North America Roll Cover Market: By Material Type (Elastomer Roll Covers, Polyurethane Roll Covers, Composite Roll Covers, Ceramic Roll Covers, Metallic Roll Covers); Roller Type (Hard Roll Covers, Soft Roll Covers); By Functionality (Heat Resistant Roll Covers, Chemical Resistant Roll Covers, Abrasion Resistant Roll Covers, Corrosion Resistant Roll Covers, Anti-Stick Roll Covers, Impact Resistant Roll Covers); Application (Pulp and Paper, Textile, Metal Processing, Printing, Packaging, Food and Beverage, Wood Processing, Plastic Film and Foil Processing); Industry (Manufacturing, Automotive, Consumer Goods, Construction, Mining); Country—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: Jan-2025 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA01251117 | Delivery: Immediate Access

| Report ID: AA01251117 | Delivery: Immediate Access

Market Scenario

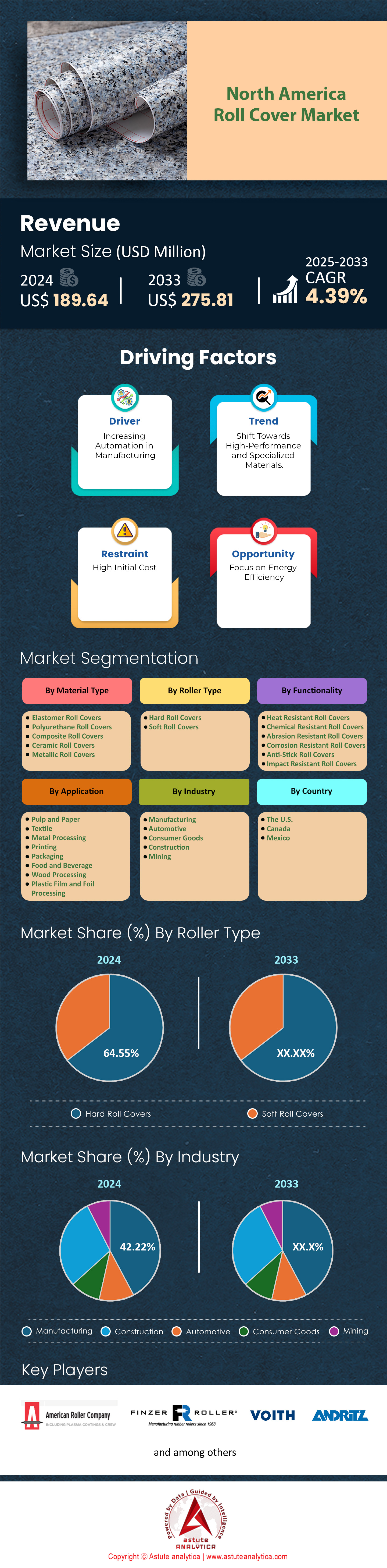

North America roll cover market was valued at US$ 189.64 million in 2024 and is projected to hit the market valuation of US$ 275.81 million by 2033 at a CAGR of 4.39% during the forecast period 2025–2033.

Roll covers are specialized sleeves or coatings applied around industrial rollers to protect against abrasion, chemical degradation, and extreme operating conditions. They ensure uniform tension, smooth product flow, and precise surface quality in applications ranging from papermaking to film manufacturing. Anderson Coating Solutions fulfilled 15 new orders for silicone-based roll covers in Texas during early 2024, indicating heightened material demand in that region. One polymer plant in Ohio now ships 2,500 polyurethane roll covers per month to an automotive assembly chain, underscoring the importance of resilient materials. Three automotive lines in Kentucky collectively installed 600 advanced roll covers in June 2024 to minimize conveyor belt downtime.

The North America roll cover market is witnessing strong growth due to expansions in sectors like pulp and paper, packaging, textile, and automotive. Four textile mills in Georgia replaced 30 nitrile covers with EPDM variants in the first quarter of 2024 to tackle higher heat loads. A paperboard facility in Maine recently adopted six carbon-fiber roll covers to address mechanical stress during high-speed processing. A leading packaging film producer in South Carolina switched from 45 rubber covers to carbon-fiber-based alternatives for weight reduction on high-speed lines in spring 2024. In parallel, a major steel mill in Pennsylvania invested 2 million dollars in corrosion-resistant covers to support continuous casting operations.

