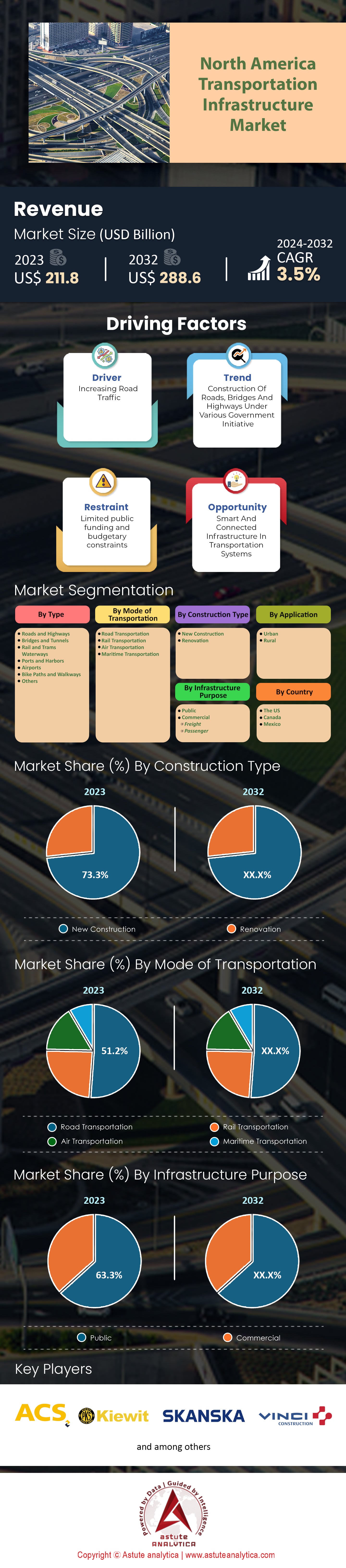

North America Transportation Infrastructure Market: By Type (Roads and Highways, Bridges and Tunnels, Rail and Trams, Waterways, Ports and Harbors, Airports, Bike Paths and Walkways, Others); Construction Type (New Construction and Renovation); Mode of Transportation (Road Transportation, Rail Transportation, Air Transportation, Maritime Transportation); Purpose (Public and Commercial (Freight and Passenger); Application (Urban and Rural); Country —Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: 03-Apr-2024 | | Report ID: AA0923610

Market Scenario

North America Transportation Infrastructure Market was valued at US$ 211.8 billion in 2023 and is projected to reach a market valuation of US$ 288.6 billion by 2032 at a CAGR of 3.5% During the Forecast Period 2024–2032.

North America's transportation infrastructure, characterized by its vast highways, expansive rail networks, and active airports, remains pivotal for the continent's economic vitality. A detailed assessment reveals that the United States alone has a staggering 6.58 million kilometers of roads. Yet, the vastness of this network is juxtaposed against the stark realities of maintenance and age. The American Society of Civil Engineers has raised concerns, highlighting that over a third of these major roads are in suboptimal conditions, oscillating between poor to mediocre grades. This road network includes 76,334 km of expressways and a vast stretch of 2.28 million kilometers of unpaved pathways. Addressing these infrastructure challenges would necessitate a colossal financial input, estimated at around $836 billion, targeted just for roads and bridges.

Rail transportation, on the other hand, offers a contrasting narrative in the North America transportation infrastructure market. While freight rail seems to be flourishing, registering the movement of approximately 1.2 billion tons of goods each year, passenger rail appears to be in a perpetual game of catch-up when compared to global counterparts. To provide a monetary perspective, the United States channels roughly 2.4% of its GDP towards infrastructure development. This investment appears minuscule, especially when compared to nations like China, where figures soar beyond the 5% mark.

