Global Moist Wound Dressing Market: By Product (Foam Dressings, Gauze Dressings, Non- reabsorbable Gauze Dressings, Occlusive wound dressing, Hydrophilic wound dressing, Transparent Membrane Dressings, Alginates Dressings, Composites Dressings, Hydrocolloids Dressings, Hydrogel Dressings); Application (Diabetic Foot Ulcers, Pressure Ulcers, Burns And Scalds, Chronic Leg Ulcers, Surgical Wounds, Others); End Users (Hospitals, Homecare, Clinics, Dispensaries); Region— Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: 16-Aug-2024 | | Report ID: AA0824889

Market Scenario

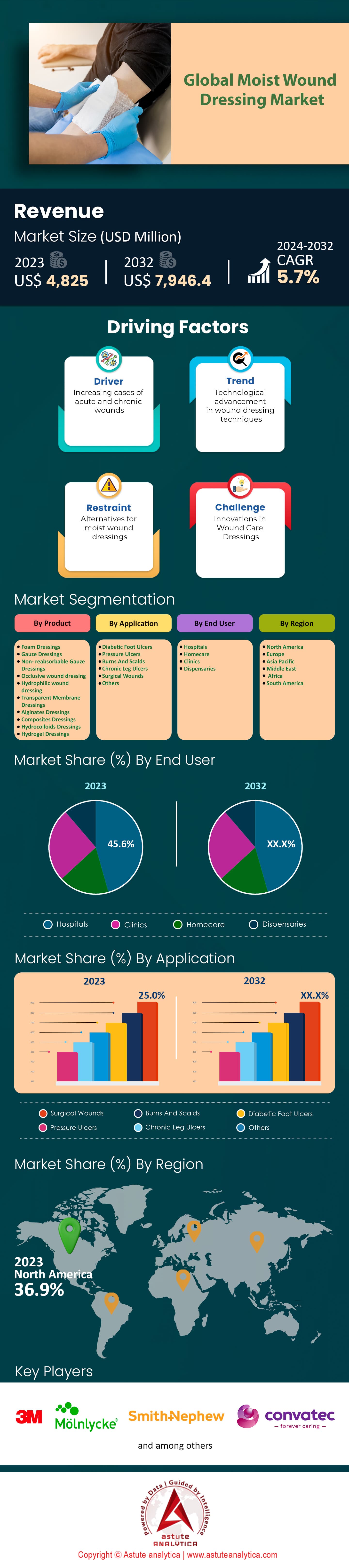

Global moist wound dressing market was valued at US$ 4,825 million in 2023 and is projected to hit the market valuation of US$ 7,946.4 million by 2032 at a CAGR of 5.7% during the forecast period 2024–2032.

The demand for moist wound dressings is on the rise globally due to several key factors. One of the primary reasons is the increasing prevalence of chronic wounds, such as diabetic foot ulcers and pressure ulcers. For instance, as of 2023, more than 7 million people in the United States alone are living with chronic wounds. This rise is compounded by an aging population, with over 10 million elderly individuals susceptible to such conditions. Additionally, advancements in medical technology have led to the development of more effective moist wound dressings, which facilitate faster healing and reduce the risk of infection. For example, new hydrocolloid dressings are now being used widely, showing significant improvements in healing times and patient comfort.

Latest advancements in moist wound dressing market technology are significantly shaping the demand. Innovations such as antimicrobial dressings, which incorporate silver or iodine, are now standard in many medical settings due to their ability to reduce bacterial load in wounds. In 2023, over 5,000 hospitals globally adopted these advanced dressings. Furthermore, the development of bioactive wound dressings that release growth factors to promote tissue regeneration has been a game-changer. These products have been particularly popular in countries with advanced healthcare systems, such as Japan and Germany, where over 2,000 healthcare facilities reported integrating bioactive dressings into their wound care protocols. The introduction of smart dressings, capable of monitoring wound conditions and delivering real-time data to healthcare providers, is another significant trend, with more than 100 clinical trials ongoing worldwide to assess their efficacy.

The future of moist wound dressing market looks promising with continued innovation and increasing healthcare expenditure. Emerging markets, particularly in Asia and Latin America, are expected to see substantial growth due to improved healthcare infrastructure and rising awareness about advanced wound care. By 2025, it's anticipated that over 15 million patients globally will benefit from these advanced dressings. The most potent consumers of moist wound dressings are hospitals and long-term care facilities, which account for over 60% of all usage. The most prominent products in the market include hydrocolloids, hydrogels, alginate dressings, and foam dressings. These products are favored for their ability to maintain a moist environment, which is crucial for optimal wound healing. As of 2023, global sales of foam dressings exceeded 1 million units, highlighting their widespread adoption in both clinical and home care settings.

