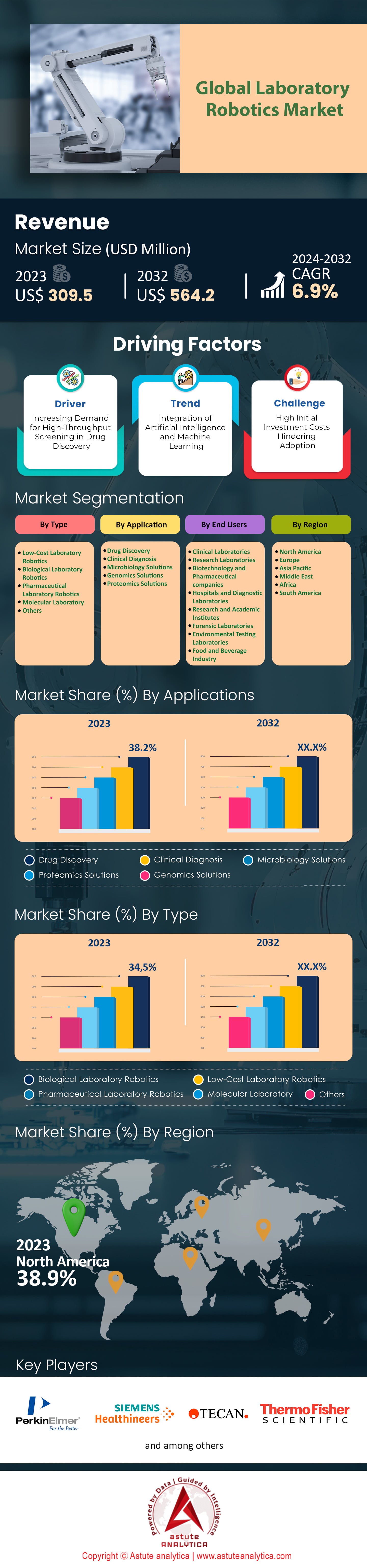

Global Laboratory Robotics Market: By Type (Low-Cost Laboratory Robotics, Biological Laboratory Robotics, Pharmaceutical Laboratory Robotics, and others); Application (Drug Discovery, Clinical Diagnosis, Microbiology Solutions, and others); End User (Clinical Laboratories, Research Laboratories, Biotechnology and Pharmaceutical companies, and others); and Region—Industry Dynamics, Market Size, Opportunity and Forecast for 2024–2032

- Last Updated: 28-Nov-2024 | | Report ID: AA0122120

Market Overview

Laboratory robotics market generated a revenue of US$ 309.5 million in 2023 and is projected to attain a value of US$ 564.2 million by 2032 at a CAGR of 6.9% during the forecast period 2024–2032.

Laboratory robotics entails a variety of programmable machines that have been novelly designed to perform tasks that were typically performed by technicians. These tasks include high-throughput and bulky sampling, data collection, and analysis among others in various fields. Thus, it is reasonable to conclude that there is an increase in the need for laboratory robotics which is given the increasing scope as well as intricacy of the laboratory workflow processes. The boom in laboratory robotics can also be attributed to the boom in the biopharmaceutical and biotechnological sectors, which seek to deliver more accurate and precise results at a faster pace.

Research and quality assurance testing, clinical diagnostics, proteomics, as well as genomics are some of the core functional areas where laboratory robotics market shines brighter. In drug discovery, robots can analyze 100,000 compounds in a day whilst other manual techniques were unable to attain this reach. Also, In the past twelve months, robotic systems have led to the sequencing of more than 50,000 genomes which is aiding the field of checking medicine suitability for individual patients. Pharmaceutical and Biotechnology firms alongside their academic and government research counterparts, clinical facilities and chemical production plants are the primary consumers of these technologies. The growth in these sectors provably increases the adoption of robotic technologies thus the over 300 biotech start-ups in 2023 provide a good example.

