Global Military Grade PCB Market: By Material (Aluminum, Copper, Laminates (FR- 4, Copper Clad (CCL), Polyimide, PTFE, Others)); Type (Single-Sided PCB, Double-Sided PCB, Multilayer PCB); Design (Rigid PCB, Flexible PCB, Rigid-flex PCB); Application (Radio Communications Systems (Radar), Control Tower Systems, LED Lighting Systems, Defense Navigation, Satellite Subsystems, Cyber Counterintelligence Systems, Jet Instrumentation, Temperature Sensors, Auxiliary Power Units, Airborne Warning and Control Systems, Others); End users (Naval Operations, Aviation, Defense, Aerospace, and Others); Region—Market Forecast and Analysis for 2024–2032

- Last Updated: 16-May-2024 | | Report ID: AA0723533

Market Scenario

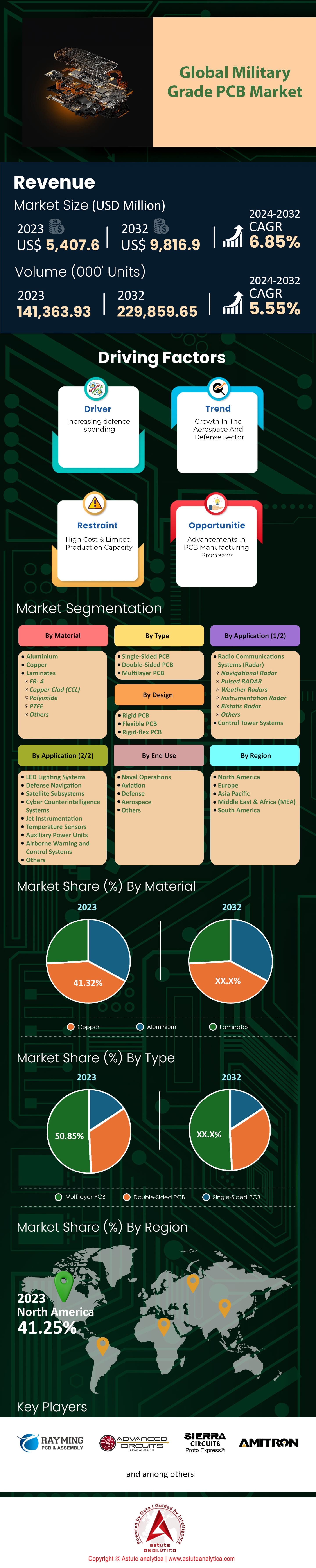

Global military grade PCB market was valued at US$ 5,407.6 million in 2023 and is projected to surpass market valuation of US$ 9,816.9 million by 2032 at a CAGR of 6.85% during the forecast period 2024–2032.

The global military-grade Printed Circuit Board (PCB) market is a crucially dynamic sector characterized by continuous advancements in technology and growing military modernization efforts. As of 2023, this market is experiencing steady growth underpinned by factors such as increasing military expenditure globally, the rising need for durable and highly efficient electronic components in defense applications, and the growing trend of miniaturization. Notably, an emphasis on robustness, reliability, and high performance is evident as military applications often require PCBs that can endure extreme conditions, including high temperatures, corrosive environments, and intense vibration or shock. The rise in adoption of smart weapons and communication systems is another trend influencing the market landscape, requiring sophisticated PCBs that can manage the complex functioning of these advanced systems.

The military grade PCB market is principally driven by the defense sector, with key consumers including various defense and aerospace manufacturers. End-user behavior in this market is largely shaped by the need for reliable, durable, and technologically advanced components that can ensure the smooth operation of military-grade electronics. Given the critical nature of military operations, the emphasis is on the procurement of PCBs that meet stringent quality and performance standards, resulting in a preference for established and reputable suppliers.

Opportunities in the military grade PCB market are abundant, primarily due to the constant need for upgraded and innovative technologies. Technological advancements such as the integration of Artificial Intelligence (AI) and Internet of Things (IoT) in military applications present significant opportunities for growth. Manufacturers focusing on the development of PCBs that can support these advanced systems are expected to gain a competitive edge in the market.

Looking to the future, the military grade PCB market is poised for continued growth. With increased defense spending and continued military modernization efforts, demand for advanced PCBs is likely to persist. Moreover, the escalating tensions and security concerns globally imply a greater reliance on sophisticated military equipment, hence stimulating the market for military-grade PCBs. In addition, the advent of cutting-edge technologies such as AI, IoT, and 5G are forecasted to further augment the market, as they necessitate the deployment of robust, highly efficient PCBs. Consequently, the military grade PCB market holds a promising future, marked by constant innovation and an increased focus on performance, reliability, and durability.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Automation in Manufacturing Process

Automation is increasingly becoming a vital driver in the global military grade PCB market. Military-grade PCBs demand exceptional precision and must be able to withstand harsh conditions. Hence, their manufacturing requires high accuracy and efficiency, and these parameters are best achieved through automation. Robotic and automated systems provide superior precision and consistency over human labor, ensuring an exceptionally high level of quality that is paramount in military applications.

