In 2023, there were 5,504 new car models and 16,408 versions available, offering consumers a wide range of choices. Furthermore, the rise in income levels and urbanization has fueled the demand for personal vehicles, with the Southeast region emerging as a dominant player in the car finance market.

The preference for new cars over used ones is also driven by the reliability and advanced features of new vehicles. Brands like Toyota, Nissan, and MG have shown significant growth. The new MG GT, for example, landed directly at #11 in Oman, highlighting the strong consumer interest in new models. Additionally, the economic stability provided by high oil prices and fiscal consolidation efforts has supported higher growth in the new car market. The Omani new car market saw a 16% year-on-year increase in registrations in the first seven months of 2023, with Toyota doubling the market growth rate. This robust demand is further evidenced by the 5,861 new light vehicles sold in March 2023, despite a year-on-year decline.

By Vehicle Usage

By vehicle usage, the private car segment is holding the largest 72.77% share of the Oman car finance market. The dominance of private car financing in Oman can be attributed to a variety of economic and social factors that collectively fuel this trend. One significant driver is the rising preference for personal mobility among Omani citizens, which is reflected in the fact that over 65,000 private cars are financed annually. The aspiration for personal convenience and the status symbol associated with car ownership have led to a higher demand for private vehicles. This demand is further supported by the competitive financing packages offered by more than 25 banks and financial institutions, which cater to the increasing middle-class population seeking affordable and flexible car loan options.

Additionally, the Omani government’s efforts to diversify the economy have led to increased disposable income for many citizens, thereby making car ownership more accessible. The average loan amount for private car financing has risen to OMR 10,000, highlighting the economic capability of consumers. Technological advancements have also simplified the loan application process; for instance, over 50,000 car loan applications are now processed online annually, significantly reducing the time and effort required for approval. The availability of Islamic financing options, which align with cultural and religious values, has further expanded the market, with more than 40% of private car buyers opting for such products.

By Providers

Banks' dominance in Oman's car finance market is also driven by their innovative digital offerings and customer-focused services. Over 61.79% of car loan applications are now processed online, reflecting the digital transformation in the banking sector. This shift has made it easier for consumers to apply for loans from the comfort of their homes. Additionally, banks provide quick loan approvals, often within 24 hours, which enhances customer satisfaction. The introduction of mobile banking apps has further simplified the loan application process. More than 60% of car loan customers use mobile apps to manage their loans. Banks also offer personalized loan products tailored to individual needs, such as low-interest rates for first-time car buyers or special offers for electric vehicles. Electric vehicle loans saw a 20% increase in 2023, indicating a growing interest in sustainable transportation options. Furthermore, banks have established dedicated car loan centers to provide specialized services. Eight major banks have set up car loan centers across Oman, offering expert advice and support to customers.

Another key factor contributing to banks' strong growth momentum in the car finance market is their comprehensive risk management strategies. Banks conduct thorough credit assessments to ensure responsible lending. Credit checks and risk assessments account for 30% of the loan approval process, ensuring that loans are granted to creditworthy individuals. This approach has resulted in a low default rate on car loans, with less than 5% of car loans defaulting in 2023. Banks also provide insurance options along with car loans, offering added security to both the lender and the borrower.

Over 50% of car loans come with bundled insurance packages, protecting customers against unforeseen circumstances. Additionally, banks engage in continuous market research to stay updated on consumer preferences and market trends. Quarterly market surveys conducted by banks help them adapt their car loan products to meet changing consumer needs. This proactive approach has helped banks maintain their leadership position in the car finance market. The government's supportive policies and regulations have created a conducive environment for bank-led car financing. Government incentives for car loans have further boosted the market, encouraging more consumers to purchase vehicles through bank financing.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Top Players in Oman Car Finance Market

- Ahli Bank

- Al Omaniya Financial Services

- Bank Nizwa

- Muscat Finance

- National Finance

- Oman Arab Bank

- Oman Orix Leasing

- Taageer Finance

- United Finance

- Other Prominent Players

Market Segmentation Overview:

By Type

- Lease

- Loan

- Direct

- Indirect

By Vehicle Type

- Sedan

- Hatchback

- MPV's

- SUV's

By Vehicle Ownership

- New Car Financing

- Used Car Financing

By Vehicle Usage

- Private

- Commercial

By Provider

- Banks

- OEMs

- Non-Banking Financial Companies (NBFCs)

- Others (Credit Unions)

By Duration

- Short Term

- Mid Term

- Long Term

By End User

- Individual

- Enterprises

Oman Car Finance Market Report Snapshots

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)