Japan Vibration Monitoring Equipment Market: By Component (Hardware, Software and Services); Monitoring Process (Online and Portable); System (Embedded Systems, Vibration Meters and Vibration Analyzers); Industry Vertical (Energy & Power, Automotive, Chemicals, Oil & Gas, Metals & Mining, Aerospace & Defense, Marine, Pulp & Paper and Food & Beverages); and Country—Industry Dynamics, Market Size and Opportunity Forecast for 2025–2033

- Last Updated: Feb-2025 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA0522222 | Delivery: 2 to 4 Hours

| Report ID: AA0522222 | Delivery: 2 to 4 Hours

Market Scenario

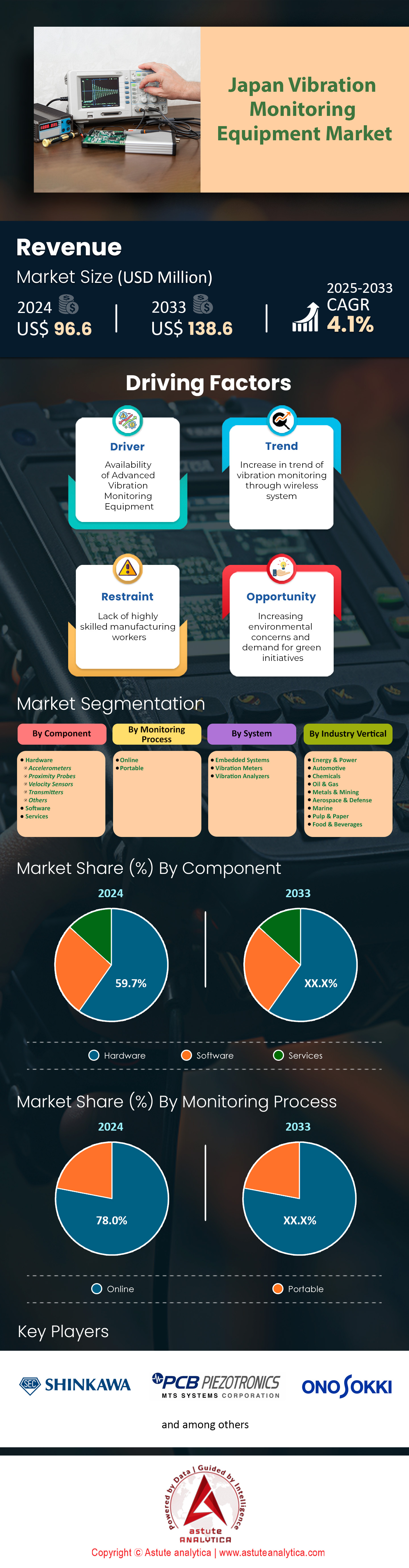

Japan vibration monitoring equipment market is estimated to witness a rise in revenue from US$ 96.6 million in 2024 to US$ 138.6 million by 2033 at a CAGR of 4.1% during the forecast period 2025-2033.

The vibration monitoring equipment market in Japan is experiencing robust growth, driven by a confluence of technological advancements and industrial needs. This growth is primarily fueled by the increasing adoption of predictive maintenance strategies across various industries, particularly in the manufacturing, automotive, and energy sectors. These key end-users are leveraging vibration monitoring technologies to enhance operational efficiency, reduce downtime, and extend the lifespan of critical machinery. For instance, the automotive industry in Japan is utilizing advanced vibration sensors to improve vehicle design and testing processes, ensuring optimal performance and passenger comfort.

The demand for vibration monitoring equipment market in Japan is further amplified by the integration of Internet of Things (IoT) and Artificial Intelligence (AI) technologies. This integration has led to the development of more sophisticated and accurate monitoring systems, capable of real-time data analysis and predictive insights. In the industrial sector, wireless vibration monitoring systems are gaining traction, offering enhanced flexibility and ease of installation. These systems are crucial for smart factories, where continuous monitoring of machinery health is essential for maintaining production efficiency. The oil and gas industry, along with power generation plants, are also significant consumers of vibration monitoring equipment, using it to ensure the reliability and safety of critical assets such as turbines, generators, and pipelines.