Moreover, automated manufacturing increases production speed, reduces labor costs, and enhances production efficiency. These benefits not only lead to direct cost savings but also free up resources that can be reinvested into research and development activities. In turn, this investment propels the advancement of PCB technologies, driving the evolution of more sophisticated and efficient products in the global military grade PCB market.

Furthermore, automated manufacturing also reduces the likelihood of errors that can compromise the functionality and reliability of the PCBs. This factor is of utmost importance considering that any malfunctioning in military-grade PCBs could potentially risk lives and national security. Therefore, as the industry continues to move towards automation, we can anticipate a significant positive impact on the military grade PCB market.

Trend: Increased Use of Flexible and Rigid-Flex PCBs

The trend of using flexible and rigid-flex PCBs is gaining momentum in the military grade PCB market. Traditional rigid PCBs, while offering several advantages, do not provide the same level of resilience and adaptability that flexible and rigid-flex PCBs do. They are significantly more durable and can withstand high stress and strain, making them perfectly suited for use in military applications where equipment is often subjected to harsh environmental conditions.

These PCBs can conform to small and irregular shapes, which allows them to be integrated into compact military devices and equipment. This is particularly beneficial as defense technologies increasingly miniaturize to enhance portability and efficiency. In addition to their physical advantages, flexible and rigid-flex PCBs can also support complex circuitry, contributing to the sophistication and functionality of military equipment.

Given their numerous advantages, the demand for flexible and rigid-flex PCBs is projected to increase significantly. This trend is set to shape the future of the military grade PCB market, driving innovation and growth in the sector.

Challenge: Compliance with Strict Regulations

A significant challenge in the military grade PCB market is the need to comply with stringent quality and safety regulations. Due to the critical applications of military-grade PCBs, they must meet rigorous standards of durability, reliability, and performance. These standards are ensured through numerous domestic and international regulations, which govern aspects such as quality control, safety, and environmental impact.

Manufacturers are mandated to comply with these regulations, and non-compliance can lead to severe repercussions, including significant fines, production halts, and damage to reputation. Such outcomes can significantly affect a manufacturer's market standing and profitability. However, maintaining consistent compliance with these regulations often entails high costs. This poses a significant challenge, especially for small and medium-sized manufacturers, who may struggle to bear these costs without compromising on efficiency and profitability.

Thus, navigating the complex regulatory landscape while ensuring operational efficiency is a considerable challenge in the military grade PCB market. Manufacturers must constantly strive to strike a balance between maintaining adherence to regulations and optimizing profitability. This challenge necessitates continuous improvement in manufacturing processes and a proactive approach to regulatory compliance.

Segmental Analysis

By Material

The military grade PCB market is categorically divided into Aluminium, Copper, and Laminates based on material. Among these, the Copper segment held the highest revenue share of 41.32% in 2023, thanks to copper's excellent thermal and electrical conductivity which makes it ideal for high-frequency military applications. Copper PCBs are particularly used in radar systems, high-speed computers, and radio frequency amplifiers, where heat dissipation is a crucial factor.

However, the Laminates segment is projected to grow at the highest rate of 7.41% during the forecast period. Laminates, with their lightweight properties and excellent electrical insulation, are becoming increasingly important in various applications such as aviation, defense, and aerospace. They are particularly suited for environments with high moisture and high-temperature conditions, ensuring durability and longevity.

By Type

When analyzing the military grade PCB market by type, the key segments include Single-Sided PCB, Double-Sided PCB, and Multilayer PCB. The multilayer PCB segment led the market with the highest revenue share of 50.85% in 2023 and is predicted to exhibit a growth rate of 7.19% during the forecast period. Multilayer PCBs, with their capacity to pack high circuit complexity into a compact size, are a cornerstone of complex military devices. They not only enable higher density circuits but also reduce the overall size of the equipment, which is critical in the military sector where portability and space optimization are essential.

Moreover, they facilitate faster signal transmission and improved noise reduction, enhancing the efficiency and reliability of the equipment. The increasing complexity of military electronic systems, combined with the demand for more compact and lightweight devices, is expected to drive further growth in this segment.

