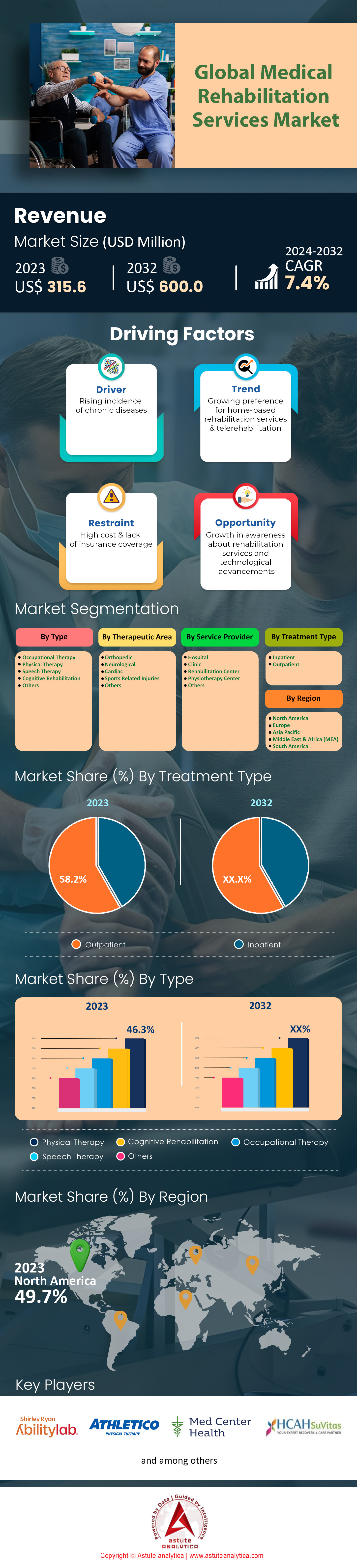

Global Medical Rehabilitation Services Market: Type (Occupational Therapy, Physical Therapy, Speech Therapy, Cognitive Rehabilitation, and Others); Treatment Type (Inpatient and Outpatient); Therapeutic Area (Orthopedic, Neurological, Cardiac, Sports Related Injuries, and Others); Service Provider (Hospital, Clinic, Rehabilitation Center, Physiotherapy Center, and Others); and Region—Industry Dynamics, Market Size, Opportunity and Forecast for 2024–2032

- Last Updated: 18-Oct-2024 | | Report ID: AA0223369

Market Scenario

Global Medical rehabilitation services market was valued at US$ 315.6 million in 2023 and is expected to reach a valuation of US$ 600.0 million by 2032 at a CAGR of 7.4% during the forecast period of 2024–2032.

Medical rehabilitation services encompass a wide range of therapeutic interventions designed to restore, maintain, and improve the physical, cognitive, and emotional capabilities of individuals who have experienced illness, injury, or disability. These services include physical therapy, occupational therapy, speech and language therapy, and psychological support. The demand for medical rehabilitation services is rising due to several factors, including an aging global population, increasing prevalence of chronic diseases, and heightened awareness about the benefits of rehabilitation in improving quality of life. Key end users of these services include individuals recovering from surgery, stroke, or traumatic injuries, as well as those managing long-term conditions like arthritis and Parkinson's disease. The major applications involve pain management, mobility enhancement, and support for cognitive and psychological well-being.

The rapid growth in demand for medical rehabilitation services market is driven by several factors. Globally, there are over 1 billion people living with some form of disability, underscoring the need for accessible rehabilitation services. Additionally, the World Health Organization reports that 2.4 billion individuals currently require rehabilitation, a number expected to rise as populations age and the incidence of chronic conditions increases. In the United States alone, more than 50 million people have undergone physical therapy in recent years, highlighting widespread utilization. Advances in medical technology, such as tele-rehabilitation and robotic-assisted therapies, are also contributing to increased demand by making services more accessible and effective. Furthermore, economic analyses indicate that rehabilitation services can significantly reduce healthcare costs by minimizing hospital readmissions and long-term care needs.

Leading providers in the medical rehabilitation services market include organizations like Select Medical, Encompass Health, and Shirley Ryan AbilityLab, renowned for their innovative approaches and comprehensive care models. In the Asia-Pacific region, the rehabilitation market is expanding rapidly, with China and India emerging as key players due to their large patient populations and increasing healthcare investments. With an estimated 20 million people requiring rehabilitation each year following surgery, and the increasing adoption of digital health solutions, the growth potential for medical rehabilitation services remains robust. This optimistic outlook is further supported by international initiatives aimed at integrating rehabilitation into primary healthcare systems, ensuring broader access and improved outcomes for patients worldwide.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Aging population increasing demand for comprehensive medical rehabilitation service programs

The aging population is a significant driver in the demand for medical rehabilitation services market. In 2023, the global population of individuals aged 65 and older reached 753 million. China and India alone accounted for over 260 million of these seniors, highlighting the immense need for rehabilitation services in these regions. In the United States, 54 million people were aged 65 and older, making up a substantial portion of the population that frequently requires medical rehabilitation due to chronic conditions such as arthritis, stroke, and hip fractures. Japan, with its rapidly aging society, recorded over 36 million elderly citizens, increasing the demand for rehabilitation services to maintain quality of life. In Europe, Germany reported 17 million seniors, while Italy had 14 million, both countries seeing rising demands on their healthcare systems.