Emerging technologies have been recognized as potential game-changers for this sector. Innovations such as IoT-integrated smart roads present promising solutions to longstanding traffic management problems. Simultaneously, the surge in electric vehicles (EVs) on the roads necessitates a renewed perspective on infrastructure requirements. With North America transportation infrastructure market currently hosting more than 150,000 EV public charging stations, a number that is continuously on the rise, the pressing challenge is the projected requirement. Considering estimates that hint at 40 million EVs on American roads by 2030, there's an evident race against time to upscale the existing infrastructure. The dream of high-speed rail networks, although captivating, remains largely unrealized with only a few projects beyond the drawing board. It's not just land-based transportation that's undergoing transformation; air travel infrastructure is also evolving. North American airports, which service over 950 million flyers annually (more than 853 million in the US), are rapidly integrating technology-driven mechanisms to streamline operations and enhance air traffic management. Funding these transformative upgrades poses significant challenges in the transportation infrastructure market. While traditional funding avenues, like federal and state allocations, are still in play, there's a growing financial chasm between what's needed and what's available. The year 2022 marked a notable shift, with North America sealing transportation infrastructure deals worth approximately $44 billion through public-private partnerships. The roles of infrastructure banks and various financial instruments in this context are becoming increasingly pivotal. The gaze of investors is also turning global, with North American transportation infrastructure markets opening up to foreign investment influxes for several large-scale projects. The balancing act between addressing the deteriorating old infrastructure and integrating new technological wonders is indeed a daunting challenge.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Rapidly Expanding Electric Transportation

A colossal driver in the North America transportation infrastructure market is the electrification of transportation, especially in the road vehicles. Electrification is no longer a futuristic aspiration; it's quickly becoming the mainstay. A report from the International Energy Agency (IEA) highlighted that by the end of 2023, there were over 26 million electric cars on roads worldwide, with a significant portion (2.4 million) in North America. In the United States alone, over 918,500 electric vehicles (EVs) were sold in 2022, marking an increase of about 250% from 2018. The reasons are manifold. From environmental concerns, with the US transportation sector contributing about 28% of the country’s greenhouse gas emissions, to the rapidly declining costs of EVs, the stage is set for electrification. Battery prices, a major component of EVs, have seen a staggering drop from approximately $1,100 per kilowatt-hour in 2010 to about $151 in 2023, making EVs progressively more affordable for the average consumer. Governments are playing their part, too. Federal tax credits in the US, for example, offer up to $7,500 for electric vehicle purchasers, while states like California have additional incentives, pushing more people to embrace the EV revolution.

However, the adoption of electric vehicles necessitates parallel growth in charging infrastructure. With the US and Canada targeting a collective total of 0.6 million charging stations by 2030, the transportation infrastructure market is gearing up for massive investments in this segment. In line with the US government had already allocated more than $7.5 billion in 2023. This goes beyond just numbers; the focus is also on fast-charging systems, with investments pouring into creating charging points that can power up an EV in under 30 minutes.

Challenge: Crumbling Foundations: The Aging Infrastructure Dilemma

One of the most pressing challenges confronting the North America transportation infrastructure market is the rapidly aging infrastructure. The weight of years is not just a metaphorical burden but a tangible, measurable problem. According to the American Society of Civil Engineers (ASCE), the U.S. infrastructure, on average, was graded a "D+" in their 2017 Infrastructure Report Card. This score is emblematic of the vast deficiencies present within the system. The numbers paint a telling story. In the United States alone, there are over 617,000 bridges, of which approximately 42% are over 50 years old. In fact, as of 2023, the average age of bridges is pegged at 43 years. Worse, as of 2019, 7.5% (or roughly 46,000) of these bridges were classified as "structurally deficient," implying a dire need for repairs or replacements. Roadways, too, reveal similar concerns. A whopping $420 billion is required to fix the backlog of road repairs, a number that has only grown over the years. Moreover, congested highways result in 3.4 billion lost hours and 2.9 billion gallons of wasted fuel annually for Americans, costing the economy an estimated $160 billion.

Aging infrastructure doesn't merely represent an economic burden in the transportation infrastructure market; it also poses safety risks. Deteriorating roads and bridges can lead to accidents, infrastructure failures, and, in the worst cases, casualties. Given that the federal fuel tax, a primary source of infrastructure funding, hasn’t seen an increase since 1993, addressing these glaring issues becomes even more complex. The challenge for North America is clear: revitalizing an aging system demands not just vast financial investments but also a strategic, long-term vision for sustainable, modern infrastructure.

Trend: Harnessing Technology in Transportation Infrastructure

The advent of the Internet of Things (IoT) is making its mark felt across the transportation sector. Smart cities in the U.S. transportation infrastructure market are experimenting with sensor-equipped roads and bridges. These sensors, embedded directly into the infrastructure, can monitor traffic patterns, detect wear and tear, and send real-time data to centralized systems. By 2022, it was estimated that North America had over 2.79 billion IoT connected devices, a figure projected to nearly double by 2025. Given that a significant portion of these devices are dedicated to improving transportation efficiency, the magnitude of technological integration becomes apparent.

