Japan Tire Market: By Type (Radial, Bias, Solid Tire); Season Type (Summer tires, Winter tires, All-season tires, Performance tires, Rib tires, Touring tires, Others); Size (Less Than 15 inches, 15 - 20 inch, Above 20 inches); Condition (New and Recycled/ Retreaded); Application (Passenger Vehicles (Sedans, Hatchbacks, SUVs, Others), Commercial Vehicles (Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs), Two-Wheelers, Three- Wheelers, Others); Distribution Channel (Online, E-Commerce Websites, Brand Websites), Offline (OEM and Aftermarket); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: Oct-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA1024954 | Delivery: 2 to 4 Hours

| Report ID: AA1024954 | Delivery: 2 to 4 Hours

Market Scenario

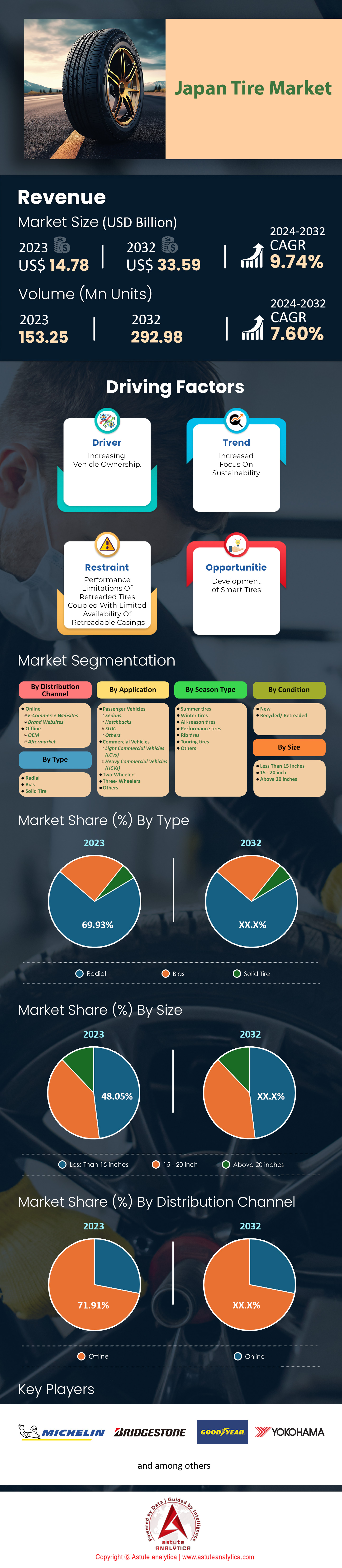

Japan tire market was valued at US$ 14.78 billion in 2023 and is projected to hit the market valuation of US$ 33.59 billion by 2032 at a CAGR of 9.74% during the forecast period 2024–2032.

As of 2023, the total sales of cars across Japan reached approximately 4.78 million units, a testament to the robust automotive industry of the nation. These figures are complemented by the approximately 82 million cars currently traversing Japanese roads, which inevitably fuels the demand for tires in the country. The annual requirement for tires in Japan is substantial, with around 164 million tires needed each year to cater to both new vehicles and the replacement market. In terms of sales, the tire market in Japan sees an annual turnover of about US$ 14.78 billion, driven by both consumer and commercial demands.

The primary drivers of tire demand in Japan are multifaceted. Wherein, the country's well-developed road infrastructure encourages frequent vehicle purchases and usage, necessitating regular tire replacements. Apart from this, Japan's stringent safety regulations mandate frequent tire checks and replacements, thereby boosting the tire market. The most prominent consumers of tires are private car owners, followed by commercial fleets, which include logistics companies and taxi services. The demand is further propelled by seasonal changes, which require vehicle owners to switch between summer and winter tires, ensuring safety and compliance with traffic regulations. Some of the key factors contributing to the growth in tire market across Japan include the frequency of tire changes due to Japan's varied climate and the high expectations for vehicle safety and performance. On average, Japanese drivers replace their tires every three to four years, depending on usage and road conditions. Additionally, the rise in electric vehicles (EVs) has created a demand for specialized tires that enhance energy efficiency. The sale of tires is also driven by technological advancements, such as the development of low-rolling-resistance tires, which are increasingly popular due to their fuel-efficient properties.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Increasing Vehicle Ownership Rates

