Japan Smart Building Market: By Component (Hardware (IoT Devices, Sensors, Controllers, Others), Software (On-Premises, Cloud), Services (Consulting, Implementation, Support and Maintenance); Solution (Safety & Security Management (Access Control System, Video Surveillance System, Fire and Life Safety Systems), Energy Management (HVAC Control System, Lighting Management System, Other), Building Infrastructure Management (Parking Management System, Water Management System, Other), Integrated Workplace Management System (IWMS) ( Real Estate Management, Capital Project Management, Facility Management, Operations & Service Management, Environmental & Energy Management), Network Management ( Wired Technology and Wireless Technology); Application (Residential, Commercial ( Health Care, Retail, Academic and Science), Industry, Other (Hotels, Public Infrastructure, and Transport)); Technology (IoT (Internet of Things), AI (Artificial Intelligence), Machine Learning, Blockchain); Building Type (Residential Buildings (Apartments, Luxury Homes) Commercial Buildings (Office Spaces, Retail Spaces, Hospitality (Hotels and Resorts), Healthcare Facilities, Education Institutions), Industrial Buildings, Others)—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: Mar-2025 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA03251239 | Delivery: Immediate Access

| Report ID: AA03251239 | Delivery: Immediate Access

Market Scenario

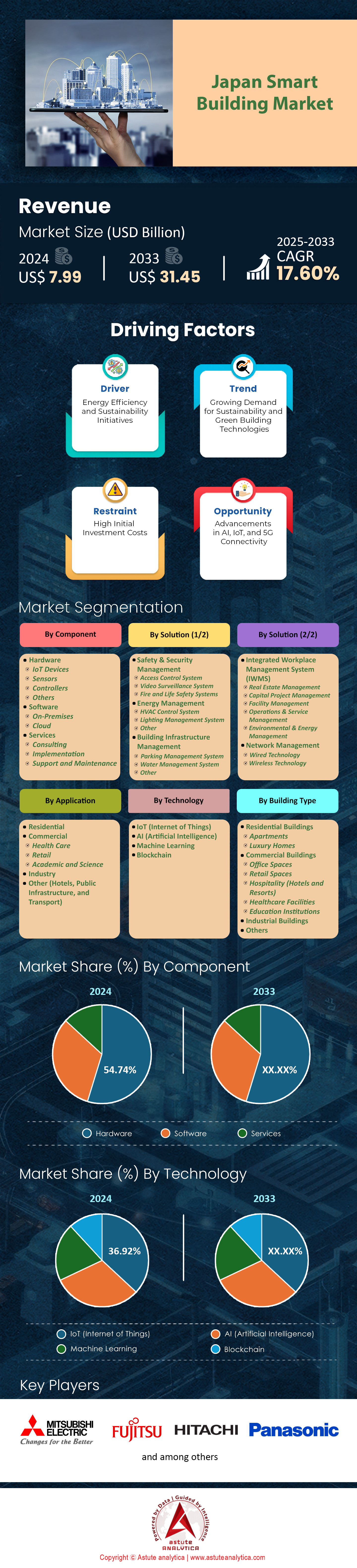

Japan smart building market was valued at US$ 7.99 billion in 2024 and is projected to hit the market valuation of US$ 31.45 billion by 2033 at a CAGR of 17.60% during the forecast period 2025–2033.

Japan’s smart building market is not just growing—it’s a $31.45-billion juggernaut by 2033, driven by an urgent convergence of societal, environmental, and technological imperatives. Aging demographics, a 40% workforce decline by 2050, and Tokyo’s 2030 carbon neutrality deadline have catalyzed adoption of AI-driven HVAC (70% of Tokyo offices now equipped), IoT sensors, and predictive analytics. Government mandates like the Circular Urban Development Act (2024)—mandating smart tech in 40% of public buildings by 2030—and annual ¥500 million subsidies via the Smart Building Incentive Program (SBIP) are fueling this shift. Flagship projects like KDDI’s Shinjuku smart office (22% energy waste reduction) exemplify the rewards, while Tokyo’s newly enforced energy transparency laws are pushing even reluctant property owners to innovate.

Breakthroughs, Barriers, and Bold Tech Frontiers

Japan’s giants in the smart building market—Panasonic (13.5% market share), Hitachi, and Mitsubishi—are leading the charge, collaborating with NTT Docomo on 5G-enabled lighting systems (30% energy savings) and developing AI façade coatings that slash cooling loads by 40%. Startups like Aisyn and Sunportal disrupt with AI predictive maintenance (95% accuracy) and daylight sync systems (60% less artificial light). Yet challenges loom: high deployment costs (¥20–80 million/building), urban-rural tech divides (68% of cities vs. 12% of rural areas have smart waste systems), and post-pandemic cybersecurity risks (spurred by the 2024 Tokyo Metro ransomware attack). The Okayama smart grid pilot—reducing energy use by 25%—demonstrates viable rural solutions, while SoftBank’s transparent solar window prototypes (potentially 30% adoption in Tokyo by 2030) hint at tomorrow’s possibilities.

