Malaysia Microfinancing Market: By Provider (Bank, Non-governmental Organizations (NGOs), Non-banking Financial Institution (NBFCs), and Others); End Users (Medium Enterprises, Small Enterprises, Micro Enterprises, Self Employed, and Others); Country—Market Size, Industry Dynamics, Opportunity Analysis and Forecast For 2024–2032

- Last Updated: Apr-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA0424812 | Delivery: 2 to 4 Hours

| Report ID: AA0424812 | Delivery: 2 to 4 Hours

Market Scenario

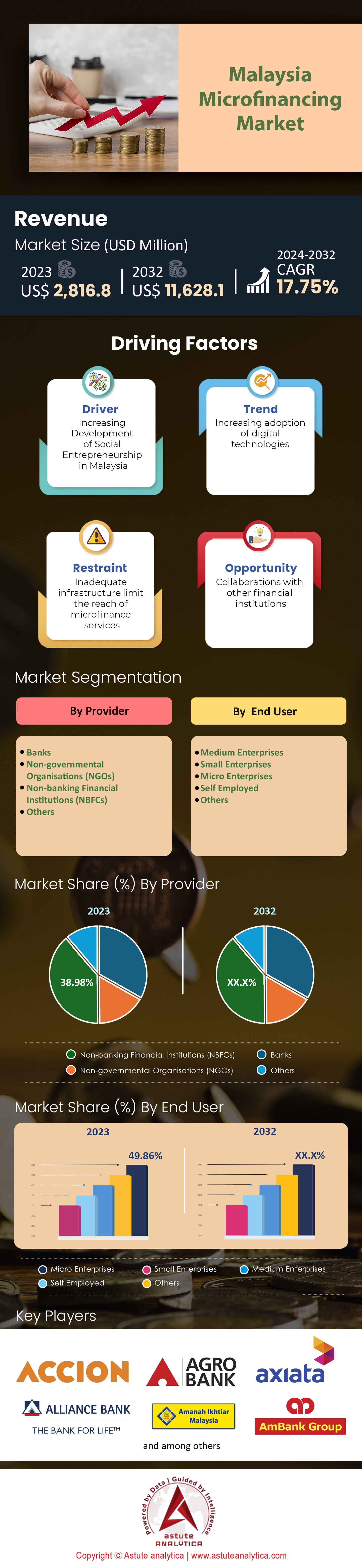

Malaysia Microfinancing Market was valued at US$ 2,816.8 million in 2023 and is projected to hit the market valuation of US$ 11,628.1 million by 2032, at a CAGR of 17.75% during the forecast period 2024–2032.

The microfinancing market in Malaysia has been on the rise, and there are many reasons why that’s been the case. One of them is the fact that people have been looking to expand financial initiatives so more people can get involved. In addition, the country as a whole has seen a large uptick in entrepreneurship, which naturally increases demand for credit among communities that otherwise wouldn’t be able to get it. Government organizations such as Bank Negara Malaysia and Malaysian Industrial Development Finance Berhad have also done their part in allocating funding and providing support to microfinance institutions, which has played a big role in their development. Another example of this is when BNM provided RM 500 million (about USD 120 million) to the sector through its Microenterprise Facility (MEF). As for what’s planned for future, government officials have said their investment will be directed at programs that promote social and environmental objectives.

In addition to the growth of microfinance institutions themselves, we’ve also seen an increase in borrowers who utilize these services. Data from BNM shows that there were over 2.5 million borrowers as of 2021, which demonstrates how easy it is to get one of these loans compared to a traditional one. When COVID-19 hit and put a strain on everybody's wallets throughout Malaysia, many microfinance institutions stepped up by implementing loan moratoriums and reducing interest rates in the Malaysia’s microfinancing market. These measures helped existing customers stay afloat during tough times while also showing just how resilient they are during economic uncertainty.

In terms of what’s next for Malaysia’s microfinancing market, experts predict even better efficiency and reach thanks to more digitization across the industry. For example: mobile banking apps whose sole purpose is helping low-income individuals manage their assets could become very popular very soon. Additionally, fintech startups like VICI Capital who specialize in small lending have the potential to revolutionize how these companies serve their clientele base.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Government Support, Initiatives, and Rising Entrepreneurship:

In Malaysia, an entrepreneurial spirit and government initiatives have come together to create a flourishing microfinancing market. Government assistance such as Bank Negara Malaysia’s Microenterprise Facility (MEF) is injecting tons of money into the sector, with aims to strengthen it and help small businesses succeed. For instance, the MEF allocated RM 500 million in 2021—equivalent to about USD 120 million—to microfinance. It's clear that the government is taking the sector seriously and wants to see it grow. The country's SME sector also contributes a significant portion to its GDP. At 38.4%, SMEs made up nearly two-fifths of all economic activity in 2023. There were over 1,154,809 SMEs in the country during that year too—a number that has surely grown since then.

