Japan Vacuum Furnace Market: By Component (Vacuum Vessel, Hot Zone, Pumping System, Cooling System, Control System, Handling System); Type (Horizontal and Vertical); Operation (External Heating and Internal Heating); Application (Heat Treatment (Hardening, Tempering, Annealing, Carburizing), Melting, Brazing, Sintering, Others); End Users (Aerospace and Aviation, Medical, Automotive, 3D Printing and Additive Manufacturing, Research Laboratories, Others)—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: Feb-2025 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA02251177 | Delivery: Immediate Access

| Report ID: AA02251177 | Delivery: Immediate Access

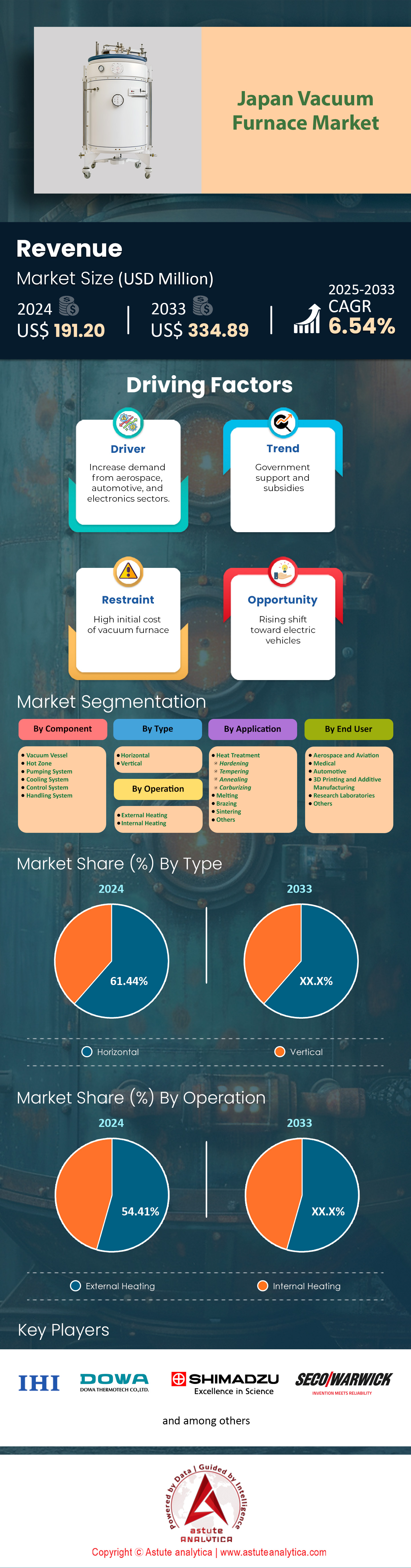

Japan vacuum furnace market was valued at US$ 191.20 million in 2024 and is projected to hit the market valuation of US$ 334.89 million by 2033 at a CAGR of 6.54% during the forecast period 2025–2033.

The demand for vacuum furnaces in Japan is surging, driven by advancements in manufacturing technologies and the need for high-precision thermal processing. In 2024, the unit sales volume of vacuum furnaces in Japan has reached over 1,200 units, reflecting a robust growth trajectory. Among the types, horizontal vacuum furnaces are projected to grow the fastest, with sales expected to exceed 500 units this year, making them the largest segment. This growth of the vacuum furnace market in Japan is fueled by their ability to handle larger workloads and provide uniform heating, which is critical for industries like aerospace and automotive. Wherein, some of the key end-users of vacuum furnaces in Japan include automotive manufacturers, aerospace companies, and electronics producers. These industries rely on vacuum furnaces for applications such as brazing, annealing, and sintering. The most prominent type of vacuum furnace in Japan is the quenching furnace, which accounts for nearly 40% of all units sold. These furnaces are primarily used in batch operations, where precision and consistency are paramount.

