Mobile Energy Storage System Market: By Capacity (Below 3,000 KWh, 3,000-10,000 KWh, Above 10,000 KWh); Classification (Towable Systems, Float-in, and Others); Battery Type (Lithium-ion, Lead-acid, Nickel-cadmium, Others); System (Off-Grid and On-Grid); Application (Commercial, Industrial, Residential); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: Oct-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA1024950 | Delivery: 2 to 4 Hours

| Report ID: AA1024950 | Delivery: 2 to 4 Hours

Market Scenario

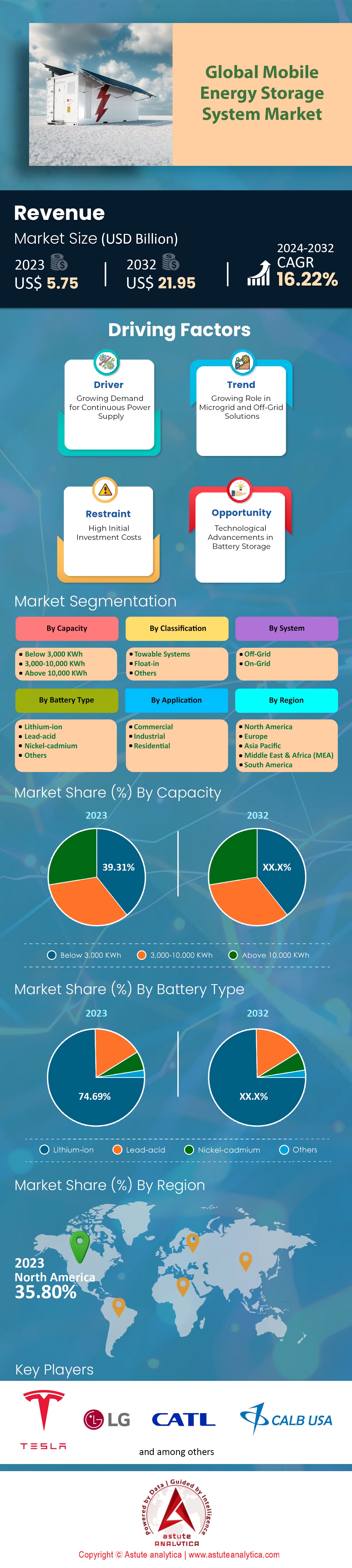

Mobile energy storage system market was valued at US$ 5.75 billion in 2023 and is projected to hit the market valuation of US$ 21.95 billion by 2032 at a CAGR of 16.22% during the forecast period 2024–2032.

Mobile Energy Storage Systems (MESS) serve as a quick and easy energy storage option that can be moved from one place to another when needed, with MESS, locations do not restrict energy supply since energy MESS can be supplied anywhere and anytime. It is possible for these systems to include lithium-ion or flow batteries which can charge from a grid or from renewable energy in order to later on use that charged energy anywhere it is needed. The demand for MESS is on the rise due to greater use of renewable energy in power grids, the tackling of issues pertaining to lower stability of the grid system and more frequent natural disasters that create a need for one. Further, development of electric vehicle (EV) infrastructure and the need for energy in areas with no connection to energy grid are also factors affecting the market. Mobile energy storage allows users to charge their devices in places where charging ports are not available.

The mobile energy storage system marketability relies on containerized battery units, modular power stations and portable battery packs. Tesla holds the lead with its megapack and powerpack systems; Siemens with Siestorage; BYD with Battery-Box and energy storage stations; ABB and LG Energy Solution. They are on the edge of the competition, developing innovations in mobile energy storage systems to satisfy the diverse energy requirements of the market. For instance, Tesla's Megapack has a storage capacity of 3 MWh making it best suited for utility scale projects. So far, Tesla’s Megapack installations worldwide have now exceeded 5GWh of cumulative capacity. In 2023, the average capacity of mobile energy storage systems being implemented is around 2MWh and as of December 2023, the total global installed capacity of MESS amounted to approximately 7 GWh.

