North America Printing Toners Market: By Production Technology (Convectional toners and Chemical toner); Resin (Polyester, Styrene-Acrylic, Specialty Polymers); End Use (Printing & Stationary, Packaging, FMCG, Advertising and Branding, and Others); Country— Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: 25-Jul-2024 | | Report ID: AA1123672

Market Scenario

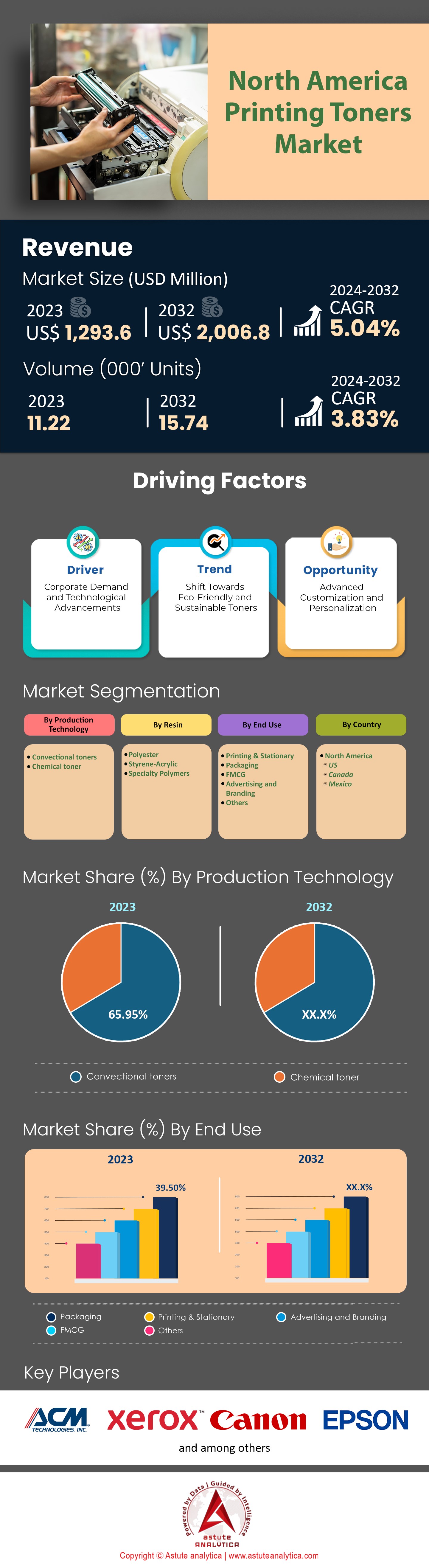

North America Printing Toners Market was valued at US$ 1,293.6 million in 2023 and is projected to attain a market valuation of US$ 2,006.8 million by 2032 at a CAGR of 5.04% during the forecast period 2024–2032.

The North American printing toners market, a segment critical to the region's printing industry, is currently navigating through a phase marked by transformative trends and evolving consumer behaviors. As of the latest analysis, the U.S. continues to be the powerhouse of this market, with over 72.83% revenue share in 2023, a figure that reflects the country's robust demand for high-quality printed materials. This demand is not without its nuances; there has been a noticeable swing towards more sustainable and efficient printing solutions. The U.S. market, specifically, has seen an annual increase in the adoption of eco-friendly toners by approximately 7%, a clear nod to the shifting priorities towards sustainability.

Canada, contributing significantly to the regional printing toners market due to its steady economic growth and the increasing awareness of eco-conscious business practices. Mexico, though a smaller contributor, displays potential with a growing CAGR expected to be around 6% over the next five years, spurred by the country's expanding manufacturing and industrial sectors. Together, these regions are knitting a fabric of market growth that is both diverse and interconnected, with trade agreements such as USMCA smoothing the path for cross-border commercial activities.

The technological landscape within the North American printing toners market is also witnessing significant shifts. Digital printing technologies, which allow for rapid and cost-effective production, are being adopted at a rate that outpaces traditional printing methods. This surge is particularly potent in the personalized print products sector, which has seen an 8% growth in demand year-over-year. In tandem with this growth is the burgeoning segment of color toners, expected to experience a 5% increase in market share by 2031, as they are increasingly preferred for their vivid and high-definition print quality.

