Global Membrane Separation Technology Market: By Material (Polymeric Membranes (Natural Polymers and Synthetic Polymers), Inorganic Membranes (Metallic and Ceramic); Technology (Reverse Osmosis, Ultrafiltration, Microfiltration, Nanofiltration, Electro Dialysis, Pervaporation, Others); Application (Gas Separation, Liquid Separation, Solid Separation); End User (Water and Wastewater Treatment (Desalination, Public Works Water Treatment, Waste Recycling), Food and Beverages (Dairy Processing, Beverage Processing, Food And Starch Processing), Medical and Pharmaceutical (Pharmaceutical Processing, Medical Equipment, Others), Industrial Processing and Others); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: 27-Jun-2024 | | Report ID: AA0624859

Market Scenario

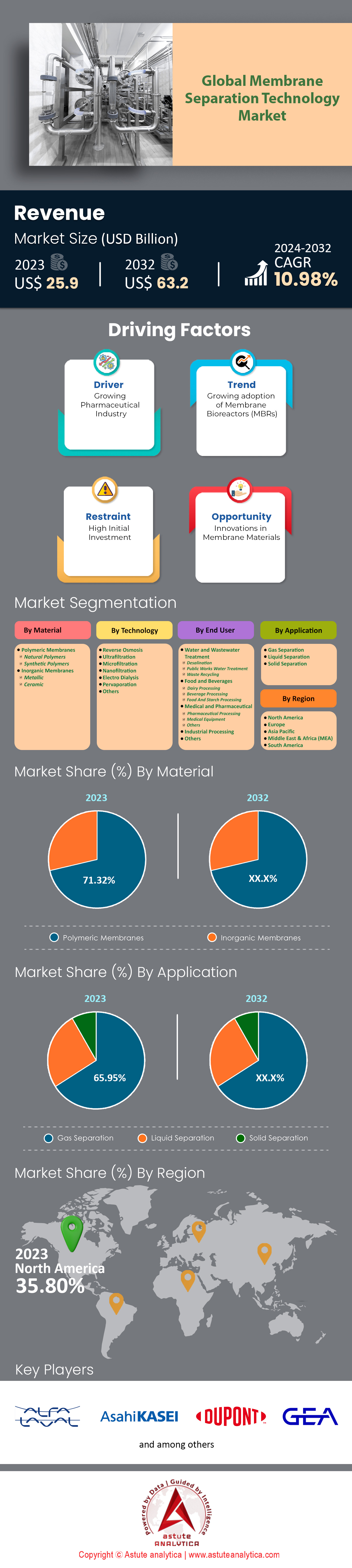

Global membrane separation technology market was valued at US$ 25.9 billion in 2023 and is projected to hit the market valuation of US$ 63.2 billion by 2032 at a CAGR of 10.98% during the forecast period 2024–2032.

Due to its efficiency, cost-effectiveness and being environmentally friendly nature, the demand for membrane separation technology has increased significantly across multiple industries. The adoption of this technology by sectors like water treatment, food processing, pharmaceuticals production and chemical synthesis is on the rise. Most of this growth can be attributed to strict regulations aimed at curbing industrial pollution as well as sustainable water management needs worldwide; where over the last three years alone there has been a 40% increase in adopting MBRs for waste water treatment which shows how important they’re towards ensuring compliance with environmental laws.

The demand for membrane separation technology market is motivated by many factors. Industries are being forced to adopt more advanced methods of separation mainly because of their concern on resource use and waste generation. What makes this option attractive is that membranes are highly selective, require little energy and use few chemicals in the process. The utilization of reverse osmosis and ultrafiltration has played a significant role in improving quality as well as extending the shelf life of products in the food and beverage industry which has recorded a growth rate of 35% since last year alone. Biologics production has also increased by 25% within pharmaceutical companies worldwide thereby necessitating filtration through different kinds of membranes used during sterilization or even protein purification stages among others. In addition to all these achievements made possible by using membrane technologies, there was an estimated daily desalination capacity reaching up 95m³/d (million cubic meters) globally powered through them so as to meet potable water requirements around planet Earth which peaked at about 2023.

