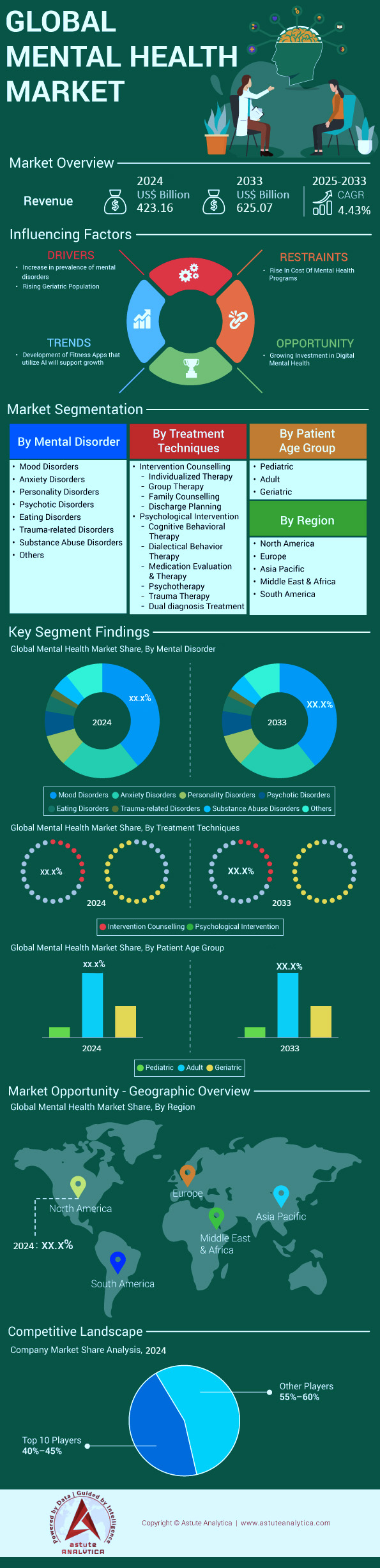

Mental Health Market: By Mental Disorder (Mood Disorders, Anxiety Disorders, Personality Disorders, Psychotic Disorders, Eating Disorders, and Others); Treatment Techniques (Intervention Counselling, Individualized Therapy, Group Therapy, Family Counselling, Discharge Planning, and Others); Patient Age Group (Pediatric, Adult, and Geriatric); Region— Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: Feb-2025 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA0322189 | Delivery: 2 to 4 Hours

| Report ID: AA0322189 | Delivery: 2 to 4 Hours

Market Snapshot

Mental health market is anticipated to witness a rise in its revenue from US$ 423.16 billion in 2024 to US$ 625.07 billion by 2033 at a CAGR of 4.43% over the forecast period 2025–2033.

Mental health services and medications in the mental health market have surged in demand, fueled by innovative treatments, broader awareness, and expanded remote-care offerings. In 2024, health systems across multiple U.S. states collectively documented 270 million prescriptions for psychiatric conditions, reflecting a heightened focus on pharmacological interventions. Sertraline remains the most widely prescribed antidepressant, with 39.5 million prescriptions issued this year, followed by Escitalopram at 31.7 million and Bupropion at 29 million. A major telehealth network tallied an average monthly increase of 18,500 newly filled psychotropic medications, underscoring the sustained shift to digital treatment pathways. In-person appointments continue grappling with longer queues, as median wait times reach about 64 days, while telepsychiatry sessions offer slightly faster access for 44 days on average.

The pressing need for accessible care in the mental health market is reflected in data showing that 160 million U.S. residents live in designated mental health provider shortage zones, with around 7,900 additional clinicians required to fill current gaps. Hospitals report operating near full capacity, sometimes exceeding 140% bed utilization rates in acute psychiatric units, highlighting the strain on infrastructure. On a global scale, approximately 290 million individuals are living with depression in 2024, intensifying the call for diverse clinical and community-based solutions. Meanwhile, PTSD remains a serious concern, affecting roughly 14 million Americans, many of whom wait extended durations for appropriate trauma-focused therapy. In response, pioneering rapid-intake programs have cut first-visit scheduling from 38 days to about 25 days, spotlighting a novel strategy to expedite patient support.

