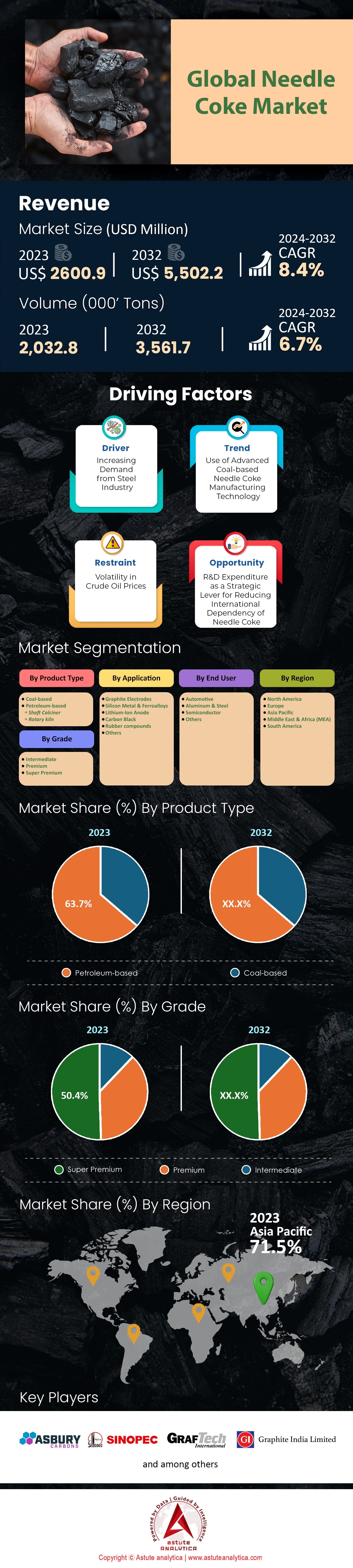

Global Needle Coke Market: By Product Type (Coal based and Petroleum based) ; Grade (Intermediate, Premium, and Super Premium); Application (Graphite Electrodes, Silicon Metal & Ferroalloys, Lithium-Ion Anode, Carbon Black, Rubber compounds, Others); End Users (Automotive, Aluminum & Steel, Semiconductor, Others); Region— Market Forecast and Analysis for 2024–2032

- Last Updated: 20-May-2024 | | Report ID: AA0723526

Market Scenario

Global needle coke market was valued at US$ 2,600.9 million in 2023 and is projected to surpass the valuation of US$ 5,502.2 million by 2032 at a CAGR of 8.4% during the forecast period 2024–2032.

The global needle coke market has witnessed substantial growth over the years, and it shows no signs of slowing down. This industry, as of 2021, had a massive production capacity of about 3,250kt/a, displaying the sheer scale and impact of this critical commodity. Dominating the production landscape, China is undeniably the largest producer of needle coke. With a robust production capacity of approximately 2,240kt/a, China contributes an impressive 68.9% to the global production capacity. Not to be overlooked, the United States, Japan, and South Korea also stand as substantial contributors to the global needle coke supply chain.

In an economic climate where the demand for needle coke is escalating, the market is projected to expand at a compound annual growth rate (CAGR) of over 7% between 2023 and 2030. This rising demand is primarily fuelled by the steel industry's escalating reliance on graphite electrodes and the surging demand within the rapidly developing graphite battery sector. The average price for needle coke hovered around USD 2,500/t in 2022. This cost analysis is integral for understanding the broader market dynamics and potential returns for both producers and investors.

Delving deeper into the needle coke market, we find that it is heavily concentrated. A handful of key players - the top 7 producers, to be exact–control about 35% of the global market share. This signifies high barriers to entry, underscoring the scale, and capital required to venture into the needle coke production. Wherein, the principal consumers of needle coke include the steel industry, the blossoming graphite battery industry, and the ever-evolving electronics industry. These sectors rely heavily on needle coke, leading to increased demand and creating a favorable market environment for producers.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Increasing Demand for Steel and Graphite Batteries

Rising demand for steel, primarily attributed to the increasing consumption of graphite electrodes in the steel industry is one of the most influential drivers for the global needle coke market. Needle coke, as a critical raw material for graphite electrodes, sees its demand surge in direct proportion to the steel industry's growth. As global economies rebound and industrialization gains momentum post-pandemic, the steel industry is witnessing a robust recovery. Construction, transportation, and infrastructure sectors are further fueling the demand for steel, thereby propelling the market.

In addition, the escalating interest in electric vehicles (EVs) and renewable energy storage solutions is bolstering the growth of the graphite battery industry. Given that needle coke is an indispensable component in the manufacturing of these batteries, the EV boom directly translates into heightened demand for needle coke. This growing need, driven by sustainable energy solutions and the green revolution, is a significant propellant for the needle coke market.

Trend: Diversification into High-Performance Materials

The global needle coke market is increasingly witnessing a trend of diversification into high-performance materials. As technologies evolve, industries are constantly in search of materials that can improve efficiency and performance. Needle coke, due to its unique characteristics, such as low coefficient of thermal expansion, high thermal conductivity, and superior electrical conductivity, has found its use in the manufacture of high-performance materials.

This includes carbon fiber, used extensively in aerospace, automotive, and sports equipment, and graphene, a promising material in electronics and energy storage. As research and development in these areas continue, the trend of diversifying needle coke uses is expected to provide a boost to the market.

Restraint: Environmental Regulations and Market Concentration

Environmental regulations pose a significant restraint on the global needle coke market. Needle coke production is energy-intensive and leads to considerable CO2 emissions, contributing to environmental degradation. As a result, there is growing pressure from environmental bodies and governments around the world to limit production or enforce cleaner production methods. This can lead to increased production costs, potentially hampering market growth.