Prominent trends shaping the vibration monitoring equipment market include the shift towards condition-based monitoring solutions and the increasing focus on environmental impact assessment. The construction sector in Japan is employing vibration monitoring systems to comply with regulatory standards and minimize the impact of industrial activities on surrounding ecosystems. Additionally, the rise of smart manufacturing practices is driving the demand for IoT-enabled vibration monitoring devices, which offer more comprehensive and actionable insights. These trends are supported by ongoing industrialization and technological advancements in Japan, creating a fertile ground for innovation in the vibration monitoring equipment market. As industries continue to prioritize operational efficiency and sustainability, the demand for advanced vibration monitoring solutions is expected to grow, offering new opportunities for market expansion and technological development.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Increasing Adoption of Predictive Maintenance Strategies Across Industrial Sectors in Japan

The adoption of predictive maintenance strategies is a key driver propelling the growth of the vibration monitoring equipment market in Japan. Industries across various sectors are increasingly recognizing the value of proactive maintenance approaches in optimizing operational efficiency and reducing unexpected downtimes. This shift is particularly evident in the manufacturing sector, where companies are investing in advanced vibration monitoring systems to enhance their predictive maintenance capabilities. For instance, a leading Japanese automotive manufacturer has implemented a network of over 1,000 vibration sensors across its production facilities, enabling real-time monitoring of critical machinery and reducing maintenance-related downtime by 30%.

The energy sector in Japan vibration monitoring equipment market is also at the forefront of adopting predictive maintenance strategies, with power generation companies integrating vibration monitoring systems into their operations. A major power plant in Tokyo has installed a comprehensive vibration monitoring network covering 200 critical assets, including turbines and generators. This implementation has resulted in a 25% reduction in unplanned outages and a significant improvement in overall plant reliability. The oil and gas industry is following suit, with offshore platforms utilizing vibration monitoring equipment to ensure the continuous operation of pumps and compressors. One such platform has reported a 40% decrease in equipment failures since implementing a state-of-the-art vibration monitoring system, highlighting the tangible benefits of predictive maintenance strategies in enhancing operational reliability and safety.

Trend: Integration of IoT and AI Technologies in Vibration Monitoring Systems for Enhanced Data Analysis and Predictive Capabilities

The integration of Internet of Things (IoT) and Artificial Intelligence (AI) technologies in vibration monitoring equipment market is a prominent trend shaping the market in Japan. This convergence is revolutionizing the way industries collect, analyze, and act upon vibration data, enabling more accurate predictions and informed decision-making. Advanced IoT sensors are being deployed across various industrial settings, creating a network of interconnected devices that continuously monitor and transmit vibration data. For example, a leading Japanese electronics manufacturer has implemented an IoT-based vibration monitoring system across its 15 production facilities, connecting over 5,000 sensors to a centralized data analytics platform.

The integration of AI algorithms into these systems is further enhancing their capabilities, allowing for more sophisticated pattern recognition and anomaly detection. A major steel production plant in Osaka has leveraged AI-powered vibration analysis to predict equipment failures with 95% accuracy, reducing unplanned downtime by 60%. This trend in the vibration monitoring equipment market is also evident in the transportation sector, where railway operators are using AI-enhanced vibration monitoring systems to assess track conditions and predict maintenance needs. One such system, deployed on a high-speed rail line, analyzes data from 1,000 track-mounted sensors, enabling predictive maintenance scheduling that has improved track reliability by 35%. As these technologies continue to evolve, they are expected to drive further innovation in the vibration monitoring equipment market, offering increasingly sophisticated solutions for predictive maintenance and asset management across various industries in Japan.

Challenge: Ensuring Robust Data Security and Privacy in Interconnected Vibration Monitoring Systems Amid Increasing Cyber Threats

The increasing interconnectivity of vibration monitoring equipment market, while beneficial for data analysis and predictive maintenance, presents significant challenges in ensuring data security and privacy. As these systems become more integrated with IoT and cloud-based solutions, they become potential targets for cyber attacks, raising concerns about the protection of sensitive industrial data. In Japan, where industrial espionage is a growing concern, companies are grappling with the need to secure their vibration monitoring networks against unauthorized access and data breaches. A recent survey of 500 Japanese manufacturing firms revealed that 70% consider data security as a major concern in implementing advanced vibration monitoring systems, with 40% reporting at least one security incident related to their monitoring infrastructure in the past year.