Despite the optimistic growth projections, the market faces challenges, particularly from the environmental front. Stringent regulations and a growing culture of corporate responsibility are pushing companies to innovate in the realm of sustainable toner solutions. The push for a circular economy is not just a trend but a business imperative in the printing toners market, with recycling programs for cartridges experiencing a 10% uptick in participation. This eco-friendly transition is not merely a compliance measure but also a strategic business move, as approximately 30% of North American consumers now prefer environmentally responsible print materials.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Corporate Demand and Technological Advancements

The North American printing toners market is primarily driven by the consistent requirement for printed materials in the corporate sector, particularly within packaging, publishing, and labeling industries. Despite the digital shift, the North American packaging industry is projected to burgeon to a valuation beyond $200 billion by 2025, advancing at a CAGR of 4%. This growth highlights the ongoing need for printing toners in product branding and information dissemination. Corporate reliance on physical marketing materials also remains prevalent, with about 95% of businesses still incorporating print in their marketing strategies. This enduring preference underscores the stable demand for printing toners.

Technological enhancements in toner production contribute significantly to market expansion. Chemically produced toners, which provide improved print quality, environmental benefits, and higher efficiency, have seen a surge in adoption, increasing by approximately 20% recently. Furthermore, the inclination towards color printing, favored for its visual appeal in advertising and packaging, is stimulating growth in the color toner segment. The market's upward trajectory is further supported by the escalating quality demands in printing, with advancements in toner technology facilitating the development of products that meet the evolving requirements of high-resolution and color-intensive printing tasks. These factors collectively suggest a promising growth potential for the North American printing toners market, buoyed by the corporate sector's sustained demand and the progressive stride in printing technology.

Trend: Shift Towards Eco-Friendly and Sustainable Toners

A prominent trend in the North America market is the escalating shift towards eco-friendly and sustainable toners. This trend is rooted in the growing environmental awareness and the subsequent demand for green printing practices. The market is witnessing an increasing preference for bio-based toners, which use vegetable oils and other renewable resources rather than petroleum-based products. The drive towards sustainability is not merely a response to consumer sentiment but also a compliance measure with stringent environmental regulations set forth by agencies such as the EPA.

The sustainability trend in the printing toners market is further bolstered by the rise of the circular economy, where the life cycle of products, including printing toners, is extended through recycling and reuse. This is evident in the increased rates of cartridge recycling programs, which have become more sophisticated, allowing used toners to be remanufactured with quality that rivals new cartridges. Manufacturers are also investing in zero-waste production processes and offering take-back programs, which have gained traction among eco-conscious consumers. As businesses and consumers alike seek out sustainable options, the demand for green toners is anticipated to grow, with projections indicating a notable uptick in sales of these products over the next decade. The shift towards environmentally friendly products is not just a passing trend but a transformative movement in the printing industry, reshaping production methods and consumer habits in the context of global sustainability goals.

Opportunity: Advanced Customization and Personalization

The printing toners market in North America is at the tip of a significant opportunity with the rise of advanced customization and personalization. In an era where branding and differentiation have become paramount, the ability to offer customized printing solutions provides a competitive edge. This opportunity is rooted in the evolving technological landscape, where digital printing technologies have matured to enable short-run print jobs economically and efficiently. These technologies accommodate the growing desire for personalized marketing materials, custom packaging designs, and on-demand printing services.

The trend of personalization extends beyond the marketing sphere into individual consumer behavior in the North America printing toners market. The demand for customized print products, such as personalized photo books, bespoke invitations, and tailored business materials, is on the rise. Digital printing technology's flexibility to handle variable data printing where each print can be different, opens up a new realm of possibilities for high-margin personalized products. Manufacturers that can leverage these technological advancements to offer customizable toner solutions are well-positioned to tap into this opportunity. With an estimated 30% of consumers expressing interest in personalized products and services, the market potential for customized printing solutions is significant. As a result, the printing industry is witnessing a shift towards smaller, more targeted print runs that cater to the desire for individuality and exclusivity, presenting a lucrative opportunity for players in the toner market.

Segmental Analysis

By Production Technology

In the North American printing toners market, the segmentation by production technology provides a revealing snapshot of industry preferences and growth patterns. Conventional toners, produced through a mechanical grinding process to create fine toner powder, are the stalwarts of the market. They have a stronghold with a commanding 65.95% share, reflecting the industry's reliance on tried-and-tested methods that have historically served the bulk of printing needs. The familiarity of technology, widespread availability, and the breadth of applications across various printing tasks bolster this segment's preeminent position.

What's particularly interesting is that this conventional segment is not just resting on its successes; it's also projected to grow at the most vigorous CAGR of 5.4%. This growth trajectory suggests a dual phenomenon. On one hand, it underlines a market that values the reliability and consistent quality of conventional toners. On the other hand, it indicates an active development within this segment, likely driven by incremental innovations that improve efficiency, print quality, and environmental impact, making these toners more appealing in a competitive landscape.

This robust growth of conventional toners, in the face of more modern production technologies, highlights a market that respects tradition but is also adaptable to innovations within that space. It reveals that even as the North American market looks toward more technologically advanced solutions, there remains a strong current of demand for conventional toners that are expected to not only maintain their market share but also expand it in the coming years.

