Middle East And North Africa Digital Advertising Market: Analysis by Platform (Mobile Ad, In-App, Mobile Web, Desktop Ad, Digital TV, and Others); Ad format (Digital Display Ad, Programmatic Transactions, Non-programmatic Transactions, Internet Paid Search, Social Media, Online Video, and Others); End User (Media and Entertainment, Consumer Goods & Retail Industry, Banking, Financial Service & Insurance, Telecommunication IT Sector, Travel Industry, Healthcare Sector, Manufacturing & Supply Chain, Transportation and Logistics, Energy, Power, and Utilities, and Others); Country—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: Apr-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA0424806 | Delivery: 2 to 4 Hours

| Report ID: AA0424806 | Delivery: 2 to 4 Hours

Market Scenario

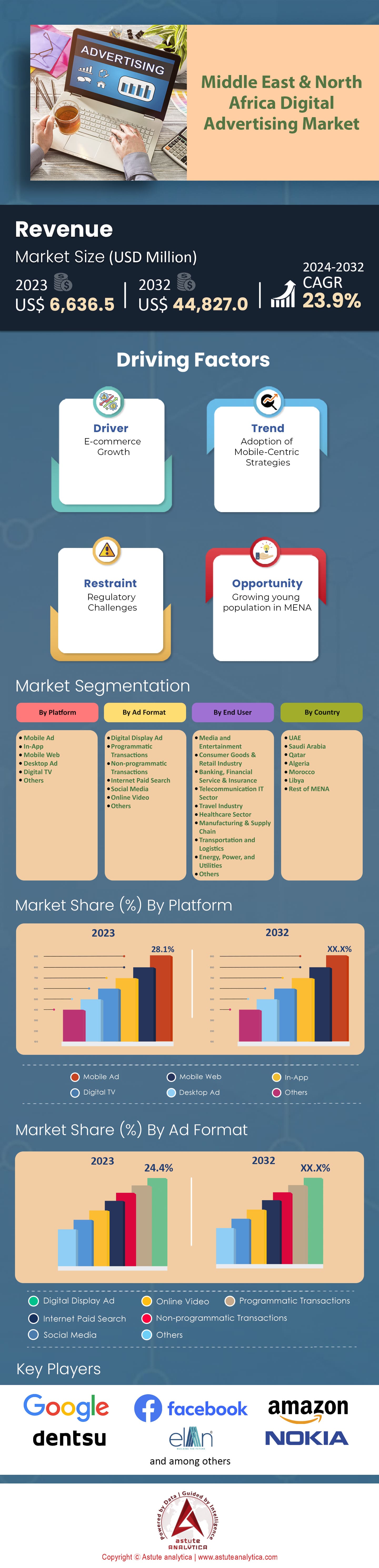

Middle East and North Africa Digital Advertising Market was valued at US$ 6,636.5 million in 2023 and is projected to hit the market valuation of US$ 44,827.0 million by 2032 at a CAGR of 23.9% during the forecast period 2024–2032.

The Middle East and North Africa (MENA) is witnessing an unprecedented boom in digital advertising, driven by a range of factors – including the rapid uptake of mobiles and smartphones. According to a report from GSMA Intelligence, unique mobile subscribers in the MENA region are set to reach 459 million by 2025, giving a penetration rate of 69%. This widespread access to mobile technology has opened up new avenues for businesses to engage with their target audiences through digital channels. Apart from this, increasing internet access is having a positive impact on the market. The International Telecommunication Union (ITU) says that internet penetration has grown from 35.3% in 2010 to 70.3% in 2023. This means there are considerably more people online who advertisers can reach out to with targeted or personalized marketing messages.

Furthermore, Covid-19 has forced consumers across the Middle East & North Africa digital advertising market to spend more time online for work, entertainment and socializing, thereby accelerating adoption of digital channels. Technology advances have also played their part in MENA’s growing enthusiasm for digital ads. Artificial intelligence (AI) and machine learning (ML) are being used by brands to optimize ad targeting as well as personalization and performance tracking. In fact, a study by Astute Analytica found that 72% of companies intend on investing in AI and ML technologies over the next three years. By using these tools advertisers can make sure they deliver highly relevant ads at the right moment. In addition to this, social media platforms have become increasingly popular across MENA, which is boosting use of digital advertising. We Are Social and Hootsuite’s latest report reveals there are approximately 222 million active social media users in the region – a penetration rate of about 45%. Firms can use Facebook, Instagram and Twitter etc., not just for interacting with customers but also for raising brand awareness that drives conversions – thanks largely to precise demographic targeting based on users’ interests and behaviors.