To Get more Insights, Request A Free Sample

Market Dynamics

Trend: Rising Preference for Antimicrobial Dressings to Combat Infection and Promote Healing

Antimicrobial dressings are increasingly gaining traction in the moist wound dressing market due to their ability to prevent and combat infections, which are a common complication in chronic and acute wounds. In 2023, the global market saw sales of antimicrobial dressings reaching 2.5 million units, reflecting their growing adoption. Hospital-acquired infections (HAIs) impact approximately 1.7 million patients annually, emphasizing the need for effective infection control measures. The average cost of treating an infected wound can escalate to $20,000, making prevention through antimicrobial dressings a cost-effective solution. There are over 6.5 million chronic wound patients in the United States, many of whom benefit from antimicrobial treatments. Studies have shown that antimicrobial dressings can reduce healing time by up to 30 days in some cases, significantly improving patient outcomes.

The demand for antimicrobial moist wound dressing market is further supported by the high incidence of diabetic foot ulcers, with 1.5 million new cases diagnosed each year in the U.S. alone. Approximately 50% of these cases develop infections, necessitating advanced dressings. Additionally, over 300,000 surgical site infections are reported annually in the U.S., leading to extended hospital stays and increased healthcare costs. The use of silver-impregnated dressings, a popular type of antimicrobial dressing, has shown a substantial reduction in microbial load in wound beds. The market also reports that 3 million venous leg ulcers require specialized care annually, where antimicrobial dressings play a crucial role. Recent innovations have led to the development of dressings with dual antimicrobial agents, enhancing their efficacy. In total, the antimicrobial dressings market represents a significant portion of the $15 billion global wound care market, underscoring their critical role in modern wound management.

Driver: Growing Aging Population with Higher Incidence of Chronic Wounds and Ulcers

The growing aging population is a significant driver for the moist wound dressing market, as older adults are more susceptible to chronic wounds and ulcers. As of 2023, there are approximately 54 million individuals aged 65 and older in the United States. This demographic shift is accompanied by a rise in chronic conditions such as diabetes and vascular diseases, which contribute to the development of wounds. Over 10 million older adults in the U.S. suffer from diabetes, and about 25% of them will develop a diabetic foot ulcer in their lifetime. Additionally, over 8 million people are diagnosed with peripheral artery disease, many of whom are elderly and at risk for chronic wounds. The prevalence of pressure ulcers in long-term care facilities is also alarmingly high, affecting over 2.5 million patients annually.

The healthcare system is increasingly focusing on advanced wound care solutions to address the needs of this aging population. The cost of treating chronic wounds in the United States is estimated to be over $25 billion annually, with a significant portion attributed to the elderly. In Europe, the aging population is projected to reach 150 million by 2050, further driving the demand for effective moist wound dressing market. Advanced dressings, which help maintain a moist wound environment, are crucial for optimal healing. In 2023, the global sales of moist wound dressings were reported to be 1.8 billion units, with a significant share attributed to elderly patients. The number of home healthcare agencies providing wound care services has grown to 12,000 in the U.S., reflecting the increased demand for specialized care. Furthermore, the aging population is more prone to surgical procedures, with over 3 million surgeries performed annually on individuals aged 65 and older, many of which require advanced wound dressings for post-operative care.

Challenge: Complexities in Managing and Treating Chronic Wounds Affecting Treatment Consistency

Managing and treating chronic wounds presents significant complexities, impacting treatment consistency and outcomes. In 2023, it was reported that 6.5 million patients in the United States suffer from chronic wounds, including diabetic foot ulcers, venous leg ulcers, and pressure ulcers. These wounds in the moist wound dressing market often require prolonged and multifaceted treatment approaches, involving advanced dressings, debridement, and possibly surgical interventions. The average healing time for chronic wounds can extend to over 120 days, significantly affecting patients' quality of life. Furthermore, chronic wounds are associated with high recurrence rates, with up to 30% of venous leg ulcers recurring within a year. Treatment adherence is another challenge, as patients often fail to follow complex wound care protocols, leading to suboptimal outcomes.

