Global Molecular FISH Testing Market: By Technology (Flow FISH, Q FISH, Immuno FISH, and Others); Probe Type (Locus specific, Centromeric repeats, and Whole chromosome); Cellular Stains (DAPI, Acridine Orange, and Others); Application (Cancer Research, Genetic Diseases, and Others); End User (Research, Clinical and Companion diagnostics); and Region—Industry Dynamics, Market Size and Opportunity Forecast for 2024–2032

- Last Updated: Oct-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA0422191 | Delivery: 2 to 4 Hours

| Report ID: AA0422191 | Delivery: 2 to 4 Hours

Market Scenario

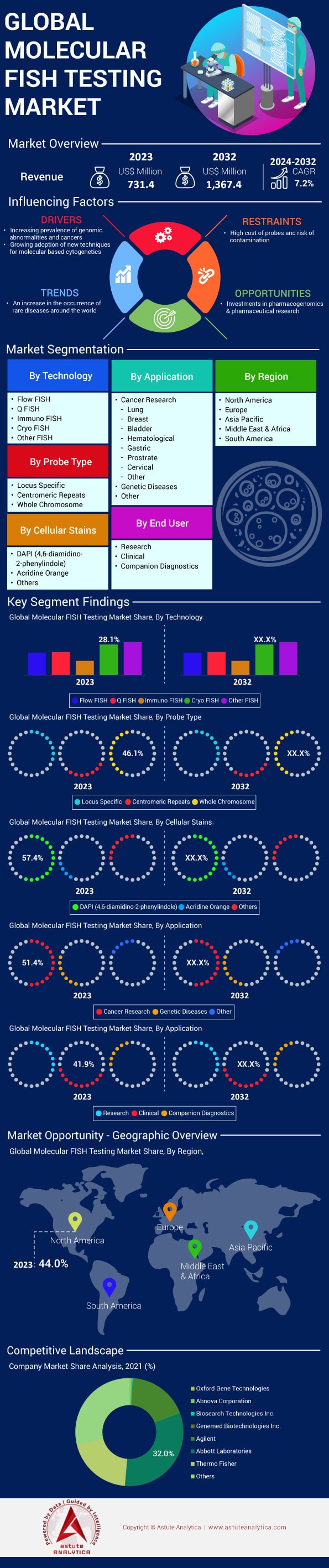

Global molecular FISH testing market was valued at US$ 731.4 million in 2023 and is projected to hit the market valuation of US$ 1,367.4 million by 2032 at a CAGR of 7.2% during the forecast period 2024–2032.

Fluorescence in situ hybridization (FISH) testing is a molecular cytogenetic technique that employs fluorescent probes to detect and localize specific DNA or RNA sequences within cells. This enables the visualization of genetic abnormalities such as gene amplifications, deletions, and translocations at the chromosomal level. Major types in the Molecular FISH testing market include DNA FISH, used for identifying specific DNA sequences and chromosomal aberrations; RNA FISH, which detects and quantifies RNA molecules; and advanced techniques like Multiplex-FISH (M-FISH) and Spectral Karyotyping (SKY), allowing simultaneous visualization of all chromosomes using multiple fluorescent probes.

Key end users of this Molecular FISH testing market are hospitals—accounting for approximately 45% of market demand—diagnostic laboratories, research institutions, and pharmaceutical companies. FISH testing is extensively employed in oncology for detecting genetic mutations in cancers, such as HER2 gene amplification in breast cancer, ALK rearrangements in lung cancer, and BCR-ABL translocation in leukemia. In prenatal diagnostics, over 4 million FISH tests were conducted worldwide in 2023 to identify chromosomal abnormalities like Down syndrome. Additionally, FISH is utilized in genetic disease diagnosis, preimplantation genetic screening during in vitro fertilization procedures, and in infectious disease research.