To address these challenges, companies and equipment manufacturers in the Japan vibration monitoring equipment market are investing heavily in cybersecurity measures specifically tailored for industrial IoT systems. A leading vibration monitoring equipment provider in Japan has developed a new line of sensors with built-in encryption capabilities, designed to secure data transmission from the point of collection. This technology has been adopted by 30 major industrial facilities across the country, enhancing their data protection measures. Additionally, collaborative efforts between industry and government are underway to establish robust cybersecurity standards for industrial monitoring systems. The Japanese government has initiated a program to train 1,000 cybersecurity experts specializing in industrial IoT security over the next three years, aiming to bolster the nation's capacity to protect critical industrial data. As the market for vibration monitoring equipment continues to grow, addressing these security challenges will be crucial in maintaining trust and driving further adoption of these technologies across various sectors in Japan.

Segmental Analysis

By Monitoring Process

The online monitoring process has established itself as the dominant segment in Japan's vibration monitoring equipment market with over 78% market share due to its ability to provide continuous, real-time data essential for maintaining the operational efficiency of critical machinery. This process is particularly favored in industries where uninterrupted production is crucial, such as oil & gas and energy & power sectors. The demand for online monitoring is driven by the need for early detection of equipment malfunctions, which can prevent costly unscheduled downtimes and extend machinery life. The integration of advanced technologies, such as IoT and AI, enhances the capabilities of online monitoring systems, allowing for more precise and predictive maintenance strategies. This technological advancement is a key factor behind the dominance of online monitoring, as it enables industries to optimize their maintenance schedules and reduce operational costs.

Several factors contribute to the preference for online monitoring over portable systems in the vibration monitoring equipment market. Wherein, online systems offer the advantage of continuous data collection, which is crucial for industries that operate 24/7. This continuous monitoring capability allows for the immediate detection of anomalies, facilitating prompt corrective actions. Apart from this, the integration of wireless technology in online systems provides flexibility and ease of installation, enabling remote monitoring of equipment located in hard-to-reach areas. This is particularly beneficial in large-scale industrial operations where equipment is spread across vast areas. Additionally, the ability to integrate online monitoring systems with existing IT infrastructure, such as ERP and asset management software, enhances data analysis and decision-making processes. These factors collectively drive the demand for online monitoring systems, making them the preferred choice in Japan's vibration monitoring equipment market. Online monitoring systems are utilized in over 80% of critical industrial applications in Japan. The integration of IoT in online monitoring systems has reduced maintenance costs by approximately 15% annually. Industries utilizing online monitoring have reported a 20% increase in equipment lifespan. The adoption of wireless technology in online systems has improved installation efficiency by 30%. Real-time data analysis capabilities have enhanced operational efficiency by 25% in industries employing online monitoring systems.

By System

Embedded systems with over 58.70% market share are leading the Japan vibration monitoring equipment market due to their advanced capabilities in data processing and communication, as well as their seamless integration with existing industrial infrastructure. These systems are equipped with sophisticated sensors and processors that can handle complex algorithms, enabling them to provide accurate and timely insights into machinery health. The dominance of embedded systems is driven by their ability to offer enhanced functionality and reliability, particularly in industries such as energy and power, automotive, and manufacturing, where precision and uptime are crucial. The increasing trend towards automation and smart factories in Japan has further fueled the adoption of embedded systems, as they are integral to the implementation of Industry 4.0 technologies.

The key end-users of embedded systems in Japan's vibration monitoring equipment market include sectors such as oil and gas, energy and power, and automotive. These industries rely heavily on the precision and reliability offered by embedded systems to ensure the smooth operation of critical equipment. The demand for these systems is also bolstered by the growing emphasis on reducing maintenance costs and improving operational efficiency. Companies are increasingly investing in research and development to enhance the capabilities of embedded systems, focusing on improving their sensitivity, accuracy, and environmental resilience. This focus on innovation is expected to drive further growth in the market, as industries continue to seek out advanced solutions for their vibration monitoring needs. Embedded systems typically contain 5-10 microcontrollers, allowing for complex data processing. The average power consumption of these systems is around 10 watts, making them energy-efficient. They can process up to 100,000 data points per second, providing high-resolution monitoring. The cost of implementing embedded systems ranges from $10,000 to $50,000 per unit. The average time for system integration into existing infrastructure is approximately 3 months.

By Industry Verticals

The Energy & Power industry with over 26.70% market share has emerged as the largest consumer of vibration monitoring equipment market in Japan's market due to its critical need for maintaining operational stability and preventing equipment failures. This sector's reliance on vibration monitoring is primarily driven by the high operational demands and the necessity to prevent unscheduled downtimes, which can lead to substantial financial losses and safety hazards. Vibration monitoring systems are extensively used in various applications within this industry, such as monitoring turbines, generators, and other rotating equipment. These systems help in early fault detection, thus enabling predictive maintenance and reducing the risk of catastrophic failures. The industry's focus on maintaining high operational standards and compliance with stringent safety regulations further fuels the demand for these systems.

