LNG Bunkering Market: By Product Type (Truck-to-Ship, Port-to-Ship, Ship-to-Ship, and Portable Tanks); Application (Container Fleet, Tanker Fleet, Cargo Fleet, Ferries, Inland Vessels, and Others); and Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: 31-Oct-2025 | | Report ID: AA0222148

Market Snapshot

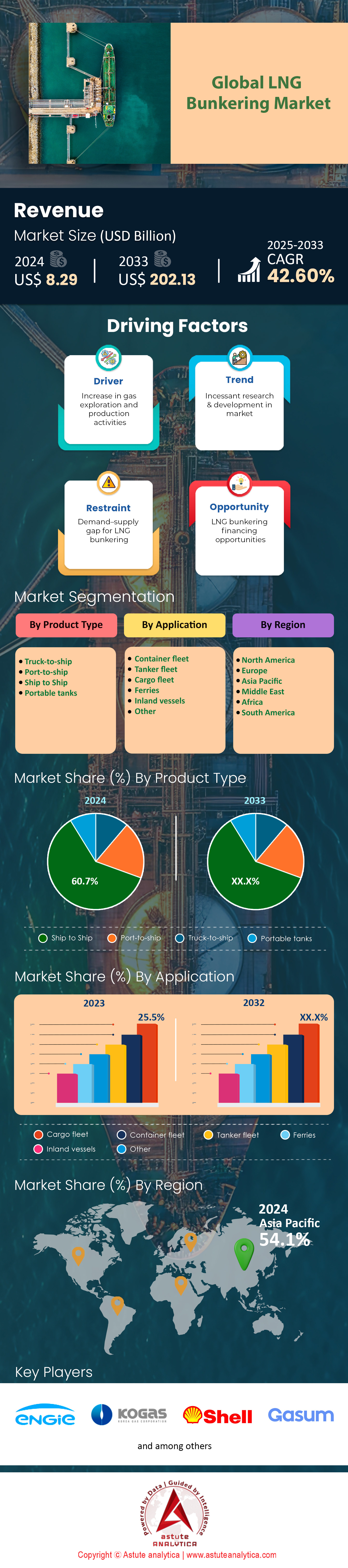

LNG bunkering market was valued at US$ 8.29 billion in 2024 and is projected to hit the market valuation of US$ 202.13 billion by 2033 at a CAGR of 42.60% during the forecast period 2025–2033.

Key Findings

- Based on product type, Ship-to-Ship (STS) bunkering is at the forefront of LNG bunkering market.

- Based on application, cargo fleets' dominance in LNG bunkers to remain unhindered, set to control over 25.5% market share.

- Asia Pacific is controlling the largest 54.10% market share.

- Global LNG bunkering market is poised to reach US$ 202.13 billion by 2033.

A definitive and accelerating demand curve for the LNG bunkering market is materializing, driven by the physical expansion of the world's dual-fuel fleet. By the close of 2024, 641 LNG-powered ships were in active service, a figure bolstered by a record 169 deliveries during that year. The forward-looking outlook is equally robust; a remarkable 264 new orders for LNG-fueled vessels were placed in 2024 alone. Industry analysis confidently projects that over 1,200 of these advanced vessels will be operational by 2028. For stakeholders, this vessel pipeline represents a direct and quantifiable forecast of future fuel sales, creating a stable foundation for strategic investments in the LNG bunkering market.

The essential infrastructure required to service this growing fleet is developing in lockstep, demonstrating market readiness. As of early 2025, LNG fuel was available at 198 ports globally, with firm plans for an additional 78 to come online. Critically, the specialized fleet of LNG bunker vessels (LNGBVs), which are fundamental to efficient operations, grew to 64 in 2024. The industry's commitment to scaling up is further evidenced by eight new LNGBV orders placed in February 2025. Such parallel development of vessels and bunkering capacity is a hallmark of a healthy market, effectively minimizing logistical risks and building shipowner confidence.

