Malaysia Physical Security Market: By Component (System (Physical Access System, Video Surveillance System, Perimeter Intrusion & Detection, Physical Identity & Access Management, Physical Security Information Management and Others) and Service Type (Access Control as a Service, Video Surveillance as a Service, Remote Monitoring Service, Security System Integration Service, Professional Services, and Others); Enterprise Size (Small & Medium Enterprises and Large Enterprises); Industry (BFSI, Government, Retail, Transportation, Residential, IT & Telecom, and Others); Region—Market Forecast and Analysis for 2024–2032

- Last Updated: Feb-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA0823554 | Delivery: 2 to 4 Hours

| Report ID: AA0823554 | Delivery: 2 to 4 Hours

Market Scenario

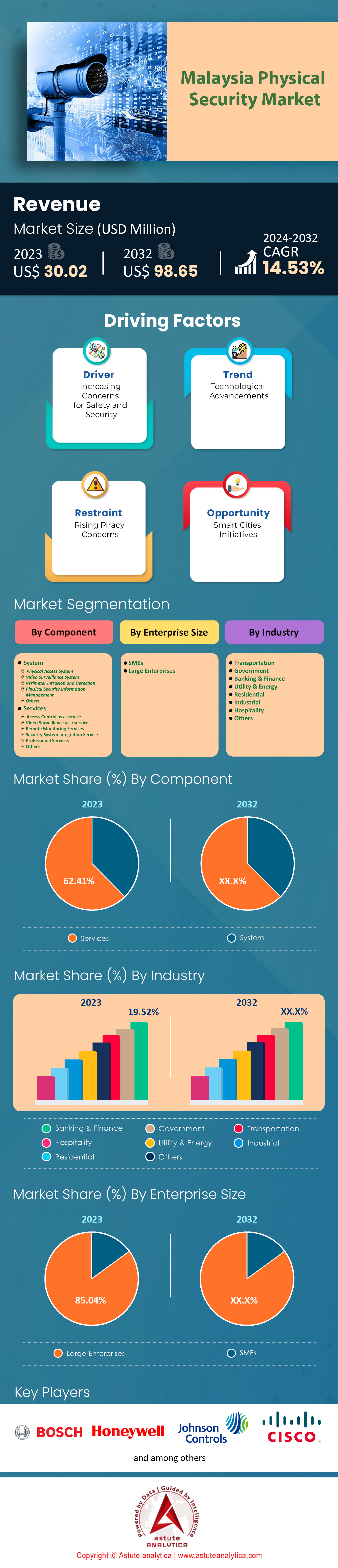

Malaysia physical security market was valued at US$ 30.02 million in 2023 and is projected to surpass the market size of US$ 98.65 million by 2032 at a CAGR of 14.53% during the forecast period 2024–2032.

Malaysia has been experiencing a surge in the demand for physical security over the past few years. This demand is driven by a variety of factors, from socio-economic to geopolitical considerations. Based on current trends and the growing commercialization in urban centers like Kuala Lumpur, Penang, and Johor Bahru, the number of security personnel has seen a steady increase in these cities in the country. Additionally, the increasing number of high-rise condominiums, gated communities, commercial centers, and special economic zones further contribute to the demand for physical security market.

The number of establishments or stores needing security is also significant. Most commercial establishments, ranging from shopping malls, office buildings, hotels, and resorts, to schools and hospitals, usually employ security services, either in-house or outsourced. With the rise in tourism and international business activities in the country, the need for security in these sectors has also intensified. However, the demand and supply scenario for physical security services in Malaysia has always been dynamic. Historically, the supply often struggled to keep up with the burgeoning demand. The high demand is not just in quantity but also in quality; many businesses and residential areas in the Malaysia physical security market now prefer guards who are equipped with modern security training, capable of handling advanced security systems, and adept at crisis management.

While many security firms in the Malaysia have risen to the occasion by providing extensive training programs and incorporating technology into their services, a gap still remains. This has led to a situation where many establishments are willing to pay a premium for highly skilled security personnel, leading to increased wages and benefits in some sectors of the security industry. As a result, immigrants have played a substantial role in the Malaysian security sector. Many security personnel, particularly at the lower levels, are from neighboring countries, primarily Nepal, Indonesia, and Myanmar. While Malaysia has benefited from this influx of foreign labor – given that they often fill roles that are in high demand – there have also been challenges.