Connected vehicles are another game-changer. As of 2021, there were approximately 84 million connected cars on the roads in the U.S., with that number expected to surge to 305 million by 2035. These vehicles communicate with each other and with the infrastructure, ensuring smoother traffic flow, reduced congestion, and enhanced safety. To give this perspective, studies suggest that vehicular communication can reduce non-impaired collisions by up to 80%, representing not just economic savings but potentially saving thousands of lives annually in the transportation infrastructure market. Public transportation is also undergoing a technological transformation. Real-time tracking, contactless payments, and AI-driven route optimization are becoming the norm. Cities like Toronto and San Francisco have reported a 20% increase in public transport efficiency and a 15% reduction in commute times due to such integrations.

This ongoing digital transformation in transportation infrastructure is supported by increasing investments in 5G technology. It's projected that by 2025, 75% of North America's urban population will have access to 5G networks, ensuring seamless connectivity for the transportation systems of the future.

Segmental Analysis

By Type:

A closer look at the North America transportation infrastructure market by type reveals that roads & highways are not just the backbone but the dominant segment of North America's transportation infrastructure. They command a significant 37% of the market's revenue share. This dominance is substantiated by the numbers. In 2022 alone, the market valuation for road and highway infrastructure stood at a staggering USD 78.6 billion. Such high investment in roads and highways underscores their pivotal role in connecting cities, towns, and rural areas, facilitating trade, commerce, and mobility across the continent.

The future trajectory for roads & highways also appears promising. Projections suggest a bright horizon with this segment poised to grow at the highest compound annual growth rate (CAGR) of 4.2% over the next decade, culminating in 2031. Several factors contribute to this optimistic outlook. The increasing urbanization, population growth, and burgeoning demand for efficient transportation avenues in North America necessitate the expansion and refinement of the existing road network. Add to this the continent's focus on establishing seamless intercity and interstate connectivity, and it becomes evident why roads & highways will continue to reign supreme in the foreseeable future.

By Construction Type:

North America transportation infrastructure market is dominated by new construction, holding a lion's share of over 73.3% of the market. This dominance is reflective of the continent's aggressive push to expand its transportation footprint. Be it establishing new transit corridors, building bypasses to decongest urban centers, or laying down fresh tracks to connect remote areas, new construction projects are in full swing across North America.

However, while new construction holds the majority share, there's another segment that's grabbing attention – the renovation segment. With a significant chunk of North America's transportation infrastructure aging and in need of upgrades or repairs, the renovation segment is witnessing accelerated momentum. It's expected to grow at a swift pace, registering the fastest CAGR of 4.3% between 2023 and 2031. This growth can be attributed to the dual challenges of maintaining the structural integrity of existing infrastructure while modernizing it to cater to contemporary demands. Factors such as changing weather patterns, increasing vehicular load, and the need to integrate technology into legacy systems are driving investments in renovation projects.

By Mode of Transportation:

Road transportation stands out as the dominant mode in the North American transportation infrastructure market, holding an impressive 51.2% share as of 2023. Its dominance is not just in terms of market share, but also in growth prospects, as this segment is expanding with the highest CAGR of 4.4%. The reasons behind this dominance are multifaceted. Utilizing public transportation on roads not only provides mobility for individuals but also propels the broader economy. The economic impacts are evident in investment patterns. Mexico, for instance, has invested heavily in this sector, with 16 specific investments totaling approximately USD 4.6 billion. These investments encompass the construction of highways, interchanges, and various other transportation infrastructure facilities.

Yet, while investments are pouring in across the North America transportation infrastructure market, there's a notable disparity between the required and actual financing to address the continent's infrastructural needs. The American Society of Civil Engineers (ASCE) highlighted this issue, pointing out an alarming "infrastructure investment gap" that, if left unchecked, could result in a staggering $10 trillion loss in U.S. GDP this decade. Transportation demands will account for the lion's share of these financing needs. The urgency to address these gaps isn't just about economic growth but also about safety and functionality. The U.S. Government Accountability Office's report sheds light on the state of decay: 10% of bridges are deemed physically defective, and another 14% are operationally obsolete. In essence, one out of every four bridges require attention. The Bipartisan Infrastructure Deal, inked in 2021 with an allocation of $550 billion, is a step towards redressing these infrastructure deficits. The deal underscores the commitment to expand, renovate, and modernize transportation avenues, ensuring safer and more efficient travel.

