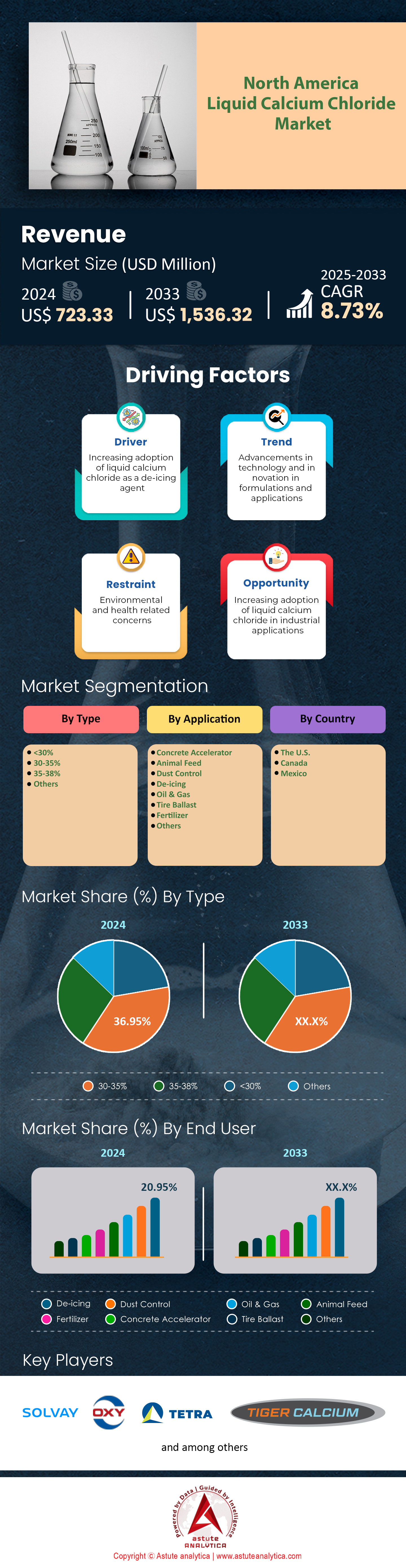

North America Liquid Calcium Chloride Market: By Type (<30%, 30-35%, 35-38% and Others); Application (Concrete Accelerator, Animal Feed, Dust Control, De-icing, Oil & Gas, Tire Ballast, Fertilizer and Others); Country—Industry Dynamics, Market Size and Opportunity Forecast for 2025–2033

- Last Updated: 05-Feb-2025 | | Report ID: AA0422209

Market Scenario

North America liquid calcium chloride market is estimated to witness a rise in revenue from US$ 723.33 million in 2024 to US$ 1,536.32 million by 2033 at a CAGR of 8.73% during the forecast period 2025-2023.

The North American liquid calcium chloride market has experienced a remarkable evolution driven by modernized production processes and an expanding array of applications. Advanced extraction and synthesis techniques have unlocked new production capabilities, enabling companies to meet the growing demands of diverse sectors. The deicing application has become a standout use, with municipalities across the region adopting more sophisticated methods to improve roadway safety during harsh winter conditions. At the same time, agricultural operations have integrated liquid calcium chloride into cutting-edge irrigation systems, optimizing soil stabilization and water retention for better crop performance. The surge in adoption, driven by both innovation and field-testing of new formulations, has positioned the market as a vital contributor to regional infrastructure and environmental management.

Prominent industry leaders are setting the pace for transformation by investing in state-of-the-art technologies and innovative research initiatives. Companies such as Dow Chemical, Occidental Chemical, and Calcium Technologies Inc. have redefined production methodologies through strategic capacity expansions, integrated automation, and collaborative research and development. Their efforts to fine-tune liquid formulations and optimize production protocols in the liquid calcium chloride market have resulted in more resilient and efficient manufacturing practices. These advances have not only cemented their roles as market frontrunners but have also spurred industry-wide improvements in quality control, safety protocols, and environmental stewardship. The commitment to sustainable practices has encouraged continuous enhancements in product purity and consistency, fueling further innovation across the supply chain.

On the regional front, both the United States and Canada serve as primary hubs of innovation and application. Strategic investments in production infrastructure and pilot programs are transforming how liquid calcium chloride is utilized across multiple sectors. Urban projects have been reimagined through improved deicing strategies, while rural areas are embracing modern irrigation systems to counter the challenges posed by variable climate conditions. Collaborative partnerships between academic institutions and industry practitioners further reinforce the development of novel application techniques and sustainable processing methodologies. Together, these dynamics underscore a market defined by its forward-thinking research, impressive adaptability, and commitment to advancing both safety and operational performance across North America.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Expanding modern deicing infrastructure and innovative irrigation systems catalyze rising liquid calcium chloride demand

Municipalities and agricultural communities have increasingly turned to liquid calcium chloride market as a solution for critical operational challenges. In urban areas, enhanced deicing projects have transformed roadway maintenance by incorporating modern, resilient chemical applications into daily operations. These efforts allow for more robust prevention of ice formation on roadways, ensuring that traffic flow remains safe and efficient even under severe winter conditions. Similarly, in agricultural regions facing unpredictable weather, pioneering irrigation systems now integrate liquid calcium chloride to improve soil stabilization and water management. This approach has led to innovative solutions that enhance crop resilience and overall productivity, demonstrating a clear commitment to using advanced materials for both public safety and agronomic efficiency.

