Global Lithium-ion Battery Market- (By Type - Lithium Nickel Magnesium Cobalt (LI-NMC), Lithium Ferro Phosphate (LFP), Lithium Cobalt Oxide (LCO), and others; By Power Capacity - 0-300 mAH, 3,000-10,000 mAH, and others; By Application - Consumer Electronics OEMs, Automotive OEMs, Energy Storage, and others; By Form/Design – Pouch, Cylindrical, Elliptical and others; and By Region); Region—Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: 11-Mar-2024 | | Report ID: AA0122125

Market Scenario

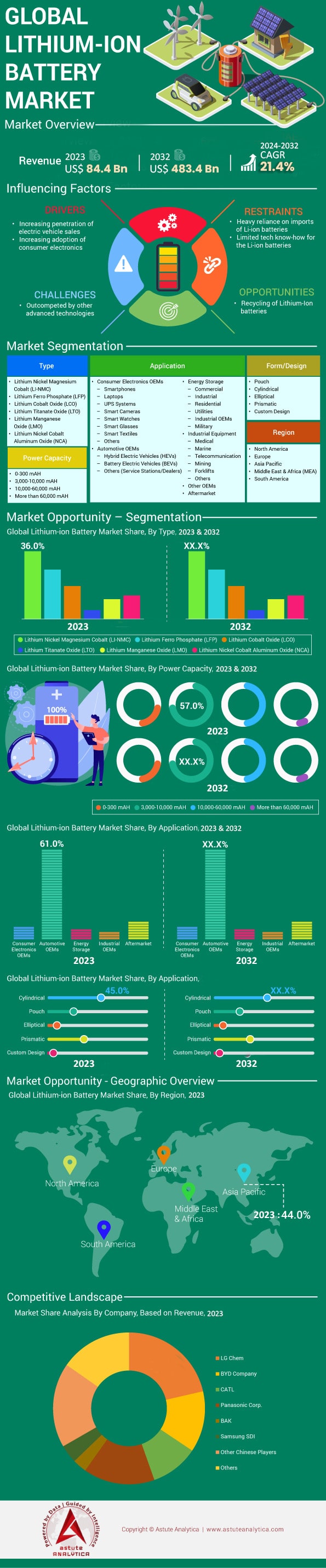

Global lithium-ion battery market generated a revenue of US$ 84.4 billion in 2023 and is projected to surpass the market valuation of US$ 483.4 billion by 2032 at a CAGR of 21.40% during the forecast period 2024–2032.

The lithium-ion battery market is hurtling towards a future of explosive growth and tricky challenges. Powered by the rise of electric vehicles (EVs), it has been witnessing a strong demand than ever, 550 GWh in 2022 to be exact, and that number is projected to explode to 4,500 GWh by 2030. That surge underlines the potential for a 10-fold revenue increase industry-wide, shooting past $410 billion within the decade. China is expected to lead the market with its insatiable thirst for electricity, which would account for 40% of all demand by 2030.

However, supply chain vulnerabilities threaten this trajectory. Demand for critical materials like lithium, cobalt, and nickel is set to increase exponentially – lithium needs an 18-20x boost in supply while cobalt requires a 17-19x fill and nickel will require a mammoth uptick of between 28-31x by 2050. A crippling shortage of lithium –a material found in batteries - could slow down EV production within this decade if not addressed soon. Battery recycling offers a solution but only if manufacturers can find consistent supplies that are ethically sourced.

Price fluctuations make things even more difficult for the lithium-ion battery market. The average price of one battery unit was USD 150 per kWh across markets in 2023 — with some variations based on region and location— . These tumultuous price changes highlight what experts call “market stabilization.” Something needs to be done so that companies can plan ahead without worrying about sudden cost spikes or drops in future years. Sustainability initiatives are also taking hold as manufacturers explore ways to minimize mining impacts, improve recycling programs and develop alternative chemistries.