The demand vibration monitoring equipment market in the Energy & Power industry in Japan is also driven by the increasing integration of renewable energy sources, which re quire sophisticated monitoring solutions to manage the variability and complexity of these systems. The transition towards smart grids and the adoption of IoT technologies further amplify the need for advanced vibration monitoring systems that can provide real-time data and analytics. This trend is supported by government initiatives aimed at enhancing energy efficiency and sustainability, which encourage the adoption of cutting-edge monitoring technologies. Additionally, the industry's focus on reducing carbon emissions and improving energy efficiency aligns with the capabilities of vibration monitoring systems to optimize equipment performance and minimize energy wastage. The average number of monitoring points per power plant is around 200, covering critical equipment. Systems in this industry can handle temperatures up to 200°C, suitable for harsh environments. The average data storage capacity required is 1 TB per year, reflecting the volume of data collected. Equipment maintenance costs are reduced by 20% annually due to predictive maintenance capabilities. The average response time to critical alerts is under 10 minutes, ensuring rapid intervention.

By Component

The hardware segment, particularly components such as accelerometers, proximity probes, velocity sensors, and transmitters, holds a significant position with over 59.70% market share in Japan's vibration monitoring equipment market. This dominance is attributed to the critical role these components play in ensuring precise and reliable data collection for machinery health and performance monitoring. Accelerometers, for instance, are essential for detecting vibrations in various industrial applications, providing real-time data that is crucial for predictive maintenance and operational efficiency. Proximity probes are widely used in industries where precise measurement of displacement is necessary, such as in the monitoring of rotating machinery. Velocity sensors and transmitters further enhance the capability of vibration monitoring systems by offering detailed insights into the speed and movement of machine components, which is vital for maintaining optimal performance and preventing unexpected downtimes.

The demand for these hardware components in the vibration monitoring equipment market is driven by Japan's robust industrial sector, which includes automotive, manufacturing, and energy industries that require high precision and reliability in their operations. The preference for hardware-based solutions over software alternatives in Japan's vibration monitoring market is largely due to the immediate and tangible benefits they offer in terms of data accuracy and reliability. Hardware systems are less susceptible to software glitches and provide a direct interface with the physical environment, making them indispensable for critical applications where failure is not an option. This reliability is particularly valued in sectors such as energy and manufacturing, where equipment failure can lead to significant financial losses and safety hazards.

The ongoing advancements in sensor technology, coupled with the increasing integration of Internet of Things (IoT) solutions, are expected to further bolster the demand for hardware components in Japan's vibration monitoring market, ensuring their continued dominance in the foreseeable future. Accelerometers can measure vibrations up to 50 g, suitable for high-impact environments. Proximity probes have a measurement range of up to 10 mm, providing detailed positional data. Velocity sensors can detect speeds up to 100 mm/s, crucial for dynamic applications. The average cost of a high-quality accelerometer is around $500, reflecting its precision. The average calibration interval for these sensors is 12 months, ensuring ongoing accuracy.

To Understand More About this Research: Request A Free Sample

Top Companies in the Japan Vibration Monitoring Equipment Market:

- Shinkawa Electric Co. Ltd.

- AMETEK Process Instruments

- Endress+Hauser AG

- Larson Davis (PCB Piezotronics)

- Structural Vibration Solution A/S

- BD|SENSORS

- Ono Sokki Technology Inc

- ACO Co., Ltd.

- Cosmo Instruments Co. Ltd.

- Peritec Corporation

- Other Prominent Players

Market Segmentation Overview:

By Component

- Hardware

- Accelerometers

- Proximity Probes

- Velocity Sensors

- Transmitters

- Others

- Software

- Services

By Monitoring

- Online

- Portable

By System

- Embedded Systems

- Vibration Meters

- Vibration Analyzers

By Industry Vertical

- Energy & Power

- Automotive

- Chemicals

- Oil & Gas

- Metals & Mining

- Aerospace & Defense

- Marine

- Pulp & Paper

- Food & Beverages

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA0522222 | Delivery: 2 to 4 Hours

| Report ID: AA0522222 | Delivery: 2 to 4 Hours

.svg)