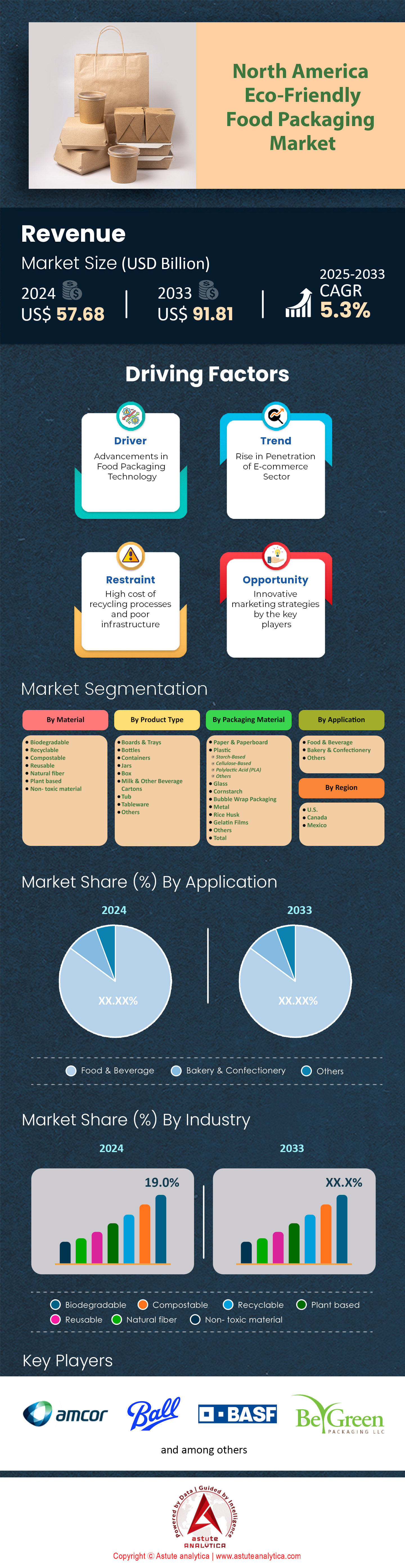

North America Eco-Friendly Food Packaging Market: By Material Type (Biodegradable, Recyclable, Compostable, Reusable, Natural Fiber, Plant Based and Non- Toxic Material); Packaging Material (Paper & Paperboard, Plastic, Glass, Corn Starch, Bubble Wrap Packaging, Metal, Rice Husk, Gelatin Films and Others); Product (Boards & Trays, Bottles, Containers, Jars, Box, Milk & Other Beverage Cartons, Tub, Tableware and Others); Applications (Food and Beverage, Bakery and Confectionery and Others); and Country—Industry Dynamics, Market Size and Opportunity Forecast for 2025–2033

- Last Updated: 04-Feb-2025 | | Report ID: AA0522223

Market Snapshot

The North America eco-friendly food packaging market is estimated to witness a rise in revenue from US$ 57.68 billion in 2024 to US$ 91.81 billion by 2033 at a CAGR of 5.3% during the forecast period 2025-2033.

North America’s eco-friendly food packaging market is evolving at a remarkable pace, driven by a convergence of consumer demand, technological innovations, and regulatory pressures. As of 2024, the number of consumers actively seeking products with sustainable packaging solutions stands at 165 million, reflecting a rapidly expanding audience that prioritizes environmental stewardship. Within this dynamic landscape, the annual production of biodegradable packaging materials has reached 2.5 million metric tons, highlighting the intensifying efforts to reduce reliance on traditional plastics.

The market’s scope in the eco-friendly food packaging market extends beyond conventional substitutions, evidenced by the 750,000 units of seaweed-based packaging sold across North America. These novel approaches have simultaneously spurred the adoption of smart packaging technologies, with 3,200 companies integrating sensors, indicators, or tracking systems to bolster product safety and transparency. Fiber-based packaging manufacturers collectively command a 12 million-ton total production capacity per year, showcasing how paper, cardboard, and molded pulp are solidifying their position as efficient and eco-conscious solutions. Such mass adoption is directly contributing to the 1.2 million tons of plastic waste reduction recorded across the region.

