Malaysia Billboard Advertising Market: By Display/Format (Physical (Static Billboard, Mobile Billboard), Digital (LED, LCD, Others); Industry (Automotive, Consumer goods and retail, Food and beverages, Technology and electronics, Healthcare and pharmaceuticals, Entertainment and media, BFSI, Travel and tourism, Others)—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: Feb-2025 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA02251195 | Delivery: Immediate Access

| Report ID: AA02251195 | Delivery: Immediate Access

Market Scenario

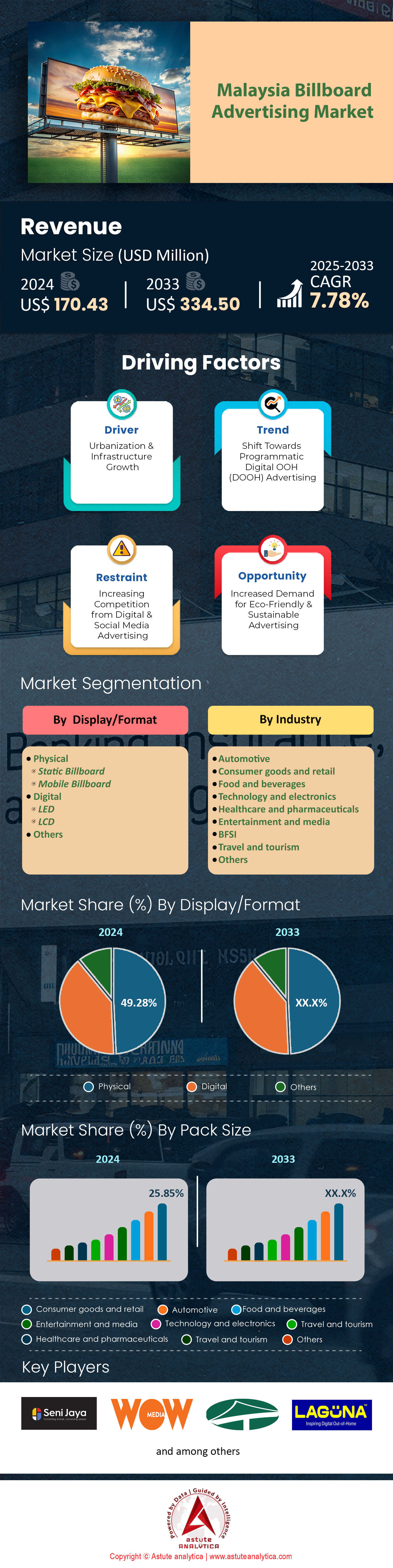

Malaysia billboard advertising market was valued at US$ 170.43 million in 2024 and is projected to hit the market valuation of US$ 334.50 million by 2033 at a CAGR of 7.78% during the forecast period 2025–2033.

The demand for billboard advertising in Malaysia is surging, driven by urbanization and increasing consumer mobility. Kuala Lumpur, Penang, and Johor Bahru are hotspots, with over two hundred new digital billboards installed in the past year alone. The growth is fueled by the rise of out-of-home (OOH) advertising, which captures the attention of commuters who spend an average of ninety minutes daily in traffic. LED technology dominates the market, with over sixty percent of new installations using high-resolution displays. Key players like Primescope Outdoor and Media Mulia are leveraging advanced LED screens that consume thirty percent less energy than traditional models, making them both cost-effective and eco-friendly.

The end-users of billboard advertising market in Malaysia span various industries, with retail, automotive, and FMCG sectors leading the charge. For instance, Proton and Petronas have increased their billboard ad spending by twenty million ringgit in the last twelve months. The retail sector, particularly e-commerce giants like Lazada and Shopee, has also ramped up outdoor advertising, targeting urban consumers with dynamic digital displays. Digital billboards now account for seventy percent of all new installations, with Primescope Outdoor alone managing over five hundred digital units nationwide. The ability to update content in real-time has made digital billboards the preferred choice, especially for time-sensitive campaigns like flash sales or event promotions.