Despite these hurdles however, one thing remains clear; there’s no stopping this industry now it’s already massive boulder rolling downhill. EVs are projected to reshape transportation worldwide with potentially about two billion EVs on roads by 2050. The lithium-ion battery market is at the center of this green energy revolution so whether it likes it or not, it’s going to continue expanding one way or another. To make sure that happens though, industry leaders must invest heavily in sustainable solutions, secure supply chains and master the ever-changing landscape of regulations, costs and technological innovation.

To Get more Insights, Request A Free Sample

Market Scenario

Trend: Sustainability Takes Center Stage in the Lithium-Ion Battery Market

The lithium-ion battery industry is changing, and it’s changing fast. There’s a real push in the sector to become more sustainable — environmentally and socially. People are starting to look closer at what they’re buying, governments are passing stricter regulations, and producers are eager to ensure that their businesses have long-term potential. There are many different ways to make batteries more sustainable, but one key area of focus for companies is minimizing the damage caused by lithium mining. Producers want to reduce water usage, find ways to use less land, and employ renewable energy sources. For example: Controlled Thermal Resources has announced plans to use a closed-loop geothermal process in order mine lithium in California.

Recycling processes need attention too in the global lithium-ion battery market. Currently only a small percentage of lithium-ion batteries get recycled — that needs to change quickly if we all want the world to be cleaner. If companies can come up with efficient methods for recycling at scale then it’ll mean less waste and more valuable materials returned into circulation. It won’t just be good for Mother Earth; it'll be profitable too. Some estimates suggest that by 2040 the recycling industry could create a $6 billion profit pool, with revenue potentially exceeding $40 billion.

Designing new, better batteries will also help solve this growing problem — maybe one day we’ll completely eliminate our need for new resources? In the meantime though there’s still value in trying out alternative chemistries or materials that reduce reliance on resources critical to supply chains or difficult to ethically source.

Driver: The Electric Vehicle Revolution Fuels Unprecedented Demand

In 2022, automotive lithium-ion battery market demand skyrocketed by 65% to reach 550 GWh – significantly faster than US electric car sales growth. This is part of a larger imbalance where lithium and other critical battery materials are in extremely short supply compared to the demand for them. Lithium made up about 60% of that surging demand in 2022. The average estimated price was $150 per kWh, but prices fluctuated across different chemistries and regions. LFP batteries jumped more than 25% and NMC batteries less so.

Projections show that the world will need as much as 18-20 times more lithium, 17-19 times more cobalt and 28-31 times more nickel by 2050 compared to current levels. There could be two billion light-duty electric vehicles on Earth by mid-century, which would mean an annual demand for lithium-ion batteries of about 4,500 GWh by 2030. Revenues from the whole value chain could grow tenfold to $410bn by then, with China holding a dominant grip over about two-fifths of the global market. However, experts expect severe lithium shortages later this decade and say planning and investment is needed now. There is hope that recycling can help reduce material needs, but with such massive projected growth the world has no choice but to expand sustainable supply chains at once.

Challenge: Securing a Reliable and Ethical Supply Chain

A big problem facing the lithium-ion battery market is finding enough supplies of the raw materials that make them. Lithium, cobalt, nickel and graphite are some of the key ingredients used in their production. However, a handful of countries have a monopoly on these materials. China alone has a vast amount of control over the global supply chain for lithium refining. This level of concentration makes it easy to disrupt supply chains around the world as well as cause geopolitical risks. It’s also predicted that demand will soon outstrip supply for some materials in the near future. Lithium already faces a potential shortage as early as 2025 which could hamper EV production and slow down clean energy transitions.

Moreover, some mines for critical minerals have had quite negative impacts on both local environments as well human rights records and social unrest issues. For these reasons it’s vital for companies to keep up with ethical sourcing practices throughout their supply chains to maintain trust within consumers and continue to meet regulatory standards in an ever-evolving space.

Segmental Analysis

By Type

Li-NMC batteries hold a major position in the lithium-ion battery market with a 36% revenue share, particularly in automotive applications. Astute Analytica predicts that by 2030, more than 28 million electric four-wheelers equipped with lithium-ion batteries will be sold worldwide, many of which may use NMC chemistry. Leading EV manufacturers such as Tesla prefer to use NMC batteries, and they are installed in their best-selling models and funded for further development.

