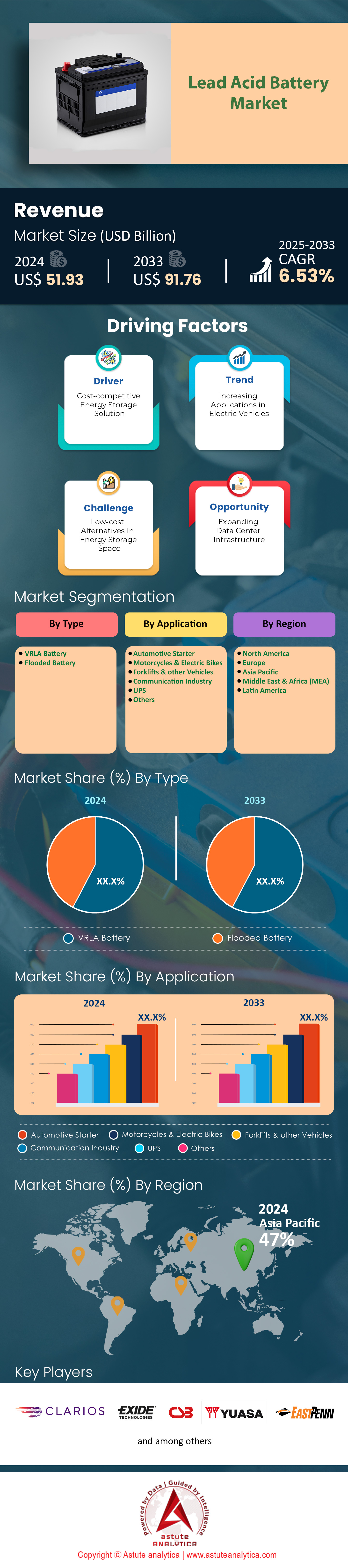

Lead Acid Battery Market: By Type (VRLA Battery and Flooded Battery); Application (Automotive Starter, Motorcycles & Electric Bikes, Forklifts & other Vehicles, Communication Industry, UPS and Others); and Region—Industry Dynamics, Market Size and Opportunity Forecast for 2025–2033

- Last Updated: 04-Nov-2025 | | Report ID: AA0622260

Market Snapshot

Lead acid battery market was valued at US$ 51.93 billion in 2024 and is project to hit the market valuation of US$ 91.76 billion by 2033 at a CAGR of 6.53% during the forecast period 2025-2033.

Key Findings

- Based on type, flooded lead acid batteries are controlling over 65% market share.

- Based on application, automotive starter applications still capture a vast portion of market consumption.

- Asia Pacific controls over 47% market revenue.

- Global lead acid battery market is set to surpass market size of US$ 91.76 billion by 2033.

An immense and reliable consumption base for the Lead acid battery market is anchored by the global automotive sector. With global vehicle production hitting 93,546,599 units in 2023, the foundational need for SLI batteries is firmly established for 2024 and beyond. This is vividly reflected in shipment volumes, with North America receiving 159 million automotive battery units in 2024, and China exporting a massive 143 million units between January and July 2024. Future demand is so robust that China is projected to export 21.29 million units in July 2025 alone. Manufacturers are scaling up to meet this, with one new Clarios plant set to supply 745,000 advanced starter batteries annually starting in 2026.

Beyond passenger cars, industrial applications create another powerful demand stream for the lead acid battery market. The global logistics network, which shipped 1.75 million forklift trucks in 2023, relies heavily on lead-acid power. This industrial-scale need is exemplified by single operators like Amazon, which utilized 75,000 robotic movers and forklifts as of mid-2024. To meet such varied demand, enormous capital is being deployed, including Clarios’s US$ 6 billion investment plan through 2035 and an estimated US$ 17 billion earmarked under India's Production-Linked Incentive scheme by August 2024. A single Chinese project is expanding lead-carbon battery output to 85 million kWh annually, signaling growth in specialized applications.

The market’s demand is further uniquely shaped by its leading-edge circular economy. The immense recycling infrastructure, which produced 1,000,000 tons of secondary lead in the U.S. in 2023, creates a stable and sustainable supply chain. New facilities are continuously adding capacity, including a Dubai plant handling 75,000 metric tons annually and a new Indian plant with a 96,000 metric ton per annum capacity. A planned Chinese facility will add a massive 600,000 tons of annual recycling capacity. This recycling strength provides a crucial buffer against raw material volatility, such as when lead costs approached 17,000 yuan per ton in mid-2025, ensuring supply security for stakeholders.

To Get more Insights, Request A Free Sample

Emerging Frontiers Create New Revenue Streams for Lead-Acid Battery Innovators

- Grid-Scale Energy Storage Adoption: A significant opportunity for the Lead acid battery market lies in grid-scale energy storage, particularly in emerging economies. Advanced lead-carbon and other enhanced chemistries are being deployed for frequency regulation and peak shaving applications. Their proven reliability and lower upfront cost compared to lithium-ion make them ideal for projects requiring durable, safe, and cost-effective solutions to stabilize power grids integrating intermittent renewable energy sources. This trend allows manufacturers to diversify beyond traditional automotive and industrial applications into the rapidly expanding utility sector.

- Growth in Micro-Hybrid Vehicles: The proliferation of micro-hybrid vehicles, which use advanced start-stop systems and regenerative braking, is creating a premium market for Enhanced Flooded Batteries (EFB) and Absorbent Glass Mat (AGM) lead-acid batteries. These vehicles require batteries with higher charge acceptance and greater cycling capabilities than standard SLI batteries. As emissions regulations tighten globally, the fleet of micro-hybrids is set to expand dramatically. This provides a lucrative opportunity for companies to market high-performance, higher-margin lead-acid batteries specifically engineered for these demanding automotive platforms, capturing significant value within the evolving transportation landscape.

Surging Data Center Power Demands Fortify Stationary Battery Market Growth

The rapid expansion of the digital economy is driving unprecedented demand for reliable backup power, creating strong growth opportunities for the lead acid battery market. Data centers—the nerve centers of cloud computing and AI—depend on large-scale uninterruptible power supply (UPS) systems to maintain operational continuity. Lead-acid batteries, especially valve-regulated lead-acid (VRLA) types, continue to dominate due to their proven safety, reliability, and cost efficiency. The growing number of new data centers and capacity upgrades is translating into massive orders for stationary batteries worldwide.

This surge is underscored by major investments and power expansions. In Virginia, a 91.5-megawatt data center campus is set to go live in 2025, while a hyperscale facility in Dublin will need a 72-megawatt backup system by early 2025. A Phoenix project launched in 2024 includes 20,000 VRLA battery units in its initial build-out. Likewise, Malaysia in the lead acid battery market is developing a data center hub with an US$ 800 million investment and a 64-megawatt phase-one requirement. In 2024 alone, contracts were signed to supply 1.2 million VRLA units for global data center upgrades. Another European technology company pledged to install 300,000 new lead-acid batteries by the end of 2025, while a 2024 Texas-based facility ordered 15,000 high-rate discharge batteries. In early 2025, India’s government tendered 50,000 battery units for national informatics centers. Meanwhile, a cloud provider’s 2024 sustainability report cited the installation of 80,000 new lead-acid batteries to enhance efficiency, and a London financial institution replaced 12,000 UPS batteries in Q1 2025. These developments collectively highlight strong and sustained demand for stationary lead-acid batteries supporting global digital infrastructure.

Rural Electrification Initiatives Power Demand in Off-Grid Energy Markets

Ongoing rural electrification programs are creating another robust growth avenue for the lead acid battery market. With millions in remote regions still lacking reliable electricity, off-grid solar systems are becoming essential. Lead-acid batteries remain the preferred choice in these applications because they are affordable, widely available, and durable in diverse environmental conditions. As governments and NGOs continue to scale solar home systems and mini-grids, battery demand is accelerating across emerging economies.

Numerous initiatives illustrate this momentum across the global lead acid battery market. In Nigeria, a 2024 program aims to distribute 150,000 solar home systems equipped with lead-acid batteries. A World Bank-backed project across Sub-Saharan Africa targets 10,000 mini-grids by 2025, requiring roughly 500,000 deep-cycle batteries. In India, a 2024 electrification drive plans to connect 25,000 villages using solar systems with lead-acid storage. Similarly, an NGO deployed 80,000 batteries for Southeast Asian healthcare clinics in 2024. A Q1 2025 tender in the Philippines sought 60,000 tubular batteries for community solar projects, while an East African firm secured an order for 200,000 units for solar irrigation. Latin America’s 2025 initiative aims for 50,000 off-grid installations, and African distributors received 1.2 million batteries for solar solutions in 2024. In Bangladesh, 35,000 solar home systems were installed in the first half of 2025, and Indonesia’s new 2025 subsidy supports annual production of 250,000 batteries for off-grid use. Together, these measures reinforce the growing importance of lead-acid batteries in achieving global energy access goals.

Segmental Analysis

Economic Viability and Proven Performance Fuel Flooded Battery Market Dominance

Holding a dominant market share of over 65%, flooded lead-acid batteries continue to be a primary choice in energy storage in the lead acid battery market, driven by their economic advantages and established reliability. A significant market factor is their extensive service life; industrial-grade batteries can achieve up to 1,500 cycles and last for 10 years or more with correct maintenance. Operational expenditures are predictable, with typical quarterly maintenance for industrial uses costing between US$ 200 and US$ 300. The technology’s long history, which spans more than 160 years, offers a performance record that newer technologies have yet to match. Consequently, from a capital investment perspective, these batteries provide a lower entry barrier, with an approximate capital cost of US$ 260 per kilowatt-hour. The Lead acid battery market is also strongly supported by an exceptionally efficient and mature recycling infrastructure.

This well-established circular economy provides a notable market advantage, as up to 99% of lead and plastic components are recyclable. In North America, for instance, recycled sources fulfill over 80% of the total lead demand, promoting raw material security. While maintenance is a requirement, it is generally straightforward; however, improper care can shorten a battery's operational life by as much as 50%. Specific maintenance services like watering and cleaning carry costs ranging from US$ 50 to US$ 75 and US$ 40 to US$ 60 per battery, respectively. For peak performance, a repeated depth of discharge between 50% and 80% is advised, alongside a cell cut-off voltage of approximately 1.75 volts to extend longevity.

- The upfront cost for a single industrial battery typically ranges from £1,000 to £4,000.

- Deep-cycle models, which are well-suited for renewable energy storage, deliver a solid 300 to 1,000 cycles.

- During the charging process, batteries can release hydrogen gas, posing a risk at a concentration of 4% in the air.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

Automotive SLI Applications Reinforce Enduring and Practical Technology Dominance in the Market

Within the automotive industry, starting, lighting, and ignition (SLI) applications remain a massive consumption segment for the Lead acid battery market. The principal reason for this is their excellent cost-to-performance ratio. Flooded batteries offer a substantial cost advantage of 30-50% compared to AGM alternatives for conventional vehicles, a critical factor for original equipment manufacturers (OEMs). The immense scale of global vehicle production directly supports this demand. China, for example, is forecast to produce 66.1 million vehicles in 2025. Furthermore, in 2023, 10.6 million new cars were registered across the 27 European Union member states, a region that contained 255 automotive manufacturing plants as of October 2024. A standard automotive battery offers a dependable service life of 3 to 5 years.

Demand from developing economies also acts as a powerful growth engine for the lead acid battery market. India's yearly battery demand is expected to reach 30 million units within the next five years, mirroring the nation's growing vehicle population. To facilitate such expansion, India has allocated an estimated US$ 17 billion for battery manufacturing facilities under its Production-Linked Incentive program as of August 2024. The fundamental design, which utilizes lead fortified with additives like antimony and calcium, is ideally suited for delivering the high-surge current required for engine ignition while enduring vehicle vibrations. The failure of just one battery can stop operations; an hour of downtime for a 20-truck fleet can cost thousands of dollars, underscoring the need for this reliable technology.

- The U.S. Environmental Protection Agency updated its emission and performance standards for lead-acid battery plants in 2023.

- Key raw materials are reliably sourced from major lead-producing nations, including the US, Australia, and China.

- A standard 12-volt automobile battery serves as the most widespread example of flooded-cell technology in everyday use.

To Understand More About this Research: Request A Free Sample

Regional Analysis

Asia Pacific Manufacturing Might Underpins Global Market Dominance

The Asia Pacific region decisively leads the global lead acid battery market, capturing over 47% of the market share through its unparalleled manufacturing output and dynamic export channels. A comprehensive industrial ecosystem, from raw material sourcing to advanced battery assembly, supports this leadership. Nations throughout the region are funneling significant capital into production facilities and setting ambitious output targets. These actions are designed to satisfy massive domestic consumption while also supplying a substantial portion of the world's lead-acid battery needs. The sheer scale of regional operations dictates the competitive landscape for the entire global market.

The region’s powerful position in the Lead acid battery market is clearly demonstrated by key figures. India’s role as a major supplier is evident from its 81,552 lead-acid battery export shipments between late 2023 and 2024, with 41 of those shipments in April 2025 being for sealed lead-acid batteries alone. In Vietnam, manufacturer Leoch reported an annual output of 48,000 tons of automotive batteries in 2024. Indonesia’s market is rapidly expanding, with plans to support 400,000 electric vehicles by 2025 and a new factory by Rept Battero adding 8 GWh of production capacity. South Korea's advanced lead-acid battery sector is set for major growth through 2029, supported by firms like LG Chem, whose Korean facilities can produce 80,000 tons of cathode material yearly. A major Thai automotive company ordered 300,000 replacement SLI batteries in 2024, while a leading Japanese industrial firm will purchase 50,000 deep-cycle batteries for its 2025 forklift fleet. Underscoring sustainability, a major regional recycling facility processed 250,000 metric tons of spent batteries in 2024.

North America Focuses on Advanced Production and Supply Chain Security

North America carves out its strategic position in the Lead acid battery market through targeted investments in advanced manufacturing and a strong focus on supply chain resilience. As a primary consumption hub, the region’s key manufacturers are prioritizing the production of higher-margin Absorbent Glass Mat (AGM) batteries. These are critical for modern vehicles featuring start-stop systems. A highly efficient recycling network is central to the region’s strategy, creating a robust circular economy that minimizes waste and reduces dependency on foreign raw materials.

Recent data highlights the success of this focused approach in the lead acid battery market. In 2024, the U.S. produced an estimated 1,000,000 tons of secondary lead, almost entirely from recycled batteries, supplemented by a domestic mine output of 26,200 metric tons in December 2024 alone. A US$ 16 million investment is expanding Clarios's South Carolina plant for AGM component manufacturing. The company also boosted its U.S. production of advanced low-antimony batteries by 1.5 million units in 2024. A new Ohio facility starting in 2026 will supply 745,000 advanced batteries annually, while another 2025 investment will increase component capacity by 30 million parts. A major U.S. automaker's contract for 500,000 AGM batteries for its 2025 models, along with 25,000 new backup units installed by Canadian telecoms in 2024, shows strong demand. Further, Mexico’s plants exported 2.2 million SLI batteries to the U.S. in the first half of 2024, and U.S. suppliers received orders for 150,000 motive power batteries in 2024.

Europe Channels Investment into High-Value and Specialized Battery Production

Europe reinforces its influential role within the global Lead acid battery market by concentrating on premium product manufacturing and strategic ecosystem investments. The continent's sophisticated automotive sector generates significant demand for high-value AGM and Enhanced Flooded Battery (EFB) types, which offer better margins. European producers are actively expanding their capacity to cater to this advanced market segment. Simultaneously, substantial investments are being made in recycling infrastructure to promote a sustainable and circular battery economy.