Players in the laboratory robotics market are innovating and broadening the scope of their product offerings to meet the increasing needs of the clients. In 2023, some new robotic platforms capable of deploying artificial intelligence for predictive assessment without increasing the experimental error rate more than ten were inaugurated by companies like Thermo Fisher Scientific and Beckman Coulter. The enhancement of laboratory robots is characterized by three important features: application of machine learning algorithms, creation of small-sized and modular robotic units, and remote management and supervision via the cloud. Furthermore, the number of partnerships between robotics companies and software companies has grown rapidly, demonstrated by more than 50 collaborations in 2023 which sought to improve the capabilities and integration of laboratory automation systems.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Increasing Demand for High-Throughput Screening in Drug Discovery

In the coming years, the pharmaceutical industry across the global laboratory robotics market is likely to witness high pressure to develop new drugs because of the rising number of intricate diseases and the lack of novel medicines. As a result high, throughput screening, which enables the quick assessment of multiple compounds, has become a universal requirement across the globe. Advanced robotic technologies have enabled Pfizer and Novartis among other huge pharmaceutical firms to screen over one million compounds yearly with reports attesting to this claim in 2023. With the assistance of lab robotics, it has been possible to automate all HTS procedural activities cutting the duration that it would have taken to complete the process from several years to several months.

With the use of laboratory robots, HTS is said to have better accuracy and repeatability thus decreasing variability caused by manual handling of processes. According to the report of the International Society for Pharmaceutical Engineering published in 2023, the use of robotics has resulted in an increase of 30% in the number of potential drug candidates, giving strong impetus to the growth of the laboratory robotics market. In addition to that, automation has brought the cost down per assay, with organizations realizing around $500,000 saving on annual labor and reagent costs. Robotics application within HTS has also allowed dispensing of ultralow liquid volumes where dispensers can deliver nanoliters which eliminates wastage of reagents by more than 90 percent.

Further, the trend for personalized therapies is also increasing the needs for laboratory robotics for HTS. Assays and screenings are becoming more specific and more robots will allow for this variability and an increase in these applications. As of 2023, more than 200 trials for robotic personalized medicine have taken place, which is a substantial jump from the previous years. This expansion has been aided and abetted by government funding, with the NIH, among other agencies, putting over US$ 300 million into automation technologies to accelerate the process of discovering medicines.

Trend: Integration of Artificial Intelligence and Machine Learning

When we consider robots performing human-like tasks in laboratories, AI integration into robots changes how experiments are completed as well as how data collected from such experiments is handled. Built-in AI technological systems in the laboratory robotics market enable machines to make decisions, and adjust plans and expectations all within one function, therefore increasing the efficiency and number of discoveries. The Robotics Industries Association did a survey and found that in 2023, AI capabilities were included in over 50% of new Laboratory robotic systems that were installed.

Collaboration between AI systems and robots makes it possible for navigation through an assortment of staggering tasks even in the case where unexpected complications emerge, and there are no guides available. Some such examples include construction of genomic sequencing labs that can automatically adjust the sequencing parameters because the constructed machines are enabled with machine learning. Such advanced technologies in the laboratory robotics market were enabled by Beckman Coulter who recently unveiled a robotic system with AI based algorithms for crime detection.

Partnerships between robotics firms and technology corporations have been growing faster lately with the intent of building complex artificial intelligence based systems for lab use. For example, in 2023, Thermo Fisher Scientific contracted with IBM in order to facilitate the deployment of IBM’s Watson AI into their robotic systems to boost data analytics and predictive maintenance performance. It is likely that this trend towards incorporating AI into laboratory robotics will continue as it is anticipated that the AI-equipped laboratory robotic systems will be a market worth 1.5 billion dollars by 2025.

Challenge: High Initial Investment Costs Hindering Adoption

The high costs of robotics, especially in smaller labs, proves a significant challenge to the laboratory robotics market. Installation, training, and maintenance expenses add to the average system’s total cost, which normally ranges from US$ 500,000 to over US$ 3 million. The funding rule might be somewhat less rigid, however, during the interview, many reported that it was still the 60% of the reason that they couldn't make a shift into robotics. Furthermore, new advancements in technology may lead to obsoletion of existing systems which in turn would require further investments. This particular worry may be more pronounced for commercial institutions where the timeframes for securing money may be different than those for systems nearing obsoletion. Licenses for software and use of advanced machinery may further bump a lab's expenses by $50,000 every year.

