Medical Display Market: By Product (Surgical Field Cameras, Distribution Systems, Monitors, Servers, and Hybrid Visual System); Technology (LED-backlit LCD Display, CCFL-backlit LCD Display and OLED Display); Panel Size (Under 22.9 Inch Panels, 23.0-26.9 Inch Panels, 27.0-41.9 Inch Panels and Above 42 Inch Panels); Resolution (Up to 2MP, 2.1-4MP, 4.1-8MP and Above 8MP); Display Color (Color Display, Monochrome Display); Application (Diagnostic, General Radiology, Mammography, Digital Pathology, Multi-modality, Surgical/ Interventional, Dentistry and Others); Region—Industry Dynamics, Market Size and Opportunity Forecast for 2025–2033

- Last Updated: 19-Oct-2025 | | Report ID: AA0123358

Market Snapshot

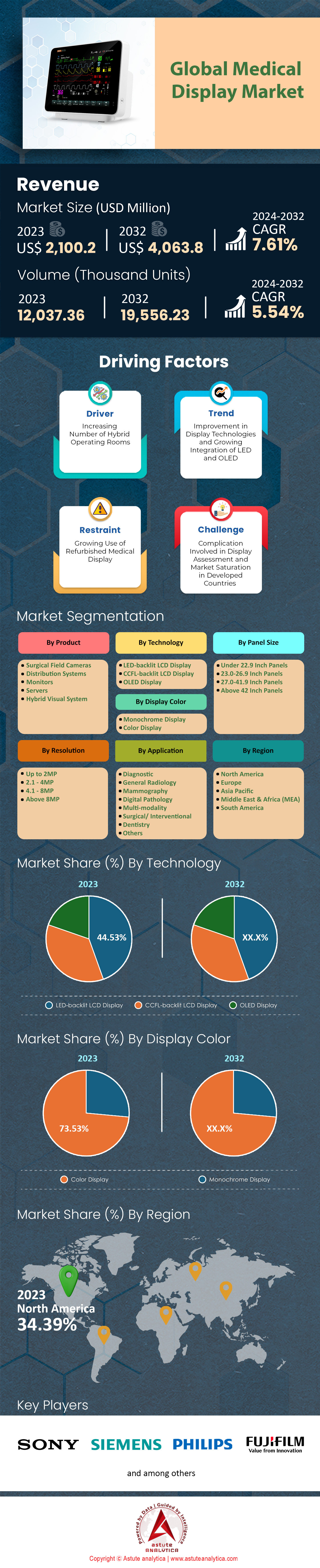

Medical display market was valued at US$ 2,260.03 million in 2024 and is estimated to generate a revenue of US$ 4,218.25 million by 2033 at a CAGR of 7.61% over the forecast period 2025-2033.

Key Findings Shaping the Market

- Based on product type, hybrid visual systems, which include fixed C-Arms, CT scanners, and MRI scanners, have taken a leading position in the market with revenue share of more than 41.32%.

- When it comes to technology, LED-backlit LCD display technology has become the cornerstone of the market by capturing more than 44.53% market share.

- Based on resolution, the 2.1 - 4MP resolution screens is leading the medical display market with more than 35.2% market share.

- Based on application, diagnostics application segment captured over 27.52% market share within the market.

- Medical display market is set to reach valuation of US$ 4,218.25 million by 2033.

A confluence of factors is creating a robust and expanding demand landscape across global medical display market. The sheer volume of procedures provides a foundational layer of demand. In 2024, U.S. hospitals are set to perform 15.3 million inpatient and 18.9 million outpatient surgeries. Diagnostic imaging contributes significantly, with an expected 84 million CT exams and 42 million MRI procedures in the U.S. for 2024. The increasing complexity of these procedures, such as the 600,000 robotic-assisted surgeries performed in 2024, necessitates higher-specification visualization tools. This procedural growth is a primary engine for the medical display market.

Infrastructural expansion provides a second critical demand driver. Growth is occurring in both traditional and emerging settings. The U.S. now has over 9,000 active Ambulatory Surgery Centers, with the average ASC housing four operating rooms. Simultaneously, hospitals are modernizing, with over 38,600 operating rooms in the U.S. as of 2024. Leading integrators like Stryker have an installed base of over 11,000 integrated ORs. The construction of advanced facilities, such as the 1,200+ U.S. hospitals with hybrid ORs, further solidifies the need for new display installations.

