Japan Water Treatment Market: By Type (Corrosion Inhibitors, Scale Inhibitors, Biocides & Disinfectants, Oxidants, Coagulants & Flocculants, Chelating Agents, Anti-Foaming Agents, PH Adjusters and Stabilizers, Others); Treatment Technology (Chemical, Pre-Chlorination, Aeration, Disinfection, Physical, Sedimentation, Filtration, Dissolved Air Flotation (Degasification), Biological, Bioremediation, and Others); End Users (Industrial (Power Generation, Refineries, Pulp & Paper, Metal & Mining, Food & Beverages, Oil & Gas, Other); Municipal (Drinking Water, Wastewater, Recreational, Rivers, Lakes, Coastal Water)— Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: Jan-2025 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA1023641 | Delivery: 2 to 4 Hours

| Report ID: AA1023641 | Delivery: 2 to 4 Hours

Market Scenario

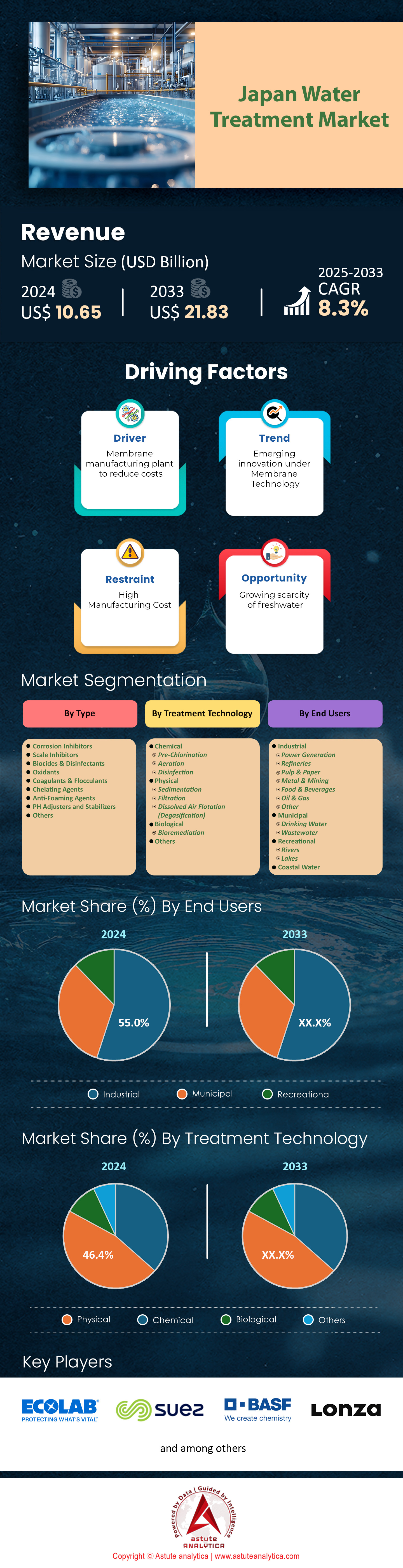

Japan Water treatment market was valued at US$ 10.65 billion in 2024 and is projected to hit the market valuation of US$ 21.83 billion by 2033 at a CAGR of 8.3% during the forecast period 2025–2033.

Japan’s water treatment market landscape stands at a crucial juncture, driven by heightened environmental goals and steady innovation. Toray Industries operates 3 specialized R&D hubs nationwide, focusing on membrane design to optimize wastewater reuse. The Tokyo Metropolitan Government allocated US$ 370 million in 2023 to modernize sewage frameworks in older precincts. Faced with aging systems, Osaka authorities replaced 1,300 kilometers of worn-out pipelines from January to November 2024. Alongside these upgrades, Fukuoka introduced 7 new desalination units to secure consistent water availability during prolonged dry spells.

Leading corporations anchor much of this progress through advanced solutions in the Japan water treatment market. Mitsubishi Chemical conducted 16 pilot projects in 2024 aimed at next-generation polymer resins that steadily remove toxic elements from industrial effluents. Hitachi currently processes 2,200 megaliters daily across about a dozen prefectures, bolstering both urban and rural water purification. Kubota Corporation launched 5 newly patented filtration systems, each designed to tackle specific micro-pollutants prevalent in agricultural zones. Suez invested US$ 50 million in strategic partnerships with regional municipalities, seeking to enhance operational efficiency while reducing energy usage. Meanwhile, Yokohama replaced 148 legacy underground tanks to reduce contamination threats from deteriorated metal structures.

