Global OLED Micro Display Market: By Product Type (Near to Eye and Head Mounted Display); Resolution Type (HD and Full HD); Technology (AMOLED (Active Matrix OLED), White OLED, RGB OLED); Application (EVFs (Electronic Viewfinders), AR and VR Glasses/Goggles, Drones, Others); Industry Vertical (Automotive, Consumer Electronics, Media, Entertainment & Sports, Retail, Aerospace & Aviation, Military & Défense, Education, Others); Distribution Channel (Online and Offline (Direct and Distributor)—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: Jul-2024 | Format:

![pdf]()

![excel]() | Report ID: AA0724865 | Delivery: 2 to 4 Hours

| Report ID: AA0724865 | Delivery: 2 to 4 Hours

Market Scenario

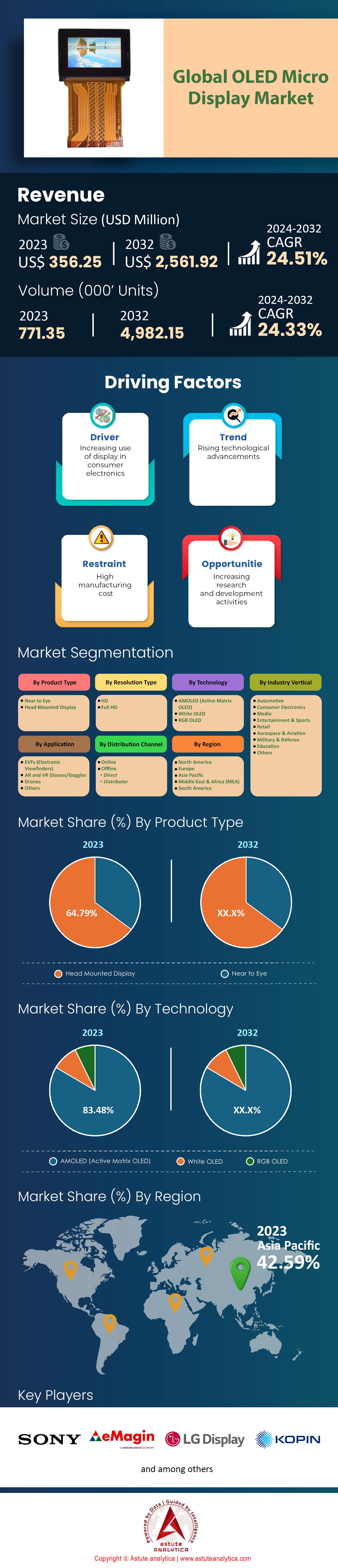

Global OLED micro display market was valued at US$ 356.25 million in 2023 and is projected to hit the market valuation of US$ 2,561.92 million by 2032 at a CAGR of 24.51% during the forecast period 2024–2032.

Due to better image quality, smaller size and lower energy consumption, the world has witnessed an unprecedented increase in demand for OLED micro displays. The unique features of OLED micro displays make them suitable for a wide range of applications but mostly in augmented reality (AR), virtual reality (VR) and wearable devices. Recent advancements made in these areas have created a need for high performing displays like never before. For example, 2023 alone saw global AR market grow tremendously with AR headsets shipping up to 5.5 million units while VR headset sales stood at 10.2 million indicating growing customer appetite towards immersive technologies backed by sophisticated display solutions. Moreover, the year 2023’s record breaking figures in the OLED micro display market show that over 300 million wearables were shipped worldwide mainly fueled by smart glasses adoption which often employ OLED micro displays due their high-resolution capabilities as well as vibrant colors.

The automotive industry too is not left behind when it comes to embracing this new technology where they are used as head-up displays (HUDs) and advanced driver assistance systems (ADAS). Over 2 million cars were fitted with them last year. For healthcare sector, there have been significant deployments such as in hospitals or clinics worldwide where they are widely used during AR assisted surgeries or even medical training programs; more than 1 million units have been deployed globally till now.

In addition, the consumer electronics sector shows an increasing appetite for OLED micro display market. Smart glasses and AR/VR devices sold more than 25 million units in 2023, representing a rapid growth in their popularity. The gaming industry also benefits from high-end gaming headsets that are equipped with OLED micro displays. Shipments of gaming headsets featuring OLED technology reached 7 million units in 2022 alone. Government support for AR/VR applications in defense resulted in the deployment of over half a million AR glasses for training and operational use. Looking at industrial applications, remote inspections and maintenance have each employed over 1.5 million devices with OLED micro displays in 2023 alone.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Growing Demand for Augmented Reality and Virtual Reality Applications Driving OLED Micro Displays

The primary driving force behind the OLED Micro Display market is the surge in demand for Augmented Reality (AR) and Virtual Reality (VR) applications. In 2023, the value of the AR and VR market was estimated to be over US$40 billion and it is predicted to grow up to US$180 billion by 2030. OLED Micro Displays are necessary for creating immersive AR and VR experiences because they provide high resolution and vivid colors. This demand is also supported by the number of shipments for AR and VR headsets, which amounted to 9.7 million units in 2022 and expectedly will reach 43.5 million in 2025; not only that but also their use across different sectors such as healthcare where it had a penetration rate of 15% last year and projected at around 45% by 2027.