Technological advancement is the third pillar, pulling the market toward more sophisticated solutions. The transition to digital pathology means large labs will digitize over 250,000 slides annually by 2025, each requiring a high-resolution display for analysis. Data generation is massive, with a single hybrid operating room producing up to 2 terabytes of data weekly. The rapid pace of innovation is confirmed by regulatory bodies; the FDA has cleared over 1,000 AI-enabled medical devices as of early 2025, and an additional 15 new AI algorithms for radiology were cleared in 2024, creating new demand within the medical display market.

To Get more Insights, Request A Free Sample

Untapped Verticals and Niche Applications Signal New Market Opportunities

- The explosive growth of office-based labs (OBLs) and outpatient cardiac catheterization labs is creating a significant new vertical: As of 2024, there are over 1,500 OBLs in the U.S. performing vascular and interventional procedures. These facilities are projected to perform over 300,000 peripheral vascular interventions in 2025. Each lab requires a full suite of high-resolution fluoroscopy displays and auxiliary monitors, representing a concentrated and rapidly growing installation base outside the traditional hospital purchasing cycle.

- Advanced veterinary medicine presents a surprisingly robust and underserved market: The number of board-certified veterinary specialty hospitals in the U.S. surpassed 800 in 2024. These facilities are increasingly equipped with human-grade imaging equipment, with an estimated 2,500 veterinary CT and MRI scanners installed by 2025. The volume of advanced imaging procedures in companion animals is growing by over 150,000 studies annually, creating a new and loyal customer base for durable, high-quality medical displays for surgical and diagnostic review.

Robotic Bronchoscopy Suites Emerge as High-Density Display Environments

The rapid adoption of robotic-assisted bronchoscopy is creating a new, technology-dense environment for the medical display market. By the start of 2025, the installed base of robotic bronchoscopy platforms in the United States, including systems from Intuitive and Auris, is projected to exceed 1,200 units. These systems are driving a surge in procedures, with an estimated 150,000 robotic bronchoscopies anticipated for 2025. This growth is fueled by the 2.2 million peripheral lung nodules detected annually in the U.S., many of which require advanced diagnostic techniques. The establishment of over 900 dedicated lung cancer screening programs provides a consistent stream of patients for these procedures.

Each robotic bronchoscopy suite represents a significant opportunity for the medical display market, as they are not single-screen environments. A typical new installation in 2024 requires a minimum of four large-format displays to show the virtual navigation pathway, live bronchoscopic video, fused CT imaging, and patient vitals simultaneously. With the number of dedicated interventional pulmonology suites in U.S. hospitals surpassing 500 in 2024, the demand for these multi-display setups is intensifying. Furthermore, as the number of physicians fully trained and credentialed on these platforms is expected to reach 3,000 by the end of 2025, utilization and the need for supporting visualization technology will only continue to accelerate.

Digital Dentistry Transformation Creates Unprecedented Demand for Clinical Displays

The dental industry's digital transformation is fueling a massive new demand driver for the medical display market. In 2024 alone, dentists in the United States are projected to place over 6 million dental implants, with each case increasingly reliant on digital planning. This is made possible by the proliferation of in-office imaging; the installed base of Cone Beam Computed Tomography (CBCT) scanners in U.S. dental practices is expected to exceed 45,000 units by 2025. These scanners will generate a projected volume of 15 million dental CBCT scans in 2025, each requiring detailed review on a high-resolution monitor.

The technological shift impacts the entire clinical workflow in the medical display market. The number of intraoral scanner units sold in the U.S. during 2024 is estimated at 25,000, replacing physical impressions with data-intensive 3D models. Consequently, dental labs are projected to 3D print over 4 million surgical guides in 2024, based on these digital plans. This workflow requires precise visualization at multiple stages, from the initial scan review to the treatment planning software. As the number of U.S. dentists fully trained in guided implant surgery is set to surpass 30,000 in 2025, the need for medical-grade displays in operatories and consultation rooms is becoming a new standard of care.