The main use of MESS includes grid support systems, emergency and backup power systems, for complementing renewable energy sources, and for events and construction sites. Final beneficiaries are power companies, industrial and commerce, isolated settlements, and rescue teams. Over 1000 units of MESS have already been set up for disaster response operations in different countries in 2023. In recent developments as at 2023, there was vast funding in the MESS technology within international mobile energy storage system markets with both state and non-state agencies considering it as an essential component to achieve energy security and sustainability targets. Funding in mobile energy storage projects surpassed $5 billion in 2023 worldwide. Such technologies as solid state batteries commercialization increased energy density and safety of devices. Other factors included legal and fiscal support which hastened MESS adoption throughout the world, with more than 60 countries expecting energy storage support policies by this date. The utilization of MESS in non-grid areas provided energy access to energy for more than 50 million people in far regions. In 2023 over 1.5 million portable power stations were sold worldwide into consumers.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Increasing Integration of Renewable Energy Necessitating Storage Solutions for Grid Stability

The current trend of transitioning towards mobile energy storage systems centers around the use of renewable energy sources such as solar and wind. With a steady increase towards the use of energy within the years, it is expected to have reached over 3,000 gigawatts of energy by the year 2023. However, without the proper energy storage, the flip flopping of these energies can be a problem in the mobile energy storage system market. MESS gives a solution to this problem as it allows to internally store the excess energy produced during the time period of need, able to supply it when use is high or generation is low.

Geographical areas with large amounts of renewable energy generation are now relying on MESS more and more to account for the load demand. For instance, in 2023, Europe deployed over 500 megawatt hours (MWh) of mobile storage units across the region to facilitate the growth in renewable energy construction. These systems play a major role in solving issues relating to frequency diversity and voltage variation by improving the availability of power. Moreover, mobile energy storage system market witnesses a flexibility to be installed in those areas with congestion in the grid or constraints on the power lines, thus enhancement makes a good contribution to better grid functioning.

The mobile energy storage system market has encompassed the integration of MESSs with renewable energy projects in such a way that it has further facilitated the establishment of microgrids in isolated and underserved regions of the globe. In 2023, more than 1,000 microgrid previously unserved communities across the globe, using mobile storage solutions, were developed. Not only does this increase energy equity but it also helps the world to reduce the emissions of greenhouse gases through the displacement of diesel generators and other fossil fuel based sources of energy.

Trend: Advancements in Battery Technology Enhancing Storage Capacity and Reducing Costs

The mobile energy storage system market is centered around improving battery technology. New features are constantly being added such like solid unit, Lithium-sulfur and other revisions of lithium-ion technologies that boost energy density, safety, and lifespan. In 2023, solid-state batteries had an energy density that goes above 400 Wh/kg this further indicates how these batteries are rivalling conventional batteries. The general battery technology market has seen a drop in the price of energy storage systems. In 2023 the average cost for a lithium-ion battery had decreased to $100 the kWh. The lowering in costs has sparked an increase in usage for mobile energy solutions in activities such as construction, events and remote power supply where previously the solutions were not affordable.

New battery management systems and artificial intelligence have contributed to an increased efficacy of the mobile energy storage system. AI driven BMS allows for optimized cycles when charging and discharging as well as forecasting when the system will require maintenance. The uptake of the AI integrated replacing The AI integrated BMS in the MESS made the installation rate grow to over 70% in 2023.

Challenge: High Initial Costs Associated with Mobile Energy Storage System Deployment

Even though the merits of mobile energy storage system market are well recognized, high capital expenditures still present a serious hurdle to its universal application. Large-capacity systems, in particular, involve a considerable amount of upfront capital outlay for the purchase and installation of mobile energy storage solutions. In 2023, the average cost of every MESS deployment stood at close to $1 million per megawatt-hour (MWh), which is a huge barrier for SMEs and the undeveloped regions. The shortage of cost effective raw materials and advanced processes of constructing mobile energy components has made it hard to incorporate AI and competent battery management systems which in turn has led to high prices. Due to decentralized mobile energy storage, the problem amplifies. Other factors including the production cost of batteries have been decreasing but for these components the cost has not reduced significantly which has set back advancements.

One of the factors delaying the immediate investment into the mobile energy storage system market is the financial burden, however, this could be overcome through leasing and EaaS business models, which are yet to be adopted in mainstream markets. This has limited the amount of funding which would have been invested into these projects, since local banks are skeptics of providing such financing further. These alternative sources of financing will undoubtedly offer opportunities for MESSs at higher cost levels. Therefore, as an overarching weakness for the energy industry as a whole, high capital requirements deter investment and this can be mitigated with technological innovations, minimum scale of production and policies that enable financing with ease.