Looking to the future, the outlook for Middle East & North Africa digital advertising market looks pretty rosy. Continued growth is anticipated for the next few years, as 5G networks allow faster and more immersive ad experiences. Meanwhile e-commerce will enable advertisers to reach consumers at many different stages of their purchasing journey. The main end-users of digital advertising in MENA are retail businesses, e-commerce platforms, car manufacturers and dealerships, travel agencies and financial services firms.

To Get more Insights, Request A Free Sample

Market Dynamics

Drivers:

MENA's Digital Surge: Smartphones, Internet Access, and Social Media Boom

The Middle East and North Africa (MENA) digital advertising market is going through a digital makeover at warp speed, thanks to three key ingredients: the ubiquity of smartphones, wider access to the internet, and the ascendance of social media. Smartphones are everywhere in the region. In 2021, MENA had more than 300 million unique mobile subscribers — and that figure is expected to rise even more. Mobile penetration is forecasted to hit 50% of the population by year-end 2022. Those adoption rates create a platform for digital connectivity. Although 4G connections accounted for about half — 48% — of all mobile connections in 2022, there’s no stopping 5G; it’s anticipated to make up almost half, or 47%, of all connections by decade's end. The country with the highest smartphone penetration rate will be Saudi Arabia at an estimated 97.1% by 2028; that figure was just shy of four-fifths (79.6%) in 2019. Connectivity has direct economic heft as well; the mobile ecosystem added roughly $200bn to MENA’s GDP in 2016 alone, equating to about one twentieth (4.1%) of total output.

More smartphones mean wider internet access. By year-end 2025, there will be around an additional hundred million users who tap into the web on their cellular devices across MENA digital advertising market — 357 million people in total compared with just over a quarter billion (264 million) as recently as two years ago in 2019. In some countries, virtually every single consumer browses online such as those in UAE where internet access availability stands at an impressive rate: close enough to everyone (99%). While Egypt lags with only three out of every four people logging on (71%), it does claim MENA's largest untapped digital market segment, with 31 million yet to be converted. SIM penetration rates will continue to reflect these upgrades in connectivity networks as well, with a likelihood of peaking at 107% of the population by 2025.

Trend:

MENA's Video Advertising Explosion: A Market on Fire

The Middle East and North Africa (MENA) digital advertising market is witnessing an unprecedented boom in video advertising. This surge is evident in the numbers: video ad spend in MENA is set to reach $2.8 billion by 2025, a remarkable CAGR of 20.6% from its 2020 level of $1.1 billion. In fact, MENA outpaces the global average for video ad spending with 44% of total digital ad spending dedicated to video in 2021, compared to the global average of 38%. This share is expected to continue rising, reaching 51% by 2025.

Saudi Arabia sits at the forefront of this trend, with video ad spend projected to grow at a staggering 22% CAGR between 2020 and 2025, reaching $1.2 billion. The UAE and Egypt also demonstrate strong potential, with expected CAGRs of 18% and 25% respectively, leading to values of $455 million and $345 million by 2025. The dominance of mobile is undeniable. Mobile video ad spend in MENA is poised to reach $2.1 billion by 2025, showcasing a 23% CAGR between 2020 and 2025. In 2021, an impressive 62% of total video ad spend in MENA digital advertising market stemmed from the mobile domain, and this share is expected to continue climbing to 75% by 2025.

Naturally, video platforms reign supreme. YouTube holds the crown as MENA's most popular video platform, accessed by 72% of internet users, followed closely by Facebook at 69%, and Instagram at 54%. Daily viewership rates across the region are substantial, with 77% of internet users in Saudi Arabia, 79% in the UAE, and 68% in Egypt watching online video content each day. Not only is video consumption high, but it's also influential. Over half (54%) of consumers in MENA prefer video content when exploring new products and services. Marketers are taking note: vertical video ads show a 90% higher completion rate compared to horizontal videos, and interactive video ads boast a click-through rate three times higher than their non-interactive counterparts. Perhaps surprisingly, MENA exceeds the global average for video ads viewed with sound on, reaching 60% compared to 50% globally.

MENA's Advertising Labyrinth: The Challenges of a Fragmented Market

The bountiful MENA region crackles with opportunity for digital advertising market, but finding way through its markets is a labyrinthine challenge. That’s because the area lacks uniformity in a big way, from the differences in digital maturity, consumer behavior and regulatory landscapes between countries to those within sub-regions of countries. Disparities in digital maturity are a basic barrier. Although smartphone penetration is rising across MENA and projected to hit 50% in 2022, there are huge gaps between richer GCC countries and even North African ones. Internet access tells the same story — while the UAE nears universal coverage (99%), Egypt still has 31 million people without access. While Saudi Arabia’s booming e-commerce market is on track to reach $88.2bn in revenue by 2025, less developed regions are just taking their first steps.