Segmental Analysis

Hybrid Visual Systems Forge a New Era in Surgical Precision and Set to Remain a Key Contributor

Hybrid visual systems, which include fixed C-Arms, CT scanners, and MRI scanners, have secured a commanding lead in the medical display market, holding a revenue share of over 41.32%. This dominance is fueled by the escalating demand for minimally invasive surgeries, which rely on superior real-time imaging. The strong adoption of robotic-assisted surgery is a testament to this trend, with Stryker's MAKO platform achieving its 70,000th knee replacement in May 2025 and CMR Surgical's Versius robot surpassing 100,000 procedures by March 2025. The global surgical robots market itself is projected to surge from $10.1 billion in 2025 to $34.8 billion by 2035, underscoring the expanding need for integrated, high-performance displays.

- Canon Medical Systems USA announced the FDA 510(k) clearance for its Adora DRFi, a new hybrid imaging system, on December 23, 2024.

- Conavi Medical submitted its next-generation Novasight Hybrid™ IVUS/OCT intravascular imaging system to the U.S. FDA for 510(k) clearance in September 2025.

- Olympus co-founded Swan EndoSurgical in July 2025 to develop a novel endoluminal robotic system.

The growing investment in advanced healthcare infrastructure further propels the segmental dominance in the medical display market. The global market for hybrid operating room equipment is on track to reach $2.7 billion by 2028, reflecting a move towards integrated surgical environments. This is supported by the expansion of imaging centers by providers like US Radiology Specialists, which plans 12 new locations in 2025, and RadNet, with 12 centers under construction in 2024. Innovation in imaging technology, such as the FDA's clearance of Siemens Healthineers' Magnetom Terra.X 7T MRI system in early 2024 and the anticipated June 2025 release of Medtronic's Hugo RAS system, continues to drive demand. Consequently, specialized markets like coronary intravascular imaging are also expanding, projected to exceed $1 billion by 2028.

LED-Backlit LCDs are the Undisputed Cornerstone of the Medical Display Market

LED-backlit LCD display technology has solidified its position as the cornerstone of the medical display market, capturing an impressive 44.53% market share. Its leadership is rooted in typically superior image quality, as high-efficiency LEDs can deliver 200% more brightness than older CCFL backlights, a critical factor for accurate diagnosis. These displays operate on a safer low-voltage system, typically between 5-24v, and their higher luminous frequency prevents flickering in dynamic images. The technology's market momentum is evident, with the global flexible LED market experiencing a 19% growth in 2023.

- The lifespan of an LED display can range from 80,000 to 120,000 hours.

- Samsung's 2024 flexible LED models can achieve 80,000 hours of use at 50% brightness.

- LED displays are more environmentally friendly as they do not contain harmful substances like mercury.

The longevity and robustness of LED technology are significant advantages, with an average lifespan of approximately 100,000 hours, making them a sound long-term investment. They are also incredibly versatile, capable of operating in a wide temperature range from -20°C to 80°C and offering a high dimming range up to 20,000:1. This technical prowess allows for slim designs, some as thin as half-an-inch, without compromising performance. Furthermore, LED backlights are more durable and can expand an LCD's color gamut to 105% of the NTSC standard, enhancing the visualization of complex medical images within the medical display market and ensuring their continued dominance.

Diagnostics Application Fuels the Market Dominance

The diagnostics application segment stands as the largest force within the medical display market, having captured a substantial 27.52% market share. This leadership is directly linked to the rising volume of medical imaging procedures globally, with projections showing over 5.9 billion procedures in 2024, a number expected to climb to 7.3 billion by 2028. This growth is not just a projection; leading providers like RadNet reported concrete increases in procedure counts during the fourth quarter of 2023, with MRI scans up by nearly 11%, CT scans by 8%, and PET/CT scans by over 17%.

- The global portable medical devices market is expected to reach $72.5 billion in 2025.

- The point-of-care diagnostics market is projected to grow from $50.08 billion in 2024 to $105.22 billion by 2033.

- Disease diagnosis accounted for 55% of the digital pathology market in 2024.

