North America ECG Patch and Holter Monitoring Market: By Product (ECG Patch, Holter Monitor, and Single Holter Monitors (3 Lead Holter Monitors, 6 Lead Holter Monitors, 12 Lead Holter Monitors, and Others); Application (Diagnostics, Monitoring (Long-term (or continuous) monitoring, Automatic analysis, Extended cardiac monitoring, Others); End Users (Hospitals & Clinics, Home Settings & Ambulatory Facilities, and Others)— Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: Apr-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA0923621 | Delivery: 2 to 4 Hours

| Report ID: AA0923621 | Delivery: 2 to 4 Hours

Market Scenario

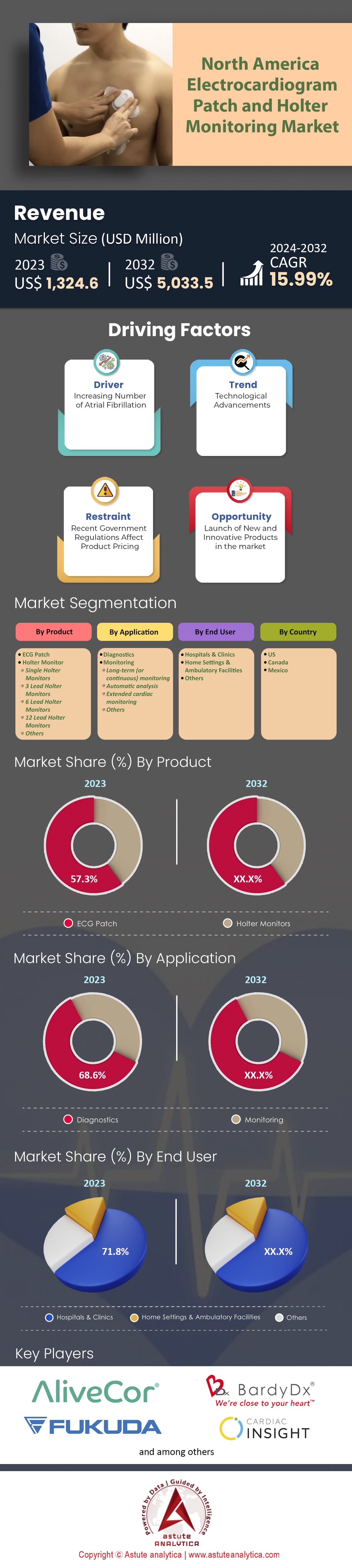

North America ECG Patch and Holter Monitoring Market was valued at US$ 1,324.6 million in 2023 and is projected to surpass the market valuation of US$ 5,033.5 million by 2032 at a CAGR of 15.99% during the forecast period 2024–2032.

The North American ECG patch and Holter monitoring market has observed significant growth in recent years, demonstrating the region's commitment to advancing cardiovascular health solutions. Various market dynamics, such as an aging population, an increase in cardiovascular diseases, and technological advancements, have all fueled this surge. The U.S. dominated this market with a staggering 85% share. The country's substantial chunk can be attributed to its robust healthcare infrastructure, heightened awareness, and increased research and development activities. Moreover, by 2022, nearly 30 million Americans had used some form of ECG patch for monitoring, a testament to its widespread acceptance.

Holter monitors, known for their extended monitoring capabilities of up to 48 hours, held about 42% of the total market share due to their reliability in detecting sporadic arrhythmias. On the other hand, ECG patches, celebrated for their convenience and user-friendly interface, are expected to grow at a CAGR of 16.25% through 2027, marginally outpacing Holter monitors. Their rise is largely driven by their potential for remote monitoring, a capability becoming increasingly critical in a world valuing telehealth solution. Another crucial aspect influencing the electrocardiogram patch and Holter monitoring market is the patient demographic. Those aged 65 and above are the primary users of these monitoring devices, accounting for approximately 60% of total users in 2022. This segment is forecasted to grow at a CAGR of 7.2% up to 2027, signaling an escalating concern for cardiovascular health among the elderly population in North America.

Technological advancements, too, play an indispensable role. In 2022, wireless ECG patches witnessed a 10% growth from the previous year, emphasizing the shift towards real-time monitoring solutions. Companies in the region are also investing heavily in research and development, aiming to produce innovative products that can deliver more accurate and faster results. Investments in this sector surpassed the $150 million mark in 2022, indicating strong market confidence.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: The Rise of Aging Population and Cardiovascular Diseases

One of the primary drivers for the Electrocardiogram patch and Holter monitoring market's exponential growth is the demographic shift toward an aging population coupled with the escalating prevalence of cardiovascular diseases (CVDs). Statistics from the American Heart Association (AHA) have highlighted that by 2030, over 40% of the U.S. population will have some form of cardiovascular disease. Such numbers are staggering and bring forth the urgency to detect and monitor heart conditions early. In 2022, the U.S. Census Bureau projected that by 2034, those aged 65 and over would outnumber children under the age of 18, marking the first time in U.S. history for such a demographic shift. This population, prone to chronic conditions like CVDs, is estimated to reach 80 million by 2030. Consequently, the demand for non-invasive and convenient cardiac monitoring solutions, like ECG patches and Holter monitors, is expected to surge.