Consumer behavior is diverse in the digital advertising market: MENA audiences are spread across different social media platforms, with YouTube dominant overall and Facebook king in Egypt; Snapchat is making big strides among young Saudis. Campaigns have to be tailored accordingly. So does language choice — Arabic dialects mix with Hebrew, Farsi and other tongues in a region hungry for culturally sensitive, linguistically varied content. Then there’s regulation. Data privacy laws vary widely across MENA — the UAE takes a tough stance but others do not operate under any sort of structure at all — so what flies easily in one country could mean disaster if it was launched somewhere else. Content that’s allowed practically everywhere can also be prohibited strictly anywhere else, calling for meticulous research and hyperlocal adaptation. Taxation policies differ too, adding another variable that can move budgets and strategy significantly across various countries.

Segmental Analysis

By Platform

The mobile ad segment has taken over the MENA digital advertising market, grabbing up a whopping 28.1% market share in 2023. This overtaking is thanks to the region's incredible growth of smartphone users, reaching every nook and cranny of countries like Saudi Arabia, UAE, and Egypt. As people continue to use their phones as their main source of internet connection, businesses are pouring money into ads that reach these mobile viewers. It also doesn't stop there. Not only is the mobile ad sector the top leader in market shares but it also expected to grow at the highest CAGR of 25.2% in the years to come. This is attributed to numerous factors such as constantly improving network coverage with 4G and 5G, cheap smartphones hitting the market hard and fast, and platforms such as Instagram or TikTok taking over attention spans more than ever before. Advertisers are using all this extra time we spend on our mobile devices to catch us off guard with vertical videos ads or mobile-optimized landing pages.

Not to mention how much targeting capabilities have improved over time this is thanks to data advertisers that can deliver highly personalized ads. In addition to this, they can now track those campaigns in real-time too.

By End Users

In 2023, the media and entertainment industry in the MENA digital advertising market hogged most of the pie as far as end users are concerned. In contrast to its competitors, it commanded a 22.6% share. Its superiority can be due to the increasing thirst for digital content seen in the region’s tech-savvy youth. Another factor is the growing availability of high-speed internet access. It seems like people everywhere are now counting on online platforms for all their entertainment needs. As a result of this, media companies have been splurging heavily on digital advertising as an attempt to promote their content and monetize them through attracting new audiences and subscribers respectively. They’ve become very diverse in how they approach these ads too.

On-demand streaming services such as Netflix and Shahid have taken digital advertising by storm. Regional broadcasters and publishers have also shifted most of their attention to this area. These companies in the MENA digital advertising market leverage a wide variety of formats just so that they can engage with viewers who will hopefully later decide to join their platform as paying customers. They’re doing something right here because this strategy has been prosperous over recent years and should continue to thrive even further into the future. The success is mainly owed to the sector’s capacity to create captivating localized content that truly resonates with its MENA audience base. By giving keen attention to unique cultural, linguistic, and social factors for each specific market, media companies can build strong brand affinities while driving up engagement rates for their digital ad campaigns.

By Ad Format

The digital display ad segment is leading the charge in the MENA digital advertising market and shows no signs of slowing down. It currently boasts a whopping 24.4% share, which is expected to continue growing through 2023. Different types of ads fall under this umbrella term, including banner ads, rich media, and native advertising. They can be found on various platforms and devices to build brand awareness and engage with viewers. There are several reasons digital display ads have become so successful in the MENA region. One of the main factors is technology. As targeting and personalization tools become more sophisticated, companies have harnessed their power to create hyper-relevant content for users. Additionally, there is now an abundance of high-quality inventory available for companies to purchase and deploy. Lastly (and perhaps most importantly), these types of ads are just visually pleasing! As consumers continue to interact with digital content more frequently, brands must find new ways to grab their attention and convert them into customers.

But despite all the success it has seen thus far, there are still several roadblocks standing in the way of complete domination in the MENA digital advertising market. Ad blindness alone has caused countless headaches across the whole industry. In addition to that, fraud continues to be a significant issue as well as fragmentation across multiple platforms and devices. To overcome these hurdles and maximize their campaigns’ impact, advertisers need to make sure they’re creating relevant and engaging content that aligns with MENA audiences' unique preferences.