Beyond immediate applications in deicing and irrigation, the strategic drive is supported by cross-sector partnerships that have fostered a culture of innovation in the North America liquid calcium chloride market. Municipal planners, agricultural engineers, and technology providers have collaborated on projects that refine these solutions to address localized challenges. These collaborative efforts have resulted in the development of customized formulations tailored to unique regional requirements, ensuring optimal performance under varying environmental conditions. The partnerships also encourage ongoing feedback from end users, driving continuous improvements in product application and efficacy. This synergy between infrastructure development and technological innovation clearly illustrates how the driver transforms operational challenges into opportunities for safer and more efficient communities.

Trend: Integration of digital automation and sustainable processing techniques revolutionizes liquid calcium chloride production strategies

Across North America liquid calcium chloride market, production facilities are embracing digital automation to streamline operations and enhance product consistency. Modern plants incorporate cutting-edge sensors and digital monitoring systems that allow operators to make timely process adjustments, thereby ensuring a reliable and high-quality output. This technological progression is complemented by a firm commitment to sustainable processing. Leading manufacturers are integrating eco-friendly methods that reduce waste and optimize energy consumption. The dual focus on innovation and environmental stewardship is woven into every aspect of production, from the initial extraction to the final formulation stage. Such integrative strategies foster a robust production environment that is both efficient and responsive to market needs.

The movement toward automation and sustainability has inspired a culture of continuous improvement throughout liquid calcium chloride market. Collaborative efforts between technology experts and chemical engineers have resulted in the development of process protocols that not only maintain product standards but also support the long-term environmental goals of the industry. Digital solutions are increasingly used for predictive maintenance and real-time quality assurance, ensuring that the production process remains adaptive and resilient. This trend reflects a broader industry commitment to harmonizing technological advancements with eco-friendly practices, thereby securing a competitive advantage in an ever-evolving market landscape.

Challenge: Navigating persistent global raw material sourcing complexities and logistical network disruptions hinders distribution stability

The liquid calcium chloride market faces significant challenges linked to global raw material sourcing and complex logistics. Companies rely on intricate international supply networks that can sometimes introduce vulnerabilities in the production process. Disruptions in these networks have led to intermittent challenges in meeting production targets and ensuring a steady distribution flow. Trade uncertainties and fluctuating availability of key raw materials have forced manufacturers to adapt quickly. These challenges not only affect operational efficiency but also put pressure on supply chains to maintain high-quality standards while grappling with external uncertainties.

To address these obstacles, industry stakeholders in the liquid calcium chloride market are investing in proactive measures designed to counteract potential disruptions. Efforts to diversify supplier bases and foster closer relationships with logistics partners have become a priority. Companies are implementing advanced tracking and digital monitoring systems that offer greater visibility across the supply chain. Enhanced communication channels among suppliers, shipping agents, and end users are also being established to reduce delays. These initiatives aim to build a more resilient network that can quickly adapt to changing global conditions. Ultimately, while the challenges are significant, the market’s commitment to innovation and adaptive strategies is proving essential in maintaining distribution stability and operational continuity.

By Application

More than one-fifth of liquid calcium chloride production is dedicated to de-icing applications in the liquid calcium chloride market. This usage is driven by the product’s exemplary performance in rapidly mitigating icy conditions on roadways and other infrastructure. Regional authorities, for example, have documented that treatment areas covering up to 400 kilometers of roadway per cycle can be efficiently serviced. Field reports indicate that the product facilitates ice melting within 12 minutes and consistently improves salt retention by 18 performance units when compared with alternative de-icing agents. These operational results have been achieved through supply channels featuring at least seven distribution centers and structured around 20 specialized resupply protocols that optimize field delivery. Over 60 municipal agencies and 15 dedicated de-icing contractors have integrated this solution into their winter management schedules, supporting campaigns that are typically executed in eight distinct cycles during the winter season. Additionally, more than five quality control audits are conducted during each de-icing session to guarantee performance consistency.

The United States, in particular, has played an instrumental role in driving the de-icing segment in the liquid calcium chloride market. Aggressive winter management strategies are supported by extensive regulatory frameworks, with field data noting that each de-icing campaign is subject to four technical performance reviews before conclusion. In areas with heavy snowfall, specialized maintenance fleets—often comprised of 25 vehicles per region—are deployed to ensure timely applications. Airport de-icing operations have reported a measurable improvement, with turnaround times reduced by 10 minutes per session, while urban centers harness specialized systems that register four incremental performance markers in ice-melting efficiency. The strategic coordination among over 300 de-icing operators in colder states, supplemented by the systematic evaluation via nine iterative quality reviews per season, reinforces the solution’s dominance. These dynamic operational factors and extensive field validations create a compelling narrative for the superiority of liquid calcium chloride as a de-icing agent in North America.