Another important factor propelling the growth of the OLED micro display market is the growing integration of OLED micro displays in consumer electronics. According to a report, over 68% of all new AR/VR devices utilized OLED technology due to its better image quality and energy efficiency compared to other display types. The consumer electronics industry has been growing steadily at about 6% YoY from an estimated valuation of US$1.1 trillion in 2022. The number of active AR users is expected to reach 1.73 billion by 2024, up from 0.81 billion in 2021, demonstrating a burgeoning market for these advanced displays. Moreover, the gaming industry, which was valued at US$ 183 billion in 2023 is now using OLED Micro Displays more often to give better user experiences.

Trend: Increasing Integration of OLED Micro Displays in Wearable Technology

One of the most prominent trends in the OLED Micro Display market is that they are being increasingly used in wearable technology. The worldwide wearables market is predicted to achieve valuation of US$171.8 billion by 2028, growing at a CAGR of 14.6%. Lightweight, flexibility and superior visuality make OLED Micro Displays an ideal choice for wearables. In 2023, 52% of new wearable devices used OLED micro displays compared to 39% in 2021. Shipments of smartwatches – a key part of the wearable tech industry – reached 225 million units in 2022; this number is expected to increase to around 370 million units by 2026. Additionally, the fitness tracker segment saw shipments totaling approximately 84 million units last year alone. It too has begun adopting more often than not organic light emitting diode small sized screens.

This trend in the OLED micro display market is prompted by increased consumer demand for high-quality displays in wearable tech. In 2023, a study found that 72% of purchasers ranked display quality as their most important factor when buying a wearable, compared to 65% in 2020. The medical wearables industry is growing at an annual rate of 10.7%, and this growth heavily relies on OLED Micro Displays (OMDs) that provide accurate visualization of data. To enhance situational awareness still more, military organizations spent $2.7 billion on AR/VR technologies last year alone; thus, they have started using wearables fitted with OMDs. Such moves only serve to further fuel these already strong trends towards better screens in clothing.

Challenge: High Production Costs and Technical Challenges in OLED Micro Displays

Among the major challenges that impact the OLED micro display market are high manufacturing costs and technical difficulties in producing such screens. Complex manufacturing processes and high-precision equipment contribute to a 35% higher cost of making an average OLED micro display than its LCD counterpart. In terms of global production, $450 million was spent on this in 2023 with much going into research and development as well as capital investment. The fact that less than 70% yield rate is achieved by these types of screens compared to over 90% for conventional liquid crystal displays (LCD) makes them expensive.

These technical challenges in the OLED micro display market further worsen the already complicated market situation. While attaining brightness levels that are very bright but also being energy efficient still remains elusive as current models can only achieve half as much screen illumination as equivalent sized LCD panels. On top of this, the average lifespan for OLEDs is around half that of LCDs i.e., 10,000 hours versus 20,000 hours which raises questions about their reliability. Another problem is related to pixel density required by AR/VR applications – usually exceeding 3,000 PPI (pixels per inch). Only 40% could attain such high densities among manufacturers in 2023 thus limiting their use cases.

Furthermore, the OLED material degrades over time and this causes color shifts and burn-in problems where 15% of devices show significant degradation within one year after being utilized. Such high defect rates—projected to be around 5% by next year—also put pressure on production costs as well as timelines. Besides protecting them against moisture or oxygen that destroys their materials, there is still a need for more advanced encapsulation technologies in order to save OLED Micro Displays from further damage which adds complexity and cost again. Nevertheless, despite all these difficulties faced so far with manufacturing methods improvement ongoing efforts are being made coupled with advances made in material science but it may take time.

Segmental Analysis

By Type

Head Mounted Displays (HMDs) have become a pivotal application for OLED micro display market with market share of 64.79% due to their superior performance characteristics. OLED displays are known for being self-emissive, which can be used to make lighter, thinner, and more power-efficient displays than standard LCDs. This is especially useful in head mounted display (HMD) as it helps in reducing weight and power usage. Also, OLED’s ability to make very dark blacks as well as high contrast ratios improves immersion levels when using virtual reality (VR) or augmented reality (AR) apps thus making them best suited for high-end HMDs. Several technological benefits lead OLED micro displays’ dominance in HMDs. In VR and AR settings, quicker response times provided by OLEDs are important in reducing motion blur and latency since it leads to a smoother user experience that feels real. Moreover, OLED micro displays can attain higher pixel densities which are necessary for fighting the screen door effect that frequently happens with VR headsets whereby one can see gaps between pixels. For example, recent developments have seen single eye resolutions go beyond 3K thereby greatly enhancing visual clarity.

