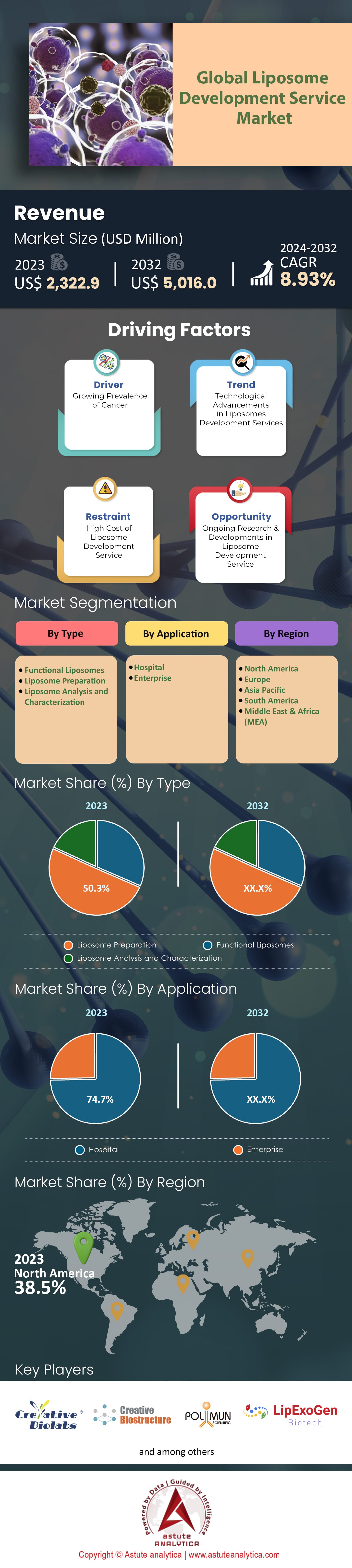

Global Liposome Development Service Market: By Type (Functional Liposomes, Liposome Preparation, and Liposome Analysis and Characterization); Application (Hospital and Enterprise); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: 29-Mar-2024 | | Report ID: AA1023627

Market Scenario

Global Liposome Development Service Market was valued at US$ 2,322.9 million in 2023 and is projected to attain a market size of US$ 5,016.0 million by 2032 at a CAGR of 8.93% during the forecast period 2024–2032.

Liposomes, tiny spherical vesicles composed of one or more phospholipid bilayers, have emerged as game-changers in the world of drug delivery. Their potential to encapsulate both hydrophilic and hydrophobic drugs has rendered them particularly valuable in therapeutic arenas. Given the rising demand, the global liposome development service market has been surging at an unprecedented rate. In recent years, the global healthcare sector's focus on targeted drug delivery systems has intensified. Liposomes, owing to their ability to increase drug stability and reduce side effects, are being increasingly preferred. For instance, Doxil, a liposome-encapsulated version of doxorubicin, was one of the first FDA-approved nanomedicines in 1995. Since then, the number of liposome-based drugs in clinical trials has risen exponentially. As of 2022, over 40 liposomal drugs were in various stages of clinical development.

On a regional scale, North America, especially the U.S., dominates the liposome development service market. This dominance can be linked to the extensive R&D activities, strong healthcare infrastructure, and substantial government funding in the region. In 2023, North American market share constituted nearly 38.5% of the global value. However, the Asia-Pacific region, led by nations like China and India, is swiftly catching up. With increasing investments in pharmaceutical research and the availability of skilled professionals, the region is expected to witness a rapid growth rate.

It has been also observed in the global liposome development service market that players are increasingly being engaged in collaborative undertakings. In 2021 alone, collaborations and partnerships in this sector saw a rise of 18% as compared to the previous year. Key industry players like CordenPharma, Encapsula NanoSciences, and Creative Biostructure have engaged in numerous partnerships, fostering an environment conducive to innovation and expansion.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Embracing Sustainable Practices in Liposome Production and a Shift Towards Plant-Based Products

Environmental consciousness has pervaded almost every industrial sector, and the liposome development service market is no exception. The driver to adopt sustainable practices in liposome production has been underpinned by a multi-faceted push. On the one hand, regulatory bodies worldwide are setting stringent standards, and on the other, there is a growing consumer demand for eco-friendly medical solutions. A critical aspect of this sustainability drive revolves around the sources of lipids used in liposome production. Traditionally, synthetic lipids and those derived from animal sources have been predominant. However, the trend is shifting towards plant-based and bio-sourced lipids. This change in the liposome development service market is not just a nod to sustainability but also addresses concerns related to potential contaminants and the ethical implications of using animal products. As per a 2023 market analysis, the demand for plant-derived lipids in liposome production has witnessed a growth of over 20% in the last two years.