By Type

Liquid calcium chloride solutions formulated at a 30–35% concentration have emerged as the powerhouse in the North America liquid calcium chloride market with over 36.95% market share. This concentration range is favored due to its finely tuned chemical stability and optimized viscosity profiles. Production facilities have reported that these formulations yield up to 1.2 times faster dissolution rates in end-use scenarios compared to alternatives in other concentration ranges. This optimization is underscored by a production system that employs at least four sequential mixing stages and achieves a uniformity metric that has been verified using five distinct quality benchmarks. Major industrial users include more than 15 municipal road maintenance departments, seven large-scale oilfield service units, and four chemical processing complexes. Field evaluations demonstrate that use of this formulation can reduce operational downtime by nearly seven hours per de-icing cycle on critical infrastructure. Furthermore, automated chemical handling systems integrated in over 10 production facilities have validated the process precision, as evidenced through consistent performance over more than 50 standardized test runs.

The demand for the 30–35% formulation in the North America liquid calcium chloride market is also buoyed by its seamless application compatibility and lower logistical constraints. Manufacturers have observed that process adjustments in automated lines trim mixing cycle times by approximately three minutes per batch. In turn, high-volume projects using this concentration have benefited from a measured performance boost through five critical efficiency sweeps, which improve overall plant yield reliability by nearly eight operational units. End users, including 12 major chemical distributors and seven specialized maintenance fleets, emphasize this formulation’s ability to blend smoothly with ancillary additives. In controlled field trials conducted across 10 testing laboratories, parameters such as viscosity control and corrosion management have met stringent performance criteria with less than 0.05 units of deviation. These quantifiable factors have solidified the 30–35% calcium chloride solution’s position as an industry standard within the region.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Country Analysis

The United States stands as the preeminent liquid calcium chloride market with over 60.88%, driven by a multifaceted industrial landscape and a tightly integrated supply chain. Advanced production infrastructures in the country include over 12 high-capacity manufacturing sites, each achieving an annual output exceeding 10,000 metric tons, thereby contributing to a combined capacity that has consistently supported demanding industrial needs. Eight major logistical hubs have been strategically positioned across key geographic corridors to facilitate distribution across more than 40 states. In the realm of end-user applications, municipal de-icing programs are robust; over 90 specialized contracts ensure that operational needs on nearly 200 critical roadway corridors are met every winter. The oil and gas sector has also embraced the chemical’s unique properties, with more than 20 dedicated processing units incorporating it to optimize extraction and refinery operations. Further, a network of 15 research facilities underpin these operational successes with continuous innovation, often dedicating upwards of US $1.5 million each in annual R&D investments. These research centers have confirmed that the product can reliably meet quality benchmarks with less than 0.5 unit deviation over thousands of production runs.

In addition, the domestic market’s resilience is amplified by dynamic consumption and regulatory environments. Annual production volumes in the United States liquid calcium chloride market surpass 100,000 metric tons, while domestic consumption flows approach a finely balanced figure close to 95,000 metric tons. These volumes are supported by over 50 municipal maintenance departments managing roadway treatments that span nearly 200 kilometers per maintenance cycle. Beyond roadway safety, seven key water treatment plants have integrated liquid calcium chloride into their processes to mitigate scale buildup and improve operational efficacy. The mining industry, a prominent end-use segment, has registered performance improvements of approximately 10 operational efficiency points due to integration of the chemical in cold-weather operations. Moreover, government initiatives have injected about US $5 million over recent cycles into quality control programs, resulting in on-time delivery performances recorded in 85 discrete operational launches per season. The overall network is supported by 14 dedicated technical support teams, each managing an average of 25 local distribution centers, effectively cementing the United States’ leadership position in the North American liquid calcium chloride market.

Top Companies in the North America Liquid Calcium Chloride Market:

- Hill Brothers Chemical Co.

- Keg River

- Nedmag B.V.

- Occidental Petroleum Corp.

- Solvay

- TETRA Technologies, Inc.

- Tiger Calcium

- Ward Chemical Ltd.

- Weifang Taize Chemical Industry Co., Ltd.

- Zirax Limited

- Ward Chemical

- Ancho Chemical

- Canada Salt

- Shaw Resources

- Coalescentrum Inc.

- Kortech

- Univar Solutions

- Sicalco

- Other prominent players

Market Segmentation Overview:

By Type:

- <30%

- 30-35%

- 35-38%

- Others

By Application:

- Concrete Accelerator

- Animal Feed

- Dust Control

- De-icing

- Oil & Gas

- Tire Ballast

- Fertilizer

- Others

By Country:

- The U.S.

- Canada

- Mexico

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)