Actual consumption data from key global hubs provides undeniable proof of this demand surge in the LNG bunkering market. The Port of Rotterdam, a crucial European benchmark, recorded total LNG bunkering volumes of 941,366 cubic meters for 2024 and set a new quarterly record in Q3 2025 with 270,254 cubic meters. This consistent activity reflects deep and growing consumption. On the supplier side, the scale of commercial operations is clear. Market leader Shell sold approximately 1.1 million metric tons of LNG bunkers in 2024, achieved through nearly 1,000 separate operations. These transactional volumes confirm the LNG bunkering market is no longer just emerging but is now in a state of rapid maturation.

To Get more Insights, Request A Free Sample

Unlocking Future Growth Horizons in the Global LNG Bunkering Market

- Scaling of bio-LNG and synthetic-LNG (e-LNG): As the shipping industry looks beyond 2030 decarbonization goals, these net-zero fuels offer a direct drop-in solution for the expanding LNG-fueled fleet. Major energy companies are already investing in production facilities. For instance, a new bio-LNG plant in Germany is set to produce 63,000 tons annually starting in 2024. Another project in Scandinavia aims for 200,000 tons of e-LNG production by 2025. Early movers who secure supply chains for these green methane fuels, a trend tracked by industry groups like SEA-LNG, will capture a substantial long-term competitive advantage.

- Geographic expansion into new maritime hubs: While Singapore and Rotterdam dominate the LNG bunkering market, significant investments are flowing into developing infrastructure in North America, the Middle East, and Australia. The Port of Jacksonville in the US is expanding its capacity, targeting over 300 ship-to-ship bunkering operations in 2025. Similarly, new terminals in Qatar are preparing to service the wave of LNG-fueled vessels transiting the region. Market players who establish an early presence in these developing nodes can secure strategic market share as global trade routes diversify.

Massive Newbuild Vessel Scale Redefines LNG Bunkering Infrastructure and Logistics Needs

The scale of new LNG-fueled vessels entering service is fundamentally reshaping the requirements of the LNG bunkering market. In 2025, CMA CGM took delivery of a colossal 24,100 TEU containership equipped with an 18,600 cubic meter LNG fuel tank, one of the largest ever built. Hapag-Lloyd also launched the first of twelve 23,660 TEU dual-fuel ships in 2024, each requiring significant fuel volumes. ZIM Integrated Shipping Services introduced ten 15,000 TEU LNG-powered vessels throughout 2024. These massive ships necessitate larger and more efficient LNG bunker vessels (LNGBVs) to minimize refueling time, as detailed in fleet data from sources like DNV's Alternative Fuels Insight platform.

This upscaling trend is visible across different vessel types. For instance, five new 210,000 DWT LNG dual-fuel bulk carriers were ordered in Q1 2025. Also, the largest LNG-powered PCTC (Pure Car and Truck Carrier) with a capacity of 9,100 cars entered service in mid-2024. Even the cruise sector is involved in the LNG bunkering market, with a new 205,000 gross tonnage LNG cruise ship delivered in late 2024. To meet these demands, new LNGBVs with capacities exceeding 20,000 cubic meters are being ordered. In total, 28 new LNG-fueled vessels over 15,000 TEU were delivered in 2024, with another 35 scheduled for 2025. An order was placed in January 2025 for two additional 24,000 TEU containerships.

Surging Financial Commitments and Orders Signal Unshakeable Confidence in LNG Bunkering

Unprecedented financial investment is flowing into the LNG bunkering market, confirming its long-term viability. In a landmark deal in Q4 2024, a consortium secured over US$ 950 million in financing for a fleet of twelve new LNG-fueled tankers. Another major shipping line confirmed a 1.2 billion dollar order for eight 16,000 TEU dual-fuel container vessels in January 2025. These large-scale commitments from major operators and financiers underscore deep-seated confidence in LNG as a mainstream marine fuel. According to analysis from maritime intelligence firms such as Clarksons Research, the orderbook value for LNG-fueled vessels surpassed US$ 45 billion by the end of 2024.