Innovation continues to surge, as evidenced by the 1,850 patents filed for cutting-edge eco-friendly food packaging market. Industry players are also incorporating recycled inputs more frequently, with 3.8 million tons of these materials used in food packaging production. Meanwhile, 7,500 food brands have already transitioned to eco-friendly packaging alternatives, each responding to consumer expectations of responsible corporate behavior. The food industry alone consumes 950,000 tons of compostable materials, illustrating an important paradigm shift that is reshaping North America’s packaging ecosystem. Within this swiftly transforming realm, the eco-friendly food packaging market presents a strong, multi-faceted opportunity for businesses and investors alike, signaling a new era where sustainable practices increasingly define product competitiveness and brand reputation.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Consumer Demand for Sustainable Solutions: Driving the Shift Towards Eco-Friendly Food Packaging in North America

Consumer demand for sustainable solutions is the primary driver propelling the eco-friendly food packaging market in North America. This shift is fueled by a growing environmental consciousness among consumers, who are increasingly seeking products that align with their values and minimize ecological impact. The demand for sustainable packaging is particularly evident in the food and beverage sector, where consumers are scrutinizing the environmental footprint of their purchases more closely than ever before.

This consumer-driven trend is reshaping the eco-friendly food packaging market landscape, with companies responding by innovating and adopting more sustainable packaging practices. Tetra Pak, a leader in food and beverage packaging, has been at the forefront of this movement, focusing on creating packaging solutions that are both functional and environmentally friendly. The use of bioplastics, derived from renewable sources like cornstarch and sugarcane, is gaining traction as they offer similar functionality to traditional plastics while being compostable or biodegradable. Notably, TotalEnergies Corbion has developed recyclable bioplastics made of polylactic acid (PLA), which have been adopted by Korean water producer Sansu for label-free water bottles. CJ Biomaterials has expanded its product lineup with a new polyhydroxyalkanoate (PHA) polymer that is certified as home- and industrially compostable, and biodegradable in both soil and ocean conditions. These innovations highlight the industry's commitment to meeting consumer expectations for sustainability, with companies that embrace these solutions benefiting from increased consumer loyalty and a stronger brand image.

Trend: Shift from Plastic to Paper-Based Packaging: A Growing Trend in North American Eco-Friendly Food Packaging

The shift from plastic to paper-based packaging is emerging as a significant trend in the North American eco-friendly food packaging market. This transition is driven by mounting concerns over plastic pollution and the environmental impact of traditional packaging materials. Paper-based packaging is increasingly viewed as a more sustainable alternative, offering biodegradability and recyclability that aligns with consumer preferences and environmental goals.

Companies across the food and beverage industry are embracing this trend, developing innovative paper-based solutions to replace plastic packaging. For instance, Diageo, the maker of Johnnie Walker, has unveiled a paper-based spirits bottle made from sustainably sourced wood pulp. Coca-Cola has introduced a paper bottle prototype as part of its World Without Waste initiative. Nestlé has launched recyclable paper packaging for its YES! snack bars, utilizing a high-speed flow wrap technology that can seal paper packaging at the same speeds as traditional plastic in the North America eco-friendly food packaging market. Unilever has committed to halving its use of virgin plastic and ensuring all plastic packaging is reusable, recyclable, or compostable by 2025. These initiatives demonstrate the industry's commitment to reducing plastic waste and embracing more sustainable packaging options. The trend towards paper-based packaging is not only addressing environmental concerns but also resonating with consumers who are actively seeking products with reduced plastic content.

Challenge: Balancing Performance and Sustainability: The Challenge of Developing Effective Eco-Friendly Food Packaging Solutions

A significant challenge facing the North American eco-friendly food packaging market is balancing the performance of sustainable packaging solutions with their environmental benefits. While there is a growing demand for eco-friendly packaging, these materials must still meet the rigorous standards required for food safety, preservation, and transportation. Developing packaging that can protect products as effectively as traditional materials while maintaining sustainability credentials is a complex task that requires innovative approaches and significant investment in research and development.

Companies are actively working to overcome this challenge through technological advancements and material innovations. For example, TIPA, a developer of compostable flexible packaging, has created fully compostable films that mimic conventional plastic in terms of transparency, durability, and printability. Novamont has developed Mater-Bi, a family of biodegradable and compostable bioplastics that can be processed using conventional plastic technologies in the eco-friendly food packaging market. Danimer Scientific has produced Nodax PHA, a marine degradable biopolymer that offers similar performance to traditional plastics. These innovations demonstrate the industry's efforts to create sustainable packaging that doesn't compromise on functionality. However, challenges remain in scaling up production of these materials and ensuring they can withstand various environmental conditions throughout the supply chain. The industry continues to invest in research to develop packaging solutions that offer both superior performance and environmental sustainability, aiming to meet the growing demand for eco-friendly options without sacrificing product quality or safety.

