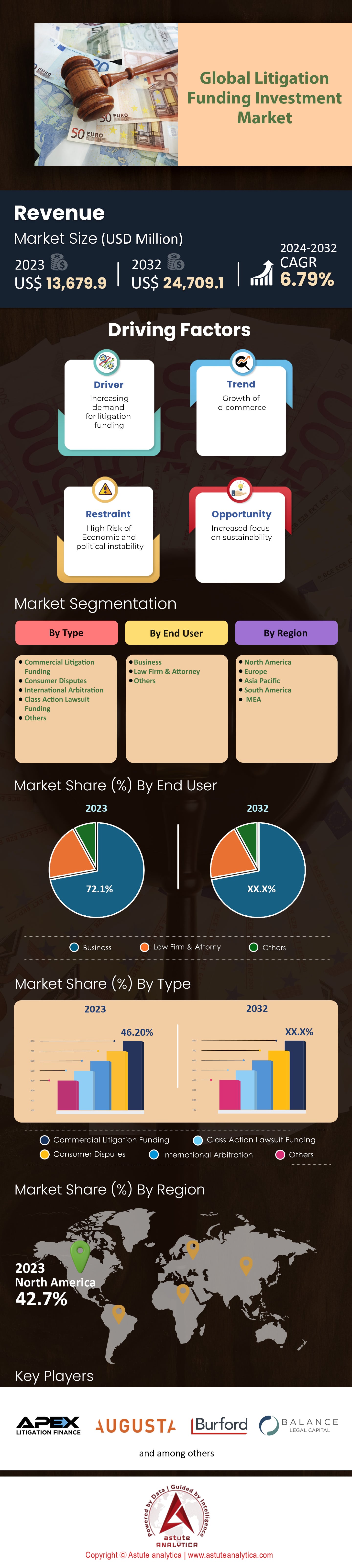

Global Litigation Funding Investment Market—By Type (Commercial Litigation Funding, Consumer Disputes, International Arbitration, Class Action Lawsuit, funding, and Other Type); End User (Business, Law Firm and Attorney, and Others); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: May-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA0723500 | Delivery: 2 to 4 Hours

| Report ID: AA0723500 | Delivery: 2 to 4 Hours

Market Scenario

Global litigation funding investment market was valued at US$ 13,679.9 million in 2023 and is projected to surpass valuation of US$ 24,709.1 million by 2032 at a CAGR of 6.79% during the forecast period 2024–2032.

Litigation funding has emerged as a game-changing financial solution, revolutionizing the way legal disputes are handled. This practice involves a third party, known as a litigation funder, providing funds to cover the costs of lawsuits in exchange for a share of the potential settlement or judgment. The concept has gained immense popularity due to its numerous benefits for both plaintiffs and law firms.

One of the key drivers behind the litigation funding investment market is the escalating number of legal disputes across various sectors and jurisdictions. As the global business landscape becomes increasingly complex, companies and individuals find themselves entangled in intricate legal battles. This surge in litigation cases, ranging from commercial disputes to intellectual property conflicts and class action lawsuits, has fueled the demand for litigation funding.

The soaring costs associated with legal proceedings have also propelled the market forward. Engaging in a lawsuit can be an expensive endeavor, with significant financial resources required to cover attorney fees, court expenses, and expert witness costs. Litigation funding provides a lifeline for plaintiffs and law firms, enabling them to pursue strong cases without shouldering the burden of exorbitant legal expenses. This financial support not only helps level the playing field but also increases access to justice for individuals and businesses alike.

In addition to these internal market dynamics, external factors such as regulatory developments and evolving legal systems play a pivotal role in shaping the landscape of litigation funding. The acceptance and recognition of litigation funding by courts and legal institutions across various jurisdictions have bolstered market prospects. As the industry continues to gain legitimacy, more jurisdictions are embracing litigation funding as a valuable tool that promotes access to justice and enhances the efficiency of legal systems.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Increasing Demand for Litigation Funding

The global litigation funding investment market is experiencing a surge in demand driven by the rising number of legal disputes across industries. Companies and individuals are becoming increasingly embroiled in complex legal battles, ranging from commercial disputes to intellectual property conflicts and class action lawsuits. As the costs associated with litigation continue to soar, plaintiffs and law firms are seeking external funding sources to cover attorney fees, court expenses, and expert witness costs.

Litigation funding provides a solution by mitigating financial risks, enabling plaintiffs to pursue strong cases, and granting access to justice without shouldering exorbitant expenses. This increasing demand for litigation funding is a key driver behind the market's growth.

Challenge: Regulatory Variations and Ethical Considerations

Different countries have distinct regulations and levels of oversight surrounding litigation funding, which creates a complex landscape for market participants to navigate. Striking a balance between facilitating market growth and safeguarding against potential risks remains a critical task.

