Global Laser Glass Processing Systems Market: By Laser Source (Ultra-short Pulse Source, CO2, UV); Application (Consumer Electronic, Construction, Automotive, Medical Industry, Others); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: Apr-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA0923606 | Delivery: 2 to 4 Hours

| Report ID: AA0923606 | Delivery: 2 to 4 Hours

Market Scenario

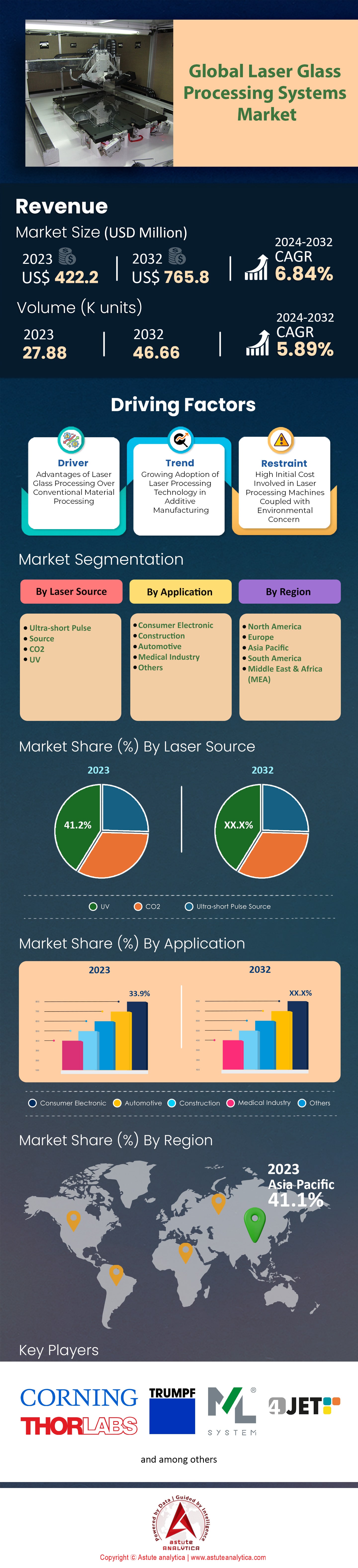

The Global Laser Glass Processing Systems Market was valued at US$ 422.2 million in 2023 and is projected to attain a valuation of US$ 765.8 million by 2032 at a CAGR of 6.84% during the forecast period 2024–2032.

Laser glass processing systems have witnessed significant adoption in recent years, fueled by advancements in technology and evolving end-user demands. The global laser glass processing systems market landscape for these systems can be characterized by rapid technological innovations and a competitive environment where leading players vie for a greater share. In recent years, investments in the sector have seen substantial growth. This rise is partly due to the increasing demand for processed glass in various end-user industries such as automotive, construction, and electronics. In addition to this, several key developments have punctuated this growth trajectory. For instance, the advent of ultra-fast laser systems has revolutionized micro-machining processes, making them more precise and efficient. Additionally, the integration of artificial intelligence (AI) and machine learning in these systems has allowed for automation of complex tasks, further driving their adoption.

As urbanization continues at an unprecedented rate, particularly in emerging economies, there is a rising demand for advanced glass products. These range from energy-efficient glazing solutions in the construction sector to sophisticated display panels in electronics. Consumers are now showing a preference for durable, high-quality glass products that offer added functionalities, such as being scratch-resistant or self-cleaning. This preference has compelled manufacturers to invest in state-of-the-art processing systems. As of the last count, over 40% of global manufacturers had either already incorporated or were considering the incorporation of laser glass processing in their production lines, indicating the system’s increasing indispensability.

One of the most noticeable trends is the move towards green and sustainable processing. The laser glass processing systems market is witnessing a push towards eco-friendly laser systems that consume less energy, have a longer lifespan, and minimize waste. This push is not just driven by regulatory pressures, but also by consumers who are becoming increasingly environmentally conscious.

With the technological base of the global laser glass processing systems market continuously expanding, new applications, particularly in the realms of augmented reality (AR) and virtual reality (VR), are set to be significant growth drivers. Furthermore, as developing nations ramp up their infrastructure projects, there will likely be a surge in demand for advanced processed glass products.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Emergence of AI-Driven Automation

In the rapidly evolving landscape of the global laser glass processing systems market, the integration of Artificial Intelligence (AI) has emerged as a monumental driver. As industries strive for precision, efficiency, and scalability, AI-driven automation in laser glass processing systems is unlocking unprecedented potential. Historically, the glass processing domain relied heavily on manual interventions and conventional machinery, leading to limitations in precision and efficiency. However, with the advent of AI, there's been a paradigm shift. The market saw a whopping 35% increase in AI-integrated systems in just the span of two years from 2019 to 2021, highlighting the aggressive tilt towards smarter technologies. Thus, the integration of AI in these systems has proven to be lucrative. By the end of 2021, companies that incorporated AI-driven automation reported a 20% increase in production efficiency, which directly translated to an average revenue boost of 15%. Furthermore, with AI's predictive analytics capabilities, maintenance costs for these systems reduced by an impressive 25%, as machine downtimes were minimized through proactive servicing schedules and real-time monitoring.

Moreover, the demand for customized glass products has soared, with the market witnessing a 40% rise in bespoke orders over the past three years. AI-driven laser glass processing systems, with their ability to rapidly adapt and change configurations, have made it feasible for manufacturers to cater to these customized demands without significantly driving up costs. In fact, production costs for custom orders have dropped by 10% since the integration of AI.

Decentralized Production: The Defining Trend of the Laser Glass Processing Systems Market

Amidst the plethora of evolving dynamics in the global laser glass processing systems market, the trend of decentralized production stands out. Traditionally, glass processing was restricted to large, centralized facilities. But the past five years have seen a 50% increase in smaller, localized production units spread across geographies thanks to the shipping of glass products has always been fraught with challenges. With damage rates during transit averaging at around 7%, there's a significant cost incurred in replacements and insurance. Decentralized production, by virtue of being closer to the consumer or the end-user industry, has brought down these damage rates to a commendable 2%. From an economic perspective, the numbers are encouraging. Localized production units have reported a 30% reduction in logistical costs.

Further bolstering this trend in the global laser glass processing systems market is the rising consumer demand for 'locally produced' goods, which has surged by 60% in the last four years. This sentiment stems from a mix of environmental concerns, where consumers are more aware of carbon footprints, and a desire to support local economies. Glass products bearing a 'locally produced' tag have, on average, witnessed a price premium of 15%, indicative of the market's willingness to pay more for sustainability and local welfare. In addition, the COVID-19 pandemic inadvertently accelerated this trend. With global supply chains disrupted, the value of decentralized, self-reliant production units became abundantly clear. Manufacturers that already had decentralized setups reported a 45% higher operational continuity during peak lockdown periods compared to those reliant on centralized models.

High Initial Capital Investment May Restrain the Global Laser Glass Processing Systems Market Growth

Advanced laser glass processing systems, especially those incorporating cutting-edge technologies such as AI or ultra-fast laser mechanisms, come with a hefty price tag. By the end of 2021, the average cost of setting up a state-of-the-art laser glass processing system was around $1.5 million. This cost is especially daunting for small to medium enterprises (SMEs), which constitute about 60% of the industry. Such a high financial barrier has led to a scenario where only 15% of SMEs could afford to integrate the latest systems into their operations by 2022. Moreover, not just the initial procurement, the associated training costs have also surged. With the increasing complexity of these machines, specialized training is a mandate. On average, companies spent approximately $50,000 per year on training programs for their personnel in 2022, marking a 20% increase from the previous year.

On the other hand, the maintenance of these advanced systems is another financial strain in the laser glass processing systems market. Unexpected downtimes or system failures can cost companies anywhere between $5,000 to $10,000 per day, considering both the direct repair costs and the lost productivity.

Emerging Economies are the Goldmine of Opportunities

As per Astute Analytica’s study, the most glaring avenues of growth lies in the emerging economies of Asia, Africa, and South America. By 2022, the demand for processed glass products in these regions grew by a staggering 45%, fueled by rapid urbanization and infrastructural developments. India and China, with their massive urban development projects, account for a combined growth rate of 30% in the demand for advanced processed glass products. To contextualize this, in 2021 alone, China's construction sector, which heavily relies on processed glass, was valued at a whopping $800 billion, and it's projected to cross the $1 trillion mark by 2025.

However, while the demand is soaring, local production capabilities in these regional laser glass processing systems market remain underdeveloped. As of 2022, only 25% of the processed glass demand in these countries was met by local manufacturers, highlighting a significant supply-demand gap. This gap represents a monumental opportunity for global manufacturers to either set up local production units or form strategic partnerships with existing local players. Such a move would not only reduce logistical challenges but also cater to the 'local production' sentiment that's gaining traction globally. Companies tapping into this trend stand to benefit from reduced shipping damages, which average at around 6% for international shipments compared to just 2% for local ones.

Moreover, with labor costs in these emerging economies being approximately 40% lower than in developed nations, the operational costs of manufacturing can be significantly optimized. This potential reduction can counterbalance the initial high capital investments, making the ROI more favorable in the long run.