One of the most prominent trends shaping demand is the shift towards energy-efficient models, with over 300 units of energy-efficient vacuum furnaces sold in the first half of 2024. Another trend is the increasing adoption of IoT-enabled furnaces, with more than 200 units equipped with real-time monitoring systems sold this year. The demand is largely coming from industrial hubs like Nagoya and Osaka, where automotive and electronics manufacturing are concentrated. Some of the top brands dominating the Japanese vacuum furnace market include Ipsen, ALD Vacuum Technologies, Seco/Warwick, Nitrex, and ECM Technologies. Consumers are increasingly shifting to vacuum furnaces due to their ability to reduce oxidation and improve material properties, with over 80% of new buyers citing these benefits as their primary reason for purchase.

To Get more Insights, Request A Free Sample

Driver: Increasing Demand for High-Precision Materials in Aerospace

The aerospace industry’s demand for high-precision materials is a primary driver of vacuum furnace market growth in Japan. Aerospace manufacturers require components that can withstand extreme conditions, and vacuum furnaces provide the necessary environment for producing such materials. In 2024, Japan’s aerospace sector has ordered over 150 vacuum furnaces specifically for titanium alloy processing, a material critical for aircraft engines. Additionally, the demand for nickel-based superalloys has led to the installation of more than 100 specialized vacuum furnaces in the first half of the year. The need for zero-defect manufacturing in aerospace has further pushed the adoption of vacuum furnaces, with over 80% of aerospace manufacturers in Japan now using them for critical component production. The trend is also supported by the government’s focus on domestic aerospace manufacturing, which has seen a 20% increase in investments this year.

Moreover, the automotive sector is also contributing significantly to this demand, with over 200 vacuum furnaces installed for gear hardening and brazing processes in 2024. The shift towards electric vehicles (EVs) has further accelerated this trend in the vacuum furnace market, as EV components require precise thermal treatment to ensure durability and performance. In the first half of 2024, more than 50 vacuum furnaces were installed specifically for EV battery component manufacturing. The electronics industry is another key player, with over 100 vacuum furnaces used for semiconductor processing this year. The growing complexity of electronic components has necessitated the use of vacuum furnaces to achieve the required material properties. This multi-industry demand has created a robust market for vacuum furnaces in Japan, with sales expected to grow by 15% in the next year.

Trend: Integration of AI and Machine Learning in Furnace Operations

The integration of AI and machine learning into vacuum furnace market operations is transforming the industry. In 2024, more than 200 vacuum furnaces in Japan have been equipped with AI-driven predictive maintenance systems, reducing downtime by up to 30%. AI is also being used to optimize heating cycles, with over 150 furnaces now capable of adjusting parameters in real-time based on material properties. This trend is particularly prominent in the automotive sector, where manufacturers have installed over 100 AI-enabled furnaces for gear hardening processes. The adoption of IoT-enabled furnaces has also surged, with more than 250 units sold this year, allowing remote monitoring and control.

Additionally, AI is being used to enhance energy efficiency, with over 50 vacuum furnaces now equipped with AI algorithms that reduce energy consumption by 20%. This is particularly important in Japan, where energy costs have risen by 10% in the past year. The aerospace industry is also leveraging AI, with more than 30 vacuum furnaces now using machine learning to optimize titanium alloy processing. The electronics sector is not far behind, with over 40 AI-enabled furnaces installed for semiconductor manufacturing in 2024. These advancements are not only improving operational efficiency but also reducing the environmental impact of vacuum furnace operations. The trend towards AI integration is expected to continue, with over 300 AI-enabled vacuum furnaces projected to be installed in Japan by the end of 2025.

Challenge: Complexity in Maintaining and Upgrading Advanced Furnace Technologies

One of the most pressing challenges in the vacuum furnace market is the complexity of maintaining and upgrading advanced furnace technologies. As vacuum furnaces become more sophisticated, with the integration of AI, IoT, and other advanced features, the maintenance requirements have also increased significantly. In 2024, over 40% of vacuum furnace operators reported difficulties in maintaining AI-integrated systems, leading to increased downtime and operational inefficiencies. The problem is particularly acute in the aerospace sector, where more than 50 vacuum furnaces have experienced technical issues related to AI and IoT integration this year.