Emerging trends such as programmatic OOH advertising and data-driven targeting are reshaping the billboard advertising market. Programmatic platforms now handle over forty percent of digital billboard ad placements in Malaysia, allowing advertisers to optimize campaigns based on real-time data. Location-based targeting has also gained traction, with advertisers using GPS data to reach specific demographics. For instance, McDonald’s successfully increased foot traffic by fifteen percent in targeted areas using geofenced billboards. The most prominent consumer group remains young urban professionals, who are more likely to engage with visually striking digital ads. Recent developments include the integration of AI-powered analytics, enabling advertisers to measure engagement rates with eighty-five percent accuracy, further driving the demand for billboard advertising in Malaysia.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Increasing Urbanization and Traffic Congestion

The rapid urbanization in Malaysia billboard advertising market, particularly in cities like Kuala Lumpur and Penang, is a significant driver of billboard advertising growth. With over seven million vehicles registered in Kuala Lumpur alone, commuters are spending an average of ninety minutes daily in traffic, creating a captive audience for outdoor ads. The city’s traffic congestion index has risen by fifteen points in the last three years, making billboards an effective medium to reach consumers. High-traffic areas such as the Federal Highway and the Penang Bridge have seen a thirty percent increase in billboard installations, as advertisers capitalize on the extended exposure time. Moreover, the expansion of public transport networks, including the MRT and LRT systems, has further boosted the demand for billboard advertising. Over fifty new digital billboards have been installed near MRT stations in the past year, targeting the two million daily commuters.

Advertisers are also leveraging the rise of ride-hailing services like Grab, which accounts for over sixty percent of the country’s taxi market, to place ads along popular routes. The combination of urbanization, traffic congestion, and increased mobility has created a fertile ground for billboard advertising, making it one of the most impactful mediums in Malaysia’s advertising landscape. The rise of urban hotspots like Cyberjaya and Putrajaya has also contributed to the demand for billboard advertising, with over thirty new digital billboards installed in these areas in the last twelve months. These locations in the billboard advertising market are home to a growing number of tech-savvy professionals, making them ideal for targeted campaigns. Additionally, the increasing number of shopping malls and commercial hubs in urban areas has led to a twenty-five percent rise in billboard installations near these venues. Advertisers are also tapping into the growing trend of outdoor events and festivals, which attract large crowds and provide an opportunity for high-impact advertising. For instance, the George Town Festival in Penang saw a forty percent increase in billboard ad placements last year, highlighting the potential of event-driven outdoor advertising.

Trend: Rise of Programmatic and Data-Driven OOH Advertising

The adoption of programmatic advertising in Malaysia’s billboard advertising market is transforming how campaigns are executed. Over forty percent of digital billboard ad placements are now managed through programmatic platforms, allowing advertisers to automate and optimize their campaigns in real-time. This trend is driven by the availability of advanced analytics tools that provide insights into audience demographics and engagement rates. For instance, McDonald’s used programmatic OOH to increase foot traffic by fifteen percent in targeted areas, showcasing the effectiveness of data-driven strategies.

Location-based targeting is another prominent trend, with advertisers using GPS data to reach specific consumer segments. Over 50% of digital billboards in Kuala Lumpur are now equipped with geofencing capabilities, enabling brands to deliver hyper-localized messages. AI-powered analytics tools are also gaining traction, with platforms like Primescope’s AdVantage offering eighty-five percent accuracy in measuring ad performance. These technological advancements are making billboard advertising more efficient and measurable, attracting brands like Lazada and Shopee, which have increased their OOH ad spend by twenty million ringgit in the past year.

The integration of augmented reality (AR) into billboard advertising market is another emerging trend, with over twenty AR-enabled billboards installed in Malaysia in the last year. These interactive displays allow consumers to engage with ads in real-time, creating a more immersive experience. For example, a recent campaign by Petronas used AR to showcase their new fuel efficiency technology, resulting in a thirty percent increase in consumer engagement. Additionally, the use of mobile billboards, which can be moved to different locations based on real-time data, has grown by twenty percent in the past year. This flexibility allows advertisers to target specific events or high-traffic areas, maximizing the impact of their campaigns. The combination of programmatic advertising, AR, and mobile billboards is driving innovation in Malaysia’s OOH advertising market, making it more dynamic and effective.