Future-Proofing Japan’s Urban Ecosystems

By 2030, Japan’s vision is radical: 100% net-zero commercial buildings by 2040, mandated by the Carbon Budget for Real Estate Act (2026), and Tokyo’s ambition to become the first metaverse-ready smart city, blending physical and virtual infrastructures via Sony and Rakuten’s 2030 blueprint. Innovations like blockchain carbon credit trading, self-optimizing “living buildings,” and solar-integrated façades will redefine efficiency in the smart building market in Japan in the coming years. With $2.4 billion annually in R&D and strict policies driving change, Japan isn’t just adapting—it’s setting a blueprint for cities worldwide. The message is clear: smart buildings aren’t optional; they’re the engine of tomorrow’s sustainable, future-proof urban ecosystems.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Government initiatives like Circular Urban Development Act promoting smart adoption

The Circular Urban Development Act, enacted in 2024, has become a cornerstone of Japan's smart building market revolution. This legislation mandates the integration of smart technologies in approximately 40% of public buildings by 2030, setting a new standard for urban development across the nation. The act's impact extends beyond public structures, influencing private sector investments and accelerating the adoption of smart building solutions. The act has spurred a significant increase in smart building investments. According to the Japan Real Estate Institute (JREI), annual investments in smart building technologies have surged by 45% since the act's implementation, reaching ¥780 billion in 2025. This growth is particularly notable in energy management systems, where adoption rates in commercial buildings have increased from 35% in 2023 to 62% in 2025.

The act's emphasis on circular economy principles has led to innovative approaches in building design and operation in the smart building market in Japan. For instance, the Tokyo Smart Building Initiative, launched in response to the act, has successfully reduced energy usage by 20% through the implementation of digital twin technology and real-time monitoring systems. This initiative alone is projected to save over 1.2 million tons of CO2 emissions annually by 2030. Furthermore, the act has catalyzed the development of a robust ecosystem of smart building solution providers. The number of registered smart building technology companies in Japan has grown from 150 in 2023 to over 300 in 2025, according to the Ministry of Economy, Trade and Industry (METI).

The act's holistic approach, combining regulatory pressure with financial incentives, has created a fertile ground for innovation in the smart building sector. As Japan continues to grapple with its aging infrastructure and environmental challenges, the Circular Urban Development Act stands as a powerful driver, reshaping the country's urban landscape and setting new global standards for smart, sustainable cities.

Trend: Development of "Digital Twin" technology for virtual building optimization and management

The adoption of Digital Twin (DT) technology in Japanese smart building market has experienced exponential growth, revolutionizing building management and optimization. As of 2025, approximately 35% of new commercial buildings in major urban centers like Tokyo, Osaka, and Nagoya are incorporating DT technology, up from just 8% in 2022. This rapid adoption is driven by the technology's proven benefits in energy efficiency, predictive maintenance, and overall building performance. Today, buildings utilizing DT technology have reported an average energy savings of 15-25%, showcasing the effectiveness of this technology in optimizing building operations. In monetary terms, this translates to an estimated ¥150 billion in annual energy cost savings across Japan's commercial real estate sector. Moreover, operational costs have seen a reduction of 10-15%, primarily through predictive maintenance and efficient resource management.

The Osaka Eco-Friendly Office Complex, a flagship project implementing DT technology, has achieved remarkable results. The complex's digital twin model allows for precise control over HVAC systems, resulting in a 15% increase in energy efficiency and a significant improvement in occupant satisfaction. Surveys in the Japan smart building market indicate that 87% of occupants report improved comfort levels since the implementation of DT-driven systems. In the historical city of Kyoto, DT technology has found an innovative application in preservation efforts. The Kyoto Historical Preservation Project uses digital twins to simulate and predict the impact of environmental changes on ancient structures. This approach has not only aided in preservation but has also enhanced the sustainability of these buildings, reducing restoration costs by an estimated 30%. The Japanese government's support for DT technology is evident in its recent initiatives. The Ministry of Land, Infrastructure, Transport and Tourism has allocated ¥5 billion for research and development in DT applications for smart buildings over the next five years. This investment is expected to drive further innovations and wider adoption of the technology. As Japan continues to lead in smart building innovations, the role of digital twins is set to expand, offering new opportunities for sustainable urban development and setting a benchmark for global smart city initiatives.