Besides the personnel, there's a growing demand for advanced physical security technologies. Surveillance systems, biometric access controls, and integrated security management platforms are being rapidly adopted across the Malaysia physical security market. This trend is driven by both the increasing affordability of such technologies and a growing awareness of their efficacy. Furthermore, special events, international summits, and conventions held in Malaysia further push the demand for short-term, high-quality physical security services. Event security requires a unique set of skills, including crowd management, emergency response, and coordination with local law enforcement, which again emphasizes the need for well-trained and experienced personnel.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Interplay of Economic Growth, Urbanization, Terrorism, and Political Instability Fuels Growth in Malaysia's Physical Security Market

The demand for physical security in Malaysia is experiencing a remarkable upswing, driven by the interplay of several compelling factors. As of 2022, statistics indicate a significant increase in security spending across various sectors. The physical security market in Malaysia is projected to grow at a CAGR of 13.56% from 2023 to 2030.

The first driving force behind the growth of the market is Malaysia's rapid economic growth, bolstered by foreign investments. As the economy expands, the value of assets and infrastructure escalates, intensifying the need for comprehensive security measures. In 2021 alone, foreign direct investments (FDI) in Malaysia rose by 35.5% compared to the previous year, reaching a record high of MYR 80.8 billion. This economic surge has prompted businesses and individuals to prioritize investments in cutting-edge physical security technologies to safeguard their assets and operations.

On the other hand, urbanization and population growth have redefined security dynamics in the country. The urban population is projected to increase to 80% by 2030, making urban areas more vulnerable to security risks. This trend necessitates advanced security solutions to protect residents, businesses, and public spaces. In response, the demand for video surveillance systems, access control solutions, and biometric authentication technologies has witnessed substantial growth. Furthermore, the growing concern about terrorism and political instability in the region has become a significant driver. The threat of terrorism has remained a key security challenge for Malaysia, prompting the government and private entities to invest in enhancing security measures across critical infrastructure and events. Notably, the government's initiatives to combat terrorism and strengthen homeland security have provided additional momentum to the physical security market.

Trend: Transformative Smart Technologies Shaping the Future of Physical Security in Malaysia

In recent years, the physical security market in Malaysia has undergone significant transformations, driven by technological advancements, changing security needs, and a growing emphasis on data-driven solutions. Malaysia's physical security sector has embraced the era of the Internet of Things (IoT) and smart technologies. By integrating interconnected security systems, sensors, and surveillance cameras, organizations gain access to real-time monitoring and analytics, enabling quicker decision-making and proactive responses. This trend has empowered stakeholders with enhanced situational awareness and greater control over security assets, proving especially valuable for large-scale facilities, transportation hubs, and smart city initiatives.

The adoption of biometric authentication solutions, including fingerprint and facial recognition, has surged across diverse industries in Malaysia. By offering higher levels of security, biometrics have gradually replaced conventional access control methods like keys and access cards. The appeal of biometric technology lies in its accuracy, efficiency, and ability to ensure secure access to sensitive areas, bolstering the overall safety of establishments.

The proliferation of cloud-based physical security solutions has revolutionized how businesses manage their security infrastructure in the Malaysia physical security market. Organizations in Malaysia have increasingly migrated to the cloud to leverage its benefits, such as remote accessibility, scalability, and reduced capital expenditure on hardware. Moreover, cloud-based systems have facilitated seamless integration with other applications and devices, streamlining security management for both small and large enterprises.

The convergence of video analytics and artificial intelligence has ushered in a new era of intelligent video surveillance in Malaysia. AI-powered security solutions enable advanced video analysis, including object detection, facial recognition, and behavioral analytics. By automating threat detection and response, these technologies empower security personnel to focus on critical tasks, leading to more efficient and effective surveillance operations.

Restrain: High-Cost Constraints to Limit the Growth of Malaysia Physical Security Market

The implementation of comprehensive physical security solutions in Malaysia faces significant cost constraints. For small and medium-sized enterprises (SMEs), the initial setup and ongoing maintenance expenses prove burdensome. The high costs encompass acquiring advanced security equipment, system integration, and employing skilled personnel. As a result, some businesses may hesitate to invest in modern security technologies, leaving them vulnerable to potential security risks. Another restraint is the lack of awareness and education about the benefits of advanced physical security solutions. Many organizations in Malaysia remain unaware of the risks they face and the available technologies to mitigate them. This knowledge gap can lead to underinvestment in security measures, hampering the overall preparedness of businesses and individuals against security threats.

The fragmented regulatory environment governing physical security also presents challenges in the physical security market. With varying standards and regulations to comply with, businesses may encounter delays in adopting new security technologies and practices. The complexity of adhering to multiple standards can deter companies from upgrading their security infrastructure, hindering the industry's growth potential.

Segmental Analysis

By Component

In the Malaysia physical security market, the service type segment has emerged as the dominant component, contributing significantly to market revenue. As of 2023, this segment accounted for more than 62% of the total market revenue and is projected to maintain steady growth with a Compound Annual Growth Rate (CAGR) of 14.07% during the forecast period.