Segmental Analysis

By Capacity

The mobile energy storage system market is led by the below 3,000 KWh segment with over 39.31% market share. This dominance is mainly led by its versatility and ability to be used in multiple platforms. These systems give the most flexible solution in terms of volume, weight and energy density such that it is critical for some industries, for example, in remote construction sites in 2022, there were more than 18,000 deployments of sub 3000 Kwh units globally in regions with grid connection availability limited. Moreover, there has been a significant drop in the average prices of these systems, with prices dropping to about US$ 250 per Kwh, making it easier for SME’s to obtain them. Further, there has been an increase in market for backup power solutions as more than 5 million small scale retailer businesses adopted mobile energy storage to decrease the risk of outages on their operations.

The growth of technological innovation has further consolidated this segment’s leadership in the mobile energy storage system market. In the latter case, the efficiency parameters for lithium-ion batteries which are the heart of these systems have, in some cases, reached energy density values of 300 Wh/kg on the latest models manufactured. By 2023 global deployment of mobile energy storage lithium-ion batteries amounted to more than 50 GWh with a large part of the production targeted towards 3,000 KWh units. The renewable energy industry also plays its part in this trend, where more than 40,000 solar residential and commercial subdivisions have used this type of mobile storage to facilitate better energy utilization. Across the globe, governments have plugged in the extra need led by the strategic relevance attached to such systems, and towards advancing their use in general provided about $3 billion in stimulants and grants, with a large emphasis on rural electrification covering more than 100,000 households.

By Classification

As a result of their excellent portability, towable systems have established its domination in mobile energy storage system market with 55.61% of the market share. The mobile towable energy systems have been developed for convenient towing over land and provide instant access for power whenever and wherever required. For example, as per figures published by Oxford economics, the construction sector all over the world which is worth over a staggering US$ 10 trillion annually, often operates in isolated areas devoid of grid supply. Towable Energy Systems can be one of the feasible solutions to provide the required power for tools and operations around those parameters. Because of the increase in natural calamities – the Centre for Research on the Epidemiology of Disasters indicates approximately 350 to 500 disasters every year – These systems are rapidly deployed into critical areas and resized when power is needed in rescue operations.

The construction sector, military, event management companies, and emergency services are key end-users of portable energy storage solutions in the mobile energy storage system market. The Department of Defense reports, for instance, cite the US military, which spent over a billion dollars in 2021 seeking portable energy deployment systems so as to improve field operations, technology and energy procurement management. As per recent report by Astute Analytica, the value of the global event industry amounts to approximately $1.1 trillion, portable power supply systems are used for outdoor events for concerts and festivals, there are around 10,000 of these major events held in a year around the world. Towable systems are also used significantly by humanitarian agencies and emergency services the International Federation of Red Cross and Red Crescent Societies states that during emergencies, mobile energy solutions have to be deployed quickly at critical locations such as hospitals and communications networks.

By Battery Type

With more than 74.65% market share, Lithium – Ion batteries constitute the predominant share of the mobile energy storage system market due to their superior characteristics of high energy density, long cycle life and low maintenance requirements. In their report on the “Lithium-Ion Batteries for Energy Storage” the US Department of Energy states that lithium ion batteries can achieve energy densities as high as 265 watt hours per kilogram which is significant for mobile applications. With regards to sales, the International Energy Agency reports that global production of lithium ion batteries was 160-gigawatt hours in 2020 indicating a reasonable supply so as to meet the demand for the market. In addition, the capacity to provide ECT structural with up to 2,000 charge-discharge cycles gives them economic appeal for the long term Usage.

The mobile energy storage system market is characterized by a large number of industries including telecommunications where supply of constant energy is a necessity along with virtually universal applications of lithium-ion batteries. As the GSMA indicates, there are more than 5.2 billion individual cellular subscribers around the world, which means energy solutions are necessary for the networks. The healthcare industry relies on lithium-ion batteries for its portable devices relying on the global market of medical devices, which according to recent report valued at over $450 billion. The electric vehicle (EV) sector is among the largest buyers of lithium-ion batteries, with the International Energy Agency reporting more than 40 million units on the roads in 2023, thus further promoting the development and improvement of economies in the battery technologies.

