Mammography Systems Market: By Product Type (Analog Mammography Systems and Digital Mammography Systems); Modality (Portable Mammography Systems and Non-Portable Mammography Systems); End User (Impatient Settings and Ambulatory Surgical Centers); and Region—Industry Dynamics, Market Size, Opportunity and Forecast for 2025–2033

- Last Updated: 18-Nov-2025 | | Report ID: AA0622265

Market Snapshot

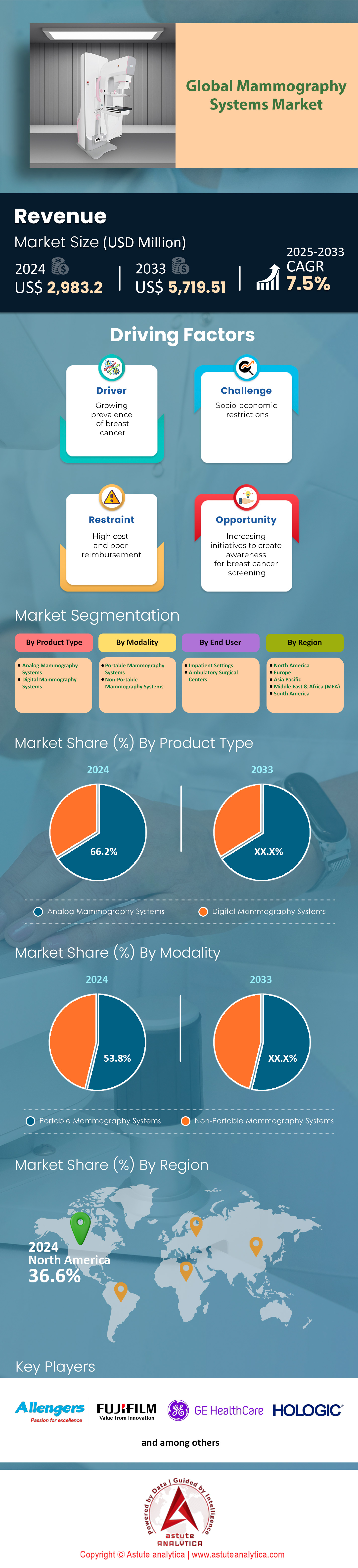

Mammography systems market was valued at US$ 2,983.2 million in 2024 and is projected to attain a value of US$ 5,719.51 million by 2033 at a CAGR of 7.5% during the forecast period 2025-2033.

Key Findings

- Based on modality, portable mammography systems segment holds highest share 53.8%.

- Based on product type, analog mammography systems segment holds highest share 66.2%.

- Based on end users, In-patient settings segment holds highest share 68.9%.

- North America accounts for over 36.60% revenue share of the global market.

The demand for mammography systems is steadily climbing. This growth is driven by a stark reality: the rising global burden of breast cancer. In 2022, there were 2.3 million new cases diagnosed worldwide, making it the most common cancer. Projections for 2025 show this trend continuing, fueled by an aging global population and lifestyle factors. In the United States alone, an estimated 310,720 new cases of invasive breast cancer are expected in women during 2024. This relentless prevalence creates a fundamental and expanding need for effective screening tools in the Mammography systems market. Early detection remains the most critical weapon against the disease, and mammography is the cornerstone of that strategy.

The most prominent systems driving the market are no longer basic 2D units. Digital Breast Tomosynthesis (DBT), or 3D mammography, has become the undisputed standard of care in developed nations. Its popularity stems from its superior clinical outcomes; DBT is proven to detect more invasive cancers and significantly reduce the rate of patient recalls for false positives. This clinical superiority is a powerful growth driver behind the mammography systems market. Furthermore, evolving screening guidelines, which now recommend mammograms for women starting at age 40 in the U.S., are expanding the eligible screening population. This creates a direct and quantifiable increase in the number of annual procedures, fueling demand for new, more efficient systems.

The demand across the global mammography systems market is unfolding in a multi-layered way. In high-income countries, the focus is on upgrading from 2D to 3D systems and integrating artificial intelligence (AI) to improve workflow and diagnostic accuracy. In emerging markets, there's a growing push to establish foundational screening programs, driving demand for more cost-effective digital systems. The market is also seeing a surge in demand for supplementary technologies like automated breast ultrasound (ABUS), especially for screening women with dense breasts. This creates a new dynamic where mammography systems are part of a broader, integrated breast imaging ecosystem, ensuring a robust and evolving demand landscape for the foreseeable future.