More adoption is being driven by advancements in membrane technology. The use of graphene oxide has completely changed the membrane separation technology market’s growth outlook as it offers high permeability and selectivity. These materials have been mostly used in desalination and wastewater management where they improve salt concentration levels. Moreover, nanocomposite membranes that are made from mixing polymers with nanoparticles can resist fouling better while at the same time increasing their mechanical strength. It is estimated that each year, the market for such items will grow by 12% due to increased usage across different sectors. Forward osmosis’ low power consumption combined with its ability to recover up to 30% more water than any other method during industrial processes has attracted a lot of interest lately; hence installations within this area have gone up by 30%.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Growing Demand in the Agro-Food and Pharmaceutical Industries

A major factor pushing the expansion of the membrane separation technology market is the increasing demand for membrane separation technology in the fields of agriculture, food, and pharmaceuticals. The use of membrane technologies in the agricultural industry, which accounts for significant share of the global membrane separation market, is aimed at milk and whey processing, juice clarification, and wastewater treatment. For example, compared to traditional methods, protein recovery from milk can be increased by up to 90%. Juice clarity can be enhanced by 95%. Agro-food industry’s membrane bioreactors (MBRs) can remove organic contaminants from waste waters by as high as 99%. Thus, proving their effectiveness.

On the other hand, pharmaceutical industries cannot do without membrane processes since they are necessary during drug formulation and API purification. They are also crucial for recovery where purification levels of 99.5% have been achieved. Companies in the membrane separation technology market that implement this technology into their production line can save up to 20% on costs. They also make it easier to meet stringent regulatory standards, thereby cutting down non-compliance risks by about 30%. These benefits will drive growth in terms of CAGR equivalent to 11.3%, over the next 9 years years (2024-2032), within the pharmaceutical industry alone. This growth has been catalyzed through such considerations among others.

Moreover, energy used per unit mass produced could be lowered by almost half through the adoption of more membrane processes within agro-industries. This helps in attaining set sustainability objectives. Meanwhile, water used for washing purposes during treatment stages might reduce even further, being limited up to three-tenths out of five-sevenths part that had initially been expected. This shows just how much we should care about these things.

Trend: Advancements in Nanostructured Materials

The membrane separation technology market has been completely transformed by advances in nanostructured materials that greatly enhance selectivity as well as efficiency. These substances – e.g., graphene-based membranes or carbon nanotubes – have unique features such as tailor-made pore structure, high surface area and increased mechanical strength. One good example is that normal water filters can only handle 1000 liters per square meter per hour per bar while those made from grapheme oxide can reach up to this rate. In other words, it’s 10 times faster than any other known filter! The demand for these new materials is so great that the global market value will rise from US$ 8.5 billion last year to an estimated US$29 bn by 2027.

Nanostructured membranes are able to cut energy use in desalination processes by half and improve gas separation efficiency by between 20% and 30%. They also last around 40% longer than traditional ones, which saves a 25% of operating expenses for every used membrane over its lifetime. For comparison, conventional heavy metal removal methods during waste water treatment can only take out as much as 99%, while nanostructured ones remove all but 0.1%. Furthermore, when applied industrially advanced membranes could save up to 30% of power currently consumed during separation processes. So far, most research funding into nanomaterials used within this field has seen 15% growth each year since at least 20211 – not surprising considering how much they promise.

Challenge: Trade-off Between Selectivity and Permeability

Polymeric membranes in membrane separation technology market face a common problem of selectivity and permeability. Ideally, selectivity should be high enough to allow only the substance one wants through while permeability should enable faster processing. Unfortunately, raising one always means lowering another. Hence, striking a balance becomes hard. Conventional polymeric membranes have selectivity of about 20-30 and permeabilities ranging from 1 to 10 GPU (Gas Permeation Unit). Nevertheless, advanced nanostructured ones can attain up to 100 GPU with reduced selectivity.

Efficiency within different industries using membrane systems is affected by such a trade-off. For instance, lower selectivity requires more energy because there will be additional steps involved, which can increase costs by up to 25%. On the other hand, higher permeability may need an operational time that is about 30% longer than usual in the global membrane separation technology market. Researching how best we can balance between selectivity and permeability could cost us $5 million per project. This indicates that huge investments are required here. Affordability limits their effectiveness since this issue affects approximately 40% of industrial processes where membranes are applied during various stages of production. It is important to note that only 15% succeed in achieving both high selectivity as well as highly permeable new materials for use in making them. This clearly shows how difficult it might be for someone to come up with such materials, even if they try their best because challenges still exist with balancing these two properties together.

A lifespan reduction of 20% may complicate matters further when adopting those designs optimized purely upon enhancing flow rates across thin walls, at the expense of other factors like robustness against fouling. So much so that presently available options fail entirely in the membrane separation technology market due to the inability to achieve a sufficient compromise between all desirable features, including lifetime expectations versus fouling resistance. High selective filters remove 99.9% of contaminants albeit slowly.

