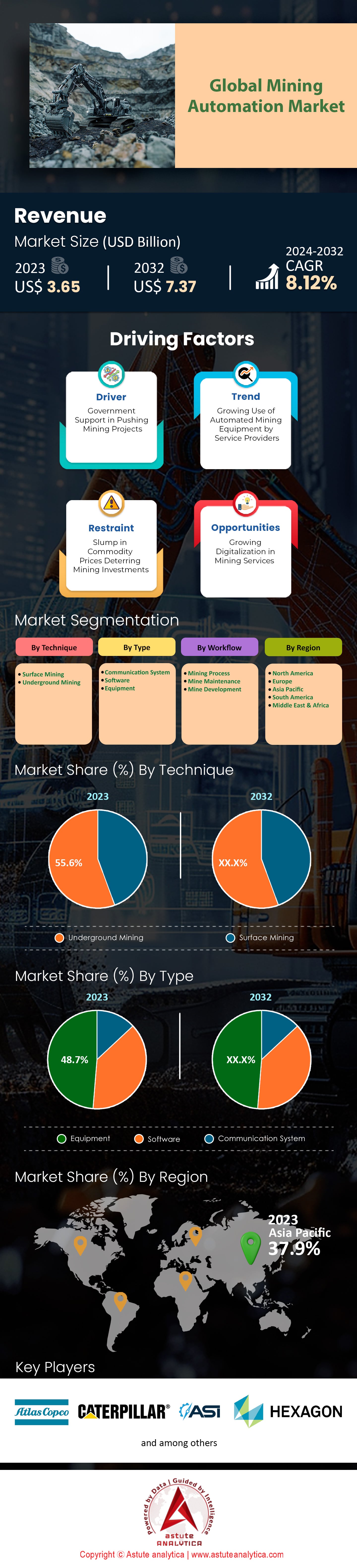

Global Mining Automation Market: Technique (Surface Mining and Underground Mining); Type (Communication System, Software, Equipment), Workflow (Mining Process, Mine Maintenance, Mine Development); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: 10-Aug-2024 | | Report ID: AA0824885

Market Scenario

Global mining Automation market was valued at US$ 3.65 billion in 2023 and is projected to hit the market valuation of US$ 7.37 billion by 2032 at a CAGR of 8.12% during the forecast period 2024–2032.

The mining automation market is experiencing a robust growth trajectory, with projections indicating an expansion from USD 3.6 billion in 2024 to USD 5.1 billion by 2029, at a CAGR of 7.2%. This surge is underpinned by the integration of cutting-edge technologies such as AI, robotics, and data analytics, which are revolutionizing the industry by enhancing safety, efficiency, and sustainability. The economic incentives are compelling, with advanced analytics alone capable of reducing operational costs by up to 20% and increasing throughput by 6%. Companies like BHP Billiton have reaped significant savings, such as the $5.8 million annual reduction in hauling truck expenses, while Barrick Gold Corporation has cut maintenance costs by 35%. The adoption of autonomous trucks and drilling systems, as demonstrated by industry leaders like Rio Tinto and Alamos Gold, underscores the market's momentum towards automation.

Environmental considerations are also propelling the mining automation market forward. Automated ventilation systems can slash energy costs by up to 40%, and the shift towards electric and autonomous vehicles is contributing to a reduction in emissions, with potential decreases of 17.9kg of CO₂ equivalent per ton of ore. These advancements align with the broader industry goals of achieving net-zero emissions and adhering to stricter environmental regulations. The market's expansion is further fueled by the need for improved resource management and the growing demand for minerals in the battery industry, which is intrinsically linked to the global push for renewable energy and electric vehicles.