By System

The mobile energy storage system market is mainly driven by off-grid mobile energy storage systems which account for more than 61.50% of the market because they offer great solutions in powering areas far away from central power grids. The International Energy Agency estimates that 770 million people worldwide did not have access to electricity in 2019. Due to this, the need for off-grid energy solutions is great. These systems are of great importance to remote places. According to the GSMA, there are over 390,000 off grid base stations in the telecom industry as of 2021 that depend on mobile energy storage systems in order to help them stay connected to networks. Off-grid systems are also of great importance in humanitarian activities as UNICEF has reported showing that during times of emergencies, off grid systems are used to ensure that important services are able to run optimally in over 150 countries with humanitarian activities.

According to the report on the World Mining Data of 2020, mining is one of the industries that talks of increased prevalence of off grid systems – it records over 1,800 currently operating mines in various corners of the earth. Such operations in the mobile energy storage system market need a dependable source of power disconnected from the grid and this gap is appropriately met by off grid energy storage system. Also, off-grid systems seem to be important for the military as well; the U.S. Department of Defense 2023 budget has approved almost US$ 1.68 billion for energy projects as mobile and off grid energy systems. However, off grid systems are no longer used without renewable energy sources; data from International Renewable Energy Agency (IRENA) shows that by the end of 2023, the amount of off grid renewable energy was about 10.6 gigawatts worldwide which was much higher than the previous years. Moreover, US$425 million were invested into the global off-grid solar sector in 2023 to support the further growth of the segment in the market.

To Understand More About this Research: Request A Free Sample

Regional Analysis

North America’s advanced energy technology and significant investment have placed it as a leader in mobile energy storage system market. It has reported a total of around 25 Gigawatts (GW) of installed battery energy storage and has reached a captivating market of more than 35.80% in 2023. Such trends indicate that USA’s market is growing, especially for its strong states such as California, where the potential has exceeded the energy storage capabilities of approximately 10 GW, which was made possible by the Self-Generation Incentive Program, dispersing funds in energy storage projects. Furthermore, increasing market share is also buoyed by the increase in electric vehicle (EV) sales. The count of the electric vehicles sold in the United States has exceeded 1.42 million units in 2023 meant that the energy storage units sales increased with the charging stations demand. Moreover, the nationwide funding is immense, with over half a billion put towards the research and development of batteries in 2023 alone. The collaboration of government agencies, private companies and research communities increases coordination to create and grow the market.

After North America, the Asia Pacific region begins to stand out in this mobile energy storage system market. Because of its ambitious renewable energy goals, China has already established over 20 GW of battery storage. With a target of adding 30 GW, the government’s “Technology Innovation Action Plan for Energy Storage,” it is evident that the nation is determined. The energy storage market of Japan has been valued at $5 billion in 2023 while South Korea has installed over 3 GW of storage systems to help strengthen the grid and support its smart grid strategies. The Asia Pacific region is further anchored in its superiority by its manufacturing capabilities. Over 70% of all Lithium ion batteries are produced in China, which continues to expand production capability and in 2023 spent over US$ 30 million on new gigafactories. The region is well entrenched when it comes to companies like CATL and BYD, as they not only can meet the internal requirements but also supply to countries from other regions. Through government support, such as subsidies, grant and good regulatory structures, adoption in residential, commercial, and utility sectors has moved with much rapidity.

Top Players in Mobile Energy Storage System Market

- Tesla

- LG Electronics Inc.

- CALB USA Inc.

- NextGen NRG

- Caterpillar Inc.

- Hamedata Technology

- Roypow Technology Co. Ltd.

- Aggreko

- Power Edison

- Delta Electronics

- Nomad Transportable Power System

- Generac Power Systems Inc.

- Alfen

- Other Prominent Player

Market Segmentation Overview:

By Capacity

- Below 3,000 KWh

- 3,000-10,000 KWh

- Above 10,000 KWh

By Classification

- Towable Systems

- Float-in

- Others

By Battery Type

- Lithium-ion

- Lead-acid

- Nickel-cadmium

- Others

By System

- Off-Grid

- On-Grid

By Application

- Commercial

- Industrial

- Residential

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- Saudi Arabia

- South Africa

- UAE

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA1024950 | Delivery: 2 to 4 Hours

| Report ID: AA1024950 | Delivery: 2 to 4 Hours

.svg)