The OLED micro display market in HMDs is growing very fast. In 2023, the value of the global HMD market was about $5.8 billion and a large part of this came from OLED micro displays due to their excellent performance. From 2023 to 2030, it is predicted that the adoption rate of OLED technology in HMDs will increase at a CAGR of 17.5%. Also, by 2024, over 500 million AMOLED screens are expected to be produced every year because of the demand for VR and AR applications among others which emphasizes higher dependence on OLED technology. This direction has been additionally backed up by continuous advancements made during production processes for different kinds of affordable organic light emitting diodes needed for various applications including but not limited to those used within gaming devices or phones’ displays.

By Resolution

Based on resolution, the dominance of the HD segment in the OLED micro display market with revenue share of 54.88%. This increase in demand for high-quality visuals can be attributed to virtual reality (VR), augmented reality (AR) and wearable technology. It is important that the HD resolution has a fine balance between clarity of image and power efficiency which makes it suitable for use in such areas. According to Display Supply Chain Consultant (DSCC)’s most recent data on global OLED micro display market, half these displays will be HD with their market share expected at 54%. The popularity of consumer electronics like smartphones and tablets among others coupled with medical devices as well military defense applications are some factors driving this expansionist trend.

Not only does its technological advancement contribute largely towards reducing costs but also allows for increased affordability through manufacturing process improvements associated with organic light emitting diodes (OLEDs). In addition, Omdia’s latest report shows shipments volumes reaching 1.8 million units during first quarter alone – up by approximately 25% since last term ended shortly after Q4/2019 began. It is mainly driven by higher demand from makers who want them embedded into smart glasses etc., designed offer immersive experiences alongside head mounted displays (HMD).

Consumer preferences and market shifts are very important in determining the popularity of the HD sector. Astute Analytica found out that 62% of customers still choose VR and AR devices with HD resolution because it offers the best compromise between visual experience and cost-effectiveness. Moreover, an increase in demand for such gadgets is expected to surpass valuation of US$ 125 bn by 2025 where HD OLED micro displays are said to be among essential elements driving this growth.

By Technology

With its better performance and versatility, AMOLED technology has taken over the OLED micro display market accounting for 83.48% of the revenue share. The higher resolution and pixel control are among the main factors that contribute to this dominance. In AMOLED displays, each pixel is controlled by a thin-film transistor (TFT) array enabling accurate brightness control as well as color precision on the screen. It is necessary for applications with detailed and vibrant images like smartphones, smartwatches or VR headsets. Moreover, AMOLEDs also support variable refresh rates ranging between 1Hz-120Hz that makes them switch faster thus saving power besides giving smoother transitions thereby improving the user experience too.

Furthermore, the AMOLED micro displays are used heavily due to their energy efficiency as they consume less power than LCDs do. This feature is especially useful in mobile devices where long battery life matters most but not at the expense of good quality representation on a screen. For example, it became possible to achieve both goals thanks to low temperature polycrystalline oxide (LTPO) implemented into these panels recently, which considerably reduces power consumption. Therefore, making them perfect for use in devices demanding prolonged operational hours without compromising visual excellence. Meanwhile, inherent flexibility within AMOLED displays enables production of foldable smartphones among other form factors that would never have been realized using less flexible types of display technology.

The OLED micro display market adoption and continuous advancements in AMOLED technology have cemented its position in the industry. Businesses such as Samsung have spent a fortune on AMOLED technology. This led to widespread adoption in high end consumer electronics due to its capability to create screens that are very bright, absolute blackness and wide range of colors.

By Application

Based on application, AR/VR glasses segment is leading the OLED micro display market with revenue share of over 52.54%. Today they are considered as the foundation stones for AR/VR applications because these devices outmatch others in many important aspects. For instance, OLEDs provide unmatched image quality thanks to their high contrast ratios and vibrant colors. This feature becomes particularly crucial within AR or VR environments where realism and immersion into virtual worlds are essential. Another advantage possessed by organic light emitting diodes over other display technologies is that they achieve true blacks by turning off individual pixels completely; no other technology can manage this except OLED which makes visual experience more intense. According to Display Supply Chain Consultants' report from 2023 year - Contrast ratio of OLED displays may reach even 1000000:1 while traditional LCD has only 1000:1 ratio.