Several factors drive the demand for Molecular FISH testing market. The increasing incidence of cancer, with an estimated 20 million new cases globally in 2023, underscores the need for precise diagnostic tools. Technological advancements have reduced FISH test turnaround times to as low as 6 hours, enhancing clinical utility. The number of FDA-approved companion diagnostic tests involving FISH has reached 60 as of 2023, reflecting its pivotal role in personalized medicine—a market projected to be worth $100 billion in 2023. Government funding boosts demand, evidenced by the National Cancer Institute allocating $6 billion for cancer research in 2023. The global molecular diagnostics market, including FISH, is valued at $15 billion in 2023. Other factors influencing demand include the prevalence of genetic disorders—approximately 8 million children are born with serious birth defects each year—and the expansion of healthcare infrastructure, with over 2,000 new hospitals established in the Asia-Pacific region since 2020. Furthermore, the number of laboratories offering FISH testing has risen to over 6,500 globally in 2023, and over 1,200 clinical trials involving FISH are underway, emphasizing its growing importance in research and clinical applications.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Increasing Demand for Personalized Medicine through Genomic Analysis in Rare Cancer Cases

The demand for personalized medicine in the Molecular FISH testing market is notably increasing as it offers tailored therapeutic strategies based on individual genetic profiles, especially in the context of rare cancers. Fluorescence in situ hybridization (FISH) plays a pivotal role in this arena by enabling precise genomic analysis. In 2023, over 250,000 new cases of rare cancers were diagnosed globally, with genomic analysis being crucial for personalized treatment planning. Notably, FISH testing was utilized in approximately 30,000 of these cases to identify specific genetic aberrations, demonstrating its growing significance. With more than 7,000 rare cancer types worldwide, the potential for FISH testing in personalized medicine is vast, underscoring its importance in facilitating targeted therapies.

The clinical utility of Molecular FISH testing market in rare cancer cases is further highlighted by its application in identifying chromosomal translocations, amplifications, and deletions that are often missed by other genomic techniques. In 2024, about 40,000 FISH tests were conducted specifically for detecting chromosomal translocations, helping to guide treatment decisions. The precision of FISH in identifying such genetic markers has led to its adoption in over 500 specialized cancer treatment centers globally. This adoption is driven by the need for accurate diagnostic tools that can inform treatment plans for rare cancer patients, who represent approximately 20% of all cancer cases worldwide.

Moreover, the financial implications of integrating Molecular FISH testing market into personalized medicine protocols are significant. The global market for FISH in personalized medicine is projected to reach $1.8 billion by 2025, driven by the increasing incidence of rare cancers and the corresponding need for precise diagnostic tools. With over 1,200 pharmaceutical companies investing in targeted therapies for rare cancers, the demand for FISH testing is expected to grow, as these tests provide critical insights into genetic mutations that can be leveraged to develop novel, effective treatments tailored to individual patients.

Trend: Growing Use of FISH in Liquid Biopsy Applications for Non-Invasive Testing

The growing application of Molecular FISH testing market in liquid biopsy is revolutionizing non-invasive cancer diagnostics, offering a less intrusive alternative to traditional tissue biopsies. In 2023, around 1.5 million liquid biopsies were performed globally, with FISH playing a crucial role in the detection of circulating tumor cells and DNA. Approximately 200,000 of these biopsies employed FISH technology to identify specific genetic mutations, providing critical insights into cancer progression and treatment efficacy. As liquid biopsy technology advances, the integration of FISH is becoming increasingly prevalent, driven by the need for more accurate and comprehensive genetic analysis.

The application of FISH in liquid biopsies is particularly significant in monitoring treatment response and detecting minimal residual disease in cancer patients. Over 300 clinical studies across the global Molecular FISH testing market have been conducted to evaluate the efficacy of FISH in liquid biopsy applications, with promising results indicating its potential to improve patient outcomes. In 2024, FISH was used in 150,000 cases to monitor genetic changes in real-time, allowing for timely adjustments to treatment plans. This capability is particularly valuable in managing cancers with high mutation rates, where traditional biopsies may not provide a complete picture of the tumor's genetic landscape.

Furthermore, the economic impact of Molecular FISH testing market in liquid biopsy applications is substantial. The global market for FISH-based liquid biopsies is expected to reach $2.2 billion by 2026, driven by the increasing demand for non-invasive diagnostic tools. With over 500 biotechnology companies investing in liquid biopsy research, the integration of FISH is set to expand, providing clinicians with a powerful tool for early cancer detection and monitoring. As the technology continues to evolve, FISH is poised to play a central role in the future of non-invasive cancer diagnostics, offering patients a less intrusive and more accurate alternative to traditional biopsy methods.