This investment wave extends directly to bunkering infrastructure. A European port authority announced a US$ 150 million investment in late 2024 to expand its LNG terminal and jetty capacity, giving a significant boost to the LNG bunkering market growth. In early 2025, an energy major committed US$ 400 million to construct two new 18,600 cubic meter LNGBVs. Further, a new order for six 8,200 CEU LNG dual-fuel car carriers was placed in Q1 2025, valued at over US$ 600 million. Also, 14 new LNG-ready VLCCs (Very Large Crude Carriers) were ordered in 2024. The total capital expenditure on new LNG bunkering assets, including vessels and port facilities, exceeded 5 billion dollars in 2024, with 22 new bunkering-related infrastructure projects announced globally.

Segmental Analysis

STS Bunkering Operations Solidify Their Strategic Market Leadership

Ship-to-ship (STS) bunkering has unequivocally established itself as the premier methodology within the LNG bunkering market, primarily due to its significant operational efficiencies. By facilitating direct LNG transfers at sea, this method circumvents port-based logistical hurdles, thereby minimizing vessel downtime. Indeed, this operational advantage is a primary driver behind its widespread adoption. The industry's confidence is further reflected in the substantial investments pouring into expanding the global fleet of specialized LNG bunkering vessels. Consequently, the increasing availability of STS services at major global shipping hubs is cementing its foundational role in the rapidly evolving LNG bunkering market.

- As of early 2025, a dedicated fleet of 32 LNG bunkering vessels was actively conducting ship-to-ship fueling.

- A landmark event in 2025 is the inauguration of India's pioneering ship-to-ship LNG bunkering facility at the port of Vizhinjam.

- Excelerate Energy’s successful completion of its 3,000th ship-to-ship LNG transfer in early 2025 underscores the method's proven reliability.

Furthermore, the tangible growth in the number and capacity of the global LNG bunkering fleet provides compelling evidence of this trend. The operational fleet expanded to 64 vessels in 2024, a notable increase from 52 the previous year. Moreover, the fleet's total capacity surged to 263,201 cubic meters by March 2025, more than doubling since 2022. This expansion is poised to continue, with 13 new bunkering vessels ordered in the first half of 2025 alone. A clear trend towards larger, more efficient operations is also visible, as the average size of new orders has climbed to 17,179 cubic meters, substantially larger than the current fleet average of 8,225 cubic meters. Looking ahead, an additional 57 ports are projected to offer LNG bunkering by the end of 2026, which will further bolster the global network for STS transfers.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

Cargo Fleet Demand Provides Unwavering Momentum for LNG Bunkers

The cargo fleet segment remains the undisputed demand driver in the LNG bunkering market, on track to command over 25.5% of the total market share. This dominance is overwhelmingly propelled by the container shipping sector's decisive move towards LNG as a viable marine fuel. The global fleet of LNG-fueled vessels reached 641 by the end of 2024, with cargo carriers forming the vast majority. In a clear signal of acceleration, a record 169 LNG-powered ships were delivered in 2024, while a further 264 were ordered, more than doubling the order rate of 2023. This upward trajectory shows no signs of slowing, with a combined total of 1,369 LNG dual-fuel vessels either in operation or on order as of mid-2025. Specifically, container ships lead the orderbook, with 142 in service and another 310 on order at the close of 2024.

- In the first six months of 2025, 81 of the 87 new LNG dual-fuel vessel orders were for container ships.

- Pacific International Lines (PIL) received its eighth LNG-powered vessel in 2025 and has 12 more on order.

- In a single month, February 2025, orders were placed for 33 new LNG-fueled container ships.

The strategic commitment from major cargo lines is a powerful indicator of the sector's profound influence on the LNG bunkering market. For example, of the 515 alternative-fuelled vessels ordered in 2024, the container and car carrier segments collectively accounted for 62%. In addition, orders for LNG-fueled vessels in the first half of 2025 amounted to an immense 14.2 million gross tons. This boom in LNG-powered cargo vessels is directly translating into higher demand for bunkering services. As a result, bunkering volumes in key cargo hubs are surging; Singapore's LNG bunker sales quadrupled in 2024 to 463,948 metric tons. Similarly, Shanghai witnessed its LNG bunkering volumes climb by over 60% in the first five months of 2025 compared to the prior-year period.