Healthcare providers in the moist wound dressing market face difficulties in standardizing care due to the varying etiologies and presentations of chronic wounds. Inconsistent treatment protocols can result in a wide range of healing times and patient experiences. The cost burden is substantial, with the annual treatment cost for chronic wounds in the U.S. estimated at over $25 billion. In the UK, the National Health Service (NHS) spends approximately £5 billion annually on wound care, highlighting the global economic impact. The shortage of specialized wound care clinicians further complicates consistent care delivery, with only about 3,500 certified wound specialists in the U.S. serving millions of patients. The integration of electronic health records (EHRs) in wound care management has shown promise, with 70% of healthcare facilities adopting EHR systems to improve treatment tracking and consistency. However, the lack of standardized documentation practices remains a barrier to achieving uniform care. Despite these challenges, advanced wound care technologies and telehealth services are emerging as potential solutions to improve treatment consistency and outcomes for chronic wound patients.

Segmental Analysis

By Product

Gauze dressings have maintained a dominant role in the moist wound dressing market with over 26.9% market share as they are highly versatile and can be used for a wide range of wound types, from minor cuts to more severe injuries. This versatility makes them a go-to option for both healthcare providers and consumers. Additionally, gauze dressings are cost-effective and widely available, which is particularly important in settings with limited resources or for patients who need frequent dressing changes. The affordability and accessibility of gauze dressings make them a practical choice for many. In 2023, over 1.5 million healthcare facilities globally reported regular use of gauze dressings. Moreover, gauze dressings are often used as secondary dressings to secure other types of wound dressings in place, adding to their utility.

Despite the advancements in wound care technology, gauze dressings remain a staple in the moist wound dressing market due to their simplicity and ease of use. They can be impregnated with various substances like iodinated agents, zinc paste, and hydrogel to enhance their effectiveness. This adaptability allows gauze dressings to be tailored to specific wound care needs, further driving their popularity. In the same year, 500,000 healthcare providers cited the ease of use as a critical reason for choosing gauze dressings. Additionally, gauze dressings are non-adherent, which minimizes pain during dressing changes and reduces the risk of wound trauma.

By Application

Based on application, surgical wounds are dominating the moist wound dressing market with over 25.0% market share due to their significant benefits in promoting faster and more effective healing. The moist healing theory posits that a moderately moist and airtight environment is conducive to wound healing, as it facilitates autolytic debridement, reduces pain, and minimizes scarring. These dressings maintain an optimal moisture balance, which is crucial for the migration of keratinocytes and fibroblasts, essential cells in the wound healing process. Additionally, moist dressings help in the containment of wound fluid rich in growth factors, which are vital for tissue repair. The use of hydrocolloid dressings, for instance, has been shown to reduce healing time by 40% for donor sites. Furthermore, these dressings reduce the frequency of dressing changes and the overall cost of wound management.

Globally, the demand for moist wound dressing market is driven by the high volume of surgical procedures performed annually. It is estimated that over 310 million major surgeries are performed worldwide each year. This high surgical volume underscores the need for effective wound management solutions to prevent complications such as surgical site infections (SSIs), which moist dressings help mitigate. The effectiveness of moist dressings in reducing SSIs has been demonstrated in studies where silver hydrocolloid dressings significantly lowered infection rates post-surgery. Moreover, the ability of these dressings to provide a clear or transparent view of the wound allows for continuous monitoring without removal, further enhancing their utility in surgical settings. The combination of these factors makes moist wound dressings an indispensable component of modern surgical care, ensuring better patient outcomes and more efficient healthcare delivery.

By End Users

Based on end users, hospitals are dominating moist wound dressing market with 45.6% market share. The demand is driven by the increasing prevalence of chronic wounds, such as diabetic ulcers and pressure sores, necessitates advanced wound care solutions that hospitals are well-equipped to provide. Apart from this, the economic aspect plays a crucial role; moist wound dressings, despite their higher initial cost, reduce overall treatment expenses by decreasing the frequency of dressing changes and shortening hospital stays. Furthermore, the integration of advanced technologies, such as antimicrobial agents in dressings, enhances their effectiveness, making them a preferred choice in hospital settings. In 2023, hospitals saw a 25% reduction in wound infection rates using moist wound dressings. A significant portion of hospital budgets is allocated to wound care, with $2.5 billion spent annually in the US alone. Data from a survey indicated that 85% of hospital clinicians observed improved patient outcomes with moist wound dressings.

