Medical Tourism Market: By Treatment Type (Cosmetic Treatment, Dental Treatment, Cardiovascular Treatment, Orthopaedics Treatment, Bariatric Surgery, Fertility Treatment, Ophthalmic Treatment, Other Treatments); Service Provider (Public, Private); And Region—Industry Dynamics, Market Size, Opportunity and Forecast for 2026–2035

- Last Updated: 27-Jan-2026 | | Report ID: AA0121042

Market Snapshot

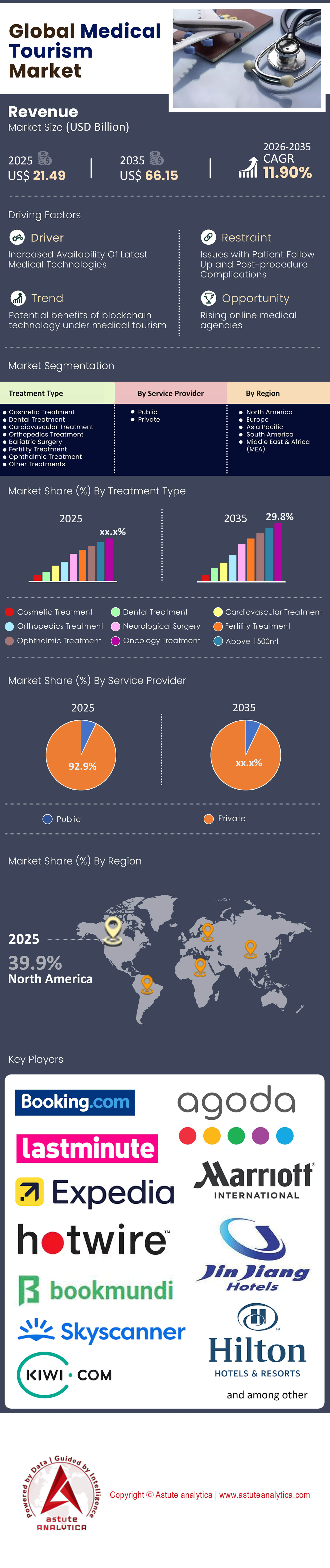

Medical tourism market, currently valued at approximately USD 21.49 billion in 2025, is projected to surge to an estimated USD 66.15 billion by 2035, registering a CAGR of 11.90% from 2026-2035.

Key Findings

- By treatment type, the global medical tourism market is led by oncology treatments, which accounted for over 24.5% of the market.

- By Service Providers, Private hospitals account for an overwhelming majority (92.9%) within the global medical tourism market.

- North America currently dominates the worldwide market with more than 40% revenue share.

- Commoditized Segment: Dental, hair, and minor cosmetic procedures where price sensitivity is the primary driver (Race to the Bottom).

- Complex Care Segment: Oncology, transplants, and robotic surgery where "Trust," "Accreditation," and "outcomes" are the currency (Race to the Top).

In 2026, the term "Medical Tourism" is becoming a misnomer, increasingly shed by serious industry stakeholders in favor of Medical Value Travel (MVT). The antiquated image of a facelift combined with a beach holiday has been superseded by a highly sophisticated, data-driven global marketplace where patients move across borders not merely for leisure, but for arbitrage—arbitrage of cost, arbitrage of technology, and arbitrage of regulatory access.

The global medical value tourism market has matured past its post-pandemic recovery phase. The "revenge travel" spikes of 2023-2024 have stabilized into sustained growth corridors. As of Q4 2025, the global medical tourism market is valued at approximately USD 22.15 billion, with a CAGR stabilizing at 11.90%.

To Get more Insights, Request A Free Sample

Global Market Economics

To understand the medical tourism market flow, one must analyze the economic pressures forcing patients across borders. The drivers are no longer unidimensional. Currently, North America take up more than 40% revenue share of the market. Wherein, the US emerged as most popular destination.

The "Push" Factors (Source Markets)

The traditional source markets (USA, UK, Canada) face a compounding healthcare crisis:

- USA: Despite insurance reforms, the "under-insured" population remains the largest exporter of patients. High deductibles ($5,000+) and uncovered elective procedures drive middle-class Americans to Mexico and Costa Rica. In 2025 alone, outbound US medical travel rose by 14% largely due to inflation in domestic healthcare administrative costs.