Looking ahead, the mining automation market is poised for continued growth, driven by the increasing adoption of digital technologies and the rise of smart connected mines. Technological innovations are expected to unlock further cost savings and operational efficiencies, with the autonomous mining truck market alone projected to reach $6.8 million by 2030. However, the industry must navigate challenges such as the integration of diverse technologies, the need for skilled personnel, and potential global protests against automation's impact on employment. Despite these hurdles, the outlook for mining automation is overwhelmingly positive, with its promise of enhanced safety, productivity, and environmental stewardship shaping the future of mining operations worldwide.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Need for Operational Efficiency and Cost Reduction in Volatile Commodity Markets

The mining industry is under constant pressure to improve operational efficiency and reduce costs, especially in the face of volatile commodity markets. This driver is compelling mining companies to adopt automation and digitization strategies. For instance, Freeport-McMoRan has been focusing on operational efficiency by implementing automation in its milling operations, resulting in lower costs and higher throughput. Similarly, Newmont Corporation has reported cost savings through the deployment of autonomous haulage systems in its open-pit mines, highlighting the financial benefits of automation.

Furthermore, the unpredictable nature of commodity prices necessitates a more agile and cost-effective approach to mining. Companies like Glencore have been leveraging digital twins and simulation technologies to optimize their operations and reduce expenditure. In 2023, Teck Resources highlighted the importance of cost reduction through automation in its annual report, citing significant savings achieved through the use of robotics and remote-controlled equipment. Additionally, the adoption of blockchain technology for supply chain transparency by companies such as De Beers has streamlined operations, reduced administrative costs and enhanced efficiency. These initiatives underscore the critical role of operational efficiency and cost reduction in navigating the complexities of volatile markets.

Trend: Integration of Advanced Control Systems to Enhance Mineral Extraction and Processing

The integration of advanced control systems in mining operations is revolutionizing mineral extraction and processing. These systems, leveraging real-time data and sophisticated algorithms, enable miners to optimize various processes, from drilling and blasting to loading and hauling. For instance, companies like Rio Tinto and BHP have been investing heavily in advanced control systems to improve ore recovery and reduce waste. In 2023, Rio Tinto reported significant improvements in ore grade control and reduction in energy consumption through these technologies. Similarly, Sandvik's AutoMine® system has shown remarkable results in automating underground load and haul processes, leading to enhanced safety and efficiency.

Moreover, advanced control systems are increasingly being integrated with predictive maintenance technologies, reducing downtime and equipment failure. Barrick Gold's implementation of AI-driven predictive maintenance has resulted in fewer unscheduled downtimes and longer equipment lifespans. Another notable example is the use of real-time monitoring systems by Vale, which has led to more precise control over mineral processing parameters, ensuring higher yield and lower operational costs. The trend also includes the adoption of machine learning algorithms to predict and mitigate potential risks, as evidenced by Anglo American's use of data analytics to enhance operational decision-making.

Challenge: Local Community Opposition Due to Environmental and Employment Concerns

Local community opposition poses a significant challenge for mining automation, primarily due to environmental and employment concerns. Communities often fear that automation will lead to job losses and environmental degradation. In 2023, a notable case was observed in South Africa, where local communities protested against mining automation at a major platinum mine, citing potential job cuts. Similarly, in Australia, the expansion of automated mining operations by FMG faced resistance from indigenous groups concerned about the impact on traditional lands and employment opportunities.

Moreover, environmental concerns are at the forefront of community opposition. The increased use of automated machinery is perceived to exacerbate environmental degradation, leading to stricter regulations and community pushback. In Canada, First Nations communities have raised objections to automated mining projects, fearing long-term ecological damage. Rio Tinto's automation projects in Mongolia's Oyu Tolgoi mine have also faced opposition due to environmental concerns, resulting in delays and additional costs. The challenge extends to the need for mining companies to engage with local communities transparently and address their concerns effectively. For instance, in 2023, Anglo American initiated community engagement programs to mitigate opposition, emphasizing sustainable practices and potential employment opportunities in automated operations.

Engaging with local communities and addressing their concerns is crucial for the successful implementation of mining automation. Companies like Barrick Gold have started to invest in community development programs, aiming to provide alternative employment opportunities and ensure environmental sustainability. In Peru, mining companies have collaborated with local governments to promote education and training programs, preparing the workforce for new roles in an automated mining environment. These initiatives highlight the importance of addressing local community opposition to foster a more sustainable and socially responsible approach to mining automation.