Segmental Analysis

By Material

Based on material, the polymeric membrane materials is dominating the membrane separation technology market with revenue share of over 71.32% and is driven by their versatility, efficiency, and cost-effectiveness. As of 2024, the polymeric membrane market is projected to grow at a CAGR of 11.25%, reflecting its escalating adoption across various industries.

Notably, the water treatment industry is responsible for 45% of all polymeric membrane demand worldwide. This shows how important they are in addressing global water scarcity. In addition, polymetric membranes are energy efficient because they use 30-50% less power than traditional separation methods; this makes them more attractive economically too. There are many reasons why people need more polymeric membranes. One major driver being that they have exceptional selectivity and permeability which improves process efficiency by far. For example; gas separation through these materials can achieve up to 99.9% purity levels meeting even the strictest petrochemical requirements. Also, their ability to work with different applications such as waste water treatment among others shows how versatile these things can get used at various points depending on what needs doing at any given time within an organization or industry itself. The demand for high purity separations in the biopharmaceutical industry has seen global membrane sales grow by an average annual rate of 12%.

By Technology

Based on technology, membrane separation technology market is led by reverse osmosis (RO) and has become indispensable in water purification and desalination processes. In 2023, the RO technology accounted for over 42.36% market share and the technology is also projected to continue dominating the market by growing at the highest CAGR of 11.76%. Reverse osmosis (RO) has become extremely popular because it can remove things like salts, bacteria, and organic matter from water. This ensures that the water is safe to drink. Its efficiency is among the highest of any technology known so far which is one reason behind such large growth numbers; these systems can remove up to 99% contaminants.

Over 40% of people around the world are affected by lack of fresh water which makes effective desalination solutions imperative. This creates higher demand for RO systems as well. The success of RO in membrane filtration lies in its high selectivity and flexible operation features. Due to working under high pressure, only molecules of water pass through while larger ones and ions are blocked thus making it applicable both in desalination and wastewater treatment. In 2023 more than two third of all seawater reverse osmosis plants around the global membrane separation technology market used this technology because it consumes less energy when compared with thermal methods.

Fouling reduction, maintenance cost savings, extended service life, cost effectiveness improvements brought about by advancements made on membrane materials have also contributed towards lowering fouling rates together with maintenance requirements. Thereby, it is enhancing durability plus affordability factors surrounding these devices where average lifespan increased from being between three-to-five years up until seven-to-ten years old thus making them even more economically appealing in the membrane separation technology market. Due to its wide range applications coupled with strong performance characteristics therefore various industries rely heavily upon Reverse Osmosis Technology (RO). Industrial sector represents 35% share within total RO market due mainly driven by stringent laws governing discharge industrial waste waters into environment. Residential segment accounts for 20% share because people need safe drinking supplies now days when they know better about health risks associated with contaminated sources.

By Application

By application, membrane separation technology market is led by gas separation due to its unparalleled efficiency, cost-effectiveness, and versatility. In 2023, it generated over 65.95% market revenue and is also expected to grow at the highest CAGR of 11.30% in the years to come. Its preference for selective gas permeation according to size and solubility among other factors is what makes it perfect for use in industries. Growth is driven mainly by demand for natural gas processing plants, hydrogen recovery units as well as carbon dioxide capture systems which have been on an upward trajectory over the years owing largely to environmental concerns such as climate change. Not only do these methods require pre-treatment stages but also consume much energy unlike their counterparts where they operate under low pressure and temperature hence lowering operational cost by about 30%.

The increasing need of clean power sources coupled with environmental sustainability has led to dominance of gases separations applications in worldwide membrane separation technology market. The membrane technology plays a crucial role in hydrogen production which could hit global revenues worth $196.3 billion come year 2025. For fuel cell use, it must be able to generate ultra-high purity levels exceeding >99.99%. Furthermore, carbon capture storage (CCS) systems are reliant on membranes that can achieve CO2 capture rates of more than 90% thereby reducing emissions drastically from flue gases.

In addition, a wide range of materials used for making these devices ensures there are different types available depending on specific needs of various industries hence enhancing their marketability even further. Ceramic or polymeric materials may be employed among others like metal-organic frameworks (MOFs) or mixed matrix materials (MMMs). For instance, nitrogen generators alone will contribute approximately US$17 bn industry wide by end 2024 due primarily because they require less space when compared with other methods; this compactness feature also enables easy scalability in the membrane separation technology market. Thus, making them more attractive options than solids based or liquids-based separation techniques. Whether economic benefits outweigh those related with environmental impact remains subject for debate however one thing is certain – revenue growth prospects are very bright indeed.