As per Astute Analytica, key offerings across the global mental health market now range from integrative talk therapy to virtual-reality exposure sessions. Telehealth visits for mental health peaked near mid-year at around 35% of outpatient consults, revealing an enduring appetite for remote modalities. Youth-focused counseling has also expanded, as mental health educational programs note a steady rise in registrations from both school districts and private institutions. Across these diverse channels, the drive to reach underserved populations remains critical, especially in states such as California, where mental health expenditures exceed $6.7 billion annually. Taking together, these trends reveal a field evolving toward greater flexibility, timeliness, and breadth of care options.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Unprecedented Digital Deployment of Cognitive Behavioral Protocols Elevating Therapeutic Reach and Medication Adherence Globally

This driver in the mental health market emerges from a confluence of rising prescriptions, advanced telehealth platforms, and widespread acceptance of structured CBT modules. In 2024, about 61 million U.S. adults are estimated to live with a mental illness, prompting swift digital expansions. Monthly telepsychiatry appointments for anxiety alone exceed 120,000 nationwide, signifying a jump from prior years. Up to 340 individuals now exist for every one mental health provider, reinforcing the need for remote-care programs. A leading CBT-focused app saw approximately 10,200 new daily users this summer, primarily seeking help with mood stabilization. Clinicians report that each patient typically requires five digital check-ins during the early therapy phase to chart medication tolerability. Innovative AI-driven screening tools—adopted by four major hospital systems—flag critical symptom changes automatically, improving patient safety. Meanwhile, short-video guidance sessions, launched by six telehealth startups, reinforce coping tactics between formal appointments.

Health insurers increasingly embrace digital interventions in the mental health market by covering at least two e-therapy subscriptions per policy cycle, fostering consistent treatment continuity. A newly introduced CBT teleclinic in the Midwest recorded 18,000 virtual visits within its first quarter, demonstrating robust consumer engagement. Some integrated care models merge pharmacotherapy with app tracking, capturing real-time data from about 8,400 patients each month. Across pilot programs, psychiatrists who adopt synchronous video sessions find that participants, on average, reduce missed appointments from nine to three. Data analytics indicate that multi-platform therapy—combining daily text-based messages and weekly live calls—yields a 20% drop in disruptive bipolar episodes among a test group of 4,500 individuals. Such outcomes show digital CBT’s potential to avert crisis escalations. As mental health boards and tech developers collaborate, the driver of digitally enabled cognitive behavioral solutions continues powering market momentum.

Trend: Widespread Application of Virtual Reality Exposure Techniques Transforming Specific Phobia and Trauma-Related Interventions Worldwide

Innovative VR exposure protocols have become a defining trend in the mental health market, tackling disorders once deemed difficult to treat through conventional talk therapy. In 2024, specialized clinics in major cities report deploying 3,500 VR sessions monthly, often targeting PTSD and acute phobias. A leading facility in San Francisco offers eight scenario-based modules simulating real-life stressors, each session lasting about 20 minutes. Demand for VR-based therapy is rising fastest among veterans, with the VA network recording 42,000 VR visits so far this year. Rapid eye movement tracking has been paired with VR for about 9,800 patients, amplifying the immersion factor. Clinics in Japan incorporate tactile feedback devices for 2,400 individuals struggling with severe panic attacks. VR protocols typically require four structured follow-ups per patient, documented in large telehealth networks. Approximately 4,600 mental health professionals trained in VR therapy throughout 2023, reflecting strong clinician interest.

Advocates emphasize that VR exposure fosters safer, more controlled environments than real-world alternatives in the mental health market. One academic study, monitoring 1,200 phobia cases, saw accelerated symptom reduction in as few as six sessions. Another group of psychologists in Canada introduced full-body suits that record biosignals from 2,100 participants, providing nuanced data about tension spikes. Collaborative research labs are launching VR libraries with more than 50 curated environments for use by 900 licensed therapists. Meanwhile, rural clinics across Europe tested mobile VR units on 3,300 patients who lack immediate access to specialized centers. Systematic feedback suggests VR-based therapy can cut overall treatment durations by about 10 days for specific phobias. This trend of immersion appeals to younger demographics, evidenced by 7,400 college students signing up for on-campus VR therapy trials. Such growth underscores VR’s central role in the evolving mental health market.

Challenge: Confronting Chronic Regional Disparities and Cultural Stigmas Obstructing Early Access to Essential Psychiatric Support

A fundamental obstacle lies in bridging stark regional and cultural divides that hinder timely interventions in the mental health market. At least 157 million American residents live in Health Professional Shortage Areas for mental health, limiting standard therapy access. Providers in low-resource zones indicate that 5.8 million annual emergency department visits list psychiatric issues as the primary reason, often escalating due to delayed treatment. In some rural states, community clinics operate at 130% capacity, turning away about 2,500 patients per quarter. Stigma remains deeply rooted; certain faith-based communities see only 1 out of every 12 struggling individuals step forward willingly. Telehealth outreach teams report 3,400 missed follow-up calls in a 12-month span, primarily from culturally diverse populations wary of conventional medicine. Bilingual staff remain scarce, with 300 interpretation requests unfulfilled monthly. Local nonprofits running anti-stigma campaigns reached 60 new communities in 2024, aiming to reduce mistrust.