Segmental Analysis

By Technique

Underground mining is driving the highest revenue within the mining automation market and captured over 55.6% market share in 2023. The segment is also poised to grow at the highest CAGR of 8.54% in the years to come. The underground technique’s dominance is led by inherent challenges and dangers of underground mining, such as limited visibility, restricted spaces, and high-risk environments, necessitate advanced automation to enhance safety and efficiency. As a result, there has been a significant increase in the deployment of automated drilling rigs, with over 1,500 units operational across major mining regions. The adoption of autonomous load-haul-dump vehicles has also risen, with more than 800 units currently in use, reducing the need for human labor in hazardous areas. Additionally, underground mines have increasingly integrated remote monitoring systems, with over 300 sites now equipped with real-time data analytics tools to track equipment performance and environmental conditions. This shift towards automation is further evidenced by the installation of over 500 automated ventilation systems, ensuring optimal air quality and temperature control.

Key developments fueling this growth include the advancement of wireless communication technologies and the integration of Artificial Intelligence (AI) and Machine Learning (ML) algorithms. The implementation of 5G networks in over 200 underground mining sites facilitates seamless communication between automated machinery and control centers. AI-driven predictive maintenance tools are now employed in over 250 mines, significantly reducing downtime and increasing operational efficiency. Furthermore, the use of robotic inspection systems has expanded, with over 100 units deployed to conduct regular equipment checks and maintenance in confined spaces. The market has also seen a surge in the adoption of automated rock-breaker systems, with over 400 units enhancing ore extraction processes. These innovations, coupled with substantial investments from leading mining companies—totaling over $3 billion in automation technologies in the past year—underscore the sector's commitment to leveraging automation for improved productivity and safety in underground mining operations.

By Type

The equipment segment of the mining automation market is at the forefront with 48.7% market share due to its critical role in enhancing operational efficiency, safety, and productivity in mining operations. Mining equipment such as autonomous haul trucks, drilling rigs, and loaders have become indispensable as they significantly reduce human error and operational downtime. Autonomous haul trucks, for instance, have clocked over 4.5 million operational hours globally, illustrating their widespread adoption and reliability. Furthermore, the integration of advanced technologies like AI and IoT in mining equipment has resulted in a drastic reduction of equipment failure rates, with predictive maintenance systems now detecting 70% of potential issues before they cause significant disruptions. The deployment of these automated equipment has also led to a 30% increase in ore recovery rates and a 50% reduction in fuel consumption, underscoring their efficiency and environmental benefits.

Key developments propelling the growth of the equipment segment include the introduction of electric and hybrid machinery, which has seen a 40% rise in orders over the past year, driven by the mining industry's shift towards sustainability. The market has also witnessed a surge in the deployment of underground mining equipment, with over 1,200 units sold in the last quarter alone, catering to the growing demand for deeper resource extraction. The adoption of remote-controlled equipment has doubled, with over 500 mines worldwide now utilizing these systems to ensure worker safety in hazardous environments. Technological advancements such as real-time data analytics have enabled operators to optimize equipment performance, leading to a 25% reduction in operational costs. Companies like Caterpillar and Komatsu have reported a 15% rise in revenue from their autonomous mining solutions, reflecting the segment's robust growth. These developments, coupled with the mining industry's continuous pursuit of operational excellence, have cemented the equipment segment's dominance in the mining automation market.

By Workflow

Based on workflow, mining process segment held over 45.7% revenue share and is set to keep growing at the largest CAGR of over 8.48% during the forecast period 2024–2032. The mining process automation has become a cornerstone of modern mining operations due to its ability to enhance efficiency, safety, and productivity. The mining industry has witnessed significant improvements with the adoption of autonomous vehicles, remote-controlled equipment, and advanced robotics. For instance, autonomous haul trucks have led to a 15% increase in productivity by minimizing downtime and operational delays, while remotely operated drills have reduced operational costs by approximately $1.2 million per year per site. Safety is another critical factor; automated systems have reduced the number of fatalities and injuries in mines by 25%, as robots can operate in hazardous conditions without risking human lives. Additionally, automation has enabled deeper mining operations, reaching depths of up to 4 kilometers, which was previously unattainable due to human limitations.