- UK & Canada (NHS/Public Systems): The "Waiting List Crisis" has become a permanent feature in the medical tourism market. With elective surgery wait times averaging 18-24 months for orthopedics in the UK, patients are utilizing "Self-Pay" options abroad. The UK’s NHS has even begun piloting cross-border partnerships to outsource backlog surgeries to certified EU and Turkish facilities.

The "Pull" Factors (Destination Medical Tourism Markets)

- Currency Arbitrage: This is the most potent, immediate driver .

- Turkey: With the Lira remaining volatile against the USD and Euro, Turkey offers arguably the highest quality-to-price ratio in the OECD. A hair transplant in Istanbul costs ~€1,800 versus ~€10,000 in London.

- India: The Indian Rupee’s exchange rate allows Indian super-specialty hospitals to offer robotic cardiac surgery at 1/10th the cost of the US, while maintaining margins due to lower labor costs (nurses, technicians) and high-volume throughput.

The Valuation Matrix

Astute Analytica value the medical tourism market based on "Spend per Patient" (SPP).

- Low SPP (<$3,000):Dental, Dermatology, Ophthalmology. High volume, low margin. (Hubs: Turkey, Hungary, Vietnam).

- Mid SPP ($5,000 - $15,000): Bariatric, Orthopedic, IVF. (Hubs: Mexico, Malaysia, India, Thailand).

- High SPP ($20,000+): Oncology, Cardiac, Neurology, Transplants. (Hubs: Singapore, Germany, USA - inbound, India - high end).

How the Facilitator Ecosystem & Digital Transformation is Shaping the Medical Tourism Market?

The middleman economy has been disrupted. The era of the "Travel Agent for Surgery"—who merely booked a flight and a hotel—is dead.

The Rise of the "Medical Concierge Platform"

In 2026, successful facilitators are Tech-First entities.

The Business Model: Platforms like Bookimed, Vaidam, and Qunomedical have evolved into "Managed Care Marketplaces." They do not charge the patient; they take a marketing fee (15-20%) from the hospital.

Differentiation: The winning platforms offer Telemedicine Triage. Before a patient buys a ticket, they upload DICOM files (X-rays/MRIs) to a secure cloud. The receiving surgeon reviews them and provides a provisional treatment plan and guaranteed price quote. This "Price Certainty" is the biggest converter of leads.

Insurance Integration Pushing the Medical Tourism Market Growth

Major global payers (Cigna, Bupa, Aetna) have launched "Global Passports."

The Shift: Insurers are incentivizing patients to go abroad for high-cost procedures. If a knee replacement costs the insurer $40,000 in the US but $12,000 in Costa Rica, the insurer covers the travel, the surgery, and gives the patient a cash rebate. This B2B segment is the fastest-growing channel for hospitals in LATAM and Asia medical tourism market.

What are the Critical Risks & Regulatory Headwinds Challenging the Market?

The fragility of medical value travel market was exposed by COVID-19, but new risks have emerged in 2026.

1. The Malpractice Void

Cross-border litigation remains the industry's Achilles heel. If a surgery is botched in Turkey, a UK patient has almost zero legal recourse. This has led to the rise of "Complication Insurance." Niche insurers (like Munich Re backed products) now offer policies specifically for medical tourists that cover the cost of corrective surgery in the home country if the original procedure fails.

2. Bio-Security & Superbugs

The spread of multi-drug resistant organisms (MDROs), such as NDM-1 (New Delhi Metallo-beta-lactamase-1), remains a PR and health nightmare in the medical tourism market. As a result, Western health authorities (CDC, NHS) frequently issue warnings about "superbugs" from specific regions (often Mexico or South Asia). Hospitals in these regions must now publish their "Hospital Acquired Infection" (HAI) rates to compete for Western patients.

3. Geopolitical Volatility

Medical tourism is the first industry to suffer during conflict. For instance, the Middle East conflicts of the early 2020s periodically halted flow to Israel and Jordan, diverting traffic to Dubai and Turkey. In line with this, stakeholders must have a diversified source market mix to survive regional shutdowns.

What Analyst at Astute Analytica Says and Recommend?

Based on the 2026 landscape, here are granular recommendations for key players in the medical tourism market.