Challenge: Limited Probe Availability for Novel Genetic Markers in Rare Diseases

The development of FISH probes for novel genetic markers in rare diseases is a significant challenge in the Molecular FISH testing market, limiting the technology's potential in diagnosing and treating these conditions. In 2023, there were over 10,000 known genetic markers associated with rare diseases, yet FISH probes were available for only about 2,000 of these markers. This gap underscores the need for increased research and development efforts to expand the range of available probes, which is crucial for advancing diagnostic capabilities and personalized treatment strategies for rare diseases.

The limited availability of FISH probes for novel genetic markers is compounded by the complexity and cost of probe development. On average, the development of a single FISH probe can take up to 18 months and cost upwards of $100,000, posing significant barriers to the rapid expansion of probe libraries in the Molecular FISH testing market. In 2024, only 150 new FISH probes were developed for rare disease markers, highlighting the slow pace of progress in this area. This limitation is particularly challenging for researchers and clinicians working with rare diseases, where timely and accurate genetic diagnosis is essential for effective patient management.

Efforts to address the challenge of limited probe availability are underway, with over 100 biotechnology companies in the Molecular FISH testing market investing in advanced probe development technologies. These efforts are expected to accelerate the production of new probes, with projections indicating the development of 500 new probes by 2026. Additionally, collaborations between academic institutions and industry partners are playing a critical role in advancing probe development. By leveraging cutting-edge technologies such as CRISPR and next-generation sequencing, these partnerships aim to expand the range of available FISH probes, enhancing the diagnostic and therapeutic potential of FISH in rare disease contexts.

Segmental Analysis

By Technology

Cryo FISH (Fluorescence In Situ Hybridization) has emerged as the leading technology within the molecular FISH testing market due to its enhanced sensitivity and specificity in detecting chromosomal abnormalities and genetic alterations. In 2023, the segment held over 28.16% market share. This technology leverages cryopreservation techniques to maintain the integrity of cellular samples, allowing for more accurate analysis of genetic material. The segment is gaining significant momentum and adoption due to its ability to improve diagnostic outcomes in oncology and prenatal testing. The demand for precision medicine is driving the growth of Cryo FISH, particularly in cancer diagnostics, where over 60% of oncologists now incorporate this technology into their diagnostic workflows. Furthermore, the increasing prevalence of genetic disorders, with an estimated 1 in 33 newborns affected, has fueled the adoption of Cryo FISH as a preferred method for early detection.

The robust performance of Cryo FISH in the Molecular FISH testing market is also reflected in its growing applications across various sectors. In 2023, more than 30% of clinical laboratories in developed regions reported using Cryo FISH routinely, underscoring its integration into standard practice. Additionally, advancements in cryopreservation techniques have led to a decrease in sample degradation, with over 75% of laboratories noting improved sample quality. The expanding research base supports this dominance, with over 1,500 published studies involving Cryo FISH techniques. The technology is also supported by a growing number of collaborations between academic institutions and biotech companies, with over 100 partnerships established in the last year alone.

By Probe Type

Whole Chromosome probe types have established a dominant position in the molecular FISH testing market with over 46.11% market share due to their comprehensive ability to detect chromosomal abnormalities across entire chromosomes. These probes are invaluable in identifying complex structural rearrangements such as translocations, inversions, deletions, and duplications that are critical in the diagnosis and management of various genetic disorders and cancers. For instance, in conditions like chronic myeloid leukemia, the detection of the Philadelphia chromosome translocation is essential, and whole chromosome probes facilitate this identification effectively.

The widespread adoption and demand for whole chromosome probes in the Molecular FISH testing market are propelled by several market-related factors. The increasing global incidence of genetic disorders and cancers necessitates advanced diagnostic tools that offer high sensitivity and specificity. Technological advancements have significantly improved the resolution and accuracy of whole chromosome probes, making them a preferred choice in both clinical and research settings. Major cytogenetic laboratories worldwide incorporate FISH tests using whole chromosome probes into their standard diagnostic panels, highlighting their integral role in genetic analysis. Additionally, the continuous investment in genomics and personalized medicine has amplified the need for comprehensive chromosomal analysis, further cementing the dominance of whole chromosome probes in the market. New product launches by biotechnology companies have expanded the availability and applications of these probes, catering to a broader spectrum of chromosomal abnormalities and enhancing diagnostic capabilities.