OLED micro displays have fast response times and low latency which are critical for reducing motion blur and delivering smooth user experience in AR/VR applications where traditional LCD can suffer from ghosting or lag causing discomfort or motion sickness for users. For example, an average response time of less than one millisecond is common among them whereas it’s about 10 to 12 milliseconds for their LCD counterparts. OLED micro displays can be highly energy efficient as well as compact thus making them suitable for wearable AR/VR devices that require lightweight power-saving components such as self-emissive nature because they don't need backlight this significantly reduces power consumption along with thickness too. There is possibility of saving up to 40% power compared with other types like LCDs. Additionally, the compact form factor of OLED micro displays facilitates the development of sleeker and more comfortable head-mounted displays, driving user adoption and satisfaction in immersive applications.

To Understand More About this Research: Request A Free Sample

Regional Analysis

The Asia-Pacific region is responsible for generating more than 42.59% revenue in the global OLED micro display market. The region is home to several dominant producers like Samsung Display, LG Display, and BOE Technology which account for over 60% share in global production capacity for OLED micro displays. Additionally, regional demand has been fuelled by rapid adoption of advanced display technologies in consumer electronics mainly driven by China, Japan, India, and South Korea among others. In fact, during 2023 alone, China accounted for about 25% share of global sales volume for OLED micro displays following strong growths within its AR/VR markets. This is primarily supported by robustness of local electronic manufacturing sector, which is projected to keep growing at a CAGR of 28% until 2032.

The regional dominance is further supported by massive investments made towards R&D. Wherein, South Korea invests not less than $2 billion each year towards display technology innovations while strategic government support like “Made in China 2025” initiative helps foster domestic capacities necessary for sustained growths even further. The Asia pacific region has over 2.5 billion smartphone users, thus, creating demand that cannot be ignored or satisfied easily without having quality products available locally.

Technological advancements and the high demand for premium electronics are responsible for the fact that North America and Europe together represent more than a 50% the OLED micro display market. North America is majorly witnessing strong growth due to presence of prominent players like Apple and Google among other leading tech companies that use only best quality displays like OLED micro displays in their electronic products. In 2023, the U.S. alone saw a 20% increase in OLED micro display usage in wearable devices and smart glasses. Furthermore, augmented reality (AR) and virtual reality (VR) industries are flourishing rapidly here too due to enormous investments made which are projected to reach US$45 billion by 2028 in terms of market size alone. Moreover, the demand is largely fueled by North America’s booming AR and VR sectors – which are projected to be worth US$45 billion by 2028.

Europe OLED micro display market, on the other hand, is holding third largest market share due to its strong automotive industry where OLED micro displays are increasingly being used in heads-up displays (HUDs) and infotainment systems. Germany alone recorded a YoY growth rate of 15% for OLED micro display adoption in automotive applications as it remains one among many important players. Additionally, regions’ emphasis on sustainable or energy-efficient technologies coupled with large R&D investments ensures that the market keeps growing year after year even if we take into account already established trends. Furthermore, what drives this industry’s further expansion is the increasing popularity of OLED displays among luxury consumer electronics especially in countries such as France and UK.

Top Players in Global OLED Micro Display Market

- BOE Technology Group Co. Ltd.

- eMagin Corporation

- Fraunhofer Fep

- Himax Technologies, Inc.

- Industrial Technology Research Institute (ITRI)

- JBD Inc.

- Kopin Corporation

- LG Display Co., Ltd.

- MICROOLED Technologies

- Nanjing Guozhao Optoelectronics Technology Co. Ltd.

- Samsung Electronics Co., Ltd

- SeeYA Technology Corporation (SeeYA Technology)

- Seiko Epson Corporation

- Semiconductor Integrated Display Technology Co. Ltd. (SIDTEK)

- Sony Corporation

- Yunnan OLiGHTEK Opto-Electronic Technology Co., Ltd

- WINSTAR Display Co. Ltd.

- Other Prominent Players

Market Segmentation Overview:

By Product Type

- Near to Eye

- Head Mounted Display

By Resolution Type

- HD

- Full HD

By Technology

- AMOLED (Active Matrix OLED)

- White OLED

- RGB OLED

By Application

- EVFs (Electronic Viewfinders)

- AR and VR Glasses/Goggles

- Drones

- Others

By Industry Vertical

- Automotive

- Consumer Electronics

- Media

- Entertainment & Sports

- Retail

- Aerospace & Aviation

- Military & Défense

- Education

- Others

By Distribution Channel

- Online

- Offline

- Direct

- Distributor

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- Saudi Arabia

- South Africa

- UAE

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA0724865 | Delivery: 2 to 4 Hours

| Report ID: AA0724865 | Delivery: 2 to 4 Hours

.svg)