To Understand More About this Research: Request A Free Sample

Regional Analysis

Asia Pacific Solidifies Global Dominance with Unmatched Scale and Momentum

The Asia Pacific region is unequivocally leading the global LNG bunkering market, commanding over 54.1% of the market share through immense infrastructural scale and voracious demand. In the first three quarters of 2025 alone, Asia's share of global sales grew, solidifying its top position. China has become a dominant force, responsible for a significant portion of global LNG bunker demand in 2025. This growth is fueled by massive vessel orders, including a July 2025 order by MSC for six 22,000 TEU LNG dual-fuel ships. Singapore remains a critical hub, with its alternative fuel sales, primarily LNG, topping 1.34 million tons in 2024. The nation’s fuel oil inventories averaged approximately 22.2 million barrels weekly in 2025, ensuring supply stability.

The region's momentum in the LNG bunkering market is broad-based, extending beyond its largest players. In October 2025, Singapore’s Pacific International Lines (PIL) named its eighth new LNG-powered vessel, part of an order book that includes another 12 dual-fuel ships. South Korea’s HMM also placed a major order for 12 LNG-fueled boxships in late 2025. Further demonstrating market maturation, Japan completed its first ship-to-ship LNG bunkering for a cruise vessel in July 2025 at Hakata Port. In April 2025, Osaka Gas launched the country’s first shore-to-ship LNG bunkering service. Even Malaysia is deepening its involvement, signing a letter of intent with Canada in October 2025 to increase investment in the LNG trade.

North America’s Bunkering Infrastructure is Rapidly Gaining Strategic Importance

North America is building a robust and geographically diverse LNG bunkering market, anchored by significant infrastructure projects and strong regulatory support. The U.S. Gulf Coast is a focal point of this expansion. In October 2025, Stabilis Solutions secured a contract to build a dedicated LNG bunkering terminal at the Port of Galveston. Houston-based JuWonOil also formally entered the Gulf Coast market in late 2025, targeting operations in Houston, Galveston, and Corpus Christi. These developments are supported by substantial federal funding, including a USD 450 million allocation for the Port Infrastructure Development Program announced in March 2024.

Activity is also accelerating on other coasts. The Port of Jacksonville (JAXPORT) remains a pioneer, operating North America’s first LNG bunker barge and hosting multiple LNG-powered ships. In February 2025, the U.S. Department of Energy eased regulations on ship-to-ship LNG transfers, a move expected to streamline bunkering operations nationwide. In Canada, British Columbia approved a USD 1.14 billion LNG storage expansion in October 2025, which includes a new marine jetty to enable LNG bunkering at the Port of Vancouver. Also, a major LNG Canada project in British Columbia was reported as near completion in January 2024, enhancing regional supply.

Europe’s Established Hubs Demonstrate Mature and Consistently High LNG Demand

Europe’s LNG bunkering market showcases the power of established infrastructure and high-volume operations, confirming the continent’s deep commitment to LNG as a marine fuel. The Port of Rotterdam continues to set records, with LNG bunkering volumes reaching 735,959 cubic meters in the first nine months of 2025. The Port of Antwerp-Bruges has seen demand triple between the first and second quarters of 2025, reaching 88,328 tons in Q2. This surge is driven largely by new LNG-powered container ships entering service on major trade lanes.

Spain has emerged as another key European player in the LNG bunkering market, with its national LNG bunker sales more than doubling in 2024 to a total of 3.8 TWh. The Port of Barcelona was a major contributor, recording 491 separate LNG bunkering operations in 2024, delivering a total of 229,750 cubic meters. These operations included 402 truck-to-ship transfers and 89 barge deliveries. This high operational tempo is supported by a growing fleet, with 822 vessels calling at Barcelona in 2024 being LNG-capable. In October 2025, Nordic energy company Gasum announced its entire fleet of bunkering and carrier vessels now operates on bio-LNG, generating compliance credits for its partners under the FuelEU Maritime regulation.