By Design

In the design segment, the military grade PCB market is divided into Rigid PCB, Flexible PCB, and Rigid-flex PCB. The Rigid PCB segment captured the most significant market share of 51.62% in 2023. These PCBs are solid and inflexible, which allows for a higher level of circuit density and a reduction in the overall size and weight of the board. Their robustness and durability make them an ideal choice for applications requiring high mechanical stability and resistance to harsh conditions, such as those found in military and aerospace environments.

However, the Flexible PCB segment is expected to register the highest CAGR of 7.37% during the forecast period. Their ability to adapt to various shapes and sizes makes them increasingly popular in designing compact and portable military equipment. These PCBs can also resist high temperatures and vibrations, making them well-suited for rigorous military applications.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

By Application

In terms of application, the Radio Communication Systems segment held the largest share of the Military Grade PCB market, accounting for 18.31%. The increased demand in this segment can be attributed to the burgeoning need for advanced next-generation aircraft, particularly in emerging nations that are significantly investing in their defense and aerospace sectors. Reliable and efficient communication is critical in military applications; hence, the need for advanced radio communication systems is escalating.

As these systems become increasingly sophisticated, incorporating modern electronic equipment, the demand for Military-Grade PCBs is set to rise correspondingly. Besides, as communication technology continues to evolve, incorporating digital and satellite communication systems, the role of PCBs in these applications is expected to expand, driving further growth in this segment.

Regional Analysis

In terms of regional analysis, North America is expected to maintain a dominant position in the Global Military Grade PCB Market throughout the forecast period, followed by Europe and Asia Pacific. In 2023, North America contributed to over 41% of the market's revenue share. This substantial market share is attributed to the region's proactive adoption and development of advanced technologies within the aerospace and defense industry, significantly enhancing the military grade PCB market.

Furthermore, the presence of leading market players in the region bolsters market growth. These companies remain competitive by frequently introducing innovative products, creating new revenue streams and securing a competitive edge. For instance, TTM Technologies Inc., a major player in the market, launched a new, highly-automated state-of-the-art PCB manufacturing facility in Malaysia in March 2022, illustrating the dynamic market activity in the region. North America's leading position in the Global Military Grade PCB Market can largely be attributed to the United States' substantial defense budget. As one of the largest defense spenders worldwide, the U.S. has continually emphasized modernizing its military equipment and fortifying its defense capabilities. In 2022, for example, the U.S. defense budget surpassed $700 billion, with a significant proportion allocated towards the procurement and advancement of high-tech military equipment.

This strong focus on defense spending is directly correlated with the growing demand for military-grade PCBs in the region. These components are essential in a variety of defense equipment, ranging from communication systems and surveillance devices to combat vehicles and advanced weaponry. As such, increased spending on military equipment invariably fuels the growth of the military grade PCB market.

Furthermore, the U.S. Department of Defense's strategy of maintaining technological superiority over potential adversaries necessitates constant advancements in military electronics. As a result, there's an escalating need for innovative and highly reliable PCBs to support these technological advancements. Adding to this, the U.S. is home to some of the largest aerospace and defense contractors, such as Lockheed Martin, Northrop Grumman, and Raytheon Technologies. These companies, driven by domestic defense spending and export opportunities, contribute significantly to the high demand for military-grade PCBs.

Top Players in the Global Military Grade PCB Market

- Advanced Circuits

- Amitron

- ANDUS ELECTRONIC GmbH

- APCT Inc.

- Epec, LLC.

- EVERMAX S.R.O.

- Mer-Mar Electronics

- Odak PCB Elektronik A.

- Rayming Technology

- RIGIFLEX TECHNOLOGY INC

- RUSH PCB Inc

- Sierra Circuits

- Twisted Traces

- Venture Electronics

- Other Prominent Players

Market Segmentation Overview:

By Material

- Aluminium

- Copper

- Laminates

- FR- 4

- Copper Clad (CCL)

- Polyimide

- PTFE

- Others

By Type

- Single-Sided PCB

- Double-Sided PCB

- Multilayer PCB

By Design

- Rigid PCB

- Flexible PCB

- Rigid-flex PCB

By Application

- Radio Communications Systems (Radar)

- Navigational Radar

- Pulsed RADAR

- Weather Radars

- Instrumentation Radar

- Bistatic Radar

- Others

- Control Tower Systems

- LED Lighting Systems

- Defense Navigation

- Satellite Subsystems

- Cyber Counterintelligence Systems

- Jet Instrumentation

- Temperature Sensors

- Auxiliary Power Units

- Airborne Warning and Control Systems

- Others

By End Use

- Naval Operations

- Aviation

- Defense

- Aerospace

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- Saudi Arabia

- South Africa

- UAE

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)