By Resin

Within the North American printing toners market, the segmentation by resin type reveals a notable preference for polyester resins, which have carved out a dominant position. Holding a substantial 69.67% of the market share, polyester-based toners are the clear frontrunners. The reasons behind this preference are many-sided, stemming from polyester's intrinsic qualities such as durability, eminence in print clarity, and versatility across different printing platforms. These resins are favored for their ability to withstand the heat and pressure of fusing to paper, yielding prints that are both vivid and long-lasting, an essential requirement for professional-grade printing tasks.

Looking ahead, the polyester resin segment isn't merely maintaining its lead; it's also on track to outpace other resin types in terms of growth in the printing toners market at a CAGR of 5.29% signals a robust expansion trajectory. This projected growth is indicative of ongoing innovations in polyester toner formulations, which continue to enhance print quality and environmental sustainability, two critical concerns for consumers and businesses alike. As the market progresses, the increasing adoption of color printing in commercial and corporate settings is expected to further catalyze the demand for polyester resins, given their superior performance in producing vibrant color prints.

By End Use

The North American printing toners market, when analyzed by end use, shows a pronounced leaning towards the packaging sector. This segment currently holds the lion's share, with 39.50% of the market pie. This dominant stake can be attributed to the critical role that printing plays in the packaging industry, where branding, labeling, and product information are essential. High-quality printing toners are indispensable for producing sharp, durable, and vibrant package designs that stand out on retail shelves and captivate consumer attention.

The packaging segment's preeminence is not only a reflection of the current state but also indicative of future trends, as it is projected to burgeon at the highest CAGR of 5.30%. This anticipated growth is in step with the increasing demand for aesthetically appealing and customized packaging solutions across a wide array of industries—from food and beverages to electronics and cosmetics. The sector's expansion is further fueled by the e-commerce boom, which necessitates durable and visually compelling packaging for shipping and handling. This trend emphasizes a market that is increasingly driven by the need to balance functionality with aesthetics in packaging, leveraging high-quality toners to deliver on both fronts. As consumer goods companies strive to differentiate their products and establish brand identity, the reliance on advanced printing toners is expected to escalate, setting the stage for sustained growth in this segment of the North American market.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Country Analysis

The United States stands out as the most significant contributor, accounting for an overwhelming 72.83% of the regional printing toners market revenue in 2023. This substantial revenue share is a proof to the U.S.'s robust commercial and industrial sectors, which exhibit a high demand for printed materials. The U.S. market is propelled by an ecosystem that encompasses a mature advertising and media industry, a strong corporate culture that relies on high-quality printed materials for branding and communication, and a significant consumer market for printed products. The U.S. dominance in the market is further cemented by the presence of leading printing toner companies and advanced manufacturing facilities that benefit from the country's sophisticated technological infrastructure. This allows for a rapid adoption of innovative toner technologies, including those that are environmentally friendly, catering to the sustainability trends that are becoming increasingly important among American consumers and businesses.

Following the U.S., Canada represents the second-largest printing toners market within North America, contributing a significant revenue share. Canada's market is characterized by its emphasis on environmental stewardship, which has driven the development and adoption of eco-friendly printing toners. The country's advanced recycling programs and stringent environmental policies have encouraged printer and toner manufacturers to innovate and focus on sustainability, thus influencing market dynamics.

Mexico, while holding a smaller portion of the printing toners market compared to its northern neighbors, is an emerging player with potential for growth. The country's increasing industrialization, coupled with a growing retail sector, has led to a heightened demand for printed materials, subsequently impacting the market. Mexico's strategic position as a manufacturing hub also offers a unique advantage, potentially serving not just the domestic market but also the broader North American supply chains. The cross-border trade agreements such as the USMCA (United States-Mexico-Canada Agreement) facilitate the seamless flow of goods, including printing toners, between these countries, thus enhancing the interconnectedness of the North American market. Moreover, the increasing penetration of digital printing technology across the region is poised to open new avenues for the market, offering customized and on-demand printing solutions that are increasingly favored by businesses and consumers alike.

Top Players in the North America Printing Toners Market

- ACM Technologies

- Xerox Corporation

- Canon

- Epson

- HP Inc.

- IBM

- IMEX Co. Ltd.

- Konica Minolta

- Lexmark

- Panasonic

- Other Prominent Players

Market Segmentation Overview:

By Production Technology

- Convectional toners

- Chemical toner

By Resin

- Polyester

- Styrene-Acrylic

- Specialty Polymers

By End Use

- Printing & Stationary

- Packaging

- FMCG

- Advertising and Branding

- Others

By Country

- US

- Canda

- Mexico

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)