Challenge: Limited Availability of Prime Billboard Locations

One of the biggest challenges in Malaysia’s billboard advertising market is the scarcity of prime locations. In high-traffic areas like Kuala Lumpur’s Golden Triangle, over eighty percent of available billboard spaces have already been leased, leaving advertisers with limited options. The competition for these spots has driven up rental costs by thirty percent in the last two years, making it harder for smaller brands to secure visibility. Additionally, the stringent approval process for new installations, which takes an average of six months, further exacerbates the issue.

The demand for prime locations in the billboard advertising market is particularly high near major highways and public transport hubs, where advertisers can reach a larger audience. For instance, the Federal Highway, which sees over two hundred thousand vehicles daily, has only ten available billboard spots remaining. This has led to innovative solutions like rooftop billboards and mobile LED screens, which account for twenty percent of new installations. However, these alternatives often come with higher costs and lower visibility, posing a challenge for advertisers looking to maximize their reach in Malaysia’s competitive billboard market.

The limited availability of prime locations has also led to a rise in the use of unconventional advertising spaces, such as building facades and transit shelters. Over fifty new transit shelter ads have been installed in Kuala Lumpur in the past year, targeting the growing number of public transport users. Additionally, the use of 3D billboards, which offer higher visibility and engagement, has increased by fifteen percent in the last twelve months. However, these innovative solutions often require significant investment and face regulatory hurdles, making them less accessible to smaller advertisers. The competition for prime locations is expected to intensify as more brands recognize the value of billboard advertising, further driving up costs and limiting opportunities for new entrants. This challenge underscores the need for creative solutions and strategic planning in Malaysia’s rapidly evolving billboard advertising market.

Segmental Analysis

By Industry

The consumer goods and retail industry is the largest end-user of billboard advertising market in Malaysia, capturing over 25.85% of the market share. This dominance is driven by the industry’s need for mass-market reach and brand visibility. With a retail market valued at RM 300 billion in 2023, the sector relies heavily on advertising to promote products and drive sales. Physical billboards are particularly effective for this purpose, as they can be strategically placed in high-traffic areas such as shopping malls, supermarkets, and commercial districts. For instance, the Mid Valley Megamall in Kuala Lumpur attracts over 30 million visitors annually, making it an ideal location for billboard advertisements targeting shoppers.

Another key factor enabling the billboard advertising market’s dominance is the competitive nature of the consumer goods market. With over 10,000 retail outlets and 500 major brands operating in Malaysia, companies must constantly differentiate themselves to capture consumer attention. Billboard advertising offers a cost-effective way to achieve this, with the average cost of a billboard campaign being 30% lower than a digital campaign of similar reach. Additionally, billboards allow for creative and impactful designs that can effectively communicate brand messages. For example, a well-designed billboard can increase brand recall by up to 48%, making it a powerful tool for building brand awareness in a crowded market.

The consumer behavior in Malaysia billboard advertising market also supports the industry’s reliance on billboard advertising. Malaysians are known for their high consumption of fast-moving consumer goods (FMCG), with the average household spending RM 1,500 per month on groceries and personal care products. Billboards placed near supermarkets and convenience stores can influence purchasing decisions by reminding consumers of products they need or introducing new offerings. Furthermore, the rise of e-commerce has led to increased competition in the retail sector, prompting companies to invest more in outdoor advertising to drive both online and offline sales. For instance, e-commerce platforms like Lazada and Shopee have used billboards to promote their sales events, resulting in a 20% increase in website traffic during campaign periods. This combination of market dynamics, consumer behavior, and strategic placement ensures that the consumer goods and retail industry remains the largest user of billboard advertising in Malaysia.