By Infrastructure Purpose:

In the North American transportation infrastructure market, the public segment emerges as the predominant player, capturing a substantial 63.3% market share. This dominance underscores the pivotal role public infrastructure plays in serving the vast and varied mobility needs of the continent's populace. From urban metros that ferry millions daily to highways that connect the heartlands, public infrastructure caters to diverse demographic and geographic requirements. The high share is a testament to the trust and dependence placed on public systems, which are often seen as more accessible, affordable, and sustainable compared to their private counterparts. The sheer scale of public infrastructure operations necessitates significant investments in their maintenance, expansion, and modernization.

As urbanization intensifies and populations grow, the demand on public infrastructure is set to increase in the North America transportation infrastructure market. Addressing this demand will require not just financial investments but also innovative planning, stakeholder collaboration, and a commitment to sustainability and inclusivity. In essence, the public infrastructure's dominance in the market is both a reflection of its current significance and an indicator of its future centrality in North America's transportation narrative.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

The transportation infrastructure market in North America presents a varied landscape, with each country including the US, Canada, and Mexico showcasing distinct characteristics, challenges, and opportunities. In recent years, Mexico has emerged as a significant player in this domain. The country's transportation infrastructure market is projected to witness an impressive growth trajectory, with an expected compound annual growth rate (CAGR) of 5.1% in the coming years. Several factors fuel this anticipated growth. Over the last two decades, Mexico has experienced a robust surge in foreign trade and travel activities. The amplification in the transportation of goods, both for domestic consumption and export, particularly to major trading partners like the United States and Canada, has underlined the need for a robust and efficient transportation system. A standout statistic that reaffirms this trend is the growing volume of goods arriving at Mexican ports. Whether it's for domestic consumption or for transit to other nations, there's a palpable demand for improved infrastructure to support this surge.

The United States, on the other hand, continues to dominate the transportation infrastructure market landscape in North America. As of 2023, the market value stands at an astounding USD 164.1 billion. This dominance is a testament to the country's sustained efforts in enhancing its transportation infrastructure. The expansion of roads and train networks, new construction projects dotting the length and breadth of the nation, and restoration endeavors targeting damaged facilities reflect the country's commitment to fortifying its transportation backbone. A case in point is the investments being directed towards refining existing operations and initiating new ones. Additionally, the Bipartisan Infrastructure Deal inked in 2021 by the U.S. president further accentuates this commitment. Allocating a monumental sum of USD 550 billion, this deal aims to infuse additional federal funds into the nation's already expansive infrastructure. Of this budget, a notable USD 110 billion has been earmarked exclusively for public transportation infrastructure. This significant financial outlay is not merely about roads, rails, and ports. It underscores a broader vision – to enhance the quality of life for American citizens. By facilitating access to reliable, eco-friendly, and safe transportation options, the deal seeks to revolutionize the way people commute, work, and live.

Top Players in the North America Transportation Infrastructure Market

- ACS Group

- AECOM

- Bechtel Corporation

- CK Hutchison Holdings Limited

- Fluor Corporation

- HDR, Inc.

- Jacobs Engineering Group

- Kiewit Corporation

- Kraemer North America

- Larsen & Toubro Limited

- OHLA USA

- Parsons Corporation

- Skanska USA Inc.

- The Bouygues Group

- VINCI Construction

- Other Prominent Players

Market Segmentation Overview:

By Type

- Roads and Highways

- Bridges and Tunnels

- Rail and Trams

- Waterways

- Ports and Harbors

- Airports

- Bike Paths and Walkways

- Others

By Construction Type

- New Construction

- Renovation

By Mode of Transportation

- Road Transportation

- Rail Transportation

- Air Transportation

- Maritime Transportation

By Infrastructure Purpose

- Public

- Commercial

- Freight

- Passenger

By Application

- Urban

- Rural

By Country

- The US

- Canada

- Mexico

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2023 | US$ 211.8 Bn |

| Expected Revenue in 2032 | US$ 288.6 Bn |

| Historic Data | 2019-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Unit | Value (USD Bn) |

| CAGR | 3.5% |

| Segments covered | By Type, By Construction Type, By Mode of Transportation, By Infrastructure Purpose, By Application, By Country |

| Key Companies | ACS Group, AECOM, Bechtel Corporation, CK Hutchison Holdings Limited, Fluor Corporation, HDR, Inc., Jacobs Engineering Group, Kiewit Corporation, Kraemer North America, Larsen & Toubro Limited, OHLA USA, Parsons Corporation, Skanska USA Inc., The Bouygues Group, VINCI Construction, Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)