NMC batteries are chosen for their high energy density and long life. The specific energy density or power of NMC batteries can be adjusted based on the ratio of nickel and manganese, making them versatile across applications. Such customization potential along with improvements in energy density and lifespan have resulted in significant investments being made into the development of NMC batteries. The Li-NMC battery segment is anticipated to grow significantly over the forecast period. High-capacity batteries above 60,000 mAh used primarily for heavy electric vehicles (EVs) and industrial applications are expected to gain an increasing market share in the lithium-ion battery market. The Asia-Pacific region is expected to witness the highest CAGR from 2023 to 2032 due to China’s dominance in both production and consumption of lithium-ion batteries including NMC type.

The Li-NMC battery market exists within a dynamic competitive landscape. While Li-NMC holds a significant share, other chemistries like Lithium Cobalt Oxide (LCO), Lithium Titanium Oxide (LTO) and Lithium Iron Phosphate (LFP) offer their own advantages thus competing for market dominance.

By Power Capacity

When it comes to lithium-ion battery market, around the 3,000-10,000 mAh power capacity is leading the market with more than 57% of revenue in its control, it holds a dominant position in the market. Not only can these versatile cells be found in all manner consumer electronics - smartphones, laptops and tablets - they also power everything from e-bikes to medical devices.

But how do they pack so much punch into such compact units? The answer lies in their high energy-density rating, which allows manufacturers to fit a lot of power into a little package. Of course, lightness is no less important than size when you're on the move - so there's that too.

It gets better: not only are these batteries efficient at what they do, but they're also efficient with energy itself. Charging and discharging wastes less energy than with other battery types; and their long lifespans mean fewer trips back to the store for replacement parts. All this power doesn't come cheap or at least it didn't used to. The strong demand for these particular batteries has helped drive down manufacturing costs over time. The technology behind them is mature and proven: consumers know what they're getting when they buy one of these products - even if it’s not exactly clear how they work.

By Application

Automotive Original Equipment Manufacturers (OEMs) drive the demand for lithium-ion batteries as they embrace electrification through huge investments amid explosive growth of electric vehicle (EV) sales worldwide. The automotive sector dominated by about 61% global lithium-ion battery market revenue in 2023. Demand for automotive lithium-ion (Li-ion) batteries increased by about 65% to 550 GWh in 2022 from about 330 GWh in 2021, driven primarily by growth in electric passenger cars sales. Projections indicate that the global market for lithium-ion batteries dedicated to vehicles is expected to reach $290bn by 2030, growing at a CAGR of 21.5%.

The adoption of EV on such a large scale supports the demand of lithium-ion batteries. Over 28 million electric four-wheelers equipped with these batteries are predicted to be sold globally by 2030. In addition, we anticipate that a significant portion of the world's population of approximately 81.6 million vehicles will be powered by EV drivetrains powered by lithium-ion batteries in the near future, with China leading both production and consumption of lithium-ion batteries for EVs at about 32% global production share as at now. The Asia-Pacific lithium-ion battery market led by China is a major growth driver for automotive lithium battery industry, where China accounted for around76% share of total global capacity in terms of production capacity and is anticipated to remain one among the largest producers globally making an estimated68% of world’s lithium-ion batteries by year 2030.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

The Asia Pacific lithium-ion battery market is projected to make a massive expansion. In 2023, the region was valued more than $37.13 billion in revenues, which accounts for around 44% of the global market. It is also expected to keep growing at a CAGR of approximately 18.6% during the forecast period. A good example of this growth is that demand for automotive lithium-ion batteries rose by 65% in 2022 hitting 550 GWh – an increase from the previous year’s 330 GWh. Such figures support projections that worldwide demand for lithium-ion batteries will reach almost 4,500 GWh every year by 2030 and Asia Pacific is poised to play a major role in this achievement. China is expected to account for a significant 40% of the total lithium-ion battery demand by 2030.