Another issue is the rapid pace of technological advancements, which has left many operators struggling to keep up. In 2024, over 60% of vacuum furnace operators in Japan required additional training to manage the latest furnace technologies. This has led to a growing demand for specialized training programs, with over 200 operators enrolled in such courses this year. However, the availability of these programs is limited in the vacuum furnace market, with only 30% of operators able to access the necessary training. This has resulted in a skills gap, with over 100 vacuum furnace operators reporting that they are not fully equipped to handle the latest technologies. Moreover, the cost of upgrading existing vacuum furnaces to incorporate advanced features is another significant challenge. In 2024, the average cost of upgrading a vacuum furnace with AI and IoT capabilities was over $50,000, making it prohibitively expensive for many small and medium-sized enterprises. This has led to a slow adoption rate, with only 20% of existing vacuum furnaces in Japan being upgraded this year. The electronics industry has been particularly affected, with over 30 vacuum furnaces in this sector remaining outdated due to the high cost of upgrades. This challenge is expected to persist, with over 200 vacuum furnaces projected to remain un-upgraded by the end of 2025.

Segmental Analysis

The horizontal vacuum furnace dominates the Japanese vacuum furnace market, capturing over 61.44% of the market share, primarily due to its superior operational efficiency and adaptability to large-scale industrial applications. Horizontal furnaces offer a more uniform heat distribution, which is critical for processes like brazing, sintering, and annealing, where temperature consistency is paramount. The design allows for easier loading and unloading of large or heavy components, reducing downtime and enhancing productivity. Key end users include the automotive, aerospace, and electronics industries, where precision and high throughput are essential. For instance, in the automotive sector, horizontal furnaces are used for heat-treating engine components, ensuring durability and performance. The aerospace industry relies on these furnaces for processing turbine blades and other critical parts that require high-temperature stability and minimal contamination. The preference over vertical furnaces is driven by the horizontal design's ability to handle larger workloads and its compatibility with automated systems, which are increasingly adopted in Japanese manufacturing to maintain competitiveness in global markets.

Horizontal vacuum furnaces are also favored for their ability to process multiple batches simultaneously, with some models capable of handling up to 500 kilograms of material per cycle. This high throughput in the Japan vacuum furnace market is particularly beneficial in industries like electronics, where components such as semiconductors and circuit boards are produced in large volumes. The furnaces' ability to maintain a vacuum level of 10^-5 torr ensures minimal oxidation, which is critical for maintaining the integrity of sensitive materials. Additionally, horizontal furnaces are equipped with advanced cooling systems that can reduce cooling times by up to 30%, further enhancing their efficiency. The integration of IoT and AI technologies in these furnaces allows for real-time monitoring and predictive maintenance, reducing operational costs by up to 20%. These factors collectively contribute to the dominance of horizontal vacuum furnaces in Japan, making them the preferred choice for industries that demand high precision, efficiency, and scalability.

External heating is the predominant operation in Japan's vacuum furnace market, accounting for over 54.41% of the market share. This method involves heating the furnace chamber from the outside, which ensures a controlled and contamination-free environment, crucial for high-precision applications. External heating is particularly effective in processes like vacuum brazing and heat treatment, where maintaining a clean atmosphere is essential to prevent oxidation and ensure material integrity. The demand for external heating is driven by industries such as electronics and medical devices, where even minor impurities can compromise product quality. For example, in the electronics industry, external heating is used to produce semiconductors and other components that require ultra-clean environments. The method's dominance is further reinforced by its energy efficiency and ability to achieve higher temperatures, making it ideal for advanced materials like titanium and nickel alloys used in aerospace and defense applications.

External heating systems in vacuum furnaces are capable of reaching temperatures up to 2,500°C, which is essential for processing high-performance materials like tungsten and molybdenum. The heating elements, often made of graphite or tungsten, have a lifespan of over 10,000 hours, reducing the need for frequent replacements and lowering maintenance costs. The uniform heating provided by external systems ensures that temperature variations within the furnace chamber are kept within ±5°C, which is critical for achieving consistent material properties. Additionally, external heating systems are designed to minimize heat loss, with thermal efficiency rates exceeding 85%. This is particularly important in industries like medical device manufacturing, where precision and energy efficiency are paramount. The ability to integrate external heating systems with advanced control systems allows for precise temperature regulation, reducing processing times by up to 25%. These advantages make external heating the preferred method in Japan's vacuum furnace market, particularly for applications that demand high precision and energy efficiency.