A deeper dive into the electrocardiogram patch and Holter monitoring market reveals the gravity of the situation. As per CDC estimates in 2022, about 700,000 Americans experience a new coronary event every year, and another 335,000 suffer a recurrent episode. These figures necessitate the importance of consistent monitoring. Moreover, the economic burden of CVDs is colossal. In 2019, direct and indirect costs for CVDs and stroke in the U.S. were estimated to be over $350 billion, which emphasizes the need for early detection and preventive measures. The demographic shift towards an aging population, intertwined with the escalating incidence of CVDs, ensures that ECG patches and Holter monitoring systems are not merely transient medical tools but essential devices for the foreseeable future in North America.

Emerging Trend: The Digital Transformation – Telehealth and Real-Time Monitoring

The integration of digital technology into healthcare, especially in the wake of the global pandemic, has been transformative in the electrocardiogram patch and Holter monitoring market. One significant trend in the North American ECG Patch and Holter Monitoring market is the rapid pivot towards telehealth solutions and real-time monitoring, ensuring timely intervention for patients. By 2022, North America had already witnessed a 250% increase in telehealth services compared to the previous year. This dramatic rise showcases the demand for remote healthcare solutions. With respect to ECG patches and Holter monitors, the trend is evident in their tech-enabled capabilities. In 2022, wireless ECG patches, which facilitate real-time monitoring, saw a 10% growth from the previous year, emphasizing the shift towards real-time monitoring solutions.

Moreover, the global telecardiology market, a segment of telehealth focusing on cardiology, is expected to reach $65.3 billion, growing at a CAGR of 17.5%. North America is positioned at the forefront of this growth, accounting for almost 40% of the global market share. This booming segment in the directly aligns with the increasing demand for devices like ECG patches and Holter monitors in the electrocardiogram patch and Holter monitoring market. Another fascinating number to consider is the rise in smartphone penetration. With over 275 million smartphone users in the U.S. as of 2022, the potential to integrate ECG patches and Holter monitoring data with smartphone applications offers an efficient, user-friendly, and real-time solution for both patients and healthcare professionals.

Challenges: Navigating the Quagmire: Data Security Concerns in ECG Monitoring

The rapid technological evolution of the Electrocardiogram patch and Holter monitoring market presents an unprecedented challenge that can't be overlooked: ensuring robust data security. As cardiac monitoring devices become increasingly integrated with digital platforms, they invariably become susceptible to potential cyber threats and data breaches. In the era of real-time and remote monitoring, a vast amount of patient data is continually transmitted between devices and healthcare providers. In 2022, a report from the Health Sector Cybersecurity Coordination Center (HC3) highlighted that medical devices and related systems were among the top vulnerable points for cyberattacks within healthcare institutions. These potential breaches aren't merely a matter of personal data theft; they can directly impact patient care. Tampered data can lead to misdiagnoses, inappropriate medical decisions, and can erode trust in these critical monitoring tools.

Furthermore, the financial implications of these breaches are monumental. According to the Ponemon Institute, the average cost of a data breach in the healthcare sector in 2021 was approximately $7.13 million, a number that has consistently been on the rise. While manufacturers and developers in the North America electrocardiogram patch and Holter monitoring market are investing heavily in fortified encryption techniques and multi-layered security protocols, the challenge remains substantial. Striking a balance between offering cutting-edge, real-time monitoring solutions and ensuring ironclad data security is the tightrope walk that stakeholders in the North American ECG Patch and Holter Monitoring market must navigate in the coming years.

Segmental Analysis

By Product:

By product, North American electrocardiogram patch and Holter monitoring market bifurcated into ECG patches and the Holter monitors. Of these, the ECG patch segment stands out, commanding a dominant position with over 57% revenue share. This dominance suggests a pronounced preference among healthcare practitioners and patients alike for the ECG patches, likely attributed to their convenience, ease of use, and technological advancements that have made real-time monitoring more accessible and efficient. While Holter monitors, with their extended monitoring capability, continue to be relevant, the rapid evolution and adaptability of ECG patches, particularly in telehealth scenarios, seem to be pushing the balance in their favor.

By Application:

When analyzed by application, the diagnostics segment emerges as the frontrunner in the electrocardiogram patch and Holter monitoring market. Currently, it holds a commanding market share of over 68.6%. This dominance underscores the critical role these monitoring tools play in diagnosing various cardiac conditions. Given the rising prevalence of cardiovascular diseases in North America, early and accurate diagnosis becomes paramount. ECG patches and Holter monitors provide invaluable insights into heart rhythms and abnormalities, and their significance in the diagnostics realm is only set to grow. The emphasis on preventive care, timely interventions, and patient-centric solutions further accentuates the importance of the diagnostics application.