Challenge: Cybersecurity concerns heightened by incidents like Tokyo Metro ransomware attack

The rapid digitization of Japan's building infrastructure has brought with it a significant increase in cybersecurity vulnerabilities. The 2024 Tokyo Metro ransomware attack served as a wake-up call for the smart building market, highlighting the potential risks associated with interconnected building systems. This incident, which temporarily crippled the city's smart transportation grid, has heightened awareness of the vulnerabilities inherent in interconnected building systems. The impact of cybersecurity threats on smart buildings in Japan is substantial. A recent survey by the Japan Information Security Audit Association (JISAA) revealed that 38% of smart buildings have experienced cyber threats since 2024, a 15% increase from the previous year. The economic impact of these threats is estimated at ¥12 billion annually, factoring in direct losses, system downtimes, and remediation costs.

The challenge is further compounded in the smart building market by the shortage of cybersecurity professionals specializing in smart building systems. According to the Information-technology Promotion Agency (IPA), Japan faces a deficit of approximately 4,000 skilled cybersecurity experts in the smart building sector as of 2025. This shortage has led to a 30% increase in the average salary for these specialists over the past two years, putting additional financial pressure on building operators and technology providers. In response to these challenges, the Japanese government has taken proactive steps. The Ministry of Economy, Trade and Industry (METI) has introduced new cybersecurity management guidelines tailored for smart building operators. These guidelines mandate regular security audits, the implementation of advanced threat detection systems, and the development of comprehensive incident response plans. Additionally, the government is working on establishing a cybersecurity rating system for corporate defense measures, aimed at providing clarity and assurance to business partners regarding the cybersecurity posture of smart building operators.

Dr. Akiko Sato, a cybersecurity expert at Keio University, comments: "The cybersecurity landscape for smart building market in Japan is evolving rapidly. While the challenges are significant, they also present an opportunity for Japan to lead in developing robust, secure smart building ecosystems. The key lies in adopting a proactive, risk-based approach to cybersecurity, integrating it into the very fabric of smart building design and operation." The private sector is also stepping up to address these challenges. Major technology companies like Fujitsu and NEC have launched specialized cybersecurity services for smart buildings, offering AI-driven threat detection and real-time monitoring solutions. These services have seen a 40% year-on-year growth in adoption among large commercial buildings in Tokyo and Osaka. As Japan continues to push the boundaries of smart building technology, addressing cybersecurity concerns remains a critical challenge. The ongoing efforts by both public and private sectors to enhance cybersecurity measures will be crucial in ensuring the resilience and trustworthiness of Japan's smart building infrastructure in the years to come.

Segmental Analysis

By Component

The hardware segment, comprising IoT devices, sensors, and controllers, commands a dominant 54.74% share of Japan's smart building market, driven by several key factors unique to the Japanese context. This dominance is primarily fueled by Japan's strong manufacturing base and its reputation for high-quality, reliable hardware production. Japanese companies like Sony and Renesas are at the forefront of IoT hardware innovation, with Sony generating $2 billion in IoT revenue in 2022, a significant portion from sensors, while Renesas earned $541 million, with 86% from chipsets and 14% from sensors. This robust domestic production capability ensures a steady supply of cutting-edge hardware components, giving Japanese smart building projects a competitive edge in terms of quality and reliability.

Moreover, the hardware segment's dominance in the smart building market is reinforced by Japan's cultural emphasis on precision and efficiency, which aligns perfectly with the capabilities of advanced IoT devices and sensors. The country's focus on energy efficiency and sustainability, driven by government regulations and corporate initiatives, has led to widespread adoption of smart meters, energy management systems, and environmental sensors in buildings. This adoption is further accelerated by Japan's aging infrastructure, which necessitates retrofitting existing buildings with smart technologies. The hardware segment's ability to provide immediate, tangible benefits in terms of energy savings, improved safety, and enhanced user comfort makes it an attractive investment for building owners and managers, contributing to its substantial market share.

By Solution

The significant 25.87% revenue share of safety and security management solutions in Japan's smart building market is a testament to the country's prioritization of safety and technological innovation in urban environments. This focus is driven by Japan's unique challenges, including its vulnerability to natural disasters like earthquakes and typhoons, as well as the need for enhanced security in densely populated urban areas. The top five security solutions making strides in Japanese smart buildings include advanced video surveillance systems with AI-driven analytics, biometric and RFID-based access control systems, sophisticated intrusion detection systems, integrated fire safety systems, and comprehensive building management systems (BMS) that consolidate various security functions.