Furthermore, ethical considerations play a vital role in shaping the industry. Concerns regarding conflicts of interest and the potential influence of litigation funders on litigation outcomes continue to be debated. Addressing these ethical considerations is crucial to maintaining the integrity and transparency of the litigation funding industry.

Trend: Expansion into Emerging Economies

A notable trend in the global litigation funding investment market is the expansion into emerging economies. These regions, characterized by evolving legal systems and increasing awareness of litigation funding, present significant growth opportunities. Market participants are actively expanding their presence in these untapped markets to capitalize on their potential. As emerging economies experience economic growth and development, the demand for legal services and litigation support is also on the rise.

This trend enables litigation funding providers to tap into new markets, broaden their customer base, and establish themselves as key players in these regions. By expanding into emerging economies, market participants can unlock new avenues for growth and contribute to the development of the global litigation funding investment market.

Segmental Analysis

By Type:

Commercial litigation funding holds the largest share in the global litigation funding investment market. In 2023, this segment accounted for a substantial revenue of US$ 6,328.8 million. The dominance of commercial litigation funding is expected to continue during the forecast period, with a projected compound annual growth rate (CAGR) of 7.22%. The demand for commercial litigation funding is driven by the increasing complexity and costs associated with legal disputes in the business realm.

As companies face intricate commercial conflicts, they seek external funding to cover legal expenses and mitigate financial risks. Commercial litigation funding provides businesses with the necessary financial support to pursue legal action and potentially achieve favorable outcomes. With its prominent market share and steady growth, the commercial litigation funding segment is poised to play a significant role in shaping the global litigation funding investment market.

By End User:

Businesses represent the largest end-user segment in the litigation funding investment market. In 2023, this segment accounted for a substantial revenue of US$ 9,377.1 million. The dominance of businesses as end users is indicative of the widespread adoption of litigation funding within the corporate sector. As companies face legal disputes, litigation funding offers a viable solution to manage the high costs associated with legal proceedings. By securing external funding, businesses can access the necessary resources to pursue litigation without compromising their financial stability.

Litigation funding provides businesses with the means to level the playing field, particularly when facing well-resourced opponents. Additionally, businesses can use litigation funding as a strategic tool to navigate complex legal challenges and protect their interests. With its significant revenue contribution, the business segment plays a crucial role in driving the growth and expansion of the global litigation funding investment market.

To Understand More About this Research: Request A Free Sample

Regional Analysis

North America emerges as the frontrunner in the global litigation funding investment market, capturing the largest market share. With a revenue of US$ 5,843.1 million in 2023, the region's dominance is projected to persist, showcasing a promising compound annual growth rate (CAGR) of 6.8% during the forecast period.

The region's strong position can be attributed to various factors. North America boasts a well-established legal system and a thriving litigation culture, resulting in a substantial volume of legal disputes across diverse industries. This fertile environment creates a robust demand for litigation funding services.

Furthermore, North America houses numerous large corporations and businesses, frequently engaged in complex legal battles. As these entities face escalating litigation costs, they turn to litigation funding as a strategic solution. By securing external funds, companies can alleviate financial burdens, mitigate risks, and pursue legal action without compromising their financial stability. In addition, the region benefits from its advanced financial markets and a favorable regulatory landscape. North America has witnessed the emergence of a diverse range of litigation funding providers, offering tailored funding solutions to plaintiffs and law firms. This availability of funding options, combined with the region's supportive regulatory environment, contributes to North America's market dominance.

Moreover, strategic partnerships between law firms and litigation funders have gained traction in the region, driving market growth. These collaborations foster innovation, expand market reach, and enhance the credibility of litigation funding as a valuable tool within the legal ecosystem. In the years to come, North America is poised to maintain its leading position in the global litigation funding investment market. The region's steady economic growth, ongoing legal developments, and increasing focus on access to justice create a conducive environment for market expansion. Alternative financing solutions like litigation funding are expected to gain further traction, solidifying North America's stronghold in the industry.

Top Players in the Global Litigation Funding Investment Market

- Apex Litigation Finance

- Augusta Ventures Limited

- Balance Legal Capital LLP

- Burford Capital LLC

- Deminor

- FORIS AG

- Harbour Litigation Funding Limited

- IMF Bentham

- Legalist Inc.

- Longford Capital Management, LP

- Pravati Capital

- Therium Group Holdings Limited

- Validity Finance, LLC

- Woodsford Litigation Funding Ltd

- Other Prominent Players

Market Segmentation Overview:

By Type

- Commercial Litigation Funding

- Consumer Disputes

- International Arbitration

- Class Action Lawsuit Funding

- Others

By End User

- Business

- Law Firm and Attorney

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA0723500 | Delivery: 2 to 4 Hours

| Report ID: AA0723500 | Delivery: 2 to 4 Hours

.svg)