This drive towards sustainability also manifests in the form of energy-efficient production processes, waste reduction, and the exploration of green solvents. It's no longer just about the end product but about ensuring the entire developmental chain minimizes its ecological footprint.

Trend: The Rise of Personalized Liposomal Therapeutics

In the era of personalized medicine, where treatments are tailored based on individual genetic makeup and specific health profiles, liposomes are playing a pivotal role. The ability of liposomes to deliver targeted therapies directly to diseased cells offers a golden opportunity to create patient-specific treatments in the global liposome development service market. Liposomes, given their flexibility in encapsulating a wide range of drug molecules, are being viewed as the perfect vehicles for individualized therapies. For instance, in oncology, where the one-size-fits-all approach has often proved limiting, liposomal preparations are being engineered to carry unique drug combinations suited for a particular patient's tumor profile. According to a 2022 report from the Personalized Medicine Coalition, over 15% of ongoing clinical trials involving liposomes are now focusing on patient-centric drug formulations.

Moreover, the trend doesn't stop at drugs. The use of liposomes for delivering specific genes in gene therapies is also on the rise. With advancements in CRISPR and other gene-editing tools, the possibility of creating liposomal vectors tailored to an individual's genetic needs has become a reality. As a result, investments in this niche of liposomal applications have surged, with biotech startups securing over $500 million in the first half of 2022, specifically for personalized liposomal platforms.

Challenge: Difficulty in Navigating the Complexity of Liposome Scalability

Liposomes, as promising as they are in the realm of drug delivery, are not devoid of challenges. One of the most significant hurdles faced by the global liposome development service market is the complexity surrounding the scalability of liposome production. Translating the success of liposomal formulations from a laboratory setting to large-scale manufacturing often presents multifaceted difficulties. At the heart of this challenge lies the intricate balance required to maintain the structural and functional integrity of liposomes during upscaling. Liposomes, by their very nature, are sensitive vesicles. Their size, lamellarity, and encapsulation efficiency – factors critical for their efficacy as drug delivery vehicles – can vary greatly with changes in production parameters. When transitioning from small-batch laboratory production to industrial-scale manufacturing, ensuring that these parameters remain consistent becomes a monumental task.

The processes like lipid hydration, drug encapsulation, and purification, which might be straightforward on a small scale, also become more complex when scaled up in the liposome development service market. The use of high-energy methods, such as sonication or high-pressure homogenization, which work effectively in a lab environment, may not translate seamlessly to a larger production scenario without incurring exorbitant costs or compromising product quality. Additionally, the regulatory landscape is rigorous, with agencies demanding consistent quality and reproducibility for any pharmaceutical product, including liposomal drugs. This means that any slight alteration in the liposomal formulation during scaling up can lead to extensive and costly regulatory re-evaluations.

Segmental Analysis

By Type:

By liposome types, liposome preparation emerges as a formidable segment by contributing a substantial 50.3% revenue share to the global liposome development service market, it undeniably serves as the cornerstone of the industry. This dominance isn't merely an ongoing trend but is fortified by projections indicating a sustained growth momentum. With an anticipated compound annual growth rate (CAGR) of 9.37% during the forecast period, the liposome preparation segment is on track to further consolidate its position.

This colossal share is attributed to the foundational role that liposome preparation plays in drug delivery and therapeutic applications. As the biopharmaceutical sector continues to grow, the demand for precise, efficient, and scalable liposome preparation methods only intensifies. Moreover, technological advancements facilitating better encapsulation methods and lipid selection processes further fuel this segment's growth.

The science behind liposome preparation has advanced leaps and bounds. Novel techniques and tools for preparing liposomes, such as extrusion methods, supercritical fluid technology, and microfluidic platforms, are being incorporated into the industry at a rapid rate. This ensures that the bioavailability of drugs is enhanced, and their therapeutic efficiency is maximized in the global liposome development service market. For instance, microfluidic methods, which allow for the production of monodisperse and size-tunable liposomes, saw a patent application increase of 15% in 2023, indicating active R&D in this sub-segment. Furthermore, the rise of personalized medicine is creating a demand for bespoke liposome preparations. With personalized treatments expected to grow at a CAGR of 11% globally, the tie-in for liposome preparations that can cater to individual patient needs will likely fuel its dominant market share further.