Looking ahead, it’s clear that this sector will see continued growth thanks to developments in areas like programmatic advertising optimization and immersive formats such as AR and 3D displays. With every passing day, the MENA digital advertising market becomes more matured — pushing companies who want a piece of its pie into uncharted territory when it comes to brand-consumer interactions. The future looks bright.

To Understand More About this Research: Request A Free Sample

Regional Analysis

Saudi Arabia and the UAE have become the regional powerhouses in bringing digital advertising to life. Saudi Arabia is currently accounting for more than 47% revenue share of the MENA digital advertising market. The country has proved that YouTube is king by having the most reach in the region with a huge number of users and time spent on the platform. These whopping figures have led to an astronomical $312m being spent on digital advertising in 2021 alone, effectively making it second only to the UAE. The Saudi consumers have also shown their engagement rate of 78% through using digital channels which interact with an average of 4.5 industries. Furthermore, more than two thirds (68%) now prefer digital video formats over traditional TV for content consumption. This dominance is likely due to YouTube's 31.40 million viewers in Saudi Arabia — which is a mind-blowing 89.50% of all social media users in the country.

However, this only scratches the surface for Saudi Arabia. It already boasts a number of fast-growing small- and medium-sized digital advertising agencies that are driven by a tech-savvy younger population that wants to see more ads while they consume online content at an impressive pace. Moreover, there has been significant government investment into expanding its 4G and 5G networks as part of "Saudi Vision 2030." With such infrastructure and e-commerce growth Saudi Arabia will be one hotbed for digital advertising.

On top of its Middle East & North Africa digital advertising market, giant status lies the UAE where a staggering $1,134m will be spent on Digital Advertising by end-2024 in MENA’s largest market for these services alone. The country leads globally with over 100% active social media penetration by its population itself ranking fourth around the world as a magnet for professionals within these agencies; thanks largely to Dubai, home to many international firms and large creative industry presence. The UAE also boasts high levels of digital adoption (78%), with consumers engaging across multiple industries through such channels topped by social media; the channel accounts for more than half of the UAE’s total digital ad spend and outstripping global averages.

The UAE is a melting pot of different races and cultures, making it an attractive market for international brands. The country also boasts some of the fastest internet connections in the world thanks to heavy investment into its digital infrastructure. Government initiatives such as “UAE Strategy for the Fourth Industrial Revolution” will propel further growth to maintain that status quo. Finally, with being an international trade and tourism hub, there is a higher demand for digital advertising in retail, hospitality and aviation sectors offering a very rich landscape for agencies seeking work here.

Recent Developments in MENA Digital Advertising Market

- Xapads partnership opens MENA advertising opportunities for Disney+ Hotstar (January 2024).

- Online Marketing Gurus expands to Dubai, offering innovative digital solutions across continents (February 2024).

- Blinx, a youth-focused digital media hub, debuts in Dubai to combat fake news (September 2023).

- IDPL partners with NKN Media for strategic expansion into MENA region (June 2023).

Key Players in the Middle East & North Africa Digital Advertising Market

- 7G Media

- Alibaba Group Holding Limited

- Amazon

- Amplify Dubai

- Apple Inc.

- Applovin Corporation

- Backlite Media

- Baidu

- Boopin

- Dentsu Inc.

- Digital Gravity

- EDS FZE

- ELAN Group

- Facebook Inc.

- FLEISHMANHILLARD

- Google, Inc.

- Grey Group

- Havas SA

- HyperMedia FZ LLC

- Microsoft Corporation

- MiQ Digital

- Mr Creative Social

- Nokia Corporation

- Tencent

- The Interpublic Group of Companies, Inc.

- Twitter Inc.

- Verizon Communications Inc.

- Yahoo! Inc

- Other Prominent Players

Market Segmentation Overview:

By Platform

- Mobile Ad

- In-App

- Mobile Web

- Desktop Ad

- Digital TV

- Others

By Ad Format

- Digital Display Ad

- Programmatic Transactions

- Non-programmatic Transactions

- Internet Paid Search

- Social Media

- Online Video

- Others

By End User

- Media and Entertainment

- Consumer Goods & Retail Industry

- Banking, Financial Service & Insurance

- Telecommunication IT Sector

- Travel Industry

- Healthcare Sector

- Manufacturing & Supply Chain

- Transportation and Logistics

- Energy, Power, and Utilities

- Others

By Country

- UAE

- Saudi Arabia

- Qatar

- Algeria

- Morocco

- Libya

- Rest of MENA

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA0424806 | Delivery: 2 to 4 Hours

| Report ID: AA0424806 | Delivery: 2 to 4 Hours

.svg)