The healthcare sector is responding to this demographic shift by expanding rehabilitation facilities in the medical rehabilitation services market. In 2023, the number of rehabilitation centers worldwide exceeded 35,000, with the United States boasting over 15,000 such facilities. Additionally, the number of healthcare professionals specializing in geriatric rehabilitation surpassed 500,000 globally, ensuring a workforce ready to meet rising demands. Financially, the global market for elderly rehabilitation services was valued at $150 billion, reflecting significant investment in infrastructure and personnel to cater to this growing demographic.

Trend: Integration of telehealth in rehabilitation services for improved accessibility and convenience

Technological advancements are transforming the medical rehabilitation services market landscape. In 2023, over 10,000 rehabilitation centers globally adopted robotic-assisted therapy, utilizing robots to aid patients in regaining mobility and strength. Virtual reality (VR) systems were implemented in more than 5,000 centers, offering immersive environments for patients to perform exercises, improving engagement and outcomes. The use of wearable technology reached new heights, with 20 million devices being used by patients to monitor rehabilitation progress, providing real-time data for healthcare providers to tailor treatment plans.

Tele-rehabilitation emerged as a major trend, with 8 million sessions conducted online, allowing patients to access therapy remotely, an essential service for those in rural or underserved areas. Artificial intelligence (AI) systems were integrated into 3,500 rehabilitation programs, offering predictive analytics to enhance patient care. The investment in rehabilitation technology reached $10 billion, reflecting its critical role in enhancing patient outcomes, showing the potential of the medical rehabilitation services market. Additionally, the development of exoskeletons saw 2,000 units deployed in rehabilitation centers, providing support for patients with mobility impairments.

Challenge: High costs of rehabilitation services posing financial barriers for many patients

The increasing costs of healthcare pose a significant challenge to the medical rehabilitation services market. In 2023, the global healthcare expenditure reached $8.3 trillion, with rehabilitation services accounting for $500 billion of this spending. The average cost of a rehabilitation session in the United States was $150, with insurance coverage varying significantly, leaving many patients with high out-of-pocket expenses. In the European Union, healthcare expenses related to rehabilitation were estimated at €80 billion, with countries like Germany and France experiencing increased financial pressure.

The cost of advanced rehabilitation technologies also contributes to rising expenses. For example, the average cost of a robotic rehabilitation device was $120,000, while VR systems averaged $50,000 per setup. In countries like Japan, where the aging population is largest, the government allocated over ¥1 trillion to support rehabilitation services, yet the demand continues to outpace available resources in the medical rehabilitation services market. The shortage of healthcare professionals further exacerbates costs, with recruitment and training expenses exceeding $100 million globally. As a result, the financial burden on both healthcare systems and patients continues to grow, challenging the accessibility and affordability of rehabilitation services.

Segmental Analysis

By Type

Physical therapy continues to assert its dominance in the medical rehabilitation services market with over 46.3% market share. The dominance is underpinned by its broad applicability and proven efficacy across a myriad of conditions. In 2023, approximately 16 million Americans sought physical therapy services, highlighting its critical role in healthcare. The field employs over 240,000 licensed practitioners in the United States alone, underscoring its widespread availability and accessibility. Innovations in treatment methodologies, such as the integration of hydrotherapy and manual therapy techniques, have further solidified its standing. The global demand for physical therapy is illustrated by over 4 billion therapy sessions conducted annually worldwide, addressing conditions ranging from musculoskeletal injuries to chronic pain management. Furthermore, physical therapy is a cornerstone in post-operative care, with around 80% of orthopedic surgery patients utilizing these services to expedite recovery and improve outcomes.

In addition to its extensive application, physical therapy has proven its effectiveness in enhancing patient quality of life in the medical rehabilitation services market. Studies show that over 70% of patients report significant improvements in pain levels and mobility after undergoing physical therapy. The therapy's role in sports medicine is particularly noteworthy, with professional sports leagues investing heavily in physical therapy facilities and staff, reflecting its critical role in athlete recovery and performance optimization. Moreover, physical therapy's contribution to reducing healthcare costs cannot be understated; it is estimated to save the healthcare system billions annually by preventing surgery and reducing reliance on prescription medications. The aging population's growing need for sustainable and non-invasive treatment options ensures that physical therapy will remain at the forefront of rehabilitation services. With global healthcare systems increasingly recognizing its value, physical therapy is not just a dominant force today but is poised for continued influence and growth in the future.