Kitakyushu now operates 26 advanced water reclamation facilities that focus on nutrient extraction to support sustainable agriculture. These expansions in the water treatment market illustrate the synergy between local officials and technology providers, who share a commitment to preserving water resources for future generations. Established policies keep pushing stakeholders toward robust architectural improvements, ensuring that every city’s unique geological and demographic demands are met with precise engineering solutions. The outcome is a diversified market where both large-scale and specialized players compete to refine filtration, desalination, and advanced treatment methodologies. As water needs intensify, Japan’s integrated approach—fueled by government investment, corporate R&D, and municipal initiatives—continues to set a precedent for reliable, high-quality water treatment systems.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Escalating industrial complexity demanding advanced solutions for multifaceted water treatment expansions across modern Japan

Japan’s industrial sector has seen tremendous diversification, with electronics, automotive, and high-tech manufacturing at the forefront. In 2024, Toyota initiated 5 facility upgrades aimed at closed-loop wastewater systems that capture and recycle water on-site. East Nippon Expressway Company, responsible for large highway networks, installed 3 compact treatment plants specifically designed to minimize runoff contamination near critical road intersections. Panasonic opened 2 pollution-control labs focused on mitigating byproducts from semiconductor production, illustrating how varied industries require custom solutions. Toray’s new pilot program implemented 6 field-based tests analyzing advanced membranes under high chemical loads, a bold move that exemplifies the evolving demands from complex industrial operations. Hitachi Zosen, known for infrastructure projects, outfitted 4 large factories with proprietary multi-barrier treatment technology to keep heavy metals at bay. IHI Corporation, to address the rise in chemical-based manufacturing, partnered with local councils for 9 customized facility expansions that streamline reuse of nutrient-rich effluent.

Such diversification in the Japan water treatment market amplifies the need for highly adaptive filtration techniques, advanced digital control systems, and real-time monitoring. This surge in multisector demand also encourages closer collaboration between municipalities and private enterprises. Mitsubishi RNG, an offshoot focusing on resource recovery, introduced 1 high-precision sensor suite enabling near-instant detection of micro-contaminants—as industrial outflow often contains heavily concentrated pollutants. Hitachi’s dual-layer technology, tested on 45 chemical varieties, underscores how industrial needs push the boundaries of engineering. Wherein, ongoing expansions across Japan water treatment market require efficient fail-safe mechanisms, prompting 12 cross-training initiatives for specialized technicians adept at handling advanced instruments. Each project, whether for electronics giants or automotive suppliers, underscores that the market must adapt quickly or risk stagnation. As Japan’s industrial complexity accelerates, so does the impetus for water treatment providers to refine, test, and deploy flexible systems that can handle everything from heavy metals to intricate chemical compounds, paving the way for broader industry collaboration.

Trend: Growing municipal preference for integrated smart-sensor systems simplifying multi-point water quality oversight across diverse cityscapes

Japanese municipalities are increasingly turning to intelligent monitoring platforms to unify and streamline water quality management. Tokyo’s metropolitan water bureau deployed 2,800 sensor nodes capable of detecting pH, turbidity, and residual chlorine in critical canals, ensuring timely alerts for contamination surges. Yokohama began testing 80 remote-operated drones that sample river segments in real time, facilitating analysis of dissolved oxygen and trace heavy metals. Sapporo’s pilot scheme in the water treatment market showcased 27 sensor arrays near industrial corridors to measure microplastic presence, supporting early interventions before pollutants spread downstream. Kawasaki, partnering with a local robotics firm, mounted 4 advanced scanning probes at high-flow intersections to monitor temperature differentials that signify equipment malfunctions. These integrated systems reduce manual intervention, freeing up municipal resources for more strategic tasks.

Manufacturers recognize this adoption surge and answer with flexible, scalable sensor solutions. Toshiba developed 1 cloud-based platform linking detection instruments to centralized command centers, enabling city managers to diagnose issues remotely. In a parallel move, Fujitsu installed 3 wide-area networks for water authorities in rural prefectures, bridging connectivity gaps that once hampered real-time oversight. NEC introduced a specialized data encryption system tested on 14 major pipelines, alleviating concerns over potential cybersecurity breaches in expanded sensor networks. This digital evolution in the water treatment market resonates strongly among local operators, who see automated alerts and real-time analytics as indispensable for safeguarding reservoirs and canals. Maintenance also benefits, as sensor feedback reveals patterns of corrosion, sediment buildup, or infiltration, prompting more precise scheduling of repairs. Traveling inspectors historically needed 6 days to gather water samples from a single reservoir, whereas integrated sensor grids cut the routine to less than 2. Indeed, Japan’s embrace of sensor-driven management marks a forward-looking trend, spotlighting the role of data-driven governance in maintaining a pure, uninterrupted water supply.