To Get more Insights, Request A Free Sample

Beyond Screening: Tapping New Frontiers in the Mammography Systems Market

- Dual-Purpose Imaging for Cardiovascular Health: A significant opportunity lies in leveraging mammograms for opportunistic screening of cardiovascular disease. New AI algorithms can analyze breast arterial calcification (BAC) from existing mammogram images, a known indicator of heart disease risk. Companies can develop and market these AI software modules as value-add upgrades to existing digital systems. This creates a new revenue stream without requiring new hardware, additional radiation, or extra patient time, positioning mammography as a vital tool in women’s overall health, not just breast cancer detection in the mammography systems market.

- Expansion into Point-of-Care and Mobile Solutions: There is a growing demand for compact, durable, and more affordable mammography systems designed for mobile screening vans and small, remote clinics. This addresses the critical gap in healthcare access for underserved and rural populations globally. Manufacturers who can engineer systems with a smaller footprint, lower power consumption, and robust tele-mammography capabilities will unlock a vast, untapped market segment, moving beyond the confines of large hospitals and established imaging centers.

AI Integration: Driving Efficiency in Modern Breast Imaging Centers

The demand for intelligent workflow solutions is profoundly shaping the Mammography systems market. Healthcare facilities face immense pressure from a growing radiologist shortage, with a projected shortfall of nearly 3,000 diagnostic radiologists by 2025. Consequently, a single radiologist may be tasked with interpreting screening batches containing 100 mammograms or more. This immense workload, a key factor in burnout, has created a powerful demand for AI-driven efficiency tools. AI platforms are now being deployed to triage cases, helping radiologists prioritize suspicious scans for immediate review.

These systems are delivering measurable results. AI software, which can carry an annual license fee of USD 20,000 per system, demonstrably reduces reading time. Studies in 2024 show AI can cut interpretation times by 60 seconds or more per case. With over 100 FDA-cleared AI algorithms now available in the mammography systems market, adoption is accelerating. A key financial driver is the potential to lower patient recall costs, which can average USD 500 per unnecessary follow-up exam. Moreover, the massive datasets, often containing over 1 million images for training a single algorithm, and the associated 2 terabytes of data storage required annually per machine, underscore the significant investment in intelligent imaging infrastructure.

Advanced Modalities: Redefining the Clinical Gold Standard for Screening in Mammography Systems Market

A fundamental shift toward clinically superior technology is driving significant capital investment. The transition from 2D to 3D mammography, or Digital Breast Tomosynthesis (DBT), now defines the market. A new DBT system represents a major expenditure, with costs frequently exceeding USD 400,000. These advanced systems generate a much larger volume of information, producing between 60 to 90 image slices per view. Although a modern DBT scan has a low radiation dose of just 1.5 milligrays (mGy), the complexity of the technology necessitates a significant annual service contract, often valued at USD 30,000 to maintain optimal performance and uptime for the facility.

Building on this digital platform, the demand for even more advanced diagnostic tools like Contrast-Enhanced Mammography (CEM) is growing in the mammography systems market. CEM is a relatively quick procedure, adding only 7 minutes to a standard exam. It requires an intravenous injection of 1.5 milliliters of iodine-based contrast per kilogram of body weight. The clinical value of CEM is gaining recognition, supported by a favorable reimbursement of approximately USD 250 from Medicare for the procedure. The expanding evidence base, with over 50 active clinical trials investigating new applications for CEM in 2025, is solidifying its role and encouraging more facilities to adopt the technology.

Segmental Analysis

Digital Systems Command the Future of Breast Cancer Detection Technology

Currently, analogue mammography system is holding the fort with over 66.20% revenue share. However, digital mammography systems are cementing their lead in the mammography systems market. They hold a massive share, ranging from 46.8% to as high as 80.9% across different digital categories in 2025. The move away from analog technology is fueled by better results. For instance, 3D digital mammography finds between 20% and 65% more invasive cancers compared to older 2D methods. A major benefit is improved patient safety, as these systems use 30-40% less radiation. Innovation continues to push the segment forward. GE HealthCare introduced its Pristina Via system in 2024, and Fujifilm launched the Amulet Sophinity in the same year. In 2025, Hologic released an AI-powered 3D platform, showing how quickly smart technology is being integrated.

- The sub-segment of full-field digital mammography (FFDM) alone captures a huge 70% of the market.

- Projections show digital systems will command a 65.2% market share in 2025.

- An advanced AI deep learning model from April 2024 showed it could outperform human radiologists.

The efficiency of digital platforms is a huge plus for busy clinics in the mammography systems market. Images are available instantly, which speeds up the entire workflow. These systems also connect smoothly with hospital records and image archives, known as PACS and EMR. Better data management leads to quicker and more accurate diagnoses. As a result, patients experience less anxiety and fewer callbacks for repeat scans. The combined advantages of better clinical outcomes and streamlined operations ensure these advanced mammography systems remain the gold standard in breast imaging.