For Hospital C-Suites

Stop Being a Generalist: You cannot be the "Best Hospital for Everything." Pick a niche. If you are in Colombia, own "Body Contouring." If you are in Bangalore, own "Robotic Oncology."

Accreditation is Baseline, not a differentiator: JCI is now table stakes. The differentiator is Clinical Outcome Data. Publish your success rates. Publish your re-admission rates. Transparency builds trust more than a gold seal logo.

Invest in International Patient Departments (IPD): This is not a front desk job. You need multi-lingual staff who handle visas, airport transfers, and—crucially—cultural food requirements. (e.g., offering Halal food is non-negotiable for Middle Eastern markets).

For Government Tourism Boards

Visa Policy is Marketing: The "E-Medical Visa" with a 48-hour turnaround is the highest ROI infrastructure investment.

- Create "Medical Cities": Cluster hospitals, hotels, and recovery centers. This reduces logistics friction for the patient. (Model: Dubai Healthcare City).

For Investors (PE/VC) in Medical Tourism Market

Look Beyond Hospitals: The brick-and-mortar hospital space is capital intensive and saturated.

- The "Ancillary" Opportunity: Invest in the ecosystem around the surgery.

- Recovery Resorts: High-end hotels with 24/7 nursing staff.

- Fintech: "Buy Now, Pay Later" (BNPL) solutions specifically for cross-border medical payments.

- Translation Tech: Real-time AI medical translation apps for doctor-patient consultations.

Segmental Analysis of the Medical Tourism Market: Where the Money is Going?

By Treatment, Oncology Treatment Stays at the Top

To invest or build strategy, one must look at procedural trends. The 2026 market is defined by four high-yield pillars. Wherein, Oncology treatment accounted for the largest 24.50% market share.

1. The "Zoom Boom" Legacy: Cosmetic & Aesthetics in Medical Tourism Market

The cultural shift toward video conferencing created a permanent demand for facial aesthetics in medica tourism market.

- The Trend: "Tweening" procedures (preventative Botox/fillers for under-30s) and "Mommy Makeovers."

Patients are increasingly traveling for technique, not just price. For example, the "Turkish Rhinoplasty" or "Brazilian BBL" are specific aesthetic styles that drive travel regardless of cost.

2. Dental Tourism: The Gateway Drug

Dental remains the highest volume segment (approx. 35% of total travelers).

- The Economics: A full mouth restoration (All-on-4 implants) costs $25,000–$35,000 in the US. In Turkey or India, the same procedure with Straumann or Nobel Biocare implants (same brands) costs $6,000–$8,000.

This show that the margin for clinics in destination countries is high because the material cost is fixed globally, but the dentist's labor cost is 80% lower.

3. Reproductive Exile: Fertility (IVF) & Surrogacy

This is the most "regulatory sensitive" sector in the global medical tourism market. It is not always cost, it is often legality.

- Gender Selection: Banned in the UK/Australia/China, but legal (or gray) in parts of the US (PGD testing) and Dubai.

- Surrogacy: With closures in India and Thailand years ago, the market shifted to Georgia, Mexico, and parts of Eastern Europe. In 2026, we see a rise in demand for "Egg Freezing Tourism" among career-focused women in restrictive Asian nations traveling to Malaysia or Spain.

- Success Rates: Clinics in Spain and the Czech Republic are marketing higher success rates than UK clinics due to less restrictive laws on donor egg anonymity.

4. Critical Care: Oncology & Cardiology the Leader in Medical Tourism Market

This is the "High Value" in Medical Value Travel market. It has been found that Patients from Africa and the CIS region travel to India and Turkey because the diagnostic equipment (PET-CT, CyberKnife, Proton Beam Therapy) simply does not exist at home.

A Canadian patient with a suspected tumor might wait 3 months for an MRI. In India, they can have the MRI, biopsy, and start chemo within 72 hours of landing.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

The Hegemony of the Hospital: Why Large-Scale Providers Control Nearly 92.9% of Medical Tourism Market Value

In the global medical tourism market ecosystem, while boutique clinics exist, Multi-Specialty Hospitals are the undisputed apex predators. As of 2026, they command approximately 93% of the total revenue generated in the sector. While smaller providers compete on volume (dental/cosmetic), hospitals dominate the high-margin "Value" segment due to three structural moats:

- The "ICU Safety Net": For risk-averse medical travelers undergoing major surgery (orthopedics/bariatrics), the presence of an on-site Level 3 Intensive Care Unit is non-negotiable. The capability to manage life-threatening complications effectively locks small clinics out of the insured and critical-care markets.