The service type segment encompasses various offerings tailored to meet the evolving security needs of businesses and organizations. These services include Access Control as a Service, Video Surveillance as a Service, Remote Monitoring Service, Security System Integration Service, and Professional Services. Access Control as a Service provides secure access management solutions to restrict entry to authorized personnel only. Video Surveillance as a Service enables businesses to deploy surveillance cameras with remote access and cloud storage. Remote Monitoring Service allows real-time monitoring of security systems and alerts for prompt response to incidents. Security System Integration Service offers seamless integration of various security components for comprehensive protection. Professional Services encompass expert consultation, implementation, and maintenance support to ensure optimal security solutions.

Given the increasing demand for comprehensive security measures and the growing adoption of advanced technologies, the service type segment is expected to witness sustained growth, catering to the diverse security requirements of businesses across various industries.

By Enterprise Size

The Malaysia physical security market is heavily dominated by large enterprises in terms of enterprise size. As of 2023, large enterprises held over 85% of the total revenue share, indicating their significant influence in driving the demand for physical security solutions. The forecast also suggests that large enterprises will continue to play a leading role, with an expected CAGR of 13.43% in the coming years. Large enterprises often have complex security needs and substantial resources to invest in advanced physical security solutions. These organizations prioritize robust security infrastructure to protect their valuable assets, sensitive data, and critical operations. Their requirements encompass a wide range of security components, from access control and video surveillance to sophisticated analytics and integration services.

While large enterprises lead the market, there is still ample room for growth among small and medium-sized enterprises (SMEs). As awareness of security threats increases and technological advancements become more accessible, SMEs are expected to become increasingly receptive to adopting physical security solutions tailored to their specific needs.

To Understand More About this Research: Request A Free Sample

By Industry

Based on industry, government of Malaysia is largest end users of the physical security to safeguard infrastructure, national defense requirements, and public safety obligations. In 2023, the government accounted for 17.75% revenue share of Malaysia physical security market. Each year, the government allocate and spend huge amounts of money on ministries such as Ministry of Defense, Ministry of Home Affairs among others to provide physical security. These departments have the duty to protect the country’s borders, government installations, and public areas which calls for robust physical security systems. The number of personnel in Royal Malaysian Police force is more than 130,000 where a good fraction takes up roles related with providing physical protection hence reflecting on how committed the government is in this sector alone. Moreover, Ministry of Defense with its MYR 15.1 billion budget (as at 2023) has wide ranging military base security’s needs. This cover defense installations as well strategic assets guarding requirements.

Besides being responsible for immigration matters, prisons management, and internal security within nation, the Malaysian Immigration Department oversees over 150 entry points throughout Malaysia and therefore demanding strict adherence to safety measures while undertaking these duties. In addition, there are many correctional facilities run by department of prison services thus creating need for holistic approach towards enhancing physical protection mechanisms.

The number of government responsibilities in different departments makes the government the biggest employer in physical security as a sector. The Ministry of Health alone looks after 145 government hospitals, while the Ministry of Education is responsible for securing more than 10,000 public schools all over the country. Moreover, thousands are employed by the Ministry of Transport which deals with airport and port security. They work as security personnel safeguarding vital installations against any threats. These figures indicate just how wide-ranging and diverse this field can be within Malaysia itself.

Top Players in Malaysia Physical Security Market

- Cisco Systems, Inc.

- Entrypass Corporation

- Genetec Inc.

- Hangzhou Hikvision Digital Technology Co., Ltd.

- Johnsons Control

- NEC Corporation

- Robert Bosch GmbH

- RSS security sdn bhd

- Securiforce Group

- Other Prominent Players

Market Segmentation Overview:

By Component

- System

- Physical Access System

- Video Surveillance System

- Perimeter Intrusion & Detection

- Physical Identity & Access Management

- Physical Security Information Management

- Others

- Service Type

- Access Control as a Service

- Video Surveillance as a Service

- Remote Monitoring Service

- Security System Integration Service

- Professional Services

- Others

By Enterprise Size

- Small & Medium Enterprises

- Large Enterprises

By Industry

- Banking & Finance

- Government

- Utility & Energy

- Transportation

- Residential

- Industrial

- Hospitality

- Others

View Full Infographic

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2023 | US$ 30.02 Million |

| Expected Revenue in 2032 | US$ 98.65 Million |

| Historic Data | 2019-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Unit | Value (USD Mn) |

| CAGR | 14.53% |

| Segments covered | By Component, By Enterprise Size, By Industry |

| Key Companies | Cisco Systems, Inc., Entrypass Corporation, Genetec Inc., Hangzhou Hikvision Digital Technology Co., Ltd. , Johnsons Control, NEC Corporation, Robert Bosch GmbH, RSS security sdn bhd, Securiforce Group, Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA0823554 | Delivery: 2 to 4 Hours

| Report ID: AA0823554 | Delivery: 2 to 4 Hours

.svg)