Segmental Analysis

By Material Type

Biodegradable materials have emerged as a leading force in the North American eco-friendly food packaging market, capturing over 19% market share. This dominance is primarily driven by heightened environmental awareness and stringent regulatory pressures aimed at reducing plastic waste. The most prominent biodegradable materials in this segment include Polylactic Acid (PLA), Polybutylene Succinate (PBS), and starch-based plastics. PLA, derived from renewable resources like corn starch, has gained significant traction due to its versatility in applications ranging from food containers to cutlery. The demand for these materials is on the rise, fueled by consumer preferences for sustainable products and corporate commitments to environmental stewardship.

The current production volume of biodegradable materials used in food packaging across North America eco-friendly food packaging market is substantial, with an estimated annual output of 1.5 million tons. Key producers in this market include BASF SE, NatureWorks LLC, and Cargill, Incorporated, who are continuously innovating to meet the burgeoning demand. These manufacturers are responding to the increasing market needs by investing in advanced technologies and expanding their production capacities. For instance, NatureWorks has announced plans to increase its PLA production capacity by 75,000 tons annually. The integration of biodegradable materials in food packaging is further driven by technological advancements that improve their properties and applications, making them more competitive with traditional plastics. As a result, the North American market is witnessing a shift towards biodegradable materials, with an estimated 250,000 tons of PLA being consumed annually in the food packaging sector alone. This trend is expected to continue, with projections indicating a 15% year-over-year growth in biodegradable material consumption for food packaging applications.

By Product Type

Boards and trays have established themselves as the dominant product category in the North American eco-friendly food packaging market, commanding over 32.40% market share. This prominence is attributed to their versatility, functionality, and ability to provide sturdy support for a wide range of food products. The total consumption of boards and trays in the region is substantial, with an estimated 2.3 million tons used annually in eco-friendly food packaging applications. This high consumption rate is driven by their adaptability to different food types, including fresh produce, baked goods, and ready-to-eat meals.

Key end-users of eco-friendly boards and trays include major food service providers, supermarkets, and catering services. Companies like Whole Foods Market and Panera Bread have been at the forefront of adopting these sustainable packaging solutions, with each utilizing over 10,000 tons of eco-friendly boards and trays annually. The demand for these products in the eco-friendly food packaging market is on the rise due to increasing consumer preference for sustainable packaging and the growing emphasis on reducing carbon footprints in the food industry. More end-users are opting for eco-friendly alternatives in boards and trays due to their cost-effectiveness and ease of customization. Manufacturers are investing in innovative designs and materials to improve functionality and aesthetic appeal, with some companies reporting a 30% increase in production capacity for eco-friendly boards and trays in the past year. The rise of e-commerce and food delivery services has further spurred demand, with an estimated 500,000 tons of eco-friendly boards and trays being used annually in the online food delivery sector alone. This trend is expected to continue, with projections indicating a 20% increase in the use of eco-friendly boards and trays in the North American food packaging market over the next five years.

By Packaging Material

Paper and paperboard materials have established themselves as the most prominent eco-friendly packaging in the North America eco-friendly food packaging market, commanding over 40.70% market share. This dominance is primarily driven by their inherent properties of recyclability and biodegradability, which align perfectly with the increasing consumer demand for sustainable packaging solutions. The most prominent materials used for the production of eco-friendly paper and paperboards include recycled paper, virgin paper, and corrugated board. These materials offer a versatile range of applications, from packaging for fresh produce to ready-to-eat meals, making them a preferred choice for many food and beverage companies.

The demand for paper and paperboard packaging is largely coming from the food and beverage sector, which is the largest end-user industry for eco-friendly food packaging in North America. The production volume of paper and paperboard for packaging purposes in the region is substantial, with an estimated 3.8 million tons produced annually. This high production volume is supported by a well-established recycling infrastructure, with approximately 68% of paper and paperboard being recycled in the United States as of 2022. Major producers like International Paper and WestRock are continuously innovating to improve the sustainability and performance of their products, with some companies reporting a 25% increase in the use of recycled content in their paper-based packaging over the past five years. The growing trend of on-the-go consumption and the rise of e-commerce have further boosted the demand for paper-based packaging, with an estimated 1.2 million tons of paper and paperboard packaging being used annually in the e-commerce food sector alone. Additionally, the development of innovative paper-based packaging solutions, such as molded pulp and coated paper, has expanded their application scope, with some manufacturers reporting a 40% increase in the production of these specialized paper-based packaging materials in the past year.

By Application

The food and beverage industry stands as the largest end-use application of eco-friendly food packaging market in North America, controlling over 85.1% of the market consumption. This dominance is attributed to the industry's high volume of packaged goods and the increasing consumer demand for sustainable packaging solutions. The size of the food packaging market in the region is substantial, with an estimated value of USD 111.8 billion in 2024. This significant market size is driven by the industry's focus on reducing carbon footprints and meeting stringent regulatory requirements for sustainable packaging.