Key cover types include rubber, polyurethane, composite, and silicone, with each variant catering to distinct industrial demands. Rubber covers, particularly nitrile and EPDM, thrive in heavy-duty environments due to high elasticity and chemical resistance. Polyurethane covers are favored for their durability in the automotive sector, as reflected by a gear manufacturer in Michigan that adopted polyamide-based covers for 140 precision rollers in 2024. Meanwhile, fiberglass and carbon-fiber composites have grown popular for packaging lines, with one Wisconsin-based operation reporting a 23-day reduction in maintenance downtime after installing lightweight covers in mid-2024. These developments highlight the dynamic landscape of the North America roll cover market, propelled by diverse end-user requirements and continued material innovations.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Accelerating Need For Precision Roller Coatings In High-Performance Industrial Fabrication Across The Entire Region

Every day, North American roll cover market production floors push the boundaries of roller technology to handle higher speeds and heavier loads. An automotive forging plant in Wisconsin recently validated 40 high-resilience covers rated at 2,800 psi, illustrating the growing emphasis on damage-proof surfaces. Meanwhile, a specialty calender line in Ohio tested new elastomer formulations that remained stable over 12,000 hours of continuous use, proving that longevity is no longer a tentative goal but a pressing requirement. Engineers at a Canadian metals workshop noticed that their retooled press rollers with a 2,200-pound tension rating boosted dimensional consistency for intricate aluminum profiles. Throughout these facilities, design teams are collaborating with chemists to craft tailor-made coatings—there is a clear demand for covers that can accommodate faster machine cycles without compromising on product uniformity.

As custom roller manufacturing evolves, producers in the roll cover market across North America are experimenting with hybrid compounds and reinforcing layers. A New York electronics assembly plant, handling extremely delicate substrates, upgraded eight specialized lines with advanced polyurethane covers embedded with braided fibers to avoid micro-tearing. Over in Illinois, a polymer testing lab reported a newly discovered proprietary blend that tolerates extreme heat and delivers 600 additional hours of operational life compared to conventional nitrile formulations. By adapting these cover materials to niche production environments, managers see noticeable gains in both uptime and product throughput. One composite research facility in California even found that 15-roller systems fitted with triple-layer covers reduced frictional heating enough to eliminate secondary cooling steps. These instances underscore a shared priority: whether the end use is automotive, film processing, or electronics, industry players are racing to adopt sophisticated coatings that absorb mechanical stress while preserving the tight tolerances required in modern manufacturing. With this appetite for precision at an all-time high, roll cover specialists are devising ever more resilient solutions, cementing the role of precision coatings in driving the region’s industrial competitiveness.

Trend: Widespread Integration Of Intelligent Sensor-Enabled Industrial Roll Covers For Enhanced Remote Monitoring And Diagnostics

Manufacturers in the roll cover market keen on predictive maintenance are welcoming a new wave of rollers embedded with data-gathering sensors. A packaging operation in Georgia recently outfitted 10 lines with covers that transmit real-time updates on thermal buildup, allowing technicians to fix localized hot spots before they balloon into major disruptions. In New Jersey, a plastics conversion facility introduced four sensor-equipped rollers that measured surface vibrations every 20 minutes, ultimately identifying microscopic cracks that would have gone unnoticed until a catastrophic failure. This proactive mindset has been echoed in an appliance assembly plant in Indiana, where data-driven covers alerted workers of friction spikes on three conveyor lines, saving hundreds of man-hours through early interventions. By decoding these readings, maintainers can fine-tune tension forces and even orchestrate lubrication schedules with precision.

