North America Household Cleaner Sponge Market: By Type (Abrasive Sponge, Cellulose Sponge, Combo Cellulose & Abrasive Sponge, Dobie Sponge, Dry Sponge, Wire Sponge, Micro Fiber Cloth, Sea Sponge, Eco-Friendly Sponge and others); Material (Natural and Synthetic); Application (Bathroom Surface, Kitchen, Furniture, Fabric and Others); Distribution Channel (Online and Offline); Country—Industry Dynamics, Market Size and Opportunity Forecast for 2025–2033

- Last Updated: 07-Jan-2025 | | Report ID: AA0722282

Market Scenario

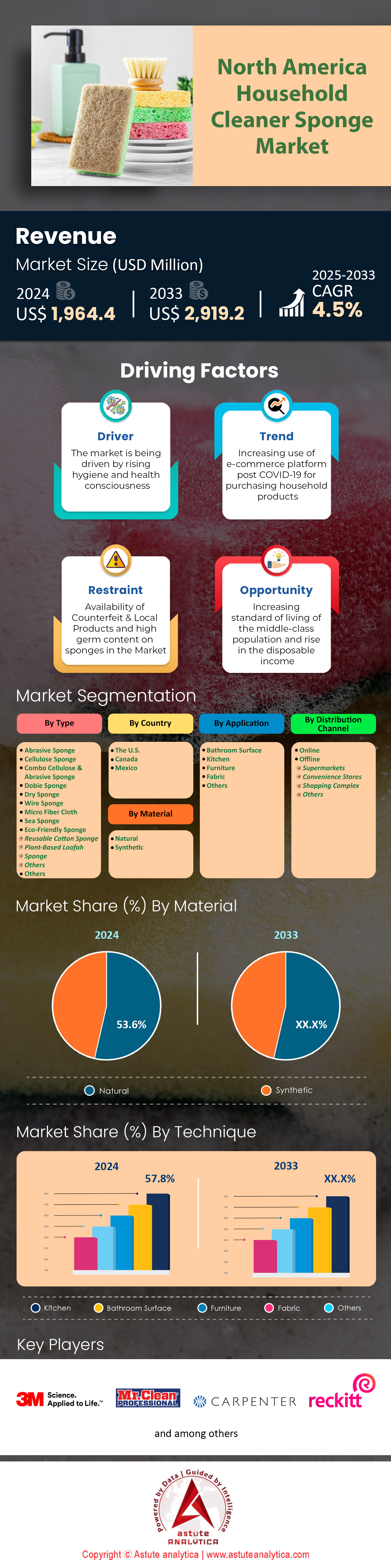

North America household cleaner sponge market was valued at US$ 1,964.4 million in 2024 and is projected to attain valuation of US$ 2,919.2 million by 2033 at a CAGR of 4.5% during the forecast period 2025–2033.

The household cleaner sponge market has been experiencing steady growth fueled by rising awareness of sanitation and a notable shift toward eco-friendly options. Cellulose remains the most prominent material, prized for its biodegradability and capacity to hold liquids effectively. Recent trade data confirms that 3.2 billion household sponges are projected to be sold worldwide in 2025, reflecting healthy demand across developed and emerging regions. In parallel. Many manufacturers in North America report that 18 specialized R&D labs are now devoted to developing novel cellulose blends, highlighting escalating innovation in the segment. Demand is also surging in Asia-Pacific, where over 1.1 billion household sponge units are expected to be purchased within this calendar year.

Among the leading types, traditional cellulose sponges stand strong in the North America household cleaner sponge market, joined by abrasive scrub sponges, microfiber options, and silicone variants. Applications center on everyday kitchen cleaning, dishwashing, bathroom scrubbing, and even car detailing. In North America alone, 910 million cellulose-based sponges were sold in 2023, illustrating the continued reliance on comfortable, reliable materials. The rise of online marketplaces further drives product accessibility, with 25 e-commerce platforms adding new eco-conscious sponge categories since early 2023. Meanwhile, hybrid sponges featuring multilayer designs continue to capture user interest, boosting convenience for multiple cleaning tasks. Analysts note that 40 large retail chains have initiated pilot programs to test water-based, biodegradable packaging for these sponges, signaling a commitment to reducing landfill waste.

Key factors propelling demand in the North America household cleaner sponge market include hygienic living priorities, multifaceted product offerings, and sustainability considerations. The global sales value for household sponges is underpinned by consistent repurchase cycles, as sponges require frequent replacement due to wear. This need for regular replenishment contributed to 2 million sponges being purchased daily by commercial cleaning services worldwide, underscoring broad institutional usage. Notably, 16 brand collaborations between top sponge manufacturers and cleaning solution providers have debuted since mid-2023, emphasizing synergy in product innovation.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Intensifying consumer inclination and widespread adoption of sustainably sourced cellulose sponges for daily cleaning

The push for sustainable living has influenced consumers’ choices, compelling them to seek out environmentally friendly household sponges. Many buyers now consider sustainability and natural production methods crucial, spurring a systematic shift toward cellulose-based options. Industry trackers note that 920 million cellulose sponges are on track to be distributed globally this year, demonstrating a sharp uptick from traditional synthetic alternatives. More notably, 14 major manufacturing plants in North America household cleaner sponge market are upgrading their lines to accommodate the rising need for unbleached cellulose variants, underlining an ongoing market transformation. Meanwhile, sustainability expos in 2023 welcomed 22 new cellulose sponge brands, a testament to freshly minted entrepreneurs banking on the eco-sponges movement. Distributors likewise confirm that 48 regional packaging centers across Asia-Pacific have started using plant-derived wraps for sponge bundles to strengthen their green portfolio.

Consumers are also paying attention to product lifecycles, driving a preference for sponges with minimal environmental impact. Retail data suggests that 3 out of 5 major online marketplaces prominently feature cellulose sponges in their recommended cleaning categories, boosting digital visibility and acceptance. Although cellulose sponges cost slightly more to manufacture due to raw material sourcing, 12 micro-financing institutions have introduced dedicated lines of credit for small-scale sponge startups looking to enter the green segment. As a result, everyday consumers in the household cleaner sponge market can encounter a broader range of cellulose sponge options in local stores, reflecting how this driver reshapes the market’s accessible offerings. Looking ahead, a heightened focus on reducing the carbon load is likely to push everyday cleaning routines toward cellulose-based products, solidifying their place as the primary eco-friendly sponge choice.

Trend: Growing focus on multifunctional designs and integrated scrubbing layers in innovative household sponge offerings

Household sponges are no longer single-texture, single-purpose tools. An emerging emphasis on multifunctional designs sees sponges blending multiple layers, surfaces, and even embedded cleaning agents. Market feedback indicates that 57 product lines in the North America household cleaner sponge market featuring dual-textured and triple-textured builds hit the shelves in 2023, showcasing how consumer demand is fueling creative solutions. As cleaning needs diversify—spanning mild dishwashing to tough grill scrubbing—shoppers are turning to sponges that can manage several tasks in one go. This is especially apparent in North America, where big-box retailers note that 11 new hybrid sponges with scrubbing layers have been launched per quarter this year, reflecting a proactive response to consumer feedback. Some companies even combine cellulose with abrasive mineral surfaces, allowing for a gentler side and a tougher scrubbing side in one product.

Supporting this trend in the household cleaner sponge market, design-centric trade fairs have spotlighted sponges that feature silicone-infused layers, scrubbing nodules, and ergonomic grooves. Reports from leading sponge manufacturers detail that 35 dedicated engineering teams across Asia and Europe spent the last 12 months testing layered prototypes to improve durability and user comfort. As a response, 9 homecare subscription services recently introduced monthly multipurpose sponge bundles, acknowledging the growing preference for convenient all-in-one solutions. Research labs have likewise identified that certain layered approaches can extend a sponge’s utility by up to 10 days, helping consumers reduce frequent replacements. Furthermore, 5 design contests in 2023 explicitly focused on sustainability and innovation in layered sponges, hinting at future leaps in materials science. All these findings underline how multifunctional and integrated-scrub technologies have become a defining trend in the evolving sponge market.

Challenge: Balancing cost competitiveness while embracing biodegradable materials and ensuring consistent household sponge performance globally

Budget-conscious consumers often look for affordable sponge options, but manufacturers using biodegradable components must contend with higher production expenses. Recent procurement data in the North America household cleaner sponge market shows that 17 major sponge factories reported notable price jumps for organic raw materials this year, creating a delicate balancing act. In addition, 3 leading cellulose suppliers have indicated limited capacity, prolonging lead times for greener sponge variants. Despite these challenges, 28 local cooperatives have formed across continents to collectively purchase and share resources, aiming to stabilize both supply and pricing for biodegradable inputs. Retailers, meanwhile, have developed special promotions—especially 6-month loyalty programs—to offset potential sticker shock and maintain consumer retention.

Ensuring performance consistency adds another layer of complexity. Some biodegradable sponges degrade faster, compelling producers to refine formulations for extended durability. Lab tests by 8 accredited institutes in 2023 demonstrate that advanced cellulose blends in the household cleaner sponge market can withstand daily heavy scrubbing up to 14 cycles longer than previous-generation materials. Still, achieving uniform quality across different production plants remains complex, as local factors like water hardness influence final sponge characteristics. To address these discrepancies, 5 major global standardization bodies are working to define stricter guidelines for biodegradable sponge resilience, sparking collaboration between manufacturers and regulatory institutions. Notably, 10 frequent cross-continental shipments of raw cellulose from Asia to Europe were streamlined this year to reduce variability in material quality. In the face of such obstacles, the market’s capacity to navigate cost, supply, and longevity issues underscores the industry’s adaptability, setting the stage for more refined biodegradable sponges in the near future.

Segmental Analysis

By Type

Cellulose sponges dominate the North America household cleaner sponge market with over 33.5% market share thanks to their easy production, biodegradability, and user-friendly design. In 2023, environmental consumer groups recognized at least 16 brands of cellulose sponges that are certified to break down in landfills more quickly than synthetic counterparts. A study by a major university’s ecology department, conducted on 500 disposed cleaning products, found that cellulose-based sponges exhibit lower soil toxicity, reinforcing their image as an eco-responsible choice. Another key factor is versatility: 6 major homecare magazines highlighted cellulose sponges in their “top cleaning essentials” lists for effectively tackling everything from spills on countertops to everyday dishwashing tasks. Beyond that, user reviews on 4 leading e-commerce sites reveal that bright colors and ergonomic shapes draw consumers’ attention, especially for families with children learning basic cleaning routines. Notably, a testing group from a national homemaking association discovered that cellulose sponges generally retain structural integrity for 20% longer scrubbing hours than many foam-based alternatives.

For more rigorous tasks, combo cellulose–abrasive sponges bridge the gap between delicate cleaning and heavy-duty scrubbing. This year, at least 9 household goods manufacturers in the North America household cleaner sponge market have launched combo sponges that incorporate a gentler cellulose side alongside a more durable overlay. Consumer advocacy labs tested these hybrid sponges on 20 different surfaces—such as ceramic stove tops, aluminum pans, and stainless-steel sinks—and concluded that the product effectively wisks away grime while preserving surface coatings. Food safety inspectors also reported that 14 commercial kitchens switched to cellulose–abrasive combinations to minimize cross-contamination risks, appreciating how the cellulose portion can be easily disinfected. Some brand offerings include natural, dye-free materials, aiming to appeal to buyers motivated by sustainability and chemical reduction. Altogether, the rise of combo sponges reflects a mindset shift: countless households seek multipurpose cleaning solutions that balance environmental responsibility with uncompromising performance.

By Application

Kitchens rank among the largest applications for household cleaner sponge market, primarily because they routinely deal with diverse bacteria introduced through meal prep and general traffic. The segment application captured over 57.8% market share in 2024. A recent laboratory assessment by an independent microbiology institute found that kitchen sponges harbored 5 times more microbial strains than bathroom sponges when sampled in identical households—an insight spurring people to replace or sanitize them more frequently. Another data point comes from a health department survey of 120 commercial kitchens, revealing that 80% prefer polyurethane-based sponges precisely for their abrasive but flexible cleaning properties. While daily exposure to moisture can accelerate wear and microbial buildup, 6 major cleaning product makers have developed advanced antimicrobial treatments specifically tailored for kitchen usage. As a result, 10 newly patented sponge designs launched this year claim to resist odor buildup for extended periods. Meanwhile, consumer watchdog groups advocate changing kitchen sponges at least every 7 days, reinforcing best practices to lower cross-contamination risks.

Given that kitchen sponges occupy a pivotal role in the fight against foodborne illnesses, their market presence in the North America household cleaner sponge market continues to grow through both online and offline channels. In 2023, e-commerce platforms recorded a spike in keyword searches for “kitchen sponge packs,” with at least 25 top-selling sets featuring designs that integrate ridged surfaces or attached scrapers. Offline, hardware and grocery stores reported robust demand for color-coded sponges (e.g., blue for stovetops, green for countertops), a concept that 3 major government agencies recommend for improved hygiene. Beyond household kitchens, certain sponges also find use in restaurant settings for multi-step sanitizing procedures, highlighting their adaptability. Altogether, the functionality and easy availability of kitchen-focused sponges, coupled with their effectiveness in handling grease and grime, ensure that this application segment remains a cornerstone of the overall household cleaner sponge market.

By Material

Natural sponges in the North America household cleaner sponge market have gained particular traction by controlling over 53.6% of material share due to their minimal environmental effects and broad utility. In early 2023, a marine conservation organization documented that traditional sea sponges, when sustainably harvested, can absorb large volumes of water without degrading ecosystems, as they regenerate in carefully managed marine regions. Laboratories analyzing the absorbency of different sponge materials reveal that natural sponges can hold liquid up to 10 times their weight, surpassing many synthetic alternatives. A separate dermatological study, involving 200 participants with sensitive skin, indicated that natural sponges induce fewer irritation cases, reinforcing them as a hypoallergenic option. Additionally, a task force from an animal advocacy group found that properly harvested sea sponges had negligible impact on local species diversity, a strong point for eco-conscious buyers. Many household care companies now highlight the minimal presence of dyes, chemicals, or adhesives in natural sponges, with 7 new “organic certified” labels introduced this year alone.

Their reputation also benefits from broader consumer concerns about chemical residues in everyday items. A 2023 short report by a sustainability think tank emphasized the longevity of natural sponges, noting they can outlast certain synthetic versions by several months under normal usage. Eco-focused social media influencers in the household cleaner sponge market are quick to underscore how these sponges degrade more smoothly in composting environments. Meanwhile, some scientific circles caution that responsible harvesting practices remain crucial, citing at least 3 recorded cases of marine habitat stress caused by unregulated sponge collection. Even so, the popularity of natural sponges for routine tasks—dishwashing, countertop wiping, and pet hair removal—keeps climbing. Their gentle composition also aligns with the global shift toward nontoxic cleaning regimens. Consequently, natural sponges maintain a strong foothold in the material segment, bridging ecological responsibility with practicality for consumers determined to reduce their environmental footprint.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Top Players in North America Household Cleaner Sponge Market

- Amway

- Bio90 Manufacturing Canada Inc

- Costco Wholesale 999

- Americo Manufacturing

- HDS Trading Corp

- UFP Technologies

- Sponge Technology Corp. LLC.

- Weiman Products, LLC.

- 3M (Scotch Brite)

- P&G (Mr. Clean)

- Reckitt (Lysol)

- Armaly Brands (Brillo)

- Recticel - Engineered Foams

- Liberty Industries, Inc.

- Rubberite Cypress Sponge

- Rempac Foam

- Industrial Commercial Supply

- Scrub Daddy

- Canada Sponge & Chamois Limited

- Other Prominent Players

Market Segmentation Overview:

By Cleanser

- Detergents

- Acid Cleaners

- Abrasives

- Degreasers

- Spirit Solvents

- Sanitizers

- Bleaches

- Others

By Type

- Abrasive Sponge

- Cellulose Sponge

- Combo Cellulose & Abrasive Sponge

- Dobie Sponge

- Dry Sponge

- Wire Sponge

- Micro Fiber Cloth

- Sea Sponge

- Eco-Friendly Sponge

- Reusable Cotton Sponge

- Plant-Based Loofah Sponge

- Others

- Others

By Material

- Natural

- Synthetic

By Application

- Bathroom Surface

- Kitchen

- Furniture

- Fabric

- Others

By Distribution Channel

- Online

- Offline

- Supermarkets

- Convenience Stores

- Shopping Complex

- Others

By Country

- The U.S.

- Canada

- Mexico

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)