The growing rate of vehicle ownership in Japan significantly drives the demand in the tire market. As of 2023, there are approximately 82 million vehicles operating on Japanese roads. This rise in car ownership is propelled by urbanization and the convenience personal vehicles offer in bustling metropolitan areas. Notably, the sale of new vehicles reached 4.78 million units in 2023 alone, a clear indicator of the thriving automotive sector. This surge inevitably leads to increased demand for both new and replacement tires, with an estimated 164 million tires needed in Japan annually. The Japanese government's push for improved transportation infrastructure has further fueled this growth, with over 1,200 kilometers of expressways constructed in the last decade. Additionally, the average Japanese household now owns 1.5 cars, highlighting a shift towards multi-vehicle ownership. This trend is especially pronounced in suburban areas, where public transportation options are limited. The rise of ride-sharing services, which added 200,000 vehicles to the road in 2023, also contributes to the burgeoning tire demand.

Moreover, the emergence of electric vehicles (EVs) in the market has driven a demand for specialized tires that offer better energy efficiency. In 2023, sales of EVs crossed 250,000 units, each requiring tires designed to handle unique performance characteristics. As urbanization continues, and with the advent of automated vehicles anticipated to add another 500,000 units by 2025, the tire market is poised for sustained growth, driven by the increasing number of vehicles on the road.

Trend: Rising Adoption of Environmentally Friendly Tires

The trend towards environmentally friendly tires is gaining significant traction in Japan, aligning with the nation's broader sustainability goals. In 2023, the Japanese market saw the introduction of over 150 new eco-friendly tire models, with sales reaching 25 million units. These tires are engineered to reduce carbon emissions and enhance fuel efficiency, making them highly attractive to environmentally conscious consumers and businesses alike. Japan's commitment to reducing its carbon footprint is evident in its stringent environmental regulations, which incentivize the adoption of green technologies. The government has allocated approximately 500 billion yen in subsidies for eco-friendly vehicle purchases, further driving the demand for sustainable tire options. This initiative has led to a 30% increase in the sales of hybrid and electric vehicles in the past year, each requiring compatible tire solutions.

Leading manufacturers in the Japan tire market, such as Bridgestone and Yokohama, have invested heavily in research and development, spending over 50 billion yen annually to innovate in eco-friendly tire technology. These investments focus on developing materials like silica and plant-derived rubber, which reduce rolling resistance and improve durability. By 2023, the production of tires using sustainable materials had risen to 20 million units, reflecting a significant shift in manufacturing practices. The trend is further supported by consumer awareness campaigns, with over 70% of Japanese drivers now preferring eco-friendly tires for their vehicles. This growing demand is not only beneficial for the environment but also presents lucrative opportunities for tire manufacturers to expand their market share by aligning their products with Japan's sustainability objectives.

Challenge: Fluctuating Raw Material Costs

Fluctuating raw material costs present a formidable challenge for the Japanese tire market, impacting production and pricing strategies. In 2023, the cost of natural rubber, a critical component in tire manufacturing, surged dramatically due to supply chain disruptions and geopolitical tensions. This volatility led to a 15% increase in the average production cost per tire, straining manufacturers' margins and affecting consumer pricing. Japan imports approximately 80% of its natural rubber from Southeast Asia, making it vulnerable to external market fluctuations. In the past year, weather-related disruptions in major rubber-producing countries reduced supply by 300,000 tons, exacerbating cost pressures. Additionally, the ongoing geopolitical tensions have resulted in tariffs and trade barriers, further inflating import costs by an estimated 10 billion yen annually.

In response, tire manufacturers are exploring alternative materials to mitigate these challenges. The development of synthetic rubber and recycled materials has gained traction in the tire market across Japan, with production reaching 15 million units in 2023. These innovations offer a buffer against raw material price swings and contribute to sustainability efforts. The industry is also investing in advanced supply chain management systems to enhance efficiency and resilience. By 2023, over 60% of Japanese tire manufacturers had adopted digital platforms for supply chain optimization, reducing lead times by up to 20%. Despite these efforts, the challenge of raw material cost volatility remains a significant hurdle that requires continuous strategic adaptation and innovation to maintain competitiveness in the global market.