Beyond reducing downtime, sensorized covers inspire an entirely new level of process optimization. A research team near Washington integrated sensor arrays on six high-speed printing rollers, allowing them to track minute shifts in alignment and calibrate accordingly. In Texas, a specialized adhesives producer noticed that its newly deployed sensor-laden rollers cut chemical usage by regulating dispensing rates in real time and preventing excessive coatings on the substrate. An aerospace supplier in Arizona roll cover market, known for strict quality protocols, gained an extra 500 hours of uninterrupted operation after linking sensor readings to automated strain-balancing software. Others report similar breakthroughs: a large-scale paper mill in Wisconsin updated its software to gather roller metrics from eight in-built sensor covers in a single dashboard, improving line speeds without sacrificing uniformity.

Challenge: Maintaining Roll Cover Performance Stability Under Extreme Operational Temperatures And Constantly Evolving Production Lines

North America’s industrial landscape in roll cover market is peppered with processes that shift from one temperature extreme to another in a heartbeat, placing enormous strain on roller coatings. In Arizona, a copper smelting facility tested a new high-tolerance ceramic blend on four rollers exposed to 1,400°F, a critical move to stop blistering that plagued previous covers. At a pharmaceutical plant in New York, roll covers must shuttle smoothly between heated sealing units and chilled cooling tunnels, prompting engineers to adopt multi-layer constructs with insulating cores. On the other side of the spectrum, a electronics lab refined silicone covers rated for -10°F, discovering that even small microtears can expand when frigid bursts strike repeatedly. Taken together, these examples reflect a shared struggle: balancing heat spikes, rapid cooling, and mechanical stress leaves little margin for error.

Beyond temperature, modern factories in the North America roll cover market often overhaul production lines at a brisk pace, complicating the life cycle of roll covers. A robotics integration team in Ohio replaced 14 traditional rubber shells with advanced EPDM-based formulations to withstand abrupt acceleration from newly installed robotic arms. Meanwhile, an automotive battery recycler in Michigan switched out 10 legacy covers after noticing that repeated reconfigurations led to partial delamination under pressurized testing. In Illinois, a metal-forming facility discovered structural instability in five composite covers once it started running heavier gauge steel. Each redesign, each new piece of automation, and each shift in production demands can disrupt the delicate balance of chemical resistance, elasticity, and thermal sturdiness that keeps rollers in prime condition. To meet these challenges, manufacturers are gravitating toward multi-component blends with insulating layers and shock-absorbing surfaces, ensuring that roll covers maintain consistent performance no matter the temperature swings or process modifications. Such solutions help busy operations stay on schedule, sparing them costly downtime in a competitive industrial environment.

Segmental Analysis

By Material Type

Elastomers command 41.82% share of North America roll cover market because they offer robust flexibility and resilience under varying loads and temperatures. Providers such as Trelleborg and Voith Paper have developed specialized elastomer-based roll covers—like Trelleborg’s PressHus series—that withstand the rigorous demands of high-speed printing and coating lines at facilities run by Domtar and International Paper. These covers excel in delivering consistent surface properties, which is crucial for ensuring uniform ink transfer and web tension control. Additionally, elastomers possess a capacity to rebound quickly after contact with abrasive materials or chemical coatings, minimizing downtime. In 2023, the US-based Rubber Manufacturers Association reported an uptick in sales of synthetic elastomers for industrial applications, attributing the surge to heightened activity in packaging and tissue production lines. This material’s chemical resistance further reduces maintenance complexities, enabling operators to keep their processes running smoothly even when processing corrosive substances or high-temperature adhesives.

Beyond durability, elastomers present a cost-effective solution in the roll cover market due to simpler thermal and mechanical bonding processes, compared to options like ceramic or polyurethane covers. Valmet’s rubberized roll surfaces, for instance, are known to extend service intervals for corrugating and printing operations in Georgia-Pacific plants across the southern United States. Elastomers also resist micro-cracking better, a feature particularly beneficial in environments where temperature fluctuations are routine—such as pulp pressing in cold climates or hot-platen lamination lines in warmer regions. Conversion specialists value how quickly these covers can be refurbished through methods like in-house grinding or reglazing, reducing long-term operational costs. The versatile nature of elastomers has led industries like flexible packaging and corrugated box manufacturing to adopt these covers for processes requiring rapid adjustments in tension or nip pressure. Consequently, elastomers set themselves apart by providing reliability, smoother product throughput, and modification ease, solidifying their top position among North American roll cover materials.