Technological evolution, particularly in digital pathology, is a major catalyst for this segment's growth in the medical display market. The global digital pathology market was valued at $1.15 billion in 2024 and is forecasted to reach $3.86 billion by 2032. Within this space, whole-slide imaging scanners held a 45% market share in 2024. Key players are seeing significant returns, with Roche's digital pathology segment generating approximately $1.2 billion in revenue in 2024, and Philips' IntelliSite Pathology Solution bringing in around $900 million. This demonstrates the immense value placed on high-quality diagnostic displays to support these advanced applications.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

Optimal Clarity Drives the 2.1-4MP Resolution Dominance in Market

Screens featuring a resolution of 2.1 - 4MP have become the leading segment in the medical display market, commanding a market share of more than 35.2%. Their prevalence is due to an ideal balance of diagnostic-level clarity and cost-effectiveness, meeting the stringent requirements for primary diagnosis. The FDA, which classifies PACS displays as class II devices, has specific technical guidelines that these monitors satisfy for a majority of radiological tasks. While this segment leads, the shift to high-resolution displays is a notable trend, with monitors between 4 and 6 megapixels becoming increasingly popular, especially in the growing field of digital pathology.

- For digital pathology, a 27-inch monitor should have a minimum resolution of 4MP.

- Higher resolution displays can help reduce pathologist fatigue by minimizing the need for panning and zooming.

- The FDA provides specific guidance on the technical specifications for displays used in diagnostic radiology, including resolution.

The push towards higher resolutions is driven by efficiency and the complexity of modern imaging. For instance, digital pathology images can be massive, reaching up to 100,000x100,000 pixels, which is 30 to 50 times larger than a typical radiological image. In this context, higher resolution is not a luxury but a necessity for retaining intricate detail in the medical display market. Recommendations suggest a 6MP resolution for a 30-inch monitor and 8MP for a 32-inch monitor to optimize workflow. A compelling study highlighted the efficiency gains, showing that the number of zoom interactions was reduced by a 4:1 ratio when using a 12MP display compared to a 2MP monitor, illustrating the powerful incentive for healthcare facilities to invest in higher-resolution screens.

To Understand More About this Research: Request A Free Sample

Regional Analysis

North America’s Market Dominance Is Driven by Unmatched Infrastructural Scale

North America leads the global medical display market, commanding a significant share due to its vast and technologically advanced healthcare ecosystem. The region's leadership is underpinned by immense capital investment and procedural volume. For instance, the U.S. is projected to complete 125 new hospital construction or expansion projects in 2024 alone. The U.S. Food and Drug Administration's pipeline remains robust, with the agency approving over 40 new AI-enabled medical imaging devices in 2024. Furthermore, major providers like Kaiser Permanente have allocated capital budgets exceeding 3 billion dollars for technology and facilities in 2024, ensuring consistent upgrade cycles.

The scale of clinical activity is unparalleled in the medical display market. More than 1,500 U.S. hospitals now operate a dedicated robotic surgery program, each utilizing multiple advanced displays. The Centers for Medicare & Medicaid Services added 11 new procedures to the ASC payable list for 2025, driving equipment demand in outpatient settings. Canada is also investing heavily, with Ontario's 2024 budget including funding for over 50 new hospital development projects. Moreover, U.S. teleradiology groups are expected to interpret more than 75 million medical imaging studies remotely in 2024. The National Institutes of Health awarded over 600 million dollars in grants for medical imaging research in fiscal year 2024, fueling future innovation. Finally, over 2,000 U.S. healthcare facilities now hold HIMSS Stage 6 or 7 certifications, indicating a high degree of digital maturity that demands premium display technology.

Europe’s Market Position Is Fortified by Sweeping Digital Health Reforms

Europe’s demand in the medical display market is propelled by government-led digitalization initiatives and stringent regulatory upgrades. The UK’s National Health Service has earmarked over 2 billion pounds for diagnostic equipment upgrades in its 2024-2025 capital plan. In Germany, more than 1,200 hospitals have received funding through the Hospital Future Act (KHZG) for digital projects as of 2024. The EU4Health Programme has also allocated over 500 million euros in 2024 to create the European Health Data Space, driving interoperability and data visualization needs. French healthcare is expanding its private sector, with plans for 15 new private hospital openings in 2024. Moreover, over 5,000 imaging devices compliant with the new EU Medical Device Regulation (MDR) were installed in 2024, representing a significant technology refresh. The continent's commitment to innovation in the medical display market is clear and well-funded.