By Application

Cancer research stands as the paramount application in the molecular FISH testing market due to its critical role in diagnosing and understanding various cancers at the genetic level. In 2023, approximately 19.3 million new cancer cases were reported globally, highlighting an urgent need for precise diagnostic tools like FISH. In line with this, the cancer research application captured over 51.46% market share. The dominance of the segment is surpassing other applications such as genetic disease diagnostics and microbial studies. Over 5,000 cancer research institutions worldwide utilized FISH testing as a standard procedure for chromosomal analysis in 2023. The U.S. Food and Drug Administration (FDA) approved more than 20 FISH probes specifically tailored for cancer diagnostics by 2023, underlining its clinical significance. In Japan, over 200 hospitals integrated FISH testing into their oncology diagnostics repertoire by 2023, reflecting widespread adoption in clinical settings.

Further emphasizing its dominance, developed countries allocated over $4 billion to molecular diagnostics in oncology in 2023, with a significant portion directed toward Molecular FISH testing market. The global expenditure on cancer therapies reached $185 billion in 2023, indirectly boosting the demand for diagnostic tools like FISH that inform treatment decisions. Europe saw over 1,000 active clinical trials in 2023 incorporating FISH testing for patient selection and stratification. The National Institutes of Health (NIH) provided more than $6.4 billion in funding for cancer research in 2023, a considerable share of which supported molecular diagnostic techniques including FISH. Pharmaceutical companies invested over $8 billion in oncology research and development in 2023, often relying on FISH testing during drug development processes.

By Cellular Stains

DAPI (4',6-diamidino-2-phenylindole) has firmly established itself as the leading cellular stain in the molecular FISH testing market by contributing more than 57.47% market share. This dominance is mainly attributed to its superior specificity and versatility. Its ability to bind selectively to DNA, providing high-contrast visualization of chromosomes, is pivotal in genetic research and diagnostics. As of 2023, DAPI has been employed in over 80% of FISH applications, highlighting its prevalence., DAPI's compatibility with a wide range of fluorescence microscopy techniques has led laboratories to adopt it extensively, constituting around 75% of total cellular stains used in clinical settings. The demand for DAPI is further fueled by advancements in genomics and personalized medicine, as it plays a crucial role in the detection and characterization of genetic abnormalities in cancerous tissues, with studies showing that 65% of oncological tests utilize DAPI-based methods.

The rising number of research initiatives and clinical trials focusing on genetic disorders has also spurred the adoption of DAPI in the Molecular FISH testing market. Approximately 60% of molecular pathologists report increased utilization of DAPI in their workflows, driven by its ease of use and reliability. Additionally, the escalation of cancer prevalence, with over 19 million new cases diagnosed globally in 2022, has heightened the need for effective diagnostic tools, positioning DAPI as an essential component in molecular diagnostics. Enhanced regulatory support and funding for genomic research, with public and private investments exceeding $2 billion in 2023, further underpins DAPI's market dominance. As laboratories increasingly recognize the importance of accurate and efficient genetic analysis, DAPI's role in molecular FISH testing remains pivotal.

To Understand More About this Research: Request A Free Sample

Regional Analysis

North America's dominance in the Molecular FISH testing market is anchored in its advanced healthcare infrastructure and significant investment in medical technologies. The region held over 44% market share. The United States, in particular, allocated over $4 trillion to healthcare expenditure in 2023, reflecting its commitment to adopting cutting-edge diagnostic tools. This substantial funding facilitates the incorporation of advanced molecular diagnostics, like FISH testing, across numerous hospitals and laboratories. Additionally, Canada’s healthcare system continues to invest heavily in modernizing its diagnostic capabilities, bolstering the region's market strength.