By Application:

When analyzing the global liposome development service market from an application perspective, hospitals emerge as the leader by accounting for a staggering 74% of the global revenue. The hospitals are not just the primary consumers but also the primary benefactors of advancements in the market. This dominance stems from multiple factors. Hospitals are often at the forefront of administering advanced therapeutics, where liposomal drugs play a pivotal role due to their targeted delivery mechanisms. The increase in the number of hospital admissions, coupled with the growing emphasis on precision medicine, amplifies the demand for liposomal drugs and treatments. Furthermore, the presence of specialized care units in hospitals dealing with oncology, infectious diseases, and other critical care treatments, where liposomal drugs have a pronounced impact, accentuates this trend.

The nature of treatments that use liposomal drugs often requires specialized facilities. Treatments like chemotherapy, which are increasingly using liposomal preparations for targeted drug delivery, are primarily administered in hospitals. With cancer treatments globally expected to witness a 7% increase annually, the dependency on hospitals for such applications is clear. Additionally, hospitals in the global liposome development service market are continually expanding their research wings. Hospital-affiliated research institutions and labs are entering partnerships with biopharmaceutical companies, leading to a more direct application of liposomal drugs and techniques. For example, in 2023, collaborations between hospital research wings and pharma companies saw a 12% increase, hinting at a growing symbiosis.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

North America, spearheaded by the U.S., remains a formidable contributor to the liposome development service market. With a market share that amounted to a significant 38.5% of the global value in 2023, its impact is significant thanks to the U.S.'s commitment to research and development. Recent study indicates that R&D spending in the pharmaceutical sector in the U.S. exceeded $55 billion in 2022 alone. Additionally, renowned institutions such as Johns Hopkins and Mayo Clinic bolster the nation's stronghold in the domain. Moreover, the presence of a robust healthcare infrastructure, marked by state-of-the-art research labs, cutting-edge technology, and a vast network of seasoned professionals, further consolidates North America's position. Furthermore, government initiatives have played a pivotal role. For instance, the Biomedical Advanced Research and Development Authority (BARDA) has consistently earmarked substantial funds, with a 7% increase in 2022, promoting advanced research in liposomal drugs.

The dynamics of the Asia-Pacific liposome development service market cannot be overlooked. While traditionally the region has played third fiddle to North America, recent trends suggest a shift in the winds. China and India, with their burgeoning pharmaceutical sectors, are at the forefront of this surge. In 2022, top 10 pharma companies in China invested over $5.2 billion in pharmaceutical R&D, with a considerable chunk dedicated to nanomedicine and liposome technology. Furthermore, the introduction of policies, such as the "Made in China 2025" initiative, signifies the nation's intent to climb the value chain in the biopharmaceutical sector. India, often dubbed the 'pharmacy of the world', has also made significant strides. The Indian pharmaceutical sector, valued at $50 billion in 2022, has seen a 12% year-on-year increase in investments targeting liposome research.

What truly augments the Asia-Pacific momentum is the availability of skilled professionals. According to the World Economic Forum, in 2022, China and India collectively produced over 9 million STEM graduates, creating a vast talent pool driving innovation in the liposome development services. However, the region is not without challenges. Regulatory hurdles, intellectual property rights issues, and certain infrastructural gaps might pose bottlenecks. Yet, given the rate of growth and investment, these challenges are likely to be surmounted in the foreseeable future.

Top Players in the Global Liposome Development Service Market

- Creative Biolabs

- Creative Biostructure

- Polymun Scientific Immunbiologische Forschung

- LipExoGen Biotech

- T&T Scientific

- TTY Biopharm

- FormuMax Scientific

- Creative Biogene

- Dalton

- PlantaCorp

- CD Bioparticles

- BSP Pharmaceuticals

- Other major players

Market Segmentation Overview:

By Type

- Functional Liposomes

- Liposome Preparation

- Liposome Analysis and Characterization

By Application

- Hospital

- Enterprise

By Region

- North America

- The US

- Canada

- Europe

- Germany

- France

- UK

- Russia

- Nordic Countries

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Middle East & Africa

- UAE

- Saudi Arabia

- Turkey

- Rest of MEA

- South America

- Brazil

- Mexico

- Rest of South America

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2023 | US$ 2,322.9 Mn |

| Expected Revenue in 2032 | US$ 5,016.0 Mn |

| Historic Data | 2019-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Unit | Value (USD Mn) |

| CAGR | 8.93% |

| Segments covered | By Type, By Application, By Region |

| Key Companies | Creative Biolabs, Creative Biostructure, Polymun Scientific Immunbiologische Forschung, LipExoGen Biotech, T&T Scientific,TTY Biopharm, FormuMax Scientific, Creative Biogene, Dalton, PlantaCorp, CD Bioparticles, BSP Pharmaceuticals, Other major players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)