Furthermore, the needle coke market is highly concentrated, with the top 10 producers controlling about 70% of the global market share. This dominance creates a barrier to entry for new players and stifles competition. Additionally, such concentration can lead to price manipulation and supply instability, which could act as deterrents to the overall market growth. As such, market concentration and regulatory pressures represent significant challenges for the global needle coke industry.

Segmental Analysis

By Grade

In the global needle coke market, the intermediate grade stands tall as the predominant force, securing over 50.4% of the market revenue in 2023. This dominance is projected to persist, with a forecasted compound annual growth rate (CAGR) of 5.61% during the upcoming period. The intermediate grade's success primarily lies in its versatile application scope, especially within the steel and battery industries.

The intermediate grade of needle coke strikes an optimal balance between quality and cost-effectiveness, rendering it the preferred choice for manufacturers across the globe. It delivers the requisite performance standards while being economically viable, ensuring a wider adoption. The sustained demand from rapidly developing industries, like electric vehicle manufacturing and renewable energy, is further propelling the intermediate grade's market dominance. This grade's application in these future-forward industries positions it favorably for continued growth and consolidation of its leading market position.

By Application

By application, the graphite electrode segment is projected to continue holdings its leading position during the forecast period. As of 2023, the segment contributed more than 72.9% share of the total revenue. This unequivocally establishes the graphite electrode's central role in various industries. Moreover, this segment's trajectory is poised for continued advancement at a CAGR of 7.28% during the forecast period thanks to its fundamental importance across industries. Functioning as a crucial component in electric arc furnaces, primarily within the steel production sector, graphite electrodes capitalize on their remarkable thermal conductivity, low electrical resistance, and exceptional mechanical strength. These attributes collectively enable efficient and economically viable steel manufacturing.

On the other hand, the needle coke market is finding its utility in other domains. Notably, its role in manufacturing anodes for lithium-ion batteries is vital for the burgeoning electric vehicle and portable electronics markets, owing to its enhanced electrical conductivity and structural integrity. Additionally, needle coke contributes to the production of specialized carbon materials with aerospace and nuclear applications, as well as silicon metal and specific carbon products.

By End User

By end users, aluminum and steel industry occupies a paramount position in the global coke needle market and is also projected to remain as the largest consumer by contributing over 48.7% of the total revenue until the end of the forecast period. Furthermore, the segment is expected to keep growing at a CAGR of 7.33% in the coming years. The aluminum and steel sector's dominance in needle coke consumption as their manufacturing processes heavily rely on the use of needle coke-based electrodes in electric arc furnaces. Wherein, needle coke is an essential component for the production of high-quality carbon anodes utilized in the electrolytic process of aluminum smelting across the aluminum industry.

Similarly, in the steel industry, needle coke-based electrodes are pivotal in electric arc furnaces for melting scrap metal to produce steel. The unique properties of needle coke, such as high thermal conductivity and low electrical resistance, make it indispensable for achieving efficient and cost-effective processes in these industries.

Given the current market circumstance and future outlook, the segmental growth can be attributed to the continual expansion of the aluminum and steel sectors, primarily driven by infrastructural development, automotive manufacturing, and increased demand for consumer goods.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

The Asia Pacific region stands unrivalled in the global needle coke market, claiming a lion's share of over 71.5% of the market revenue in 2023. Cementing its position as the global epicenter of needle coke production, the region accounts for about 70% of worldwide production. The juggernaut of this impressive output is China, with India, South Korea, and Japan following as significant contributors.

A closer look at the consumption pattern reveals a similar trend. The Asia Pacific region is also the world's largest consumer of needle coke, responsible for approximately 65% of global consumption. The consumption landscape is led by China, followed by India, South Korea, and Japan. This vast consumption scale is reflective of the region's robust industrial framework, characterized by a burgeoning steel industry and rapidly developing electronics and graphite battery sectors.

With an impressive projected compound annual growth rate (CAGR) of 8.8% from 2024 to 2032, the demand for needle coke market in the Asia Pacific region is poised for robust growth. This surge is primarily fueled by the growing utilization of graphite electrodes in the steel industry and the escalating demand for graphite batteries.

While the region's supply of needle coke is deemed sufficient to meet the growing demand, a supply-demand gap is emerging in the segment of high-quality needle coke. Despite the overall sufficient supply, the current production capacity is falling short of fulfilling the increasing appetite for premium quality needle coke. On analyzing the end-user sectors, it is evident that the steel industry, graphite battery industry, and the electronics industry are the major consumers of needle coke in Asia Pacific. The steel industry, in particular, emerges as the largest end-user, trailed by the graphite battery industry and the electronics industry.

Top Players in the Global Needle Coke Market

- Asbury Carbons

- China Petroleum & Chemical Corporation (Sinopec)

- GrafTech International Ltd.

- Graphite India Ltd.

- Indian Oil Corporation Limited

- Mitsubishi Chemical

- NIPPON STEEL Chemical & Material Co., Ltd.

- POSCO Future M Co., Ltd.

- Reliance Industries

- RIZHAO HENGQIAO CARBON CO.,LTD

- Sojitz Ject Corporation

- Sumitomo Chemical

- The Phillips 66 Company

- Tokai Carbon Ltd.

- Other Prominent Players

Market Segmentation Overview:

By Product Type

- Coal based

- Petroleum based

- Shaft Calciner

- Rotary kiln

By Grade

- Intermediate

- Premium

- Super Premium

By Application

- Graphite Electrodes

- Silicon Metal & Ferroalloys

- Lithium-Ion Anode

- Carbon Black

- Rubber compounds

- Others

By End User

- Automotive

- Aluminium & Steel

- Semiconductor

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia & New Zealand

- ASEAN

- Rest of APAC

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)