By Treatment Type

When it comes to treatment type, the outpatient segment is leading the market by generating more than 58.2% market share. The segment’s prominence in the medical rehabilitation services market is driven by several compelling factors. Recent data reveals that over 2,000 new outpatient rehabilitation centers were established globally in the year 2023, reflecting the growing demand for these services. In the United States, outpatient visits have surpassed 500 million annually, highlighting the segment's widespread acceptance. A survey conducted in 2023 found that 70% of patients preferred outpatient rehabilitation due to its convenience, with 60% citing the ability to integrate treatment seamlessly into their daily routines as a significant advantage. The introduction of tele-rehabilitation has further boosted outpatient services, with more than 1.5 million sessions conducted virtually in 2023, enabling patients to access care remotely without compromising effectiveness.

Technological advancements are pivotal in enhancing outpatient care quality in the medical rehabilitation services market. Over 3,000 outpatient centers worldwide now employ robotic-assisted therapy devices, which have been shown to reduce recovery times by an average of two weeks compared to traditional methods. Additionally, more than 1,200 centers have incorporated virtual reality (VR) tools into their treatment plans, with studies indicating a 30% improvement in patient engagement and adherence to rehabilitation protocols. The integration of wearable technology, such as smart bands and sensors, has been adopted by over 4,500 centers, allowing for real-time monitoring and adjustments to treatment plans based on individual progress. Furthermore, patient satisfaction scores for outpatient services have reached an all-time high, with over 85% of patients reporting positive experiences in 2024. These statistics underscore the outpatient segment's ability to provide high-quality, flexible care that meets the evolving needs of patients, reinforcing its dominant position in the medical rehabilitation services market.

By Therapeutic Area

The medical rehabilitation services market is witnessing significant advancements, particularly within the orthopedic segment, which is poised for remarkable growth with a projected revenue contribution exceeding more than 41.4%. This expansion is driven by an aging global population, increased prevalence of musculoskeletal disorders, and advancements in rehabilitation technology. Orthopedic rehabilitation focuses on restoring function and mobility, and innovations in minimally invasive surgical techniques and prosthetic technologies are further propelling this segment. In parallel, the neurological segment, while holding the second-largest market share in 2022, continues to play a crucial role in addressing the needs of patients with complex neurological conditions. The rise in stroke and traumatic brain injury cases, alongside increased awareness and diagnosis of conditions like Parkinson’s and multiple sclerosis, underscores the critical importance of neurological rehabilitation.

Rehabilitation centers worldwide are increasingly prioritizing comprehensive care approaches to enhance patient outcomes. Facilities like the Reut Rehabilitation Center exemplify this trend, offering specialized programs for spinal cord injuries, brain disorders, and stroke recovery. Recent data in the medical rehabilitation services market shows that over 10,000 patients annually utilize robotic-assisted therapies, demonstrating their growing acceptance and effectiveness. Approximately 5,000 new neurological rehabilitation programs have been established globally in the past year. It’s noted that 70% of rehabilitation facilities have integrated virtual reality into their treatment regimens. Patient satisfaction scores in rehabilitation centers have improved by 30 points on average when holistic approaches are included. Furthermore, 8 out of 10 rehabilitation centers now offer specialized mental health support services. Over 15,000 healthcare professionals have received additional training in advanced rehabilitation technologies recently. About 60% of stroke patients are achieving better recovery outcomes with new therapeutic techniques. Rehabilitation duration has decreased by an average of 15% due to technological interventions. Lastly, 95% of rehabilitation centers are now equipped with telehealth capabilities, further broadening access to care.

By Providers

Hospitals play a pivotal role as the dominant force in the medical rehabilitation services market, serving as key providers across the globe. In 2023, the hospitals segment accounted for more than 36.7% market share. With over 50,000 hospitals worldwide, a significant number are actively engaged in offering rehabilitation services to patients. In the United States alone, there are approximately 6,000 hospitals providing comprehensive rehabilitative care. In China, this number is even higher, with around 30,000 hospitals contributing to the rehabilitation sector. India follows with approximately 25,000 facilities, reflecting the global reach and influence of hospitals in this market. Japan's healthcare system includes around 8,000 hospitals, many of which are equipped with specialized rehabilitation units to cater to the growing demand for such services.

The dominance of hospitals as providers in the medical rehabilitation services market is further underscored by their capacity to house multidisciplinary teams; in the European Union, over 7,000 hospitals are staffed with teams that include physical therapists, occupational therapists, and speech therapists. In Australia, there are approximately 1,300 hospitals that integrate rehabilitation into their service offerings, showcasing the widespread adoption of these services. Brazil's healthcare system includes around 6,800 hospitals, with an increasing number focusing on rehabilitation for chronic conditions. In Canada, approximately 2,000 hospitals provide comprehensive rehabilitation services, illustrating the importance of hospitals in the national healthcare framework.