By End Users

North America Electrocardiogram Patch and Holter Monitoring market based on end users, hospitals & clinics lead the market, holding an impressive 71.8% share. This dominance underscores the pivotal role these institutions play in cardiac care and diagnostics in the region. The reliance on hospitals and clinics for ECG and Holter monitoring stems from various factors. Firstly, these establishments are often equipped with state-of-the-art technology and expert professionals, ensuring accurate diagnosis and timely interventions. Given the critical nature of cardiovascular conditions, patients and healthcare providers gravitate towards settings where comprehensive care can be assured.

Furthermore, the trajectory for this segment is bullish. The hospitals & clinics segment isn't merely resting on its laurels. It's projected to witness a robust growth, expanding at a compounded annual growth rate (CAGR) of 16.2% in the foreseeable future. This growth rate signifies the increasing integration of these monitoring tools in these settings, aligned with the rising incidence of cardiovascular diseases.

To Understand More About this Research: Request A Free Sample

Country Analysis

The North American electrocardiogram patch and Holter monitoring market has been a focal point of interest due to its dynamic interplay of technological innovations and healthcare demands. In this matrix, the United States stands out, not merely as a significant contributor but as a dominant leader, wielding an impressive market share of over 84%. The dominance of the US in this market is attributable to its unparalleled healthcare infrastructure and a keen emphasis on cardiovascular health. The nation's prodigious healthcare expenditure, with an estimated spending of over $4 trillion in 2022, demonstrates its commitment. A substantial portion of this vast budget is judiciously directed towards acquiring cutting-edge medical equipment and technology, laying the groundwork for the thriving ECG patch and Holter monitoring market. Furthermore, the prevalence of cardiovascular diseases in the US presents a compelling narrative. The alarming statistics from the American Heart Association, which indicate that nearly half of the adult population suffers from some form of cardiovascular ailment, have spurred an urgent demand for top-tier diagnostic and monitoring tools. This urgency is further intensified by the projected demographic shift: by 2030, the aging population, which is more susceptible to cardiac conditions, is expected to cross the 74 million mark.

Innovation remains the lifeblood of the US's stronghold in the electrocardiogram patch and Holter monitoring market. With a consistent history of being at the vanguard of medical technological breakthroughs and an investment appetite that pumped over $14 billion into health tech startups in 2022, the nation ensures that healthcare providers have access to the most advanced versions of ECG patches and Holter monitors. Apart from this, strong insurance dynamics also play a pivotal role. As insurance entities increasingly acknowledge the imperativeness of early diagnosis and preventive strategies, there's been a rise in reimbursements for cardiac monitoring tests. In a recent study from 2021, it was noted that over 210 million Americans possess insurance that offers coverage for some variant of cardiac monitoring, providing a significant boost to the market's trajectory.

Nevertheless, the role of educational initiatives cannot be understated in the electrocardiogram patch and Holter monitoring market. Persistent efforts by bodies like the American Heart Association to foster awareness about heart health have borne fruit. Over two years, from 2020 to 2022, there's been a commendable 15% surge in individuals actively seeking regular heart check-ups.

Key Players in the North America ECG Patch and Holter Monitoring Market

- AliveCor, Inc.

- Cardiac Insight Inc.

- Fukuda Denshi Co., Ltd.

- GE Healthcare

- Hill -Rom

- Koninklijke Philips N.V.

- Medtronic Plc.

- LifeSignals, Inc.

- Nihon Kohden Corporation

- Schiller AG

- Other Prominent Players

Market Segmentation Overview:

By Product

- ECG Patch

- Holter Monitor

- Single Holter Monitors

- 3 Lead Holter Monitors

- 6 Lead Holter Monitors

- 12 Lead Holter Monitors

- Others

By Application

- Diagnostics

- Monitoring

- Long-term (or continuous) monitoring

- Automatic analysis

- Extended cardiac monitoring

- Others

By End User

- Hospitals & Clinics

- Home Settings & Ambulatory Facilities

- Others

By Country

- U.S.

- Canada

- Mexico

View Full Infographic

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2023 | US$ 1,324.6 Mn |

| Expected Revenue in 2032 | US$ 5,033.5 Mn |

| Historic Data | 2019-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Unit | Value (USD Mn) |

| CAGR | 15.99% |

| Segments covered | By Product, By Application, By End User, By Country |

| Key Companies | AliveCor, Inc., Cardiac Insight Inc., Fukuda Denshi Co., Ltd., GE Healthcare, Hill -Rom, Koninklijke Philips N.V., Medtronic Plc., LifeSignals, Inc., Nihon Kohden Corporation, Schiller AG, Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA0923621 | Delivery: 2 to 4 Hours

| Report ID: AA0923621 | Delivery: 2 to 4 Hours

.svg)