To tackle the problem, some suppliers in the laboratory robotics market have introduced leasing strategies and modular robotics that let laboratories increase their level of automation gradually. However, the uptake has been slow with only 20% of the laboratories looking into those options in the year 2023. To some extent, government grants and subsidies are provided in some regions to mitigate costs, however, the information and availability are still low. Furthermore, A critical challenge which is to be crossed over to ensure wider availability of laboratory robotics is the large sunk cost that begins with a set.

Segmental Analysis

By Type

As of 2023, biological laboratory robots have emerged as leaders in the global laboratory robotics market, which is projected to control over 34.5% market share. This dominance is attributed to increasing automation in both biological research and clinical diagnostics. Such robots are needed for complex tasks, for example, genetic sequencing, which routinely involves a huge amount of data. Current generation sequencing projects, for example, produce more than 2.5 exabytes of data every year. In order to manage this growth in data production, an efficient means of collection, analysis and interpretation of such data is required.

Technological improvements in robotics and the increase in funding for biological research strengthen the dominance of the segment . For example, funding in life sciences research and development surpassed US$ 200 billion in 2023 and a fair proportion of funds were directed to automation technologies. Also, because of the boom in personalized medicine, over 10,000 compounds are being screened during drug discovery using laboratory robotics. Moreover, the capabilities of robotic systems got a major improvement through the fusion of artificial intelligence allowing for processes such as automated cell culture, which had last year over a million robotic cultures performed in leading laboratories.

Pharmaceutical firms, Biotechnology companies, and academic institutions are the major end users of biological laboratory robotics market. Developed nations around the world are spending over US$180 billion on R&D in pharma sector. Wherein, robotics is employed to speed up drug development and cut down costs. The cancer treatments. CRISPRs based therapies are part of the biotechnology sector which employs gene adjustments for development and the sector is worth $5.2 billion. Over 500 universities around the globe incorporate robotics into their laboratories in order to enhance accuracy and efficiency, hence academic institutions use these robots to remain cutting edge in an already competitive research industry.

By Application

In 2023, robots become more common in drug development and now are an element of the standardization in processes that are focused on creating new drugs. Currently, this segment is holding more than 38.2% share of the laboratory robotics market. It is evident from the statistics considering that average pharmaceutical company budget used for new drug development is equal to around $2.6 billion that there is a whip of pain in this sector. Robots enable high-throughput screening, which consists in testing roughly 300,000 compounds in certain facilities. This kind of automation reduces drug discovery cycle which is on average above ten years long by enhancing the effectiveness and efficiency of early phase clinical trials.

As a result, patients in the laboratory robotics market are able to get access to more drugs that are created out of the technological advancement in drugs manufacturing owing to laboratory robots which increase productivity and reduce costs in drug development. In several of the laboratories, by using automated machines instead of employing the direct labor force, 50% of manual work requirements had to be met thus enabling scientists to perform more sophisticated aspects of analysis instead of ordinary tasks. It is estimated that the total cost of drug development can be lowered by approximately $500 million by employing laboratory robotics. This is because fewer failures occur in the latter stages of development due to robots assisting in minimizing human errors. On a yearly basis, the pharmaceutical industry spends more than $180 billion in research and development, which has the potential to be optimized.

By End Users

Biotechnology and pharmaceutical companies control the highest share of laboratory robotics market for their expansive R&D operations and the requirement to automate complex processes. There are more than 7,000 drugs in the pipelines globally, the scope of activities in these industries requires robotic solutions to increase the volume of work while ensuring accuracy. Other important reasons making these companies invest in lab robots are the desire to enhance efficiency, cut down expenses, and improve the accuracy of data provided. Instead of human hands, laboratory robots can undertake tasks such as liquid handling with an error margins cut by 80% because of the precision automation enables. They also facilitate operations without stopping work enhancing the level of sales. For instance, there has been an average reduction of 2-3 years in the drug development cycle through the assistance of robots hence delivery of new treatments in the market is quicker.