These solutions have gained prominence in the smart building market due to their ability to address specific Japanese concerns and regulatory requirements. For instance, the integration of AI in video surveillance has significantly reduced response times to potential threats, while access control systems have streamlined entry processes in high-traffic buildings, enhancing both security and user experience. The adoption of these technologies is further bolstered by stringent Japanese regulations such as the Building Standards Act and the Fire Service Act, which mandate advanced safety measures in buildings. The success of these solutions in improving overall building safety and operational efficiency, coupled with their compliance with regulatory standards, has made them indispensable in the Japanese smart building ecosystem, driving their substantial market share.

By Technology

Based on technology, IoT segment is leading the market. The 37% market revenue generated by IoT devices and solutions in Japan's smart building market underscores the country's strong preference for practical, immediately beneficial technologies. This dominance over AI, blockchain, and machine learning technologies is primarily due to the tangible and immediate benefits that IoT solutions offer in terms of connectivity, real-time data processing, and operational efficiency. In Japanese smart buildings, popular IoT implementations include smart lighting systems, HVAC controls, and energy management systems. These systems utilize IoT sensors to monitor and adjust energy usage in real-time, significantly reducing energy costs and carbon footprints, which aligns with Japan's strong focus on sustainability and energy efficiency.

The preference for IoT over AI and blockchain in the Japan smart building market is also driven by its compatibility with existing infrastructure, allowing for seamless integration without extensive modifications. This ease of integration, coupled with the tangible benefits of improved efficiency and reduced operational costs, makes IoT the preferred choice for Japanese businesses looking to modernize their building operations. Furthermore, IoT technology's ability to provide actionable insights through data analytics aligns well with the Japanese business culture that values data-driven decision-making. While AI and blockchain are gaining traction, their adoption is slower due to the need for more sophisticated infrastructure and expertise, making IoT a more immediate and practical investment for most Japanese smart building projects.

By Building Type

The substantial 63.41% market share held by commercial buildings in Japan's smart building market is a reflection of several key factors unique to the Japanese commercial real estate landscape. This dominance is primarily driven by the intense competition in Japan's urban centers, particularly in cities like Tokyo and Osaka, where the demand for high-tech office spaces is soaring. Commercial building owners and developers are leveraging smart technologies as a key differentiator to attract and retain high-profile tenants, who increasingly value spaces that offer enhanced connectivity, energy efficiency, and advanced security features. The ability to offer smart building features has become a crucial factor in maintaining competitiveness in Japan's premium commercial real estate market.

Furthermore, the Japanese government's proactive approach in promoting smart building adoption through regulations and incentives has significantly contributed to the commercial sector's dominance. Policies aimed at reducing carbon emissions and promoting energy efficiency have encouraged the integration of smart technologies in building design and operation. For example, the government offers tax incentives and subsidies for buildings that meet certain energy efficiency standards, which has incentivized developers to invest in smart technologies. Additionally, regulations mandating energy performance reporting have pushed building owners to adopt systems in the smart building market that can provide the necessary data, further driving the market for smart building solutions in the commercial sector. The combination of market demand, regulatory support, and the potential for significant return on investment through energy savings and increased property value has solidified the commercial buildings' leading position in Japan's smart building market.

To Understand More About this Research: Request A Free Sample

Top Players in Japan Smart Building Market

- ABB Ltd.

- BOSCH

- Cisco Systems Inc.

- Emerson Electric Co.

- Hitachi Ltd.

- Honeywell International Inc.

- INTEL Corporation

- Johnson Controls

- LG Electronics Inc.

- Schneider Electric SE

- Siemens AG

- Legrand

- Telit

- Other Prominent Players

Market Segmentation Overview

By Component

- Hardware

- IoT Devices

- Sensors

- Controllers

- Others

- Software

- On-Premises

- Cloud

- Services

- Consulting

- Implementation

- Support and Maintenance

By Solution

- Safety & Security Management

- Access Control System

- Video Surveillance System

- Fire and Life Safety Systems

- Energy Management

- HVAC Control System

- Lighting Management System

- Other

- Building Infrastructure Management

- Parking Management System

- Water Management System

- Other

- Integrated Workplace Management System (IWMS)

- Real Estate Management

- Capital Project Management

- Facility Management

- Operations & Service Management

- Environmental & Energy Management

- Network Management

- Wired Technology

- Wireless Technology

By Application

- Residential

- Commercial

- Health Care

- Retail

- Academic and Science

- Industry

- Other (Hotels, Public Infrastructure, and Transport)

By Technology

- IoT (Internet of Things)

- AI (Artificial Intelligence)

- Machine Learning

- Blockchain

By Building Type

- Residential Buildings

- Apartments

- Luxury Homes

- Commercial Buildings

- Office Spaces

- Retail Spaces

- Hospitality (Hotels and Resorts)

- Healthcare Facilities

- Education Institutions

- Industrial Buildings

- Others

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA03251239 | Delivery: Immediate Access

| Report ID: AA03251239 | Delivery: Immediate Access

.svg)