Challenge: Ongoing technological fragmentation complicates collaborative alignment for uniform standards within Japan’s evolving water treatment framework

Japan’s water treatment market features multiple stakeholders—municipal bodies, private companies, and industrial clients—each invested in diverse technologies and methodologies. Tokyo Prefecture alone issued 112 separate requests for specialized treatment systems in 2024, reflecting a splintered demand funnel. Different prefectures often adopt unique disinfection strategies, as exemplified by Nagoya’s reliance on 9 chlorination standards that differ from Osaka’s advanced ozone protocols. This sprawling variety makes it challenging for solution providers to establish a single, universally recognized approach. TEPCO, involved in some hydro-related efforts, ran 4 demonstrations involving alternative oxidation methods but found partner alignment complicated by pre-existing mechanical setups. Kanazawa’s push for ultra-filtration membranes, tested in 3 separate pilot lines, underscores how local priorities can outpace centralized guidelines.

Manufacturers must navigate myriad requirements and performance metrics when marketing across multiple cities. TORISHIMA Pump launched 2 integrated solutions that carry optional modules for chemical dosing, yet uptake remains mixed due to contradicting approval procedures. EH Environmental, a smaller enterprise focusing on mechanical sludge removal, delivered 7 custom builds for remote townships but found that each location demanded distinct instrumentation. The absence of a streamlined standard also affects training efforts; in 2024, 420 technicians attended multi-day courses on specialized pumps in Hiroshima, only to discover these modules were not fully compatible with Tokyo’s recommended frameworks. Fuji Electric, despite forging 5 co-development contracts, still sees sporadic acceptance because local guidelines vary. Stakeholders in the water treatment market increasingly call for better alignment, not just to accelerate infrastructure deployment but also to ensure consistent quality control. Without cohesive technological benchmarks, each municipality interprets “optimal water treatment” on its own terms, leading to protracted project timelines. Streamlined coordination remains elusive, yet it is the linchpin for balancing localized needs with the broader objective of delivering reliable, advanced water treatment systems nationwide.

Segmental Analysis

By Type

Coagulants and flocculants dominate Japan’s water treatment market with over 40.1% market share because they effectively clarify both drinking water and industrial wastewater by causing suspended solids to bind together and settle out rapidly. Widely used coagulants include aluminum sulfate and ferric chloride, often chosen for their proven ability to neutralize electrical charges in colloidal particles Polyaluminum chloride is also popular and is frequently applied to treat challenging influents with high turbidity or organic load. Major suppliers in Japan range from ChemREADY, which specializes in tackling high-strength industrial effluent, to ChemTreat, known for its tailored coagulant formulations in sectors such as power generation and manufacturing Beyond their reliably low operational cost, these chemical treatments remain the default in many municipal plants due to high familiarity among local engineers and a well-established regulatory framework supporting their use. Meanwhile, physical water treatment solutions—such as membrane filtration and advanced UV disinfection—have gained rapid traction in Japan, largely because they deliver chemical-free operation and reduce residual sludge, aligning with the nation’s move toward greener industrial processes.

By Treatment Technology

Physical technologies in Japan water treatment market with over 46.4% share have gained significant traction in 2024 due to a confluence of stricter environmental directives and the country’s emphasis on resource sustainability Municipal utilities, prompted by revised Water Pollution Control Law guidelines, have been seeking methods that generate fewer secondary residues compared to chemical processes Membrane filtration systems—particularly ultrafiltration modules from Toray Industries—are among the most dominant physical processes, widely installed in over 60 municipal plants across Tokyo and Osaka as of January 2023. Rapid sand filtration units supplied by Ebara Engineering are also favored, with 140 newly commissioned units in Hokkaido and Miyagi Prefectures to handle seasonal turbidity peaks. Pressure-driven nanofiltration devices from Hitachi, named the ClearSeparation series, have been deployed at five key industrial parks in Kawasaki, equipped to remove complex contaminants without producing large amounts of sludge. Kubota Corporation’s ceramic membrane systems, known as Kubota RM, have reportedly reduced maintenance intervals by nearly 200 hours annually in trial sites, cutting operational costs for local utilities. Moreover, a joint government-industry project led by the Japan Water Works Association logged 24 pilot installations in 2023 to test advanced graphene-based membranes, showcasing the country’s openness to adopting forward-looking technologies.