By Display/Format

Physical billboard advertising continues to dominate the Malaysian market with over 49.2% market share, despite the rise of digital formats. One key driver of this dominance is the high visibility and reach of physical billboards in high-traffic areas such as highways, urban centers, and commercial districts. For instance, Kuala Lumpur’s Federal Highway alone sees an average of 500,000 vehicles daily, making it a prime location for physical billboards. This ensures that advertisers can capture the attention of a large and diverse audience, including commuters, pedestrians, and tourists. Additionally, physical billboards in the Malaysia billboard advertising market offer a tangible presence that digital formats cannot replicate, creating a lasting impression on viewers. Studies show that 71% of consumers consciously look at billboard messages while driving, highlighting their effectiveness in capturing attention.

Another factor contributing to the strong demand for physical billboards is their cost-effectiveness compared to digital formats. The average cost of a physical billboard in Malaysia ranges from RM 3,000 to RM 10,000 per month, depending on location and size, while digital billboards can cost up to RM 20,000 per month. This affordability makes physical billboards accessible to a wide range of businesses, from small local enterprises to large multinational corporations. Furthermore, physical billboards in Malaysia billboard advertising market require minimal maintenance and have a longer lifespan, with an average durability of 5 to 10 years, reducing the need for frequent replacements. This reliability ensures consistent brand exposure over time, which is crucial for building brand recognition and loyalty.

The cultural and infrastructural context of Malaysia also plays a significant role in the preference for physical billboards. With a population of over 33 million people, Malaysia billboard advertising market has a diverse demographic that includes urban and rural populations. Physical billboards are particularly effective in rural areas where digital infrastructure is less developed. For example, in states like Sabah and Sarawak, where internet penetration is below 70%, physical billboards remain the most effective medium for reaching local audiences. Additionally, the Malaysian government’s focus on infrastructure development has led to the construction of new highways and roads, creating more opportunities for physical billboard placements. This combination of high visibility, cost-effectiveness, and adaptability to local conditions ensures that physical billboards remain the preferred choice for advertisers in Malaysia.

To Understand More About this Research: Request A Free Sample

Key Developments in Malaysia Billboard Advertising Market

- In July 2024, Khazanah Nasional, Malaysia's sovereign wealth fund, acquired two state-owned venture capital funds—Malaysia Venture Capital Management (MAVCAP) and Penjana Kapital—to strengthen the country's venture capital ecosystem, which indirectly supports sectors such as outdoor advertising.

- In October 2024, the Malaysian government launched the National Fund-of-Funds under Khazanah Nasional with an initial allocation of RM1 billion to support venture capital fund managers investing in local startups, including those in the advertising sector.

- In 2024, Oracle announced a US$6.5 billion investment to expand cloud infrastructure in Malaysia, enhancing the digital ecosystem crucial for the growth of digital out-of-home (DOOH) advertising.

- In 2024, Catcha Digital Bhd allocated approximately RM80 million over 24 months for earnings-accretive mergers and acquisitions, potentially targeting companies in the billboard advertising sector.

- In August 2024, Verde Outdoor Media, a US-based outdoor and online advertising firm, acquired Great Outdoor Advertising, reflecting a trend of consolidation in the outdoor advertising market that could influence similar activities in Malaysia.

- In May 2024, Broadsign, a Canada-based software company, acquired OutMoove to enhance its digital out-of-home (DOOH) advertising ecosystem, potentially impacting the Malaysian market through technology expansion.

Top Companies in the Malaysia Billboard Advertising Market

- Seni Jaya

- WOW Media

- Big Tree

- LAGUNA

- Unilink Outdoor SDN BHD

- Brandavision

- Other Prominent Players

Market Segmentation Overview:

By Display/Format

- Physical

- Static Billboard

- Mobile Billboard

- Digital

- LED

- LCD

- Others

By Industry

- Automotive

- Consumer goods and retail

- Food and beverages

- Technology and electronics

- Healthcare and pharmaceuticals

- Entertainment and media

- BFSI

- Travel and tourism

- Others

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA02251195 | Delivery: Immediate Access

| Report ID: AA02251195 | Delivery: Immediate Access

.svg)