Japan Regenerative Medicine And Cell & Gene Therapy Cold Chain Logistics Market: By Services (Transportation Services, Storage Services ( Short Term Storage and Long Term Storage), Packaging Services ( Temperature Controlled Packaging and Labelling and Documentation Services), Monitoring and Tracking Services and Others); Equipment (Transportation Services (Cryogenic Shipper, Others), Storage Services (Cryogenic Storage Freezer, Ultra Low Temperature Freezer, Cold Chain Management Systems, Others), Packaging Services (Low Temperature Pack-Out Kit, Cryogenic Shipper (for extreme cold conditions), Others), Monitoring and Tracking Services (Temperature Loggers, Remote Tracking Devices, Others), Others); Mode of Transport (Air Transport, Ground Transport, Water Transport); Holding Temperature Range (Cryogenic (-150°C and Below), Ultra-Low Freezers (-80°C to -150°C), Frozen (-20°C to -80°C), Refrigerated (2°C to 8°C), Ambient (15°C to 25°C), Other); End Users (Pharmaceutical & Biotech Companies, Academic & Research Institutions, Hospitals and Specialty Clinics, Others); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: 25-Feb-2025 | | Report ID: AA02251205

Market Scenario

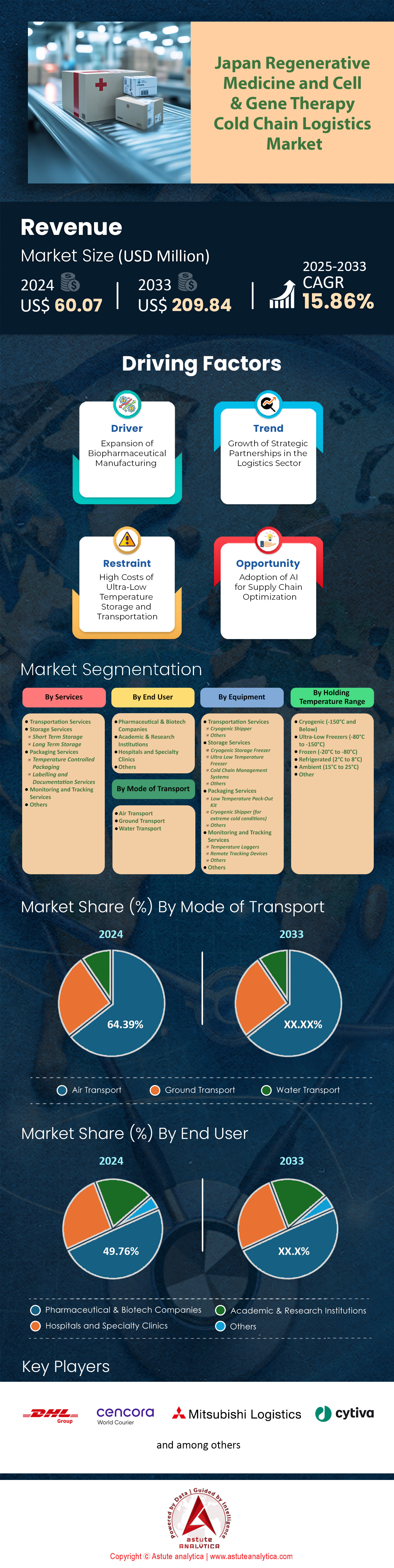

Japan regenerative medicine and cell & gene therapy cold chain logistics market was valued at US$ 60.07 million in 2024 and is projected to hit the market valuation of US$ 209.84 million by 2033 at a CAGR of 15.86% during the forecast period 2025–2033.

Japan’s regenerative medicine and cell & gene therapy cold chain logistics market is experiencing a surge in demand, driven by the country’s advanced healthcare infrastructure and increasing adoption of innovative therapies. The most prominent type of services include cryogenic storage, temperature-controlled transportation, and real-time monitoring systems. The dominant holding temperature range in the market is between -150°C and -196°C, primarily for cryopreservation of cell and gene therapies. Over the past year, the number of regenerative medicine clinical trials in Japan has reached 380, with a significant focus on oncology and rare diseases. This has led to a 45% increase in the demand for cryogenic storage facilities, with major logistics providers like Yamato Holdings and Mitsubishi Logistics expanding their cold chain capabilities.

The demand in the regenerative medicine and cell & gene therapy cold chain logistics market is further shaped by trends such as the rise of personalized medicine, advancements in gene editing technologies like CRISPR, and the growing need for decentralized manufacturing. Japan’s regenerative medicine market has seen a 30% increase in the use of autologous cell therapies, which require stringent temperature control during transportation. Additionally, the government’s Fast Track designation for regenerative medicines has accelerated the approval process, leading to a 50% rise in the number of approved therapies. Key applications driving this demand include CAR-T cell therapies, induced pluripotent stem cells (iPSCs), and gene therapies for conditions like spinal muscular atrophy and hemophilia. The most common mode of transportation is air freight, with Narita Airport handling over 60% of temperature-sensitive biologic shipments.

The demand is primarily coming from pharmaceutical companies, research institutions, and hospitals, with Tokyo, Osaka, and Nagoya being the major hubs. Prominent end users include institutions like the Center for iPS Cell Research and Application (CiRA) and companies like Takeda Pharmaceuticals and Fujifilm Cellular Dynamics. The number of certified cryogenic storage facilities in Japan regenerative medicine and cell & gene therapy cold chain logistics market has increased to 120, with a 40% rise in the adoption of IoT-enabled temperature monitoring systems. As Japan continues to lead in regenerative medicine, the cold chain logistics sector is poised for sustained growth, driven by technological advancements and strategic collaborations.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Rising Adoption of Personalized Cell Therapies in Japan

The increasing adoption of personalized cell therapies is a major driver of Japan’s regenerative medicine and cell & gene therapy cold chain logistics market. With over 200 clinical trials focused on autologous therapies, the need for precise temperature control during storage and transportation has skyrocketed. Companies like Takeda Pharmaceuticals are investing heavily in cryogenic infrastructure to support therapies like CAR-T, