Oleochemicals Market: By Product (Alkoxylates, Fatty Acid Methyl Ester, Glycerol Esters, and Others); Application (Consumer Goods, Food & Beverages, Healthcare & Pharmaceuticals, and Others); Sales Channel (Direct & Indirect); and Region— Industry Dynamics, Market Size and Opportunity Forecast, 2024-2032

- Last Updated: 18-Oct-2024 | | Report ID: AA0222143

Market Scenario

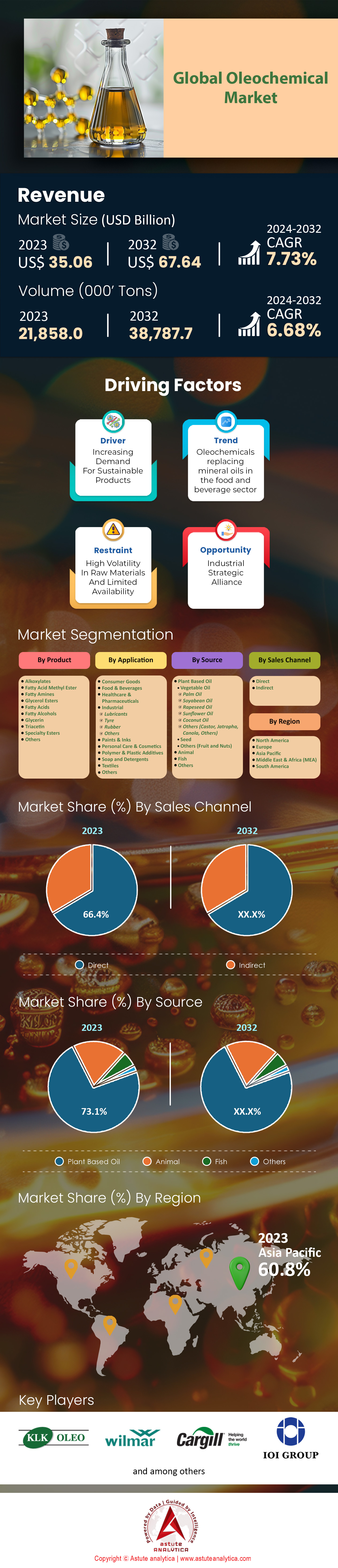

Oleochemicals market is estimated to witness a rise in revenue from US$ 35.06 billion in 2023 to US$ 67.64 billion by 2032 at a CAGR of 7.73% during the forecast period 2024-2032. In terms of volume, the market is registering a growth at a CAGR of 6.6% over the forecast period.

Oleochemicals are sourced from animal and plant fats & oils and are said to be substitutes of petrochemicals. Due to the growing consciousness about the environment and the need for sustainable and biodegradable products their demand is increasing. Important end users include personal care, food, pharmaceuticals and the industrial segment. The most important applications of oleochemicals cover soaps, detergents, lubricants, biodiesel, and personal care products. The demand is mainly driven due to the rising shift towards eco-friendly products, improved oleochemical processing, and greater use of biodiesel. Top manufacturers include Wilmar International, BASF and Cargill, which employ cutting-edge technologies and extensive supply chains to satisfy global demand. Growth potential for oleochemicals is huge due to increasing new developments in ointments in green chemistry and new applications.

The oleochemicals market is mainly controlled by the Asia-Pacific region when analyzed in terms of the volume of production and consumption, owing to the readily available raw materials as well as growing industrialization. Notably, Indonesia and Malaysia produce more than 25 million metric tons of palm oil a year, which is a major input to the oleochemical industry. Major consumers include China and India where the amount used is close to 8 million metric tons every year. Also important are Europe and North America markets which are influenced by strict regulations that require the use of eco-friendly materials that are easier to dispose off after use.

The export and import prospects in the oleochemicals market are determined by the production capacity and demand in a region. There is surplus production in Southeast Asia and this explains why more than 15 million metric tons of oleochemicals was exported in 2023. More than 6 million metric ton of oil was imported to meet domestic consumption in the US, and more than 6 million metric tons were consumed in Europe and North America. For instance, in 2023, the US imported more than 2 million tons of oleochemicals. Increase in trade agreements and the geographical diversification of supply chains will lead to an increase in exports of oleochemicals, and increase in production in the target regions will telegraph the growth in the number of companies that are investing in domestic plants. As per market predictions, the global oleochemicals market is expected to reach high levels of growth and diversity with over 5 million metric tons expansion in consumption by 2027.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Increasing Use in Pharmaceuticals and Healthcare For Targeted Drug Delivery Systems

The application ratio of oleochemicals in the pharmaceutical and medical practices, most especially in the area of targeted drug delivery systems, is one of the substantial factors pushing the demand in oleochemicals market. The reason for this is the growing need of having drug delivery systems that are more efficient, ideal in terms of improving therapeutic outcomes and minimizing side effects. The total revenue from the global pharmaceutical market is likely to reach $1.5 Trillion by the year 2025, with targeted therapies comprising the majority of this growth. The global market of drug delivery was valued at approximately $ 2.56 billion by 2030, which reflects the huge amount spent on advanced delivery systems. There are also more than 7,000 clinical specified trials for targeted therapies, which in itself speaks volumes about how much investment is directed towards precision medicine. Until mid-2024, there were over 1,500 applications for new drugs made to the FDA a good number of them contained new formulations which made use of oleochemicals.

By the end of 2024, over 250 million patients worldwide are predicted to benefit from personalized medicine. Considering these procedures, the growth oleochemicals market is expected to witness strong growth due to its ability to create micro-encapsulated biocompatible and biodegradable carriers. These types of delivery systems are paramount because the biopharmaceuticals industry, which is forecasted to be valued at $400 billion in 2023, relies heavily on them. Also, the application of oleochemicals in nanomedicine, which is expected to be more than $400 billion in 2025, indicates the increasing relevance of oleochemicals. There are more than 5,000 patents authorized all over the world during the last year, which are concerned with the development of new oleo-chemistry based carriers. In addition, increasing prevalence of chronic diseases that affect more than 1.4 billion people each year also integrates the need for targeted delivery systems which oleochemicals can provide.

Trends: Rising Demand For Oleochemicals In High-Growth, High-Margin Pharmaceutical Sectors

The growing demand for oleochemicals in rapidly expanding and high-margin pharmaceutical industries is changing the dynamics of oleochemicals market as a result of the need for transformative ideas that can address the sophisticated health problems. As at 2024, the value of the worldwide pharmaceutical market was approximately $1.5 trillion out of which the specialty drugs market has been established at $340 billion and occupies an area that often incorporates oleochemicals-based delivery systems. The biopharmaceutical sector, which is also an important area for oleochemicals, was valued at $400 billion in the year 2023, clearly indicating that these chemicals are especially useful in the preparation and delivery of drugs. The number of new drugs that were approved by the FDA which have oleochemicals components stood at 50 in 2023, that is, the growth rhythm of the sector was satisfactory. The other injecting biologics such as monoclonal antibodies which also use oleochemicals carriers expanded the global market which was previously estimated at $390 billion in 2024. This demonstrates the importance of the oleochemicals in making novel therapies.

Chronic illnesses have been on the rise this past year and currently affect more than 1.4 billion people who are actively seeking better pharmaceutical solutions. It was projected that the global market for oleochemicals will continue to thrive around the oncology segment with a value of around $177 billion. In recent years there has also been an increasing reliance on oleochemicals where the introduction of new drugs and formulations have been assisted by targeted Delivery systems bringing that market share to an estimated $3 trillion in 2025. The expansion of targeted therapies is facilitated by the increasing number of clinical trials active globally also expected to coincide with the growth in the oleochemicals market. Investors in the biopharmaceutical development market have reported around $200 Billion spent last year with a considerable share of this amount invested in the development of next generation oleochemicals.

Challenge: Limited Scalability and Supply Chain Constraints Impact Oleochemicals Availability

The scalability issue, as well as the constraint on the supply chain, has a direct relationship with the availability and expansion of the oleochemicals market. One of the major concerns is the duality of scale-up which exists between lab and industrial volume. In 2023, the size of the global chemical market stood at close to US$ 5 trillion. Out of which, US$ 850 billion comes from specialty chemicals including oleochemicals. Scaling up production for such specialized products quite often involves heavy outlays in technology and infrastructure. The number of chemical plants that were capable of producing high class oleochemicals as of 2023 was about three hundred, which is inadequate to cater for increasing demand. This lack of sufficient resources is further aggravated by the concentration of more than 70% of these plants in the developed areas, and hence the supply is unevenly spread across regions.

The raw material supply chain is another restricting element because it is bare in the oleochemicals industry. For instance, over 200 chemical manufactures in the United States and in other countries ousted their production schedules due to the almighty shortage of materials leading to a rise in the cost and the lead time. Seeing how strained the economy is, especially with the logistical and transport companies who proudly valued at US$ 9 trillion in 2023, serve a major role in supplying oleochemicals. It is doubtful that the supply will not face interruption due to the existing factors such as the current natural disasters or the global wars. Supply chain is also worsened with the factors where approval piles of around 18 months are required for regulatory clearance in 2023, especially due to the scrutiny of the oleochemicals market. Moreover, producers do face enormous hurdles caused by the compliance that absolutely doesn’t help the consumption of the oleochemicals.

Segmental Analysis

By Type

Based on type, fatty acids are leading the oleochemicals market with more than 41.3% market share. They are the key components across a wide array of industries and products, making them fundamental in the chemicals sector. This is easily explicable as they are the key ingredients in the manufacturing of soaps, detergents, other personal care products, in which they account for over 18 million metric tons of production each year. Additionally, the demand for these products has increased due to growing consumer demand for sustainable and biodegradable products, which is made easier because fatty acids come from plant and animal fats. Besides, fatty acids also benefit from the food industry utilizing an estimated 6 million metric tons of them in food additives and preservatives per year, which improve texture and increase shelf-life.

The attractiveness of fatty acids for the oleochemicals market is further enhanced owing to their wide usage in the lubricant and grease industries where the fatty acid demand is around 25 million metric tons. In the pharmaceutical industry, fatty acids are incorporated in the production of drugs and food supplements, especially omega-3 that are recommended for human health with a verified size of 2 million metric ton a year. Also, the paints and coatings industry uses fatty acids for making and formulating alkyd resins with the yearly consumption of about four million. The major final consumers are personal care, food and beverages, pharmaceuticals, as well as industrial manufacturers. The growing bio-based chemical trend and the growth in the biofuel market that currently consumes around 12 million metric tons of fatty acids further articulates their importance in the oleochemicals market. With such wide range of application and the growing global demand, the market for fatty acids will growth faster.

By Application

Based on the application, soaps and detergent segment holds the largest share of the oleochemicals market, approximately 37.8%. The use of oleochemicals in the production of soap and detergents has increased due to the increased demand for more efficient cleaning agents and the unique characteristics that these chemicals feature. Oleochemicals are an eco-friendly and non-polluting substitute for conventional surfactants oil, crude because they can biodegrade. The features of their molecules make it possible to increase the foaming and solubilization properties of the manufactured cleaning agents that are needed to emulsify and wash off dirt and grease. For the year 2023, soap and detergent market was valued at US$ 220 billion, which is attributed to the increasing level of awareness of hygiene and urbanization in developing countries. The demand of soap bars has surpassed a yearly threshold of 35 million tons in 2023, which compliments the high rate of production of oleochemicals among other raw materials.

Fatty alcohols, glycerin, and fatty acids are some the key oleochemicals that are applied in soaps and detergents. Due to their emulsification and foaming properties, fatty alcohols are produced globally about 2.5 million tones. Glycerin, on the other hand, is a form of biodiesel that is produced at an estimate of 4 million tons a year which serves as a humectant and emollient. In addition, fatty acids are obtained mainly from palm oil including the palm production, which makes up 77 million tones in global productivity. Moreover, fatty acid derivatives are forecasted to generate $92 billion by 2025 showing that palm oil refined goods would still be in high demand. Additionally, more than 1500 new applications for oleochemicals in detergent formulations were patented in 2023 showing that there are constant innovations in the industry.

By Source

Based on source, plant oils have grown to be as the major contributor to the oleochemicals market as they form the foundation of multiple industries owing to their uniqueness, sustainability and profuse composition. Key plants such as soybeans, oil palms, rapeseed, and sunflowers are pivotal in oleochemicals production due to their high yield of essential fatty acids and other valuable compounds. Soybeans alone account for more than 300 million metric tons of the world's total supply, which also forms an important ingredient in biodiesel, lubricants, and surfactants. In due course, oil palms are also the most productive of all oil worth more than 75 million metric ton every year, which explains their importance in the making of glycerol and fatty acids. Among these macromolecules, oleic and linoleic acid are proved to be important for producing bio-based plastics, as they are essential components of rapeseed and sunflower plants, which contribute around 80 million and 55 million metric tons respectively.

The attractiveness of these plant sourced materials in the oleochemicals market stems from their sustainable profile and the increasing propensity of customers towards purchasing eco-friendly goods. Plant oils have now become the go-to alternative in all industries as the world-wide trend moves towards cutting down carbon footprints. The consumption of plant-based oleochemicals in the personal care sector has risen up to 1.5 million tons over the previous one year period as the companies shift to use more natural sources. Likewise, the oleochemicals industry has added more than 2 million tons of plant-based oleochemicals to the biodegradable packaging segment fueled by the initiatives aimed at reducing plastic waste.

By Sales Channel

In 2023, the direct sales channel dominated the oleochemicals market, capturing the highest 66.4% revenue share due to its rapid delivery capabilities. All this expansion is attributed to their easy availability and efficient distribution of oleochemicals to the end-use centers. This is critical especially where time is of the essence and production lines need to be up and running with little or no fixable interruptions which these channels guarantee. In addition, manufacturers are labeling this cost-saving as an incentive and are accelerating the usage of the suitable channels at scale to bypass the usual ramp entailed through distribution and supply chain. In 2023, companies recorded a decrease of about 15% of their logistics expenditures as a result of the use of direct selling channels as opposed to using conventional means. This is cost-effective as it cuts on extra expenses that would have accrued and in turn, use the savings to fund other ventures like research into new markets.

The oleochemicals industry is expanded, with the Asia-Pacific region serving as a growing market for Eco friendly products. This growth is propelled by the growing awareness and adoption of oleochemicals as they are biodegradable and are made up of natural components. Suffice it to say, with direct sales channels, there is increased responsiveness to market demands as evidenced by a 20% increase in the speed of launch of products in the last one year. Since companies become more focused on efficiency and customer satisfaction, direct sales channels are likely to continue dominating the oleochemicals market and further consolidate their position as a key element in the supply chain.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

As of now, Asia Pacific becomes the biggest producer and consumer in the oleochemicals market, mainly because the region has plenty of natural resources and fills up the gap of industrialization quickly. In 2023, Asia Pacific region captured over 60.8% market share and is also poised to keep growing at the highest CAGR of 8.16%. Malaysia and Indonesia comes first with their combined concentrated palm oil production giving 60 million metric tons per year, which is one of the most important raw materials in the production of oleochemicals. A distinct number of more than 50 oleochemical plants are located in that region, which proves the industrial strength there. China is a strong consumer market, as the personal care market is valued at $50 billion, while India’s market exceeds $15 billion purchasing oleochemicals products such as soaps, detergents and cosmetics. Moreover, the Asia Pacific Oleochemicals Market has approximately 60 % of the total market throughout the world, thus showing its position. With the presence of raw materials and increasing domestic demand, Asia Pacific has a strategic position within the global markets.