Hospitals Emerge as the Epicenter of Comprehensive Mammography Services

Hospitals are the financial heart of the mammography systems market as they accounts for 68.90% market share. As in-patient settings, they generate the most revenue because they act as one-stop shops for diagnosis and treatment. Hospitals command a powerful end-user market share, projected to be between 36.7% and 45.68% in 2025. One analysis focusing just on the digital market puts the hospital share even higher at 63.8%. Their leadership stems from having the infrastructure to handle large-scale screening operations. National health initiatives and NGO-led screening campaigns are typically run through hospitals. Patients trust hospital-based care, and the presence of specialist teams makes them the preferred choice.

- Hospitals like TGH Imaging are leading in tech adoption, adding advanced 3D exams across 18 locations.

- The end-user landscape is clearly dominated by hospitals, which are the main providers of these services.

- Hospitals are strategically vital, serving as the primary centers for large government-backed screening programs.

The way healthcare is financed also strengthens the position of hospitals in the mammography systems market. Reimbursement policies often favor hospital-based services, which guarantees a consistent income. As part of integrated health networks, hospitals manage the entire patient experience, from initial screening to cancer treatment. This creates an environment where advanced imaging is a necessary and frequently used service. Their ability to invest in the latest mammography systems, combined with high patient volumes and comprehensive care, explains why in-patient services capture the largest slice of market revenue.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

Portable Systems Revolutionize Access to Essential Breast Health Screenings

Portable mammography systems are changing the game by capturing over 53.80% market share of the mammography systems market. They tear down barriers to care, reaching people regardless of location or income. Their market dominance comes from bringing crucial screening services to remote and underserved areas. Mobile units can boost screening rates by a stunning 448% in certain rural communities. Companies are actively expanding their mobile offerings. GE HealthCare launched a new portable unit in October 2024. In March 2025, the UC Davis MobileMammo+ bus began its service. These efforts directly help vulnerable groups. For example, American Indian or Alaska Native women are 453% more likely to use mobile services, and women in rural areas are 210% more likely.

- A single mobile program in 2022 prevented 333 emergency department visits, saving hospital resources.

- One mobile initiative in 2022 saw an impressive 20-to-1 return on its investment.

- Despite their success, a large Medicare study found utilization was only 0.4%, indicating huge room for growth.

The focused outreach of portable units is a major reason for their success in the global mammography systems market. Women who use mobile clinics often have a history of skipping regular screenings. This shows the modality is effective at engaging at-risk individuals. One successful program reported that 71% of the women it screened were from minority communities, directly addressing healthcare inequality. By delivering top-tier screening technology to local neighborhoods and workplaces, portable mammography systems serve as a vital tool for health equity. Their unique ability to improve early detection rates fully justifies their leading position in the market.

To Understand More About this Research: Request A Free Sample

Regional Analysis

North America A Market Defined by Advanced Technology Adoption

North America commands the leading share of the global mammography systems market. The region’s dominance is built on high patient awareness and significant healthcare expenditure. In the United States, an estimated 310,720 new invasive breast cancer cases are expected in 2024, with another 64,800 new cases anticipated in Canada. This substantial patient population fuels a high volume of screening procedures across more than 8,800 certified mammography facilities in the U.S. alone. The financial landscape further supports market growth, with Medicare offering a reimbursement of approximately USD 150 for a 3D screening mammogram, encouraging the adoption of advanced technology.

The mammography systems market is characterized by substantial capital investment in cutting-edge systems. The average cost of a new 3D mammography system in the region is approximately USD 450,000. These advanced systems are operated by a specialized workforce, including over 38,000 board-certified radiologists in the United States. Furthermore, the high procedural volume, with over 40 million mammograms performed annually in the U.S., necessitates significant data management. A single 3D mammogram generates about 2 gigabytes of data, underscoring the need for robust IT infrastructure. The average patient recall for additional imaging after a screening exam costs facilities around USD 500, driving demand for more accurate technologies.

Europe A Landscape of Structured National Screening Programs

Europe's mammography systems market is distinguished by well-established, government-funded national screening programs. The United Kingdom's NHS Breast Screening Programme, for instance, performs over 2 million mammograms annually. Germany leads the continent with an estimated 80,000 new breast cancer cases in 2024, while the UK anticipates around 57,000 new diagnoses. These high incidence rates underpin the steady demand for new and replacement systems across thousands of screening sites. For example, France has over 2,500 mammography units installed nationwide to serve its population.

Investment in technology is robust, though varied across the regional mammography systems market. The average price for a mid-range digital mammography system is about EUR 200,000. These systems are managed by a large pool of specialists, with more than 5,000 radiologists in Germany specializing in breast imaging. The high volume of procedures necessitates efficiency; a typical screening appointment within the NHS is scheduled for just 6 minutes. Moreover, a significant annual budget of over EUR 100 million is allocated just for the UK's screening program, ensuring consistent demand for equipment and consumables.