- Quaternary Care Monopoly: High-yield procedures—organ transplants, robotic oncology, and cardiac bypass—require massive capital expenditure (e.g., $2M+ Da Vinci systems). Only large hospital groups in the medical tourism market can amortize these costs, granting them a monopoly on the most lucrative procedural niches.

- The "One-Stop" Ecosystem: Medical tourists often present with co-morbidities requiring cross-specialty management (e.g., a diabetic cardiac patient). Hospitals offer a multidisciplinary environment under one roof, paired with sophisticated International Patient Departments (IPDs) that manage the entire non-clinical value chain (visas, translation, logistics).

Ultimately, hospitals monetize the entire patient journey, whereas clinics only monetize the procedure.

To Understand More About this Research: Request A Free Sample

Regional Powerhouses: A SWOT Analysis of Medical Tourism Market

The geopolitical map of the medical tourism market has redrawn itself.

A. South Asia: India – The Volume & Tech Giant

India remains the "Pharmacy of the World" but has successfully rebranded as the "Surgery Floor of the World."

Strengths: Unmatched cost efficiency. India holds the highest number of US-FDA approved drug plants outside the US, and a massive density of JCI (Joint Commission International) accredited hospitals (over 45 major chains).

Niche Dominance: Cardiac Bypass (CABG), Oncology, and Organ Transplants.

Strategic Shift 2026: The emergence of Tier 2 Cities (Ahmedabad, Kochi, Vizag). While Delhi and Mumbai remain hubs, Tier 2 cities in the India medical tourism market are undercutting the metros by another 20% while offering world-class facilities, aided by direct international flight connections from the Middle East.

India is aggressively targeting the "Global South" (Africa, Bangladesh, CIS countries) rather than just the West. 60% of India's medical traffic originates from immediate neighbors and Africa.

B. The Middle East & Turkey: The Aggressors

Turkey:

The "Istanbul Effect": Turkey controls the European cosmetic and hair transplant market. Government subsidies are the secret weapon here—the Turkish government heavily subsidizes marketing costs and flight tickets for medical tourists, a policy that has yielded a 300% ROI for the state.

New Frontier: Turkey is pivoting to oncology and neurosurgery to shed the "hair and teeth" only reputation.

UAE (Dubai & Abu Dhabi):

Strategy: Reversing the drain in the medical tourism market. Historically, wealthy locals used to go London/Cleveland. Now, with the establishment of local branches (Cleveland Clinic Abu Dhabi, King's College London in Dubai), the UAE is retaining domestic spend and attracting regional elites.

Regulation: The "Golden Visa" for doctors has attracted top-tier Western talent, effectively importing the surgeon rather than exporting the patient.

C. Southeast Asia: The Service & Wellness Leaders

Thailand:

Position: The world's "Wellness Capital." Thailand excels in combining medical procedures with holistic recovery.

Shift: Moving away from mass-market low-cost to "Active Aging" and "Geriatric Care" for the Japanese and Chinese markets.

Malaysia:

The Value Proposition: "Best regulated pricing." Unlike other markets where foreigner pricing is opaque, Malaysia regulates medical prices, ensuring trust. It is the dominant player for the Indonesian market and is gaining traction in the Middle East as a Halal-friendly medical hub.

Singapore:

Singapore has exited the price war. It cannot compete on cost. Instead, it competes on complexity. It is the hub for cutting-edge gene therapy, immunotherapy, and cases that other Asian nations deem "inoperable."

Top 5 Developments In Medical Tourism Market

In a landmark cross-border deal completed in January 2024, Abu Dhabi-based PureHealth finalized its $1.2 billion acquisition of Circle Health Group. This strategic move signifies the UAE's pivot from being a net importer of healthcare to a global operator, giving them ownership of the UK’s largest independent hospital network.

Bumrungrad International (Thailand) Launches "Andaman Hub": Bumrungrad Hospital announced a THB 4.3 billion investment to construct a 212-bed boutique facility in Phuket (near the international airport). Unlike their Bangkok flagship, this facility, commencing construction in 2025, is specifically designed for the "Luxury Wellness & Recovery" segment, integrating VitalLife longevity clinics with acute care.