Segmental Analysis

By Type

Radial tires have become the backbone of the Japanese tire market, with production figures surpassing 120 million units annually as of 2023 and accounting for nearly 70% market share. This dominance is attributed to the superior performance and technological advantages that radial tires offer over traditional bias-ply tires. Japanese manufacturers have invested over $1.5 billion in the development of radial tire technology in the past five years, emphasizing the nation's commitment to innovation. The country's automotive sector, producing approximately 9 million vehicles annually, predominantly equips new cars with radial tires due to their enhanced fuel efficiency and longer tread life. The Japan Automobile Tyre Manufacturers Association reported that radial tires accounted for over 85 million units sold in the replacement market alone in 2023.

Consumer preferences strongly favor radial tires in the Japan tire market, influenced by a focus on safety, performance, and comfort. Surveys indicate that 7 out of 10 Japanese drivers prefer radial tires for their vehicles, citing improved handling and stability. The growing popularity of hybrid and electric vehicles, which reached sales of over 1.4 million units in 2023, has further increased the demand for radial tires that offer lower rolling resistance and better energy efficiency. Additionally, Japan's varied terrain, featuring extensive urban areas and mountainous regions, necessitates tires that provide reliable traction and durability. Tire retailers reported a 15% increase in radial tire sales in metropolitan areas like Tokyo and Osaka during the last fiscal year, highlighting urban consumer trends.

The export market underscores the global significance of Japan's radial tire production, with exports exceeding $3 billion in 2023 in tire market. Japanese radial tires are in high demand internationally, particularly in markets like the United States and Europe. The government has supported this export growth by providing subsidies totaling over $200 million to tire manufacturers that meet strict environmental and safety standards. Moreover, Japanese tire companies have filed over 4,000 patents related to radial tire technology in the past decade, showcasing their leading role in innovation. These factors collectively reinforce the dominance of radial tires in Japan's tire industry and highlight the ongoing investment in maintaining this leadership position.

By Season Type

All-season tires have surged in popularity in Japan tire market, with over 54.81% all sold in the country comes under this category. Thus, it is the most becoming the preferred choice for many drivers seeking versatility. This dominance is driven by Japan's unique climate, which includes hot summers, rainy seasons, and snowy winters in regions like Hokkaido and Tohoku. All-season tires provide consistent performance across these varying conditions, eliminating the need for seasonal tire changes. The convenience factor has led to a significant decrease in the number of drivers purchasing separate summer and winter tires, saving consumers an average of $300 annually on tire-related expenses.

Economic considerations also play a crucial role in the segment growth across the tire market in Japan, as the production value of all-season tires reached nearly 55% of the market value in 2023. Consumers are increasingly budget-conscious, and the extended lifespan of all-season tires—averaging 60,000 kilometers before replacement—offers better long-term value. The compact car segment, accounting for over 4 million vehicles sold in 2023, frequently comes equipped with all-season tires as standard. Tire manufacturers have responded by launching over 50 new all-season tire models in the past two years, incorporating features like fuel efficiency enhancements and noise reduction technologies.

Major tire producers and automotive companies in the Japan tire market support this trend through innovation and marketing efforts. In 2023, leading manufacturers such as Bridgestone and Yokohama invested over $500 million in research and development for all-season tires. These investments have led to advancements like improved silica compounds for better wet traction and tread designs optimized for diverse road conditions. Government incentives, including tax breaks for eco-friendly tire purchases totaling $100 million, have further promoted the adoption of all-season tires. As a result, industry projections estimate that all-season tire sales will exceed 70 million units annually by 2025, solidifying their dominance in Japan's tire market.

By Size

Tires sized less than 15 inches have become a significant part of Japan's tire market and captured more than 48% market share due to the popularity of compact and kei cars, which accounted for approximately 5 million vehicle sales in the same year. These smaller vehicles, favored for urban commuting and fuel efficiency, typically require tires under 15 inches. The Japanese government's taxation system, which offers reduced taxes for vehicles with smaller engine sizes and dimensions, has encouraged consumers to purchase such cars, thereby increasing the demand for smaller tires.