Tackling these challenges in the mental health market requires systemic efforts to expand culturally competent care pathways. Regional health alliances in states like Alaska and Maine have piloted mobile therapy vans that collectively visited 57 remote towns this year. A newly formed coalition of six mental health schools introduced certificate programs focusing on culturally aligned screening tools, enrolling 1,200 students. Certain telecom initiatives sponsor no-cost mental health calls in communities where broadband remains limited, averaging 350 calls per month. Translational applications on wearable devices track patient impressions in eight primary languages, garnering interest from local councils. Meanwhile, philanthropic grants fund 400 community navigators, who accompany patients to their first in-person therapy session to dispel misconceptions. These efforts are vital, yet the demand continues to outweigh capacity, highlighting the gravity of bridging cultural stigmas to improve mental health outcomes.

Segmental Analysis

By Mental Disorders

With a market share exceeding 39.3%, mood disorders—primarily depression and bipolar disorder—are firmly positioned at the forefront of the mental health market. The widespread prevalence of these conditions largely explains their dominance. Globally, depression affects an estimated 264 million individuals, making it a significant contributor to disability. While bipolar disorder is comparatively less common, it still impacts around 40 million people worldwide, reflecting about 0.53% of the global population. The chronic, recurring nature of mood disturbances calls for continuous management, fostering a long-term need for therapeutic interventions and sustaining these disorders’ firm hold on the market.

Treatment for mood disorders comprises an array of both pharmacological and non-pharmacological approaches in the mental health market. In the pharmacological realm, bipolar disorder is typically addressed with lithium and valproate as mood stabilizers, in addition to antipsychotic medications such as risperidone and quetiapine, while antidepressants are crucial for addressing depressive symptoms. Surveys indicate that in the United States alone, roughly 13% of adults have used antidepressants in a recent 30-day span, underscoring the considerable demand for pharmaceutical care. Digital health tools, including numerous mood tracking applications and teletherapy platforms, have broadened accessibility and diversified options for people seeking treatment, reflected by the presence of well over 10,000 mental health apps worldwide. This convergence of high prevalence and comprehensive treatment strategies ensures that mood disorders remain the largest segment in the global mental health market.

By Treatment Procedure

Psychological interventions constitute the most widely utilized treatment approach within mental health services, claiming over 63% share of the mental health market. Their sustained dominance arises from established efficacy, adaptability, and a pronounced patient preference for non-pharmacological modalities. Cognitive Behavioral Therapy (CBT), supported by thousands of empirical evaluations, ranks as one of the most extensively applied and validated methods for conditions spanning mood disorders, anxiety, and more. A number of other therapies—including Dialectical Behavior Therapy, Interpersonal Therapy, and Mindfulness-Based Cognitive Therapy—fulfill specialized requirements for diverse clinical presentations and continue to gain traction.

Several interrelated factors fuel the ascendancy of psychological interventions. Wherein, evidence consistently shows that a high percentage of individuals with depression or anxiety can experience notable symptom reduction through structured therapy in the mental health market. Also, technology has unlocked fresh avenues for delivering these services at scale. Popular teletherapy platforms have reported significant spikes in enrollment, in one instance noting a 65% surge during the height of pandemic-related disruptions. Accompanying this, mental health applications, many integrating key behavioral therapy elements, have collectively been downloaded hundreds of millions of times worldwide. Additionally, research shows that most people grappling with depressive symptoms often prefer therapeutic conversations over medication, reinforcing the prominence of psychological interventions. Their capacity for individualized application further amplifies both effectiveness and appeal, particularly as mental health awareness rises and stigma diminishes. Taken together, these driving forces firmly establish psychological interventions as the premier treatment category in the mental health market.

By Patient Age

Adults account for roughly 59.7% of total market share in the mental health market, reflecting the extensive challenges this demographic routinely navigates. In the United States, approximately 52.9 million adults—equating to around 21% of the adult population—grapple with some form of mental illness in any given year. Contributing to this substantial number are the interplay of professional responsibilities, financial pressures, and familial obligations that can exacerbate underlying mental health conditions or give rise to new ones. A prominent survey indicates that 83% of U.S. employees report work-induced stress, with a quarter describing their occupations as their top stressor.

