Global Mushroom Materials Market: Analysis by Material Type (Mycelium Packaging, Mushroom Leather (Dyed Leather and Undyed Leather), Mycelium Bricks, Mushroom-Based Dyes, Mushroom Extracts and Supplements, Mushroom-Based Cosmetics, and Others); Mushroom Type (White Button Mushroom, Oyster Mushroom, Shiitake Mushroom, Maitake Mushroom, Reishi Mushroom, Lion's Mane Mushroom, Himematsutake Mushroom, King Oyster Mushroom, Snow Mushroom, and Turkey Tail Mushroom); Application (Food & Nutrition, Packaging, Textiles and Fashion, Construction & Building, Automotive, Medicinal and Nutraceutical, Agriculture, Consumer Goods, Cosmetics and Personal Care, and Others); Distribution Channel (B2B and B2C); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: Mar-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA0324799 | Delivery: 2 to 4 Hours

| Report ID: AA0324799 | Delivery: 2 to 4 Hours

Market Scenario

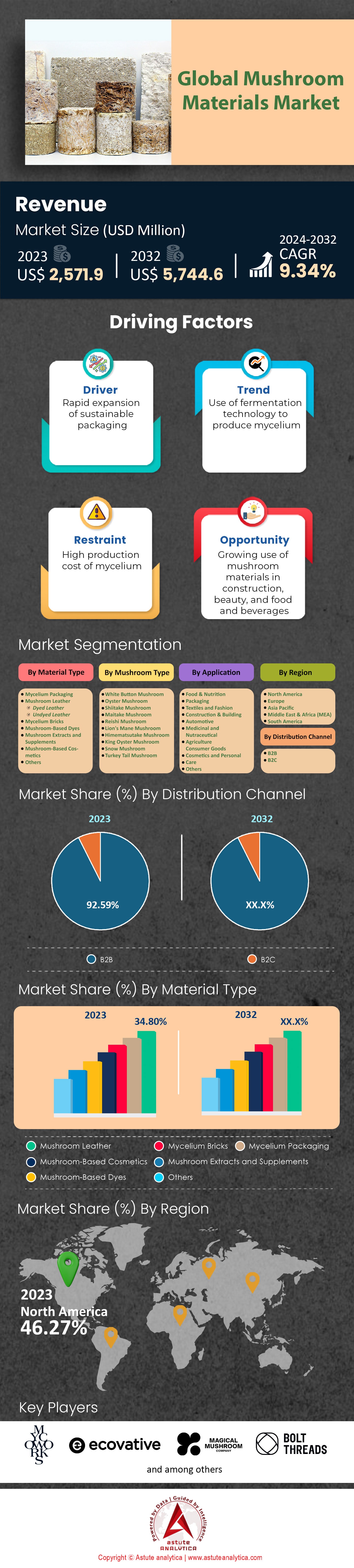

The Global Mushroom Materials Market was valued at US$ 2,571.9 million in 2023 and is projected to hit the market valuation of US$ 5,744.6 million by 2032 at a CAGR of 9.34% during the forecast period 2024–2032.

The demand for mushroom materials is growing and signifies an appetite for innovation and sustainable change. More and more, consumers are becoming eco-conscious and they’re looking for products that align with their values. Mushroom-based materials offer alternatives to traditional plastics, textiles, and construction materials which all have significant sustainability benefits. From a market perspective, the possibilities of mushroom materials seem endless. Not only can this solution provide immediate sustainability gains, but it represents a future where decentralized production models disrupt global supply chains. By localizing production, this will reduce transportation costs and create faster market responses. Another advantage is the ability to grow materials in shapes tailored to specific needs. This opens doors to niche markets and allows for highly personalized products we’ve never seen before.

The global mushroom materials market is likely to witnessed a strong line of obstacle when it comes to growth— but they are necessary to overcome. In order to build trust and secure large-scale contracts, consistent quality at scale is key. Mushroom materials must also be cost competitive compared with existing alternatives. Lastly —and possibly most importantly— is proving that these bio-fabricated solutions last long-term and perform well under diverse conditions.

The performance of mushroom materials isn’t the only thing that’ll win them their place on the market though— far from it. Investors and consumers will be drawn in by a narrative around regenerative practices as well as prospects of localized production and design revolutions enabled by bio-fabrication technology. Companies that match state-of-the-art manufacturing with a compelling narrative about sustainability are sure to make their mark in this emerging new landscape.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Increasing Number of Brand-led Sustainability Initiatives

Fashion and consumer goods businesses are trying to include bio-based materials into their products. Big brands investing in the mushroom materials market can make a huge difference for innovation. Stella McCartney, Hermès, and Kering have already adopted mycelium leather alternatives. Their approval sends the message that this stuff is worth looking into. Even companies like IKEA and Dell are exploring the use of mycelium-based packaging solutions as part of their larger sustainability goals. Big-named approval goes a long way when getting a new industry on its feet. With more eyes watching, bigger investments will be made which will lead to more research and development being done in this field.