By End Users

When it comes to end users, the membrane separation technology market is dominated by water and wastewater treatment plants, owing to its unparalleled efficiency and reliability. In line with this, the water and wastewater treatment plants held more than 47.93% market share and is poised to keep growing at a CAGR of 11.60% during the forecast period 2024–2032. This technology excels in removing contaminants, from microorganisms to dissolved solids, ensuring potable water standards are achieved consistently.

The high permeability of membrane filtration in water treatment is displayed yet again by its strong performance across various applications. In relation to strict standards set by environmental authorities such as the US Environmental Protection Agency (EPA), this technology is particularly good at weeding out pathogens and contaminants. In 2023, more than two-thirds (70%) of American municipal water treatment plants were reported to have adopted membrane filtration systems which indicates their dependability. Moreover, according to Global Water Intelligence data, there was a 9% surge seen in Asia Pacific region where urbanization and industrialization rates are growing fastest over this same year.

Another reason for the popularity of membrane filters in the membrane separation technology market is economic and environmental benefits they bring about. It is important to note that this equipment uses much less energy than other methods thereby cutting down on operational costs considerably. For instance, International Water Association (IWA) carried out a study in 2023 which showed that MBR units could help reduce power consumption by up to 30% in wastewater treatment plants. Besides being easily scalable or modular so as accommodate larger numbers living within cities; over half (65%) new European projects dealing with treating sewage incorporated membranes into their designs during 2022 — thereby proving how versatile these devices can be when tasked with meeting future water needs more efficiently.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

More than 35.80% of the total market share is held by North America in the global membrane separation technology market. The strong industrial base and strict environmental regulations are the main factors that contribute to its dominance in this region. The United States alone accounts for a large percentage. Safe Drinking Water Act and Clean Water Act have driven up adoption rates at 60% for water treatment plants using membrane filters. Also, it has been found that 70% of dairy processing facilities in North America use these methods as they help improve product quality while making operations more efficient. In addition, 80% companies involved in pharmaceuticals employ them for drug purification which enables them meet FDA standards; likewise, food safety requirements necessitate their use during production processes such juice or beer among other beverages where they have found an application rate of 55%.

Europe is the second leader in the global membrane separation technology market. The strict regulations on wastewater treatment and reuse imposed by the European Union, such as the Water Framework Directive, have been a major driver for this growth. Also, Germany alone contributes to $2.5 billion worth of revenues generated within this region which represents its largest market size. Membrane filtration technologies are employed in about 65% of Europe’s waste water treatment plants. Moreover, the adoption rate is 50% for food and beverage sector where France and Italy are leading producers of wines and cheeses respectively while pharmaceutical industry sees 75% utilization due to standards set by European Medicines Agency (EMA). Additionally, vaccine production involves use of membrane filters at 40% among biopharmaceutical companies based in Europe.

Asia Pacific occupies about 25% of the membrane separation technology market, making it the fastest-growing region at an estimated CAGR of 11.88%. These figures are driven by China and India, where rapid industrial expansion and urbanization have created a need for better water treatment systems. As such, up to 70% of municipal water treatment facilities in these two countries employ membrane filtration as a solution. The dairy sector has also seen increased adoption rates with 45% being recorded due to rising demand for high-quality products while pharmaceutical industry accounts for about 65% usage especially during production generic drugs. Meanwhile, half of all beverages produced within this area go through some form or another type(s) thereof which includes beer brewing tea processing among others. The Five-Year Plan launched by Chinese government lays more emphasis on environmental sustainability thus motivating further growth within this sector.

Prominent Players in Global Membrane Separation Technology Market

- ALFA LAVAL

- Asahi Kasei Corporation

- DuPont

- GEA Group Aktiengesellschaft

- Kovalus Separation Solutions

- Merck KGaA

- Nitto Denko Corporation (Hydranautics)

- Pall Corporation

- Pentair plc

- Suez SA

- Toray Industries

- Other Prominent Players

Market Segmentation Overview:

By Material

- Polymeric Membranes

- Natural Polymers

- Synthetic Polymers

- Inorganic Membranes

- Metallic

- Ceramic

By Technology

- Reverse Osmosis

- Ultrafiltration

- Microfiltration

- Nanofiltration

- Electro Dialysis

- Pervaporation

- Others

By Application

- Gas Separation

- Liquid Separation

- Solid Separation

By End User

- Water and Wastewater Treatment

- Desalination

- Public Works Water Treatment

- Waste Recycling

- Food and Beverages

- Dairy Processing

- Beverage Processing

- Food And Starch Processing

- Medical and Pharmaceutical

- Pharmaceutical Processing

- Medical Equipment

- Others

- Industrial Processing

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

Germany - France

- Italy

- Spain

- Rest of Western Europe

- The UK

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)