The dominance of the adult segment is further cemented by the pronounced economic consequences. Each year, hundreds of millions of workdays are lost to depression and related conditions, translating into significant output deficits for businesses and underscoring an urgent impetus for effective interventions. This reality has prompted employers and government agencies alike to escalate their commitment to mental health services. As an example, a considerable majority of large employers now include mental health benefits through employee assistance programs. Moreover, adults exhibit a relatively higher likelihood of pursuing mental health assistance than other age groups in the mental health market, underscoring the ongoing demand for accessible and varied modes of treatment. Therapeutic options for this group include everything from conventional face-to-face counseling to tech-driven innovations. The proliferation of user-friendly mobile apps—over 20,000 on major digital stores—further underscores how the adult population is specifically targeted by and engaged with a variety of help resources. Taken collectively, these factors illuminate why the adult demographic wields such a significant share of the mental health services market, highlighting both the scale of the need and the intensity of focus on this segment.

To Understand More About this Research: Request A Free Sample

Regional Analysis

North America maintains a decisive edge as the largest overall mental health market, propelled by significant prevalence rates, comprehensive healthcare systems, and considerable resources devoted to psychiatric care and research. Within the United States—the dominant player in this region—an estimated 52.9 million adults, or 21% of the adult population, experienced a mental illness in a recent evaluation. Of this group, roughly 5.6% of adults live with a condition severe enough to translate into around 14.2 million individuals contending with serious mental illness. Canada also contributes prominently to regional leadership, with statistics indicating that 1 in 5 Canadians face a mental health or addiction concern each year.

The U.S. market’s magnitude within North America mental health market is underscored by the scale of funding allocated to mental health initiatives, with expenditures surpassing the two-hundred-billion-dollar mark and incorporating both private and public efforts. This investment has fostered a wide selection of treatment offerings, from counseling-based therapies to extensive psychopharmacological regimens. Over 37 million U.S. adults receive expert mental health services, and about 16.5% of adults make use of prescribed medications to address psychological or emotional challenges. Teletherapy has also shown a rapid rise, with one leading service encountering a 65% jump in user counts as remote sessions gained popularity. Alongside, there has been a spike in digital mental health solutions, as evidenced by more than 10,000 apps catering to various psychiatric and wellness needs. Reinforcing this growth are robust public policies mandating parity between mental and physical healthcare coverage, ensuring that individuals have more equitable access to necessary interventions. Taken together, these elements—substantial investment, proactive legislation, pervasive public awareness, and rapidly expanding technology—cement North America’s status as the largest and most potent force in the global mental health marketplace.

Top Companies in the Mental Health Market:

- Acadia Healthcare

- The MENTOR Network

- Universal Health Services, Inc.

- Behavioral Health Network, Inc.

- CareTech Holdings PLC

- Ascension Seton

- Pyramid Healthcare

- Promises Behavioral Health

- Other Prominent players

Market Segmentation Overview:

By Mental Disorder:

- Mood Disorders

- Anxiety Disorders

- Personality Disorders

- Psychotic Disorders

- Eating Disorders

- Trauma-related Disorders

- Substance Abuse Disorders

- Others

By Treatment Techniques:

- Intervention Counselling

- Individualized Therapy

- Group Therapy

- Family Counselling

- Discharge Planning

- Psychological Intervention

- Cognitive Behavioral Therapy

- Dialectical behavior therapy

- Medication evaluation & therapy

- Psychotherapy

- Trauma Therapy

- Dual diagnosis treatment

By Patient Age Group:

- Pediatric

- Adult

- Geriatric

By Region:

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The U.K.

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- South America

- Argentina

- Brazil

- Rest of South America

View Full Infographic

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2024 | US$ 423.16 Bn |

| Expected Revenue in 2033 | US$ 625.07 Bn |

| Historic Data | 2020-2023 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Unit | Value (USD Bn) |

| CAGR | 4.43% |

| Segments covered | By Mental Disorder, By Treatment Techniques, By Patient Age Group, By Region |

| Leading players | Acadia Healthcare, The MENTOR Network, Universal Health Services, Inc., Behavioral Health Network, Inc., CareTech Holdings PLC, Ascension Seton, Pyramid Healthcare, Promises Behavioral Health, Other Prominent players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA0322189 | Delivery: 2 to 4 Hours

| Report ID: AA0322189 | Delivery: 2 to 4 Hours

.svg)