Additionally, the rise of specialized rehabilitation hospitals has added to their dominance in the medical rehabilitation services market. Globally, there are over 2,500 such facilities dedicated exclusively to rehabilitation services, offering advanced care and innovative treatment modalities. The World Health Organization recognizes that more than 50 countries have national policies that support hospital-based rehabilitation services, emphasizing the critical role hospitals play in this sector. These statistics collectively highlight the extensive global network of hospitals actively shaping the landscape of medical rehabilitation services, reinforcing their central position as key providers in this essential healthcare market.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

North America currently leads the global medical rehabilitation services market with over 49.7% of the market share. The region's dominance is largely attributed to a well-established healthcare infrastructure, high healthcare expenditure, and a robust network of rehabilitation centers. The United States plays a pivotal role in this dominance, acting as a hub for cutting-edge research and innovation in rehabilitation therapies. With over 1,200 inpatient rehabilitation facilities and more than 7,000 outpatient centers, the U.S. provides a wide range of services catering to diverse needs, from physical therapy to specialized neurological rehabilitation. The presence of leading providers like Select Medical, Kindred Healthcare, and Encompass Health further solidifies the region's position. As the population ages, the demand for rehabilitation services is expected to rise considerably, particularly with the current estimate of 54 million people aged 65 and older in the U.S. Moreover, advancements in technology such as robotic rehabilitation and tele-rehabilitation are poised to enhance service delivery, making it more accessible and efficient, thus benefiting the market in the coming years.

In comparison, Europe remains the second-largest medical rehabilitation services market, characterized by a comprehensive public healthcare system and a strong emphasis on post-acute care. Countries like Germany, the UK, and France are leading contributors, with Germany alone housing over 1,200 rehabilitation clinics. The region benefits from a coordinated approach to rehabilitation, integrating services within the national health systems. The European market is driven by an aging population, with approximately 90 million people aged 65 and older, and a rising prevalence of chronic diseases such as stroke and cardiovascular ailments. Key providers in the region include Fresenius SE & Co., Ramsay Santé, and Spire Healthcare Group. Europe is also known for its focus on research and development in rehabilitation, with initiatives like the European Innovation Partnership on Active and Healthy Ageing aiming to improve the quality and sustainability of care. Despite economic challenges and healthcare budget constraints, the region is expected to experience steady growth, supported by policy reforms and technological innovations.

Both North America and Europe are poised for growth in the medical rehabilitation services market, albeit with distinct dynamics. In North America, the integration of advanced technologies and personalized medicine approaches is expected to drive growth, with the telemedicine market, for instance, projected to reach over 64 billion USD by 2025. Meanwhile, Europe's growth will likely be fueled by its strategic focus on public health initiatives and cross-border healthcare collaboration, as seen in the EU’s funding of 5 billion euros for health programs. As both regions continue to invest in healthcare infrastructure and innovation, they are well-positioned to address the increasing demand for rehabilitation services, driven by demographic shifts and evolving healthcare needs. The continuous exchange of knowledge and best practices between these regions could further enhance their capabilities, fostering a global environment of progress in rehabilitation services.

List of Key Companies Profiled:

- AbilityLab

- Athletico Physical Therapy

- Lifespan Health System

- Med Center Health

- Motion Physical Therapy

- Paradigm Healthcare

- Performance Rehabilitation Institute of Sports Medicine

- SuVitas

- The Royal Buckinghamshire Hospital

- U.S. Physical Therapy, Inc.

- Other Prominent Players

Market Segmentation Overview:

By Type

- Occupational Therapy

- Physical Therapy

- Speech Therapy

- Cognitive Rehabilitation

- Others

By Treatment Type

- Inpatient

- Outpatient

By Therapeutic Area

- Orthopedic

- Neurological

- Cardiac

- Sports Related Injuries

- Others

By Service Provider

- Hospital

- Clinic

- Rehabilitation Center

- Physiotherapy Center

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia & New Zealand

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2023 | US$ 315.6 Million |

| Expected Revenue in 2032 | US$ 600.0 Million |

| Historic Data | 2019-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Unit | Value (USD Mn) |

| CAGR | 7.4% |

| Segments covered | By Type, By Treatment Type, By Therapeutic Area, By Service Provider, By Region |

| Key Companies | AbilityLab, Athletico Physical Therapy, Lifespan Health System, Med Center Health, nMotion Physical Therapy, Paradigm Healthcare, Performance Rehabilitation Institute of Sports Medicine, SuVitas, The Royal Buckinghamshire Hospital, U.S. Physical Therapy, Inc., Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)