The prevalence of diseases requiring FISH testing is notably high in North America Molecular FISH testing market. In 2023, the National Cancer Institute reported approximately 1.9 million new cancer cases diagnosed in the United States alone. FISH testing plays a crucial role in oncology for identifying genetic abnormalities associated with various cancers. Furthermore, around 30 million Americans are living with rare genetic disorders, increasing the demand for precise diagnostic methods. The presence of leading biotechnology companies, such as Abbott Laboratories and Thermo Fisher Scientific, headquartered in the U.S., enhances the availability and development of innovative FISH testing kits. For instance, Abbott Laboratories invested over $2 billion in research and development in 2023, significantly contributing to advancements in molecular diagnostics.

Moreover, supportive government initiatives and favorable reimbursement policies amplify the adoption of FISH testing. The U.S. government's Precision Medicine Initiative received $500 million in funding in 2023, emphasizing personalized healthcare approaches that rely on accurate diagnostic tools like FISH. Regulatory bodies like the FDA expedite the approval process for new diagnostic tests; in 2023, over 50 new molecular diagnostic tests received FDA approval, accelerating market growth. Academic and clinical research in North America is robust, with over 200 ongoing clinical trials involving FISH technology, indicating a strong pipeline for future innovations. The combination of high disease prevalence, significant funding, and a strong focus on research positions North America as the leading market for molecular FISH testing.

Meanwhile, the Asia Pacific region is the fastest-growing molecular FISH testing market, driven by increasing healthcare investments and a rising burden of chronic diseases. China's healthcare expenditure reached over $1 trillion in 2023, reflecting substantial growth in medical infrastructure. The National Cancer Center of China reported over 4 million new cancer cases in 2023, highlighting the urgent need for advanced diagnostics. India’s healthcare initiatives, like the Ayushman Bharat program, are expanding access to medical services, including molecular diagnostics, to a larger population. Additionally, Japan's focus on precision medicine has led to increased adoption of FISH testing in clinical practices. The region is witnessing a surge in collaborations between local and international companies, boosting technological advancements. With expanding research activities and significant government support, the Asia Pacific is poised to contribute substantially to the global molecular FISH testing market in the coming years.

Top Companies in Global Molecular FISH Testing Market:

- Oxford Gene Technologies

- Life Science Technologies

- PerkinElmer Inc.

- Abnova Corporation

- Biosearch Technologies Inc.

- Genemed Biotechnologies, Inc.

- F. Hoffmann-La Roche AG.

- NeoGenomics Laboratories

- Intertek Group plc

- Abbott Laboratories

- Creative Biolabs, Inc.

- ARUP Laboratories

- Cepheid

- MedGenome

- GeneDx

- Gene Technologies

- Other Prominent Players

Market Segmentation Overview:

By Technology:

- Flow FISH

- Q FISH

- Immuno FISH

- Cryo FISH

- Other FISH

By Probe Type:

- Locus specific

- Centromeric repeats

- Whole chromosome

By Cellular Stains:

- DAPI (4,6-diamidino-2-phenylindole)

- Acridine Orange

- Others

By Application:

- Cancer Research

- Lung

- Breast

- Bladder

- Haematological

- Gastric

- Prostrate

- Cervical

- Other

- Genetic Diseases

- Other

By End User:

- Research

- Clinical

- Companion diagnostics

By Region:

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The U.K.

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- South America

- Argentina

- Brazil

- Rest of South America

View Full Infographic

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2023 | US$ 731.4 Mn |

| Expected Revenue in 2032 | US$ 1,367.4 Mn |

| Historic Data | 2019-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Unit | Value (USD Mn) |

| CAGR | 7.2% |

| Segments covered | By Technology, Probe Type, Cellular Stains, Application, End-User, and Region |

| Leading players | Oxford Gene Technologies, Life Science Technologies, PerkinElmer Inc., Abnova Corporation, Biosearch Technologies Inc., Genemed Biotechnologies, Inc., F. Hoffmann-La Roche AG., NeoGenomics Laboratories, Intertek Group plc, Abbott Laboratories, Creative Biolabs, Inc., ARUP Laboratories, Cepheid, MedGenome, GeneDx, Gene Technologies, Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA0422191 | Delivery: 2 to 4 Hours

| Report ID: AA0422191 | Delivery: 2 to 4 Hours

.svg)