Asia Pacific A Region of Rapid Growth and Access Expansion

The Asia Pacific region represents a dynamic and rapidly expanding mammography systems market. It is driven by increasing healthcare investment and a massive patient population. China is expected to see over 430,000 new breast cancer cases in 2024, with Japan following at approximately 95,000 new cases. Government initiatives are crucial to market growth, such as India's issuance of tenders for over 50 new mammography systems for public hospitals in 2025. Efforts to improve access are also expanding screening eligibility to millions of women annually.

Market dynamics of the regional mammography systems market reflect a focus on both premium and value-segment technology. In affluent countries like Australia, the out-of-pocket cost for a private mammogram can be AUD 200. Meanwhile, South Korea has achieved a national screening participation rate of over 60 percent for eligible women. Japan has a robust installed base of more than 8,000 mammography units. The average waiting time for a screening appointment in a major Chinese city can be up to 3 weeks, signaling unmet demand. A key driver is the large-scale procurement by hospital chains, with single orders often exceeding 10 units.

Strategic Investments Reshaping the Global Breast Imaging Landscape

- GE HealthCare Acquires MIM Software: GE HealthCare completed its acquisition of MIM Software, a clinical workflow and AI firm, enhancing its capabilities in radiation oncology and molecular radiotherapy for breast cancer treatment.

- Volpara Health Technologies Acquired by Lunit: Lunit, a leading provider of AI solutions for cancer diagnostics, acquired Volpara Health Technologies for USD 193 million, combining AI and breast density

- RevealDx Secures USD 23 Million in Funding: RevealDx, an AI company focused on lung cancer diagnostics, secured significant funding that signals strong investor confidence in AI-powered imaging across various cancers, including breast.

- ProFound AI Secures NMPA Approval in China: iCAD, Inc. announced its ProFound AI for 2D mammography received regulatory approval from China's NMPA, marking a major investment and expansion into the Chinese market.

- ScreenPoint Medical Receives New FDA Clearance: ScreenPoint Medical's Transpara® AI software received FDA clearance for its new Image-Derived Score, representing continued investment in product enhancement for the U.S. market.

- CureMetrix and CureMatch AI Partner: A strategic partnership was formed between CureMetrix (AI for mammography) and CureMatch (precision oncology) to integrate imaging AI with treatment decision support.

- DeepHealth and RadNet Expand Partnership: DeepHealth, an AI software company, expanded its partnership with RadNet, the largest U.S. outpatient imaging provider, to deploy its AI mammography software across RadNet's national network.

- Annalise.ai and Siemens Healthineers Announce Collaboration: Annalise.ai entered a multi-year deal with Siemens Healthineers to integrate its AI triage and notification tools for chest X-rays, indicating broader AI platform integration relevant to mammography systems.

- Qure.ai Secures USD 40 Million in Funding: Qure.ai, a prominent medical imaging AI company, raised new funding to expand its global market presence, including its AI solutions for chest and head imaging, with applications transferable to breast imaging.

- RadNet Acquires Seven Outpatient Imaging Centers: RadNet invested in expanding its physical footprint by acquiring seven imaging centers, through its joint venture Arizona Diagnostic Radiology Group, in Phoenix, Arizona from Evernorth Care Group in January 2024.

Top Companies in the Mammography Systems Market

- Allengers Medical Systems Limited

- Fujifilm Holding Corporation

- General Electric Company

- Hologic Incorporated

- Konica Milota Incorporated

- Koninklijke Philips N.V. (Philips Healthcare)

- Metaltronica SPA

- Planmeca OY

- Siemens Aktiengesellschaft

- Toshiba Corporation

- Other Prominent Players

Market Segmentation Overview

By Product Type:

- Analog Mammography Systems

- Digital Mammography Systems

By Modality:

- Portable Mammography Systems

- Non-Portable Mammography Systems

By End User:

- Impatient Settings

- Ambulatory Surgical Centers

By Region:

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2024 | US$ 2,983.2 Million |

| Expected Revenue in 2033 | US$ 5,719.51 Million |

| Historic Data | 2020-2023 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Unit | Value (USD Mn) |

| CAGR | 7.5% (2023-2031) |

| Segments covered | By Product Type, By Modality, By End-User, By Region |

| Key Companies | Allengers Medical Systems Limited, Fujifilm Holding Corporation, General Electric Company, Hologic Incorporated, Konica Milota Incorporated, Koninklijke Philips N.V. (Philips Healthcare), Metaltronica SPA, Planmeca OY, Siemens Aktiengesellschaft, Toshiba Corporation , Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)