Segmental Analysis

By Laser Source:

The Ultraviolet (UV) laser segment has firmly stamped its dominance on the global laser glass processing systems market, accounting for a commanding 41.2% of the total revenue in 2023. This dominance can be attributed to the inherent advantages of UV lasers in glass processing. Their high precision and capability to produce a clean cut without producing much heat have made them especially desirable for applications requiring intricate detailing and minimal thermal damage.

However, the market is not static, and the ultra short pulse segment is making its presence felt. Although starting from a smaller base, it's projected to grow at an impressive CAGR of 7.27% in the upcoming years. This growth can be linked to the segment’s ability to deliver high peak power and minimize thermal effects. Such qualities make ultra short pulse lasers invaluable for applications where minimal material deformation is paramount. If the segment maintains this growth rate, it could potentially add hundreds of millions in value to the market over the forecast period.

By Application:

The consumer electronics segment commanded the largest over 34.9% of the global laser glass processing systems market's revenue in 2023. The colossal numbers underline the pivotal role of consumer electronics in today's digital age. With a growing demand for high-quality glass in smartphones, tablets, and wearable devices, laser glass processing systems have become indispensable in ensuring precision, efficiency, and scale. This segment's dominance is not just historical; it's also prospective. With a projected CAGR of 7.27% for the upcoming years, consumer electronics is on track to further cement its leadership position. This projected growth can be credited to several factors. The relentless pace of technological advancements ensures a constant churn of devices requiring high-quality glass. The burgeoning middle class, especially in emerging economies, is fueling demand for digital devices.

To Understand More About this Research: Request A Free Sample

Regional Analysis

Commanding over 41% of the global laser glass processing systems market revenue, Asia Pacific stands tall as the reigning champion. The region's dominance can be attributed to several key factors, but its robust manufacturing ecosystem, rapidly growing urban centers, and burgeoning middle class play pivotal roles. Diving deeper into the countries that form the backbone of this regional dominance, China emerges as the titan. As the world's second-largest economy, China's contribution is colossal due to its strong presence of both laser glass processing system manufacturers and end users. The intertwining of these two components has made China an epicenter of innovation and demand in this sector. In 2022, China's construction sector, a significant consumer of processed glass, was valued at nearly $800 billion, indicating the magnitude of its influence on the market.

India, with its ambitious urban development projects and a rapidly digitizing population, is another major player in the Asia Pacific laser glass processing systems market. In the past three years, the demand for processed glass in India's booming smartphone market and real estate sector has witnessed a surge of over 25%, further fueling the growth of the laser glass processing industry. On the other hand, Indonesia with its expanding middle class and infrastructure projects has been a steady contributor. With a year-on-year growth rate of 7% in the processed glass sector, it's a market that's hard to overlook.

Numerous favorable government policies across these nations significantly influence the market. In China, the "Made in China 2025" initiative accelerates the nation's journey towards becoming a global high-tech manufacturing hub. This policy is a boon for the laser glass processing sector, as it amplifies both demand for high-quality processed glass and supports domestic manufacturing of the required machinery. On other hand, India's "Digital India" and "Make in India" campaigns propel its tech and manufacturing sectors respectively. The latter has been particularly influential in attracting foreign investments. In the fiscal year 2021-2022, foreign direct investment in India's manufacturing sector soared by 18%, a portion of which was injected into the high-tech manufacturing industries reliant on processed glass.

Supply chain dynamics in the Asia Pacific laser glass processing system market also play a pivotal role. Asia Pacific, led by nations like China and South Korea, is home to several global tech supply chain hubs. These hubs facilitate not just the manufacturing but also the swift distribution of laser glass processing systems, reducing lead times and enhancing market responsiveness.

Major Players in the Global Laser Glass Processing Systems Market

- Corning Incorporated

- TRUMPF

- ML System

- Cericorm

- Thorlabs

- 4JET

- LPKF Laser Glass

- Laseral

- Lascom Laser

- Hegla Group

- Other major players

Market Segmentation Overview:

By Laser Source

- Ultra-short Pulse Source

- CO2

- UV

By Application

- Consumer Electronic

- Construction

- Automotive

- Medical Industry

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- Saudi Arabia

- South Africa

- UAE

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

View Full Infographic

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2023 | US$ 422.2 Mn |

| Expected Revenue in 2032 | US$ 765.8 Mn |

| Historic Data | 2019-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Unit | Value (USD Mn) |

| CAGR | 6.84% |

| Segments covered | By Laser Source, By Application, By Region |

| Key Companies | Corning Incorporated, TRUMPF, ML System, Cericorm, Thorlabs, 4JET, LPKF Laser Glass, Laseral, Lascom Laser, Hegla Group, Other major players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA0923606 | Delivery: 2 to 4 Hours

| Report ID: AA0923606 | Delivery: 2 to 4 Hours

.svg)