Recent Developments in LNG Bunkering Market

- CMA CGM's Major Fleet Investment (March 2025): The French shipping giant unveiled an order worth nearly USD 2.6 billion for twelve 18,000 TEU dual-fuel LNG containerships to be built at China's Jiangnan Shipyard, signaling a massive capital commitment to expanding its LNG-powered fleet.

- MSC's USD 1.2 Billion Newbuild Order (July 2025): Mediterranean Shipping Company placed a significant order valued at over USD 1.2 billion with China Merchants Heavy Industries for six 22,000 TEU LNG dual-fuel container ships, reinforcing its strategy of fleet expansion and modernization.

- TotalEnergies' Oman Joint Venture (April 2024): TotalEnergies formed a joint venture with the Oman National Oil Company to create Marsa LNG, an integrated company that will cover upstream gas production and downstream liquefaction to supply LNG as a marine fuel starting in 2028.

- U.S. Port Modernization Fund (October 2024): The U.S. government announced a USD 3 billion investment to modernize and decarbonize ports across 27 states, including funding for zero-emission equipment and alternative fueling infrastructure vital for the LNG bunkering market.

- ExxonMobil Enters Bunkering Market (October 2025): ExxonMobil officially entered the LNG bunkering market by chartering two new 20,000 cubic meter LNG bunker vessels, a strategic investment to capture a share of the growing low-emission marine fuels sector.

- FortisBC's USD 1.14 Billion Expansion (October 2025): The British Columbia Utilities Commission (BCUC) approved a USD 1.14 billion LNG storage expansion project for FortisBC, which includes a marine jetty to facilitate LNG bunkering at the Port of Vancouver.

- Maersk’s Multi-Yard Fleet Order (July 2025): Maersk placed orders for a total of 20 LNG dual-fuel containerships from shipyards in both China and South Korea, a large-scale investment to diversify its future fuel strategy and secure long-term capacity.

- U.S. PIDP Funding Allocation (March 2024): The U.S. Department of Transportation made USD 450 million available through its Port Infrastructure Development Program (PIDP) to fund modernization projects, including those that support alternative fuels like LNG.

- Stabilis Solutions' Galveston Terminal Deal (October 2025): Stabilis Solutions secured a major contract to construct a new dedicated LNG bunkering terminal and vessel at the Port of Galveston, representing a key private investment in U.S. Gulf Coast infrastructure.

Top Companies in the LNG Bunkering Market:

- Bomin Linde LNG GmbH & Co. KG

- Engie SA

- ENN Energy Holdings Ltd

- FueLNG Bellina

- Gas Natural Fenosa

- GazproBneft Marine Bunker LLC

- Harvey Gulf International Marine LLC

- Kawasaki

- Korea Gas Corporation

- Mitsui OSK Lines Ltd.

- Royal Dutch Shell PLC

- Sembcorp Marine Ltd.

- Statoil AS

- Skangas AS (Gasum)

- Total SA

- Toyota Tsusho Corp.

- Other Prominent Players

Market Segmentation Overview:

By Product Type:

- Truck-to-ship

- Port-to-ship

- Ship to Ship

- Portable tanks

By Application:

- Container fleet

- Tanker fleet

- Cargo fleet

- Ferries

- Inland vessels

- Other

By Region:

- North America

- The U.S.

- Canada

- Mexico

- Europe

- The UK

- Germany

- France

- Italy

- Spain

- Poland

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2024 | US$ 8.29 Bn |

| Expected Revenue in 2033 | US$ 202.13 Bn |

| Historic Data | 2020-2023 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Unit | Value (USD Bn) |

| CAGR | 46.2% |

| Segments covered | By Product Type, By Application, By Region |

| Key Companies | Bomin Linde LNG GmbH & Co. KG, Engie SA, ENN Energy Holdings Ltd, FueLNG Bellina, Gas Natural Fenosa, GazproBneft Marine Bunker LLC, Harvey, Gulf International Marine LLC, Kawasaki, Korea Gas Corporation, Mitsui OSK Lines Ltd., Royal Dutch Shell PLC, Sembcorp Marine Ltd., Statoil AS, Skangas AS (Gasum), Total SA, Toyota Tsusho Corp., Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)