This strategic direction is backed by significant capital projects and strong national industries. In Poland, a new battery materials plant is being built with a US$ 1.25 billion investment, and a separate EUR 240 million grant will establish a major battery metals recovery hub, complemented by a planned gigafactory investment of nearly EUR 600 million. Italy's mature lead acid battery market included 57 battery manufacturing businesses in 2024, while its recycling sector processed 148,880 metric tons of spent lead batteries. Italy also has a planned gigafactory capacity of 48 GWh. In Germany, automotive supplier VARTA employed around 4,000 people, and a top carmaker ordered 1.2 million AGM batteries in 2024. A Spanish logistics firm procured 15,000 forklift batteries in 2024, while a leading UK data center operator contracted to replace 20,000 UPS battery units in 2025, illustrating robust industrial demand.

Top 6 Strategic Capital Injections and Acquisitions Fortify the Global Lead Acid Battery Market

- EnerSys Acquires Bren-Tronics Inc. (March 2024): Global industrial technology leader EnerSys completed the acquisition of Bren-Tronics, Inc., a key manufacturer of portable power solutions and batteries for military applications, enhancing its portfolio in the defense sector.

- Clarios Invests in U.S. AGM Battery Production (January 2024): Clarios announced a US$ 16 million investment to expand its Absorbent Glass Mat (AGM) battery component manufacturing capabilities at its facility in Oconee County, South Carolina, to meet rising automotive demand.

- Dubatt Inaugurates Advanced Recycling Facility (February 2024): Dubatt Battery Recycling inaugurated its fully integrated lead-acid battery recycling plant in Dubai Industrial City, representing an investment of AED 216 million (approximately US$ 58.8 million).

- Gridtential Secures Strategic Investment (February 2024): The developer of advanced bipolar lead battery technology, Gridtential Energy, received a strategic investment from Shield Power Solutions to accelerate the commercialization of its Silicon Joule™ batteries for industrial and military applications, further adding fuel to the lead acid battery market growth.

- Exide Industries Funds Haldia Recycling Plant (February 2024): The board of Exide Industries approved an investment of up to INR 100 Crore (approximately US$ 12 million) for its wholly-owned subsidiary, Chloride Metals, to set up a new battery recycling unit at its Haldia facility.

- Amara Raja Begins Work on Manufacturing Hub (May 2024): Indian battery giant Amara Raja commenced work on its "Giga Corridor" manufacturing facility in Telangana, an INR 9,500 crore (approximately US$ 1.14 billion) project that will include lead-acid battery lines alongside other chemistries.

Top Companies in the Lead Acid Battery Market:

- Clarios

- Exide Technologies

- CSB Energy Technology

- Yuasa

- EnerSys

- East Penn Manufacturing

- Fiamm

- Sebang

- Hankook AtlasBX

- Amara Raja

- C&D Technologies

- Midac Batteries

- ACDelco

- Banner Batteries

- First National Battery

- Chilwee

- Tianneng Holding Group

- Shuangdeng Group (Shoto)

- Camel Group

- Fengfan

- Leoch

- Narada Power

- Sacred Sun Power Sources

- Coslight Technology

- Other Prominent Players

Market Segmentation Overview:

By Type:

- VRLA Battery

- Flooded Battery

By Application:

- Automotive Starter

- Motorcycles & Electric Bikes

- Forklifts & other Vehicles

- Communication Industry

- UPS

- Others

By Region:

- North America

- The U.S.

- Canada

- Mexico

- Europe

- The UK

- Germany

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- Southeast Asia

- South Korea

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- GCC

- Egypt

- South Africa

- Israel

- Turkey

- Rest of MEA

- Latin America

- Argentina

- Brazil

- Rest of Latin America

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2024 | US$ 51.93 Billion |

| Expected Revenue in 2033 | US$ 91.76 Billion |

| Historic Data | 2020-2023 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Unit | Value (USD Bn) |

| CAGR | 6.53% |

| Segments covered | By Type, By Application, By Region |

| Key Companies | Clarios, Exide Technologies, CSB Energy Technology, Yuasa, EnerSys, East Penn Manufacturing, Fiamm, Sebang, Hankook AtlasBX, Amara Raja, C&D Technologies, Midac Batteries, ACDelco, Banner Batteries, First National Battery, Chilwee, Tianneng Holding Group, Shuangdeng Group (Shoto), Camel Group, Fengfan, Leoch, Narada Power, Sacred Sun Power Sources, Coslight Technology, Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)