With the rapid increase in registered businesses from 2019-20 (it went up by 1.5%), it’s clear that people are eager to hop on opportunities in various markets. That eagerness paired with a favorable regulatory environment make for perfect conditions for someone looking for investment or innovation within the microfinance sector. Thanks to these factors, more people are starting their own businesses than ever before—which mean they need capital if they want to succeed. Microfinance institutions provide that support entrepreneurs need when starting out, thus driving market growth and making way for economic development.

Trend: Increasing Adoption of Digital Technologies

Malaysian microfinancing market has seen a digital surge in the past few years. People now prefer using technology for financing and transactions rather than traditional measures. Bank Negara Malaysia reveals that from 2019 to 2021, mobile banking usage rose by 73%, showing increasing dependence on digital channels. During the last three years, online lending platforms have increased by an annual rate of 25%, giving people easy access to microfinance services. The country experienced a 17% jump in digital payment transactions last year — a sign that cashless payments are becoming more popular. This is supported by the fact that fintech investment reached $376m in 2021, with most going towards digital lending platforms. Wallets were also adopted at a rapid pace; more than 46 million registered users were recorded this year alone.

Microfinance institutions are even looking into blockchain technology and AI-powered credit scoring to improve efficiency and accessibility. Open banking initiatives encourage banks and fintechs to work together while peer-to-peer lending platforms offer extra financing options. Clients can use robo-advisors, digital microinsurance products, and apps for financial education as well as make API integrations, cloud-based solutions, and biometric authentication for security matters. Last but not least, regulatory sandboxes create an environment where innovation can thrive without breaking any regulations or laws.

Opportunity: Microfinancing for Agro-based Industries

Malaysia's agricultural sector is a significant contributor to its economy, making up 7.4% of GDP in 2022. Vegetable production rose slightly by 0.9% in the same year. Pahang led as the highest producer at 35.1%. However, fruit production dropped marginally by 0.7% in 2023 compared to 2022. Microfinancing market plays an important role in supporting agro-based industries in Malaysia. Agrobank - a government-owned bank - grants microloans at attractive flat rates between 8-11%. Commercial banks also provide loans for these industries, but with higher annual rates ranging from 20-35%. Interestingly, these numbers are lower than the global microfinance average interest and fee rate of 37%.

The National Agro-food Policy (NAP) which was implemented from 2011 to 2020 has established three main objectives namely ensuring food security; boosting competitiveness and sustainability of agro-food industry; increasing agricultural entrepreneur's income level. Malaysia has always been dependent on import and export of finished products to boost economic growth, same goes for Malaysia's agriculture industry where competitiveness within local industry determines import and export dynamics for agro-food product.

There are several institutions in the Malaysia’s microfinancing market that provide microfinancing specifically for the needs of agrobased sectors such as Development Financial Institutions: Agrobank, Bank Rakyat and Bank Simpanan Nasional; while seven banking institutions namely Alliance Bank, AmBank, CIMB Bank, Public Bank Maybank United Overseas Bank and Bank Muamalat provide microfinance facilities. A total of RM132.6 billion approved investments were recorded across services, manufacturing and primary sectors during January-June period this year. The investments will lead to creation of over 51,850 job opportunities with more than one-third or over.

Challenge: Lower Financial Literacy and Awareness

In the dense landscape of microfinancing market in Malaysia, a problem that keeps this sector from being at its most effective is a lack of financial know-how and awareness among people, especially those in rural areas. Even with the government’s efforts to promote knowing one’s money matters, many people still don’t have enough information about products and services. In fact, only 37% of Malaysians know enough to make informed financial choices as stated by a survey done by Bank Negara Malaysia. This lack of knowledge keeps them away from accessing and making use of financial services even further. Microfinance programs won’t be able to provide economic empowerment if folks can't access these services due to their own ignorance.

It’s quite easy to see how bad it is for folks living outside urban areas — resources are limited down there! If we specifically look at Sabah and Sarawak, we’ll find that infrastructural limits and cultural barriers prevent these rural communities from accessing financial literacy programs. People instead rely on informal practices because they don’t even know more formal institutions exist in the microfinancing market. With no concept of where or how to get help building sustainable businesses using microfinance opportunities, it’s impossible for them to improve their livelihoods.

Research also shows that women tend to have lower levels of financial knowledge than men do in terms of literacy. Shockingly enough, only 35% of Malaysian women have adequate skills compared to 38% for men. It not only makes women more prone to being financially excluded but it also keeps them away from entrepreneurship and economic freedom which is what microfinancing excels at providing. To fix all this will require a lot more effort than simply creating educational programs: community outreach initiatives and digital literacy campaigns will also need doing too. Microfinance institutions can aid in increasing awareness by integrating education into the services they already offer so clients can feel confident when making decisions about money matters.

Segmental Analysis

By Provider

NBFCs segment is leading the Malaysia microfinancing market with more than 38.98% in 2023 and the segment is also projected to keep growing at the highest CAGR of 18.47% during the forecast period.