The growth of mining automation is fueled by several technological advancements and strategic developments. The integration of artificial intelligence and machine learning has remarkably enhanced predictive maintenance, reducing equipment failure rates by 40% and extending machinery lifespan by 20%. Drones are now extensively used for aerial surveys and ore mapping, increasing the accuracy of geological data collection by a factor of ten. The implementation of 5G networks has facilitated real-time data transmission and remote monitoring, significantly improving operational coordination. Moreover, advancements in battery technology have allowed for the deployment of electric autonomous vehicles, cutting down emissions by 60,000 tons annually. Companies such as Rio Tinto have invested over $940 million in automation technologies, while BHP has reported a 50% reduction in labor costs due to automation. The global mining automation market, valued at $3 billion, is expected to see substantial growth as companies continue to invest in these technologies, driven by the dual imperatives of cost-efficiency and workplace safety.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

The Asia Pacific region's dominance in the mining automation market is driven by its extensive mining activities and significant investments in technology. Countries like China, Australia, and India are leading producers of essential minerals such as coal, iron ore, and rare earth elements. China, for instance, is the world's largest producer of rare earths and a major player in coal and iron ore production. In 2023, China produced over 2.5 billion metric tons of coal and 1.4 billion metric tons of iron ore. Australia, known for its vast mineral resources, produced around 900 million metric tons of iron ore and 330 million metric tons of coal in the same year. India, another key player, produced approximately 700 million metric tons of coal and 210 million metric tons of iron ore. The region's mining companies, such as BHP and Rio Tinto, are heavily investing in automation to enhance productivity and safety. Additionally, the demand for base metals from the electrical, electronics, and automotive industries is propelling the market. The integration of advanced technologies like AI and IoT in mining operations is further boosting the market's growth.

Europe, as the second-largest market for mining automation, benefits from its robust industrial base and stringent environmental regulations. The region's mining activities are primarily focused on metals like copper, zinc, and lead, which are crucial for various industrial applications. In 2023, Europe produced around 2.2 million metric tons of copper, 1.1 million metric tons of zinc, and 800,000 metric tons of lead. Countries like Germany, Poland, and Sweden are leading producers of these metals. Germany, for instance, produced approximately 1.5 million metric tons of copper and 600,000 metric tons of zinc. Poland, a significant player in the zinc market, produced around 400,000 metric tons of zinc. European countries are also investing in sustainable mining practices and green technologies to reduce the environmental impact of mining operations. The presence of leading mining equipment manufacturers and technology providers in Europe is facilitating the adoption of automation solutions. Moreover, the European Union's policies promoting digitalization and innovation in the mining sector are driving the market's expansion.

North America's mining automation market is bolstered by the region's rich mineral resources and advanced technological infrastructure. The United States and Canada are key players in the production of minerals such as gold, copper, and uranium. In 2023, the United States produced around 200 metric tons of gold, 1.2 million metric tons of copper, and 1,000 metric tons of uranium. Canada, known for its vast mineral resources, produced approximately 180 metric tons of gold, 700,000 metric tons of copper, and 1,200 metric tons of uranium. The region's mining companies are increasingly adopting automation to improve operational efficiency and reduce labor costs. The growing demand for electric vehicles (EVs) and renewable energy technologies is also driving the need for minerals like lithium and cobalt, which are essential for battery production. In 2023, the United States produced around 5,000 metric tons of lithium and 4,000 metric tons of cobalt. Additionally, North America's focus on enhancing mine safety and reducing human intervention in hazardous environments is contributing to the market's growth. The collaboration between mining companies and technology firms in the region is fostering innovation and the development of cutting-edge automation solutions.

Top Players in Mining Automation Market

- ATLAS COPCO AB

- CATERPILLAR INCORPORATED

- AUTONOMOUS SOLUTIONS INCORPORATED

- HEXAGON AB, LIMITED

- KOMATSU LIMITED

- HITACHI CONSTRUCTION MACHINERY CO.

- RIO TINTO

- SANDVIK AB

- ROCKWELL AUTOMATION, INCORPORATED

- SIEMENS

- Other Prominent Players

Market Segmentation Overview:

By Technique

- Surface Mining

- Underground Mining

By Type

- Communication System

- Software

- Equipment

By Workflow

- Mining Process

- Mine Maintenance

- Mine Development

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- U.K.

- Germany

- France

- Spain

- Italy

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)