Trend: Growing Demand for Performance-driven Applications

Sustainability was once the sole attraction of mushroom materials market. However, a performance-driven pursuit has emerged within the market that involves their use. In this case, mycelium-based materials would take the place of high-performance synthetics and traditional materials where demanding standards are a must. A great example is in construction. If researchers can create strong building blocks, insulation panels and acoustic materials with mycelium composites, we’d be looking at a revolutionary product that displaces concrete, foam insulation and other super high-carbon-footprint things.

The automotive industry is also tinkering with mycelium for interior components like car seats and dashboards. The lightweight, fire-resistant and moldable properties of mycelium make it an ideal candidate to replace plastics and foams used in car parts. This swap would reduce weight (improving fuel efficiency) while also offering a more sustainable approach to manufacturing vehicles. It’s safe to say the push for performance-driven applications is setting an important milestone for mushroom materials markets as it shows potential to truly challenge incumbent materials where strength, durability and technical requirements are vital.

Challenge: Overcoming the Image Obstacle, Mycelium's Marketing Challenge

The science and sustainability benefits of mushroom materials market are undeniably great, but getting consumers to actually buy them is a whole other thing. People usually think of fungi as gross, rotten organisms that should be avoided at all costs. So, the thought of using them in everyday items makes people hesitant right off the bat. To get past this perception problem, the players active in the global mushroom materials market will have to take a multi-faceted approach.

First and foremost, transparency and education are key. Companies need to actively inform customers about how these things are made, how they're safe for use, and how they help the environment more than traditional materials do. Secondly, branding and product design will play a major role in boosting public interest. These things need to look clean, sophisticated, top quality — not like something you'd find on a moldy sandwich. For instance, mycelium leather handbags prove that these types of materials can be high end just like any other ones out there.

Lastly — and arguably most importantly — the language used when talking up mushroom materials will make or break whether people want to buy them or not. Words like “bio-fabricated,” “regenerative” and “grown” can evoke positive thoughts about innovation and responsibility rather than negative associations with dirt and decay.

Segmental Analysis

By Material Type, Mushroom Leather to Dominate the Market

The mushroom leather segment of the mushroom materials market is currently on top, accounting for over 38.40% in revenue share and set to continue dominating the market by growing at a CAGR of 10.18%. The mushroom leather market is quickly racing ahead thanks to its compelling sustainability benefits, ethical appeal, and increasing performance capabilities. Mushroom leather boasts a much smaller environmental footprint than animal-based or synthetic leathers do and it aligns with vegan lifestyles. Plus, advancements in mycelium technology have made it possible for mushroom leathers to look and feel like conventional leathers.

Demand for this new material comes from eco-conscious consumers, vegans, fashion-forward individuals, and technology enthusiasts alike. North America and Europe's developed markets make them prime spots for consumption. Meanwhile, Asia's urban middle class is increasingly interested in ethical luxury as well. MycoWorks, Bolt Threads, MOGU, & Ecovative Design are all leading producers of mushroom leather along with major fashion brands who are pushing forward their adoption. Scalability and cost will determine how widespread the industry can become but the future looks bright for mushroom leather as it has potential to reshape the entire industry given its unique blend of sustainability, ethics, & performance that are appealing to both consumers & brands alike.

By Mushroom Type, Oyster Mushroom Holds Prominent Position in the Mushroom materials market

The global demand for oyster mushrooms is skyrocketing and it's all thanks to the versatility and sustainability that they bring. Right now, they hold more than 31.5% market share, and they're poised to grow even more rapidly than that at a whopping CAGR of 10.43% over the next few years. Not only are these mushrooms delicious and nutritious, but they also fit right in with the growing trend of plant-based diets. They’re perfect for sustainable packaging solutions too since we so desperately need alternatives to plastics nowadays. Additionally, oyster mushrooms show a lot of potential as supplements and functional foods due to their many health benefits.

The mushroom materials market is also expanding as new innovations are being made with oyster mushrooms mycelium in textiles, leather alternatives, and building materials. Asia-Pacific leads in consumption because of culinary and medicinal traditions but Europe and North America are not far behind with their rapid growth brought on by sustainability concerns, interest in functional foods, and the pursuit of eco-friendly materials. Current producers range from small-scale farms supplying fresh 'shrooms to large-scale growers for supermarkets and food processing. However, there are some specialty producers focused on extracts, supplements, and materials innovation that represent a dynamic segment that seems to be making the most waves in this industry.

By Application, the Packaging Segment Leads the Market, Contributing over 32.50% of Market Revenue

The mushroom-based materials market is getting bigger by the day. The area that focuses on packaging has already brought in 32.50% of all revenue for global mushroom materials market and continues to grow at a rate of 10.53%. The industry is seeing a boom in demand because of the need for something other than plastic and Styrofoam. With these harmful materials only being used once, there’s been an urgent call for sustainable alternatives. That’s exactly what mushroom packaging is. It's easy to get rid of since it can be composted or biodegraded at home, which consumers can’t do with plastic or Styrofoam. But it doesn't lose its effectiveness as packaging for that reason — it insulates and protects products just like they need them, maybe even better than traditional packaging too.