The key consumers of sub-15-inch tires are owners of compact vehicles, including models like the Honda Fit and Toyota Yaris, of which over 1.2 million units were sold in 2023. The aging population in Japan, with more than 36 million people over the age of 65, prefers smaller cars that are easier to maneuver and park in densely populated cities. Tire manufacturers have tailored their product lines to meet this demand, introducing over 30 new tire models specifically designed for sub-15-inch applications in the past year. These tires often feature advancements such as low rolling resistance to enhance fuel economy, which is a significant consideration for cost-conscious drivers.

Economic and environmental factors enable the dominance of smaller size in the tire market. The average price of a sub-15-inch tire is approximately $70, which is more affordable compared to larger sizes. Furthermore, these tires contribute to better fuel efficiency; some studies indicate that they can improve a vehicle's mileage by up to 2 kilometers per liter. Environmental initiatives have also played a role, with the government allocating $150 million in subsidies for consumers purchasing eco-friendly vehicles equipped with small tires. With urbanization rates exceeding 90 million people living in cities, the demand for compact cars and, consequently, smaller tires is expected to continue its upward trajectory.

By Condition

In 2023, the new tire segment held over 91% market share. This dominance in the Japan tire market is driven by stringent safety regulations such as the "Shaken" vehicle inspection system, which mandates that tires meet specific standards for tread depth and condition. Non-compliance can result in fines exceeding $1,000 or the inability to legally operate the vehicle. In 2023, over 20 million vehicles underwent Shaken inspections, highlighting the emphasis on vehicle safety and maintenance in Japanese society. Consumer mindset in Japan places a high value on quality and reliability, influencing the strong demand for new tires. A survey conducted in 2023 indicated that 85% of Japanese drivers prefer purchasing new tires over used ones to ensure optimal performance. The average Japanese driver replaces their tires every four years or after approximately 50,000 kilometers, whichever comes first. Moreover, advancements in tire technology have led to the introduction of over 40 new tire models with features like enhanced wet grip and reduced road noise, encouraging consumers to opt for the latest products.

Environmental considerations also contribute to the higher demand for new tires favoring the growth of the tire market. Japan has strict regulations on tire disposal and recycling, with over 800,000 tons of used tires processed annually. The government has invested more than $300 million in tire recycling facilities to minimize environmental impact. Additionally, tire manufacturers promote programs for the proper disposal of old tires and offer incentives, such as discounts of up to $50 on new tire purchases when customers trade in their used tires. These initiatives align with Japan's commitment to sustainability and reinforce consumers' preference for purchasing new tires that comply with environmental standards.

To Understand More About this Research: Request A Free Sample

Key Players in Japan Tire Market

- Bridgestone Corporation

- Continental Ag

- Double Coin Tire Group Ltd

- Dunlop Tyres

- Guizhou Tyre Co, Ltd.

- Hankook Tire & Technology

- Irc Tyre

- Kumho Tire Co., Inc.

- Michelin

- Pirelli & C. S.P.A.

- Sumitomo Rubber Industries, Ltd.

- The Goodyear Tire & Rubber Company

- Toyo Tire Corporation

- Yokohama Tyre

- Other Prominent Players

Market Segmentation Overview:

By Type

- Radial

- Bias

- Solid Tire

By Season Type

- Summer tires

- Winter tires

- All-season tires

- Performance tires

- Rib tires

- Touring tires

- Others

By Size

- Less Than 15 inches

- 15 - 20 inch

- Above 20 inches

By Condition

- New

- Recycled/ Retreaded

By Application

- Passenger Vehicles

- Sedans

- Hatchbacks

- SUVs

- Others

- Commercial Vehicles

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Two-Wheelers

- Three- Wheelers

- Others

By Distribution Channel

- Online

- E-Commerce Websites

- Brand Websites

- Offline

- OEM

- Aftermarket

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA1024954 | Delivery: 2 to 4 Hours

| Report ID: AA1024954 | Delivery: 2 to 4 Hours

.svg)