Although lithium production has gone up by over three times (180%) since 2017, supply constraints are still persistent as demand continues to outstrip supply in the past year. The Asia Pacific lithium-ion battery market remains fragmented with key players including Samsung SDI Co. Ltd., Panasonic Corporation, and BYD Co. Ltd. However, China and India are anticipated to attract significant investments in the sector during the coming years.

The Asia Pacific lithium metal market was valued at $1035.8m in 2023 and it’s projected to grow at a CAGR of 18.5% from its value last year through to end of 2029. China leads both as consumers and producers of lithium metal within this particular market while Japan and South Korea also play important roles within it. Concerns however arise due to limited availability of Lithium reserves on these countries, with most Lithium resources being concentrated mainly on Australia – which supplies about46 %of Lithium chemicals.

China is a dominant processor of critical minerals in the lithium-ion battery market, controlling more than 50% of the total market share. Australia boasts the world's largest battery-grade lithium reserves which has seen it record a dramatic rise in export revenues. On the other hand, China produces 60%of the world's Lithium products and 75% of all lithium-ion batteries. However, this has seen the US and European Union look to reduce their reliance on Chinese supply chains by seeking increased self-sufficiency in Li market.

Top Players in Global Lithium-ion Battery Market

- BYD Company

- LG Chem

- Panasonic Corporation

- Samsung SDI

- BAK Group

- Hitachi Corporation

- Johnson Controls

- Toshiba Corporation

- Raja Groups

- Tata Chemicals

- TDK Electronics AG

- Sony Corporation

- Murata Manufacturing Co., Ltd.

- Amperex Technology Limited

- LITEC Co., Ltd.

- GS Yuasa International Ltd.

- Automotive Energy Supply Corporation

- Other Major Players

Market Segmentation Overview:

By Type:

- Lithium Nickel Magnesium Cobalt (LI-NMC)

- Lithium Ferro Phosphate (LFP)

- Lithium Cobalt Oxide (LCO)

- Lithium Titanate Oxide (LTO)

- Lithium Manganese Oxide (LMO)

- Lithium Nickel Cobalt Aluminum Oxide (NCA)

By Power Capacity:

- 0-300 mAH

- 3,000-10,000 mAH

- 10,000-60,000 mAH

- More than 60,000 mAH

By Application:

- Consumer Electronics OEMs

- Smartphones

- Laptops

- UPS Systems

- Smart Cameras

- Smart Watches

- Smart Glasses

- Smart Textiles

- Others

- Automotive OEMs

- Hybrid Electric Vehicles (HEVs)

- Battery Electric Vehicles (BEVs)

- Others (Service Stations/Dealers)

- Energy Storage

- Commercial

- Industrial

- Residential

- Utilities

- Industrial OEMs

- Military

- Industrial Equipment

- Medical

- Marine

- Telecommunication

- Mining

- Forklifts

- Others

- Other OEMs

- Aftermarket

By Form/Design:

- Pouch

- Cylindrical

- Elliptical

- Prismatic

- Custom Design

By Region:

- North America

- The U.S.

- Canada

- Mexico

- Europe

- The UK

- Germany

- France

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia & New Zealand

- Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2023 | US$ 84.4 Bn |

| Expected Revenue in 2032 | US$ 483.4 Bn |

| Historic Data | 2019-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Unit | Value (USD Bn) |

| CAGR | 21.4% |

| Segments covered | By Type, By Power Capacity, By Application, By Form/Design, By Region |

| Key Companies | BYD Company, LG Chem, Panasonic Corporation, Samsung SDI, BAK Group, Hitachi Corporation, Johnson Controls, Toshiba Corporation, Raja Groups, Tata Chemicals, TDK Electronics AG, Sony Corporation, Murata Manufacturing Co., Ltd., Amperex Technology Limited, LITEC Co., Ltd., GS Yuasa International Ltd., Automotive Energy Supply Corporation, Other Major Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)