By Roller Type

Hard roll covers have gained prominence in North America roll cover market with over 64.55% market share due to their superior structural integrity and dimensional stability, which are particularly valuable in metal processing lines and heavy pulp handling systems. Major steel coil processors like ArcelorMittal in Indiana rely on hard roll covers to cope with extreme compressive forces and high surface temperature during hot rolling operations. Because these covers can resist dents and deformation, end users report fewer roll changes, better thickness consistency, and improved overall process efficiency. Likewise, certain packaging converters prefer hard covers to achieve stiffer nip configurations that prevent undesired web stretch. By maintaining a rigid surface, these covers align well with the demands of high-speed corrugating lines, where uniform pressure distribution is vital for sturdy box formation. In both scenarios, robust hardness translates into consistent top performance under stress, making it a pivotal solution in routine industrial setups.

A push for longer service life also drives the adoption of hard roll cover market. Customized thermal-sprayed alloys offered by manufacturers like Spraymet or Chrome Deposit Corporation have been implemented at WestRock facilities to upgrade their classic steel rolls to more advanced hard surfaces. This approach minimizes roll wear and helps maintain consistent product quality—particularly important for large-scale printing runs or demanding calendering processes. By reducing the frequency of replacements, users see lower operational disruption and improved cost-efficiency. Additionally, maintenance protocols often are simpler with these covers, since minor surface abrasions can be polished away without compromising the cover’s structural integrity. The consistent hardness profile around the roll circumference ensures that printing and coating lines operate with predictable gauge control. As a result, hard roll covers continue to expand their reach across North America, particularly in environments where mechanical stress and tight tolerance specs are frequent concerns.

By Functionality

Abrasion-resistant roll covers stand out in the roll cover market as it controls nearly 32% of the market share because industrial processes in North America increasingly handle tough materials and high-friction surfaces, necessitating covers that retain their structural integrity over extended cycles. Pulp refiners, for instance, subject rolls to fibrous slurries that can gradually grind away softer materials. Similarly, paperboard manufacturers like Graphic Packaging International use filler and clay additives that act like sandpaper against rolls. Abrasion-resistant coatings—often based on silicone-carbide blends or reinforced elastomers—manage to ward off these wearing forces while keeping product quality intact. This functionality is particularly sought after by segments such as tissue and specialty papers, where surface uniformity directly impacts final product characteristics. As mills aim to minimize scheduled roll changes, advanced abrasion-resistant formulas have emerged from suppliers like AstenJohnson and Xerium, offering an optimal blend of hardness, tensile strength, and microscopic sealing against micro-tearing.

Aside from pulp and paper, converters involved in laminating metal foils or producing abrasive-grade adhesives also clamor for highly durable roll covers. They find that covers with protective top layers—like those equipped with tungsten-carbide or ceramic-infused sections—lower the risk of surface scoring and subsequent material defects. Lower frequency of re-grinding translates to increased uptime, a critical goal in fast-paced packaging lines. Furthermore, these covers perform well at elevated nip pressures in the North America roll cover market, ensuring that coated or laminated products maintain even thickness when processed at speeds above 1,000 feet per minute. Maintenance managers who oversee multi-shift operations note significant cost savings when adopting abrasion-resistant solutions because they can bypass frequent roll replacements. In short, the need to handle abrasive substrates and reduce downtime propels abrasion-resistant roll covers to center stage, reinforcing their standing as a strategic asset for North American mills and converters.

By Application

North America’s pulp and paper industry wields substantial influence on roll cover market growth with revenue share of over 40.66% as reflected by real-world production figures from the American Forest & Paper Association, which cites over 65 million tons of paper and paperboard produced annually in the United States alone. This continuous output forces mills to prioritize roll durability and reliability to sustain round-the-clock operations. Major players like Georgia-Pacific, Resolute Forest Products, and Domtar heavily invest in covers designed for pressing, drying, and calendering, ensuring consistent finish and thickness of paper goods. In calendering operations, for instance, an even roll surface is essential for uniform sheet gloss, a major selling point in premium paper segments. The complex web of mechanical, thermal, and chemical challenges in pulp refining also amplifies the demand for specialized covers. Many providers, such as Voith Paper and Valmet, specifically tailor their products to resist the combined effects of moisture, chemicals, and mechanical stress—a hallmark of pulp and paper processes.