Aster DM Healthcare announced its merger with Quality Care India (CARE Hospitals and KIMSHealth), expected to finalize by Q1 FY2026-27, creating Aster DM Quality Care Ltd with 10,150+ beds across 38 hospitals.

Apollo Hospitals (India) Partners with Hackensack (USA): In January 2025, Apollo Hospitals signed a strategic clinical affiliation with Hackensack Meridian Health (New Jersey, USA). The partnership focuses on robotic surgery training and clinical knowledge exchange, while Apollo simultaneously expanded its "Tele-ICU" network into Indonesia via a new deal with Mayapada Healthcare Group.

IHH Healthcare (Malaysia) Consolidates Penang: IHH Healthcare completed the acquisition of Island Hospital in Penang. This is a tactical move to dominate Malaysia’s primary medical tourism cluster. Concurrently, IHH expanded its European footprint by opening the Acibadem Kartal Hospital in Istanbul in Q1 2025, reinforcing the Turkey-Malaysia corridor.

Top Players in the Medical Tourism Market

- Fortis Healthcare Ltd.

- Apollo Hospitals Enterprise Limited

- KPJ Healthcare Behard

- Klinikum Medical Link

- Booking.com

- Agoda

- Lastminute.com

- Expedia

- Hotwire

- Bookmundi

- Skyscanner

- Kiwi.com

- Marriott International

- Jin Jiang

- Hilton Hotels

- InterContinental Hotels Group (IHG)

- Wyndham Hotels and Resorts, Inc.

- Accor Group

- Huazhu Hotels Group

- Other Prominent Players

Market Segmentation Overview:

By Treatment Type

- Cosmetic Treatment

- Dental Treatment

- Cardiovascular Treatment

- Orthopedics Treatment

- Bariatric Surgery

- Fertility Treatment

- Ophthalmic Treatment

- Other Treatments

By Service Provider

- Public

- Private

By Region

- North America

- United States (US)

- Canada

- Mexico

- Europe

- United Kingdom (UK)

- Germany

- France

- Italy

- Belgium

- Spain

- Poland

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia & New Zealand

- ASEAN

- Thailand

- Rest of ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Turkey

- Saudi Arabia

- Jordan

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2025 | US$ 21.49 Bn |

| Expected Revenue in 2035 | US$ 66.15 Bn |

| Historic Data | 2020-2024 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Unit | Value (USD Bn) |

| CAGR | 11.9% |

| Segments covered | By Treatment Type, By Service Provider, By Region |

| Key Companies | Fortis Healthcare Ltd., Apollo Hospitals Enterprise Limited, KPJ Healthcare Behard, Klinikum Medical Link, Booking.com, Agoda, Lastminute.com, Expedia, Hotwire, Bookmundi, Skyscanner, Kiwi.com, Marriott International, Jin Jiang, Hilton Hotels, InterContinental Hotels Group (IHG), Wyndham Hotels and Resorts, Inc., Accor Group, Huazhu Hotels Group, Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

FREQUENTLY ASKED QUESTIONS

The medical tourism market stands at USD 21.49 billion in 2025, projected to reach USD 66.15 billion by 2035 at a CAGR of 11.90%, fueled by value-based care and tech arbitrage.

MVT reflects a mature, data-driven market prioritizing outcomes over leisure; patients arbitrage cost, tech, and access, moving beyond cheap cosmetics to oncology and robotics.

Oncology dominates (24.5% share), followed by cardiology and transplants; private hospitals control 92.9%, leveraging ICUs and one-stop ecosystems for high-SPP procedures ($20K+).

US under-insurance/high deductibles (14% outbound rise), UK/Canada waitlists (18-24 months). Pull: India/Turkey's 1/10th costs; e.g., Istanbul hair transplant €1,800 vs. London €10,000.

Tech-first concierges like Bookimed offer telemedicine triage, DICOM reviews, and price certainty; insurers (Cigna) now rebate abroad surgeries, boosting B2B growth in LATAM/Asia.

Target ancillaries: recovery resorts, medical BNPL fintech, AI translation; Tier-2 India cities undercut metros by 20%, while Turkey/UAE pivot to oncology via subsidies and golden visas.

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)