At a macro level, the demand for speedy drug production witnessed in the laboratory robotics market due to growing need for personalized medicine and rising prevalence of chronic diseases. In the Q1 of the year 2023, the biotechnology sector alone saw investments exceeding $720 billion. At the micro level, for businesses, the objective is to the ROI by means of lowered expenditures; robots allow reaching around 25% savings in laboratories. Moreover, the Pharma and the Biotech markets are among the most competitive markets which compel the use of new technologies, including robotics, to keep the competition together with tough regulations.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

North America, mainly the US and Canada, is leading the laboratory robotics market as a result of substantial investments in automation, advanced research infrastructure and the rate of adoption in the region. The region is currently controlling over 38% market share due to strong demand across various applications including drug discovery, clinical diagnostics, genomic solutions and microbiology. In 2023, the United States conducted over 7.5 million automated clinical diagnostic test every single day which managed to lower the amounts of time taken and the levels of precision achieved. Furthermore, 60% of the entire global spending on drug discovery R&D is made by US pharmaceutical firms and a large portion of this is investment in robotics. On the other hand, Canada has strengthened its place in the market backed by over 300 active biotechnology companies, a number of which are deploying laboratory robotics to accelerate genomic and microbiological research testing.

The North America laboratory robotics market focuses on innovation, particularly on new technologies and R&D, is probably one of the main aspects that led to the development of the region. For example, just in 2023, the USA appropriated $86 billion in public and private funding of the biomedical R&D with the assistance of robotics in increasing productivity and accuracy. The region houses more than 2,000 research-oriented organization, both academic and corporate that are providing major dependency on well-integrated laboratory automation systems. Similarly, in the year 2023 alone, liquid handling systems for drug molecule screening and selection processes in the laboratories were estimated to have performed 1.5 billion sample processing procedures including the North America Region. Added to this, the USA also has more than 500 robotics integrators and that number of Custom Robotics Multi-Vendors Cooperation, which is more than enough for meeting the needs of the laboratories.

The North American healthcare and biopharmaceutical market is a major facilitator of laboratory robotics market growth. According to reports, laboratories robotic shipment was more than 25,000 robotic systems in the US in 2023, with the robotics systems being produced in great deal to meet both national and foreign markets. The region's strength is exemplified even further by the fact that it has more than 70% of all the world's patents for laboratory automation technologies.

Top Companies in Global Laboratory Robotics Market:

- AB Controls

- Aerotech

- Anton Paar

- Aurora Biomed

- Biosera

- Chemspeed Technologies

- Cleveland Automation Engineering

- Hamilton Robotics

- HighRes Biosolutions

- Hudson Robotics

- Labman

- PerkinElmer Inc.

- Protedyne (LabCorp)

- Siemens AG

- ST Robotics

- Tecan Group

- Thermo Fisher Scientific

- Universal Robots

- Yaskawa Electric

- Other Prominent Players

Market Segmentation Overview:

By Type:

- Low-Cost Laboratory Robotics

- Biological Laboratory Robotics

- Pharmaceutical Laboratory Robotics

- Molecular Laboratory

- Others

By Application:

- Drug Discovery

- Clinical Diagnosis

- Microbiology Solutions

- Genomics Solutions

- Proteomics Solutions

By End User:

- Clinical Laboratories

- Research Laboratories

- Biotechnology and Pharmaceutical companies

- Hospitals and Diagnostic Laboratories

- Research and Academic Institutes

- Forensic Laboratories

- Environmental Testing Laboratories

- Food and Beverage Industry

By Region:

- North America

- The US

- Canada

- Mexico

- Europe

- The UK

- Germany

- France

- Italy

- Spain

- Poland

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- ASEAN

- Rest of APAC

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2023 | US$ 309.5 Mn |

| Expected Revenue in 2032 | US$ 564.2 Mn |

| Historic Data | 2019-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Unit | Value (USD Mn) |

| CAGR | 6.9% |

| Segments covered | By Type, By Application, By End-user, By Region |

| Key Companies | AB Controls, Aerotech, Anton Paar, Aurora Biomed, Biosera, Chemspeed Technologies, Cleveland Automation Engineering, Hamilton Robotics, HighRes Biosolutions, Hudson Robotics, Labman, PerkinElmer Inc., Protedyne (LabCorp), Siemens AG, ST Robotics, Tecan Group, Thermo Fisher Scientific, Universal Robots, Yaskawa Electric, Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)