Astute Analytica report on Japan water treatment market also attribute a surge in physical treatment preference to public health and safety concerns, especially following increased scrutiny of chemical by-products in chlorination or advanced oxidation processes Demand for physical separation has been further spurred by national subsidies administered through the Ministry of Land, Infrastructure, Transport and Tourism, which earmarked 50 billion yen specifically for decentralized membrane installations in rural prefectures this fiscal year. Several public water authorities have noted that chemical-free approaches simplify permits, with Tokyo Metropolitan Government reporting 18 fewer permit-related administrative steps for physical-only systems. A 2023 panel study by the Japan Society on Water Environment underscored how membrane-based plants consistently meet effluent regulations requiring turbidity below 0.1 NTU. Consequently, physical treatment is solidifying its front seat status, propelled by ongoing innovations from large conglomerates and public-backed demonstration projects aimed at elevating safety, reducing ecological impact, and meeting Japan’s stringent water quality standards.

By End Users

Industrial users with over 55.0% market share has assumed a pivotal role in Japan water treatment market due to rising production demands and stringent disposal regulations under the Water Pollution Control Law, which compels industries to adopt advanced systems that reduce hazardous effluent. As of 2023, the Ministry of Economy, Trade, and Industry reported that the country’s manufacturing sector draws approximately 10.2 gigaliters of water daily, fueled by growth in electronics, automotive, and chemical segments. Tokyo’s Industrial Affairs Bureau estimated that the average wastewater disposal fee for industrial complexes surged to 290 yen per cubic meter this year, reflecting the heightened operational costs currently shouldered by large manufacturers. Heavy industries like Nippon Steel have installed Toray’s MHL640 reverse osmosis membranes at two of their major plants, each capable of treating 70,000 cubic meters per day, while Mitsubishi Chemical’s Yokohama facility invested 3.1 billion yen in a new membrane bioreactor system to bring down ammonia levels below 5 mg/L. Notably, corporate interest in zero-liquid-discharge solutions is also growing, with three pilot sites in Nagoya testing Hitachi’s CrystaPure to minimize surface water extraction.

Government legislation further cements this dominance in the water treatment market by mandating strict effluent thresholds and imposing penalties that can reach 500,000 yen per day for noncompliance. To comply with these regulations, industries often invest heavily in multi-stage treatment trains combining ultrafiltration, ion exchange, and reverse osmosis. Annual treatment expenditures have thus climbed above 80 billion yen nationwide, according to a 2023 survey by the Japan Industrial Water Association, which correlates with the need to treat complex waste streams containing metals, solvents, and other regulated substances. Several local ordinances—particularly in Kyoto and Hiroshima—now require that effluent from large-scale production lines not exceed 3 mg/L of chromium, prompting widespread upgrades in industrial facilities. This interplay of regulatory pressure, escalating water usage, and advanced treatment technologies explains why industrial water treatment currently dominates the end-user segment in Japan’s water treatment market.

To Understand More About this Research: Request A Free Sample

Top Players in Japan Water Treatment Market

- Solenis

- Ecolab

- Kemira

- Suez

- Kurita Water Industries Ltd.

- Lonza Group AG

- BASF SE

- Toray Industries Inc.

- SNF

- MT AquaPolymer, Inc.

- Other Prominent players

Market Segmentation Overview:

By Type

- Corrosion Inhibitors

- Scale Inhibitors

- Biocides & Disinfectants

- Oxidants

- Coagulants & Flocculants

- Chelating Agents

- Anti-Foaming Agents

- PH Adjusters and Stabilizers

- Others

By Treatment Technology

- Chemical

- Pre-Chlorination

- Aeration

- Disinfection

- Physical

- Sedimentation

- Filtration

- Dissolved Air Flotation (Degasification)

- Biological

- Bioremediation

- Others

By End Users

- Industrial

- Power Generation

- Refineries

- Pulp & Paper

- Metal & Mining

- Food & Beverages

- Oil & Gas

- Other

- Municipal

- Drinking Water

- Wastewater

- Recreational

- Rivers

- Lakes

- Coastal Water

View Full Infographic

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2024 | US$ 10.65 Billion |

| Expected Revenue in 2033 | US$ 21.83 Billion |

| Historic Data | 2020-2023 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Unit | Value (USD Bn) |

| CAGR | 8.3% |

| Segments covered | By Type, By Treatment Technology, By End Users |

| Key Companies | Solenis, Ecolab, Kemira, Suez, Kurita Water Industries Ltd., Lonza Group AG, BASF SE, Toray Industries Inc., SNF, MT AquaPolymer, Inc., Other Prominent players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA1023641 | Delivery: 2 to 4 Hours

| Report ID: AA1023641 | Delivery: 2 to 4 Hours

.svg)