Many things are contributing to the boom in the mushroom materials market, but government regulations are one of the biggest drivers. Plastic waste accounts for most pollution around the world, destroying ecosystems and oceans alike, so officials have been cracking down on it lately. Increasingly strict regulations require companies to look into “eco-friendly” options even more now than ever before — so much so that they’re eating into profits and hurting their business models as we speak. Eventually though they'll have no excuse not to switch over to eco-friendly options entirely if they don't soon.

By Distribution Channel

An undeniable B2B priority is evident as mushroom material’s primary distribution model. The segment holds over 92.59% of the market share and is projected to grow at a CAGR of 9.41%. This push towards a business focus can be attributed to current applications and market demands. Industries like packaging, construction, and manufacturing often require a massive amount of materials tailored for their specific needs. With the infrastructure to accommodate these large-scale orders, B2B channels in the mushroom materials market are an easy choice. The technical expertise required for adoption will be crucial for success in the B2B sector as well. Innovatively integrating mushroom materials into existing processes or products might need some guidance or support. And even if successful, scaling production and maintaining consistency across each batch can lead to roadblocks that are only eased by direct communication between parties.

Consumer research also indicates that the direct-to-consumer segment in the mushroom materials market is young in finished products featuring mushroom material. It would be unwise to shift focuses from businesses actively looking for innovative material solutions when there’s still so much untapped potential here. While costs continue to lower over time, mushroom materials might still carry a price premium compared to traditional options. But with room for negotiation and the possibility of bulk discounts being offered through B2B channels, producers should have no problem finding ways around this obstacle.

To Understand More About this Research: Request A Free Sample

By Region

North America currently takes the crown for having the largest mushroom materials market with revenue share of 46.27%. A growing concern for sustainability from consumers and a regulatory environment that sees green as a go create an ideal landscape for alternative materials made with mycelium. There’s more to it than that, though. This part of the world also acts as a major hub for innovation in mycelium technologies, thanks in large part to leading companies located here. They’re spearheading advancements in these kinds of materials so that they can be used in more ways than one. The region’s investment climate also looks good for sustainable technologies, which means North America will probably continue making big moves.

Europe has long been a mature mushroom materials market, but it's still quite substantial. The continent prides itself on its commitment to environmental responsibility and has regulations set up to make sure things stay sustainable too. This combination makes it easy for mushroom-based materials to thrive here and gives them plenty of advantages over traditional alternatives. Europe’s strong manufacturing infrastructure lets companies easily integrate these materials into their current production processes and supply chains, making adoption easier across various industries.

The Asia Pacific region takes home the award for fastest growth rate when it comes to mushroom materials and is expected to keep growing at the highest CAGR rate 10.18%. This indicates a rapidly evolving market that could change significantly over just a few years or even months. With such a large population and middle class that’s expanding quickly, this area is always ready to put new products to use — especially if they’re sustainable or innovative ones. Urban centers have seen disposable incomes grow as well, so there's more money available than ever before that people don’t mind spending on these things either.

China leads the way in producing goods quickly and cheaply, which sets up this country perfectly for scaling production of mushroom materials fast enough to make them affordable too. While Asia Pacific is known for cost-competitiveness and high production capacity, it’s worth noting that sustainability awareness has long lagged behind in this part of the world compared to North America and Europe.

Top Players in Global Mushroom Materials Market

- Bolt Threads

- Ecovative LLC

- Magical Mushroom Company

- Mogu

- Mushlabs

- Mycel

- Mycotech Lab

- MycoTechnology, Inc.

- MycoTEX

- Mycovation

- MycoWorks

- NEFFA

- Other Prominent Players

Market Segmentation Overview:

By Material Type

- Mycelium Packaging

- Mushroom Leather

- Dyed Leather

- Undyed Leather

- Mycelium Bricks

- Mushroom-Based Dyes

- Mushroom Extracts and Supplements

- Mushroom-Based Cosmetics

- Others

By Mushroom Type

- White Button Mushroom

- Oyster Mushroom

- Shiitake Mushroom

- Maitake Mushroom

- Reishi Mushroom

- Lion's Mane Mushroom

- Himematsutake Mushroom

- King Oyster Mushroom

- Snow Mushroom

- Turkey Tail Mushroom

By Application

- Food & Nutrition

- Packaging

- Textiles and Fashion

- Construction & Building

- Automotive

- Medicinal and Nutraceutical

- Agriculture

- Consumer Goods

- Cosmetics and Personal Care

- Others

By Distribution Channel

- B2B

- B2C

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- Saudi Arabia

- South Africa

- UAE

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA0324799 | Delivery: 2 to 4 Hours

| Report ID: AA0324799 | Delivery: 2 to 4 Hours

.svg)