Heat treatment is the most prominent application of vacuum furnace market in Japan, controlling nearly 50% of the market share. This process is critical for enhancing the mechanical properties of metals, such as hardness, strength, and wear resistance, which are essential for high-performance applications. The demand for heat treatment is driven by industries like automotive, aerospace, and tool manufacturing, where components must withstand extreme conditions. For instance, in the automotive sector, heat treatment is used to improve the durability of gears and crankshafts, while in aerospace, it is applied to turbine blades and structural components. The precision and consistency offered by vacuum heat treatment make it indispensable for producing high-quality parts. Additionally, the growing adoption of advanced materials like titanium and superalloys, which require precise heat treatment to achieve desired properties, further fuels the demand. The process's dominance is also supported by its ability to reduce material waste and enhance production efficiency, aligning with Japan's focus on sustainable manufacturing practices.

Vacuum heat treatment processes can achieve hardness levels of up to 65 HRC (Rockwell C scale), which is essential for producing high-strength components used in heavy machinery and industrial equipment. The process also improves fatigue resistance by up to 40%, extending the lifespan of critical components in industries like aerospace and automotive. The ability to control the cooling rate with precision, often within ±1°C per second, ensures that materials achieve the desired microstructure and mechanical properties in the Japan vacuum furnace market. Additionally, vacuum heat treatment reduces the risk of surface decarburization, which can compromise the integrity of high-performance components. The process is also environmentally friendly, with energy consumption rates up to 30% lower than traditional heat treatment methods. These factors make vacuum heat treatment the preferred choice in Japan, particularly for industries that demand high-quality, durable components with extended lifespans.

The aerospace and aviation industry is the most significant end user of vacuum furnace market in Japan with revenue share of over 31.74% market share, driven by the need for high-performance materials and components that can withstand extreme conditions. Vacuum furnaces are essential for processes like brazing, heat treatment, and sintering, which are critical for producing turbine blades, engine components, and structural parts. The demand is fueled by the industry's stringent quality standards and the need for materials with superior mechanical properties, such as titanium and nickel-based superalloys. For example, vacuum brazing is used to join complex aerospace components without compromising their integrity, while heat treatment enhances the strength and durability of critical parts. The dominance of this sector is further reinforced by Japan's strong presence in the global aerospace market, with companies like Mitsubishi Heavy Industries and Kawasaki Heavy Industries leading the way. The industry's focus on innovation and the adoption of advanced manufacturing technologies also contribute to the high demand for vacuum furnaces, ensuring the production of reliable and high-performance aerospace components.

In the aerospace sector, vacuum furnace market witnesses demand in the process components that operate at temperatures exceeding 1,000°C, such as turbine blades and combustion chambers. The ability to maintain a vacuum level of 10^-6 torr ensures that these components are free from contaminants, which is critical for their performance and safety. Vacuum brazing, a key application in aerospace, can join materials with melting points differing by up to 500°C, enabling the production of complex, multi-material components. The heat treatment processes used in aerospace can improve the fatigue life of components by up to 50%, which is essential for ensuring the reliability of aircraft engines and structural parts. Additionally, vacuum furnaces are used to produce components with dimensional tolerances as tight as ±0.01 mm, which is critical for maintaining the precision required in aerospace applications. These factors make vacuum furnaces indispensable in the aerospace and aviation industry, driving their dominance in Japan's market.

To Understand More About this Research: Request A Free Sample

- IHI Corporation

- DOWA Thermotech Co., Ltd.

- Shimadzu Mectem, Inc.

- Chugai Ro Co., Ltd.

- SECO/Warwick

- JTEKT Thermo Systems Corporation

- Other Prominent Players

By Component

- Vacuum Vessel

- Hot Zone

- Pumping System

- Cooling System

- Control System

- Handling System

By Type

- Horizontal

- Vertical

By Operation

- External Heating

- Internal Heating

By Application

- Heat Treatment

- Hardening

- Tempering

- Annealing

- Carburizing

- Melting

- Brazing

- Sintering

- Others

By End User

- Aerospace and Aviation

- Medical

- Automotive

- 3D Printing and Additive Manufacturing

- Research Laboratories

- Others

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA02251177 | Delivery: Immediate Access

| Report ID: AA02251177 | Delivery: Immediate Access

.svg)