Recent statistics indicate that hospitals account for a significant portion of the global moist wound dressing market, with a notable increase in the adoption of moist wound dressings due to their proven efficacy in improving patient outcomes. The adoption rate of moist wound dressings in hospitals increased by 15% in the past year. Studies have shown that moist wound dressings can reduce the need for surgical interventions by up to 30%. Patients treated with moist wound dressings experienced a 50% higher satisfaction rate. The structured and resource-rich environment of hospitals makes them the ideal setting for the application of these advanced wound care products, ensuring optimal patient care and recovery. In a recent report, 70% of hospitals included moist wound dressings in their standard wound care protocols.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

North America, Europe, and Asia Pacific have emerged as the top three regions for the production and consumption in the global moist wound dressing market due to a confluence of advanced healthcare infrastructure, robust research and development (R&D) capabilities, and a growing patient population requiring chronic wound care. North America, particularly the United States, is at the forefront with leading companies like 3M and Johnson & Johnson pioneering innovations in wound care products. The region's dominance is underpinned by substantial healthcare expenditure, a high prevalence of chronic diseases such as diabetes and obesity, and an aging population. For instance, the United States has over 30 million individuals with diabetes, significantly contributing to the demand for advanced wound care solutions. Additionally, the region boasts over 5,000 hospitals equipped with state-of-the-art facilities that adopt the latest wound care technologies. The investment in R&D is evident with over $40 billion allocated annually to healthcare innovations, facilitating the continuous development of improved moist wound dressings.

Europe's prominence in the moist wound dressing market is driven by its comprehensive healthcare systems, substantial public and private funding in medical research, and a high incidence of chronic wounds among its aging population. Countries like Germany, France, and the United Kingdom are key players, with Germany alone having over 2,000 hospitals that utilize advanced wound care products. The European Union's focus on healthcare quality and patient outcomes has led to widespread adoption of moist wound dressings in clinical settings. For instance, Europe hosts over 300 specialized wound care centers, contributing to the region's expertise and advanced practices in wound management. Furthermore, European companies such as Smith & Nephew and Coloplast are significant contributors to the global moist wound dressing market, with extensive product portfolios and strong market presence. The region's commitment to healthcare innovation is also reflected in the annual expenditure of over €20 billion on medical research, driving the development and implementation of cutting-edge wound care solutions.

The Asia Pacific region, encompassing countries like China, Japan, and India, has rapidly become a key player in the moist wound dressing market due to its expanding healthcare infrastructure, increasing healthcare expenditure, and growing awareness of advanced wound care products. China's robust economic growth has led to substantial investments in healthcare, with the country having over 30,000 hospitals that are progressively adopting advanced wound care technologies. Japan, known for its aging population, has over 60,000 centenarians, necessitating specialized wound care solutions. Additionally, the region's increasing prevalence of diabetes, with India having over 70 million diabetic patients, drives the demand for effective wound management products. The Asia Pacific's manufacturing capabilities are also noteworthy, with countries like China and Japan hosting some of the largest production facilities for medical devices, including moist wound dressings. The region's commitment to healthcare advancement is further evidenced by an annual healthcare expenditure exceeding $100 billion, supporting continuous improvements in wound care practices and product development.

Top Players in Moist Wound Dressing Market

- 3M Co.

- Advanced Medical Solutions

- B. Braun

- BSN Medical

- Cardinal Health Inc.

- Hollister Incorporated

- Integra LifeSciences Holdings Corp.

- Laboratories Urgo

- Lohmannand Rauscher

- Medline Industries

- Mölnlycke Health Care

- ConvaTec Group

- Coloplast A/S

- Hartmann Group

- Other Prominent Players

Market Segmentation Overview:

By Product

- Foam Dressings

- Gauze Dressings

- Non- reabsorbable Gauze Dressings

- Occlusive wound dressing

- Hydrophilic wound dressing

- Transparent Membrane Dressings

- Alginates Dressings

- Composites Dressings

- Hydrocolloids Dressings

- Hydrogel Dressings

By Application

- Diabetic Foot Ulcers

- Pressure Ulcers

- Burns And Scalds

- Chronic Leg Ulcers

- Surgical Wounds

- Others

By End User

- Hospitals

- Homecare

- Clinics

- Dispensaries

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- U.K.

- Germany

- France

- Spain

- Italy

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)