Non-banking financial institutions (NBFIs) are crucial to Malaysia's microfinance market for several reasons as they offer a wide range of financial products that cater to the needs of their clients, such as microcredit, microinsurance, and micro-savings. Amanah Ikhtiar Malaysia (AIM), for example, is a great instance of this as it provides financial assistance to low-income individuals and micro-entrepreneurs. While not being in the NBFC category, its role remains prominent in the microfinancing market since it contributes toward building up the country’s microfinance sector. Moreover, NBFIs have more branches and agents compared to traditional banks — which makes them more accessible in rural areas where most of their clients reside. In addition to their extensive reach, they typically require less collateral or formal credit history than regular banking institutions. To add on top of all these benefits some NBFIs specializes solely on providing services related to microfinance. Their approach helps them tailor specific expertise for this niche sector making them better suited than other providers who don’t focus.

Technological advances like mobile banking systems along with effective digital payment systems further accelerate their growth rate and prominence in Malaysia's financial market. Collaborations with government organizations also help expand outreach and support services through channels like cooperatives and NGOs bringing clients closer to the services they need in areas where others may not be able to provide. Finally, small businesses' increasing demands for such services coupled with low incomes has caused an upswing in demand for NBFIs over the years.

By End User

Micro Enterprises segment holds highest share of 49.86% in the Malaysia microfinancing market and is projected to grow at the highest CAGR of 18.25% during the forecast period. With almost 98.5% of businesses in Malaysia belonging to the microenterprises category, it’s no secret that there is a large demand for microfinancing products and services. Helping this segment take its revenue dominance is government initiatives aimed at supporting small businesses and fostering entrepreneurship. Even though they are small, these businesses have big dreams and with the help of microfinance offerings, these dreams are made possible through access to funding for expansion, working capital and asset acquisition.

Getting these services has become easy thanks to modern technology such as digital platforms and mobile banking solutions, which make transactions easier. Non-banking financial institutions (NBFIs) are committed to offering tailored financial products to microenterprises by leveraging their expertise and extensive network. They also offer their partnership with government agencies or NGOs as an extension of outreach and support services for microenterprises. The market prominence of Micro Enterprises in Malaysia's microfinancing market underscores their irreplaceable role in driving economic growth while fostering entrepreneurship. Small businesses are important contributors to the country's economy so providing them with a way to start up should be priority number one.

To Understand More About this Research: Request A Free Sample

Recent Developments

- In December 2023, Alliance Islamic Bank launches 1st zakat microfinancing program

- In September 2023, AMBANK (M) Bhd and BSN partner on an MSME development program, "Amplifying MSMEs Programme". The program targets the growth of 200 businesses previously supported by BSN's microfinancing.

- In August 2023, Prime Minister Anwar Ibrahim announced the i-Tekad microfinance program's funding has been increased to RM10 million, aiding low-income groups

- In August 2023, Malaysian company, GHL, provides new loan options for small businesses in the Philippinesicro

Key Players in the Malaysia Microfinancing Market

- Accion

- Agrobank

- Alliance Islamic Bank (Alliance Bank Malaysia Berhad)

- Amanah Ikhtiar Malaysia

- AmBank Group comprises AMMB Holdings Berhad

- Axiata Group Berhad

- Bank Muamalat Malaysia Berhad

- Bank Negara Malaysia

- CIMB Group Holdings Berhad

- Fundaztic

- GHL Systems Berhad

- ipay88

- Malayan Banking Berhad

- Ringgit Plus (Jirnexu Sdn Bhd)

- Rakyat Bank

- Other prominent players

Market Segmentation Overview:

By Provider

- Banks

- Non-governmental Organisations (NGOs)

- Non-banking Financial Institutions (NBFCs)

- Others

By End User

- Medium Enterprises

- Small Enterprises

- Micro Enterprises

- Self Employed

- Others

View Full Infographic

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2023 | US$ 2,816.8 Mn |

| Expected Revenue in 2032 | US$ 11,628.1 Mn |

| Historic Data | 2019-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Unit | Value (USD Mn) |

| CAGR | 17.75% |

| Segments covered | By Provider, By End User |

| Key Companies | Accion, Agrobank, Alliance Islamic Bank (Alliance Bank Malaysia Berhad), Amanah Ikhtiar Malaysia, AmBank Group comprises AMMB Holdings Berhad, Axiata Group Berhad, Bank Muamalat Malaysia Berhad, Bank Negara Malaysia, CIMB Group Holdings Berhad, Fundaztic, GHL Systems Berhad, ipay88, Malayan Banking Berhad, Ringgit Plus (Jirnexu Sdn Bhd), Rakyat Bank, Other prominent players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA0424812 | Delivery: 2 to 4 Hours

| Report ID: AA0424812 | Delivery: 2 to 4 Hours

.svg)