Asia Pacific Is a Hotbed of New Construction and Technology Adoption

The Asia Pacific region is characterized by rapid infrastructure growth and a massive patient population. China continues its aggressive expansion, approving construction for over 80 new Grade A hospitals in 2024. India’s Ayushman Bharat health insurance scheme funded over 50 million hospital admissions involving medical imaging in 2024, creating enormous demand. Japan’s government has allocated a 200 billion yen budget for 2024-2025 to promote medical digital transformation (DX) nationwide. South Korea is also advancing quickly, launching 15 new government-designated smart hospital pilot projects in 2024. In Australia, the government introduced 20 new Medicare item numbers in 2024 to support telehealth and remote diagnostic imaging consultations. This dynamic growth cements the region's rising importance in the global medical display market.

Recent Developments in Medical Display Market

- GE HealthCare Acquires MIM Software (Jan 2024): GE HealthCare finalized its acquisition of MIM Software, a move that integrates advanced imaging analytics and AI into its diagnostic imaging portfolio, directly influencing visualization requirements on medical displays.

- FUJIFILM Acquires Digital Pathology Business from Inspirata (Mar 2024): FUJIFILM strengthened its enterprise imaging and AI divisions by acquiring Inspirata's digital pathology unit, a sector critically dependent on high-resolution displays for primary diagnosis.

- NVIDIA Participates in Flywheel’s $54M Funding (Feb 2024): Technology giant NVIDIA joined a significant funding round for Flywheel, a medical imaging data platform, highlighting investment in the AI infrastructure that powers advanced diagnostic visualization.

- Olympus Launches $50M Corporate Venture Capital Fund (Apr 2024): Endoscopy leader Olympus established Olympus Innovation Ventures, a fund to invest in startups focused on medical technology and digital health, reinforcing its core visualization ecosystem.

- Philips Enhances Image-Guided Therapy Portfolio (2024): Philips focused on integrating Vesper Medical throughout 2024 to bolster its Image-Guided Therapy business, driving demand for its suite of advanced displays used in vascular procedures.

- Genesis MedTech Acquires JC Medical (Jan 2024): Genesis MedTech bought JC Medical, a maker of neuro-interventional devices, to enhance its portfolio for stroke treatments that rely on sophisticated real-time angiography displays.

- Riverain Technologies Receives Strategic Growth Investment (Feb 2024): AI software firm Riverain Technologies, which develops algorithms for chest imaging, secured a major investment to scale its solutions that are utilized by radiologists on diagnostic workstations.

List of Key Companies Profiled:

- Advantech Co. Ltd

- ASUSTeK Computer Inc

- Axiomtek Co., Ltd.

- B. Braun

- Barco

- BenQ Medical Technology

- COJE Co., Ltd.

- Dell Inc.

- DIVA Laboratories. Ltd

- Double Black Imaging

- EIZO Corporation

- FSN Medical Technologies

- General Electric Company (GE Healthcare)

- HP Inc.

- LG Corporation

- ManageEngine

- New Vision Display (Shenzhen) Co, Ltd.

- Novanta Inc

- Siemens AG

- Sony Electronics Inc.

- SOT Medical Systems

- WIDE Corporation

- Other Prominent Players

Market Segmentation Overview:

By Product

- Surgical Field Cameras

- Distribution Systems

- Monitors

- Servers

- Hybrid Visual System

- Fixed C-Arms

- X-ray computed tomography (CT) scanners

- Magnetic resonance imaging (MRI) scanners

- Others

By Technology

- LED-backlit LCD Display

- CCFL-backlit LCD Display

- OLED Display

By Panel Size

- Under 22.9 Inch Panels

- 23.0-26.9 Inch Panels

- 27.0-41.9 Inch Panels

- Above 42 Inch Panels

By Resolution

- Up to 2MP

- 2.1-4MP

- 4.1-8MP

- Above 8MP

By Display Color

- Color Display

- Monochrome Display

By Application

- Diagnostic

- General Radiology

- Mammography

- Digital Pathology

- Multi-modality

- Surgical/ Interventional

- Dentistry

- Others

By Region/Country

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- ASEAN

- Myanmar

- South Korea

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)