Support from governments and investors for sustainable and green industries further bolsters the region’s positioning in the oleochemicals market. More and more biodegradable products are being sought as the middle class grows in countries such as China and India, giving rise to demand for personal care and household items. Besides, the greater developments in technology have brought about strong competition because the production processes have been made cheaper. The Association of Southeast Asian Nations (ASEAN) has already devised measures designed to increase the volume of oleochemical exports, with a view to increasing its percentage share in the world market. With such developments the region is expected to gain a lot in the next few years, this further complements the already established regions position.

Europe is the next one in line to be the largest oleochemicals market. Stringent environmental regulations paired with the inclination towards a sustainable economy drive this demand. Germany, France, Netherlands, and Belgium are the ones of concern due to their developed chemical industries and large scale production of bio-chemicals. Europe uses approximately 5 million metric tons of oleochemicals, which are availed in the medical field, cosmetics, and manufacturing. The region encompasses over a hundred firms engaged in oleochemical production and/or conducting research. And, these companies display a perfect infrastructure of the respective industry. Excessive investment into renewable resources R&D, coupled with the climate goals of the EU further enhances this. Moreover, investments in sustainable chemistry R&D are more than $500 million/year. All these measures allow asserting that Europe isn't only a huge consumer, but an advance developer of new technologies in the market of oleochemicals as well.

List of Key Companies Profiled:

- Alnor Oil Co, Inc.

- BASF SE

- Cargill Incorporated

- Corbion N.V

- Eastman Chemical Company

- Evonik Industries

- Evyap Sabun Yag Gliserin

- Godrej Industries

- Isosciences LLC

- Kao Chemicals

- Musim Mas

- Nouryon

- Oleon NV

- P&G Chemicals

- PTT Global Chemical Public Company Limited

- SABIC

- Sakamoto Yakuhin kogyo Co., Ltd.

- Stepan Company

- Vantage Specialty Chemicals, Inc.

- Wilmar International Ltd.

- Other Prominent Players

Market Segmentation Overview:

By Product:

- Alkoxylates

- Fatty Acid Methyl Ester

- Fatty Amines

- Glycerol Esters

- Fatty Acids

- Fatty Alcohols

- Glycerine

- Triacetin

- Specialty Esters

- Others

By Application:

- Consumer Goods

- Food & Beverages

- Healthcare & Pharmaceuticals

- Industrial

- Lubricants

- Tyre

- Rubber

- Others

- Paints & Inks

- Personal Care & Cosmetics

- Polymer & Plastic Additives

- Soap and Detergents

- Textiles

- Others

By Source

- Plant Based Oil

- Vegetable Oil

- Palm Oil

- Soyabean Oil

- Rapeseed Oil

- Sunflower Oil

- Coconut Oil

- Others (Castor, Jatropha, Canola, Others)

- Seed

- Others (Fruit and Nuts)

- Animal

- Vegetable Oil

- Fish

- Others

By Sales Channel:

- Direct

- Indirect

By Region:

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2023 | US$ 35.06 Bn |

| Expected Revenue in 2032 | US$ 67.64 Bn |

| Historic Data | 2019-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Unit | Value (USD Bn) |

| CAGR | 7.73% |

| Segments covered | By Product, By Application, By Source, By Sales Channel, By Region |

| Key Companies | Alnor Oil Co, Inc., BASF SE, Cargill Incorporated, Corbion N.V, Eastman Chemical Company, Evonik Industries, Evyap Sabun Yag Gliserin, Godrej Industries, Isosciences LLC, Kao Chemicals, Musim Mas, Nouryon, Oleon NV, P&G Chemicals, PTT Global Chemical Public Company Limited, SABIC, Sakamoto Yakuhin kogyo Co., Ltd., Stepan Company, Vantage Specialty Chemicals, Inc., Wilmar International Ltd., Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)