The industry’s emphasis on energy efficiency and reduced downtime further shapes the profile of desired roll cover market in North America. Modern tissue machines, produced by Toscotec in South Carolina and used at Kruger mills, rely on low-friction surfaces that minimize drag while maintaining consistent nip pressure. Abrasion-resistant elastomeric covers with advanced bonding layers are favored for press sections, where they confront wet pulp streams that can quickly erode less resilient materials. Such covers also help maintain high dewatering efficiency, a key factor in boosting machine speed and reducing overall electricity consumption. Meanwhile, hard roll covers with ceramic coatings are adopted in finishing lines to deliver smoother surfaces for fine-grade printing papers. From jumbo rolls of pulp to high-gloss magazine stock, the pulp and paper sector’s vast product spectrum demands roll covers that excel across varied stages, fueling continuing innovation and robust investments in the North American market.

To Understand More About this Research: Request A Free Sample

Country Analysis

The United States with over 83% revenue contribution to North American roll cover market stand tall due to its massive industrial infrastructure and diverse manufacturing base, spanning everything from large-scale paper mills to robust automotive parts production. According to the American Forest & Paper Association, paper and paperboard facilities in the country alone account for more than 300,000 direct jobs. Major corporations like WestRock, International Paper, and Kimberly-Clark invest heavily in state-of-the-art production lines that use advanced roll covers for pressing, calendering, and converting. This demand intersects with the needs of sectors like steel and aluminum processing, where countless rolling mills operate continuously, each requiring covers that can endure high-pressure nip environments. Coupled with the presence of specialized research labs—like the Georgia Institute of Technology’s Manufacturing Institute—these industries benefit from continual innovation in elastomer formulations, ceramic-coating methods, and automated roll grinding technologies.

Another driving factor behind the dominance of the US in North America roll cover market is the well-established network of local roll-cover providers and service centers, which cater to the soaring operational demands of industrial giants. Suppliers such as the Voith service hub in Wisconsin and the Trelleborg facility in Massachusetts respond quickly to maintenance and replacement requests, ensuring that high-volume production lines face minimal downtime. Moreover, the US market enjoys robust capital expenditure budgets from players like Domtar and Resolute Forest Products, leading to consistent upgrades in roll-cover solutions. The presence of key automotive companies—Ford, General Motors, and Stellantis—further underlines the scale of demand for technically precise roll covers in metal forming, surface finishing, and even adhesives. Because each segment has distinct requirements—ranging from abrasion resistance in automotive sheet metal lines to chemical resilience in detergent packaging—roll-cover manufacturers find fertile ground for constant product refinement. Taken together, the industrial breadth, specialized service ecosystem, and ample funding channels positioned within the United States create a dynamic environment that propels it well ahead of other North American nations, cementing its status as the region’s top market for roll covers.

Top Players in North America Roll Cover Market

- American Roller Company

- Finzer Roller, Inc.

- Voith GmbH & Co. KGaA

- ANDRITZ AG

- Valmet

- Other Prominent Players

Market Segmentation Overview:

By Material Type

- Elastomer Roll Covers

- Polyurethane Roll Covers

- Composite Roll Covers

- Ceramic Roll Covers

- Metallic Roll Covers

By Roller Type

- Hard Roll Covers

- Soft Roll Covers

By Functionality

- Heat Resistant Roll Covers

- Chemical Resistant Roll Covers

- Abrasion Resistant Roll Covers

- Corrosion Resistant Roll Covers

- Anti-Stick Roll Covers

- Impact Resistant Roll Covers

By Application

- Pulp and Paper

- Textile

- Metal Processing

- Printing

- Packaging

- Food and Beverage

- Wood Processing

- Plastic Film and Foil Processing

By Industry

- Manufacturing

- Automotive

- Consumer Goods

- Construction

- Mining

By North America

- The U.S.

- Canada

- Mexico

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA01251117 | Delivery: Immediate Access

| Report ID: AA01251117 | Delivery: Immediate Access

.svg)