Beverage packaging plays a crucial role in driving demand for eco-friendly solutions, with innovations in biodegradable and recyclable materials leading the way. The beverage sector alone consumes an estimated 1.5 million tons of eco-friendly packaging materials annually. Major beverage companies in the North America eco-friendly food packaging market have set ambitious targets for sustainable packaging, with some aiming to use 100% recyclable, reusable, or compostable packaging by 2025. This commitment has led to a surge in demand for eco-friendly materials, with some beverage manufacturers reporting a 35% increase in the use of recycled PET in their packaging over the past three years. The food industry is equally invested in sustainable packaging, with an estimated 2.2 million tons of eco-friendly packaging materials being used annually for food products. This includes a wide range of applications, from fresh produce packaging to ready-to-eat meal containers. The industry's adoption of eco-friendly packaging is further driven by consumer preferences, with studies showing that 72% of North American consumers are willing to pay more for products with sustainable packaging. As a result, food and beverage companies are investing heavily in research and development, with some allocating up to 5% of their annual revenue towards developing innovative, sustainable packaging solutions.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Country Analysis

The United States holds a commanding position in the North American eco-friendly packaging market, accounting for over 82.8% of the region's revenue. This dominance is underpinned by several key factors, including a robust infrastructure, high consumer demand, and significant advancements in packaging technology. The U.S. market is characterized by a strong preference for sustainable packaging solutions, with approximately 70% of consumers favoring eco-friendly options. This consumer inclination is supported by stringent regulatory frameworks that promote sustainable practices, such as the FDA's guidelines on recycled plastics in food packaging.

The end-use industries in the U.S. significantly impact the demand for eco-friendly packaging, with the food and beverage sector being a major consumer. The country's food packaging market alone is projected to reach a value of US$ 31.8 billion by 2030, highlighting the substantial demand for sustainable packaging solutions. The rise of e-commerce and food delivery services has further amplified this demand, with an estimated 500,000 tons of eco-friendly packaging materials being used annually in the online food delivery sector. Major end-users of eco-friendly packaging in the U.S. include multinational corporations like Coca-Cola, PepsiCo, and Nestlé, each utilizing over 100,000 tons of sustainable packaging materials annually. Key producers of eco-friendly packaging in the region include Amcor, WestRock, and International Paper, who are at the forefront of innovation and sustainability in packaging.

The U.S.'s dominance in the eco-friendly food packaging market is also attributed to its economic and technological strengths. The country's packaging industry invests heavily in research and development, with an estimated US$ 2 billion spent annually on developing sustainable packaging solutions. This investment has led to significant innovations, such as the development of plant-based plastics and advanced recycling technologies. The U.S. government's support for sustainable practices through incentives and regulations has encouraged companies to invest in eco-friendly packaging technologies, with some manufacturers reporting a 40% increase in production capacity for sustainable packaging materials over the past five years. Moreover, the presence of leading packaging companies ensures continuous innovation, with the U.S. packaging industry filing over 1,000 patents related to sustainable packaging technologies in the past year alone. These factors collectively contribute to the U.S.'s strong position in the North American eco-friendly packaging market, driving both domestic demand and global exports of sustainable packaging solutions.

Top Companies in the North America Eco-Friendly Food Packaging Market:

- Amcor

- Ball Corporation

- BASF

- Be Green Packaging

- Berry Global

- Crown Holdings Inc.

- DS Smith

- DuPont

- Elopak

- Evergreen Packaging

- Gwp Group

- Huhtamaki Oyj

- Mondi

- Nampak

- Mondi Group

- Paperfoam

- Printpak Inc.

- Sealed Air

- Sealed Air Corporation

- Smurfit Kappa Group

- Sonoco Products Company

- Sustainable Packaging Industries

- Swedbrand Groups

- Tetra Laval

- Tetra Pak

- Westrock Company

- Winpak Ltd.

- Othe Prominent Players

Market Segmentation Overview:

By Material Type

- Biodegradable

- Recyclable

- Compostable

- Reusable

- Natural Fiber

- Plant Based

- Non- Toxic Material

By Packaging Material

- Paper & Paperboard

- Plastic

- Starch-Based

- Cellulose-Based

- Polylactic Acid (PLA)

- Others

- Glass

- Corn Starch

- Bubble Wrap Packaging

- Metal

- Rice Husk

- Gelatin Films

- Others

By Product

- Boards & Trays

- Bottles

- Containers

- Jars

- Box

- Milk & Other Beverage Cartons

- Tub

- Tableware

- Others

By Application

- Food and Beverage

- Bakery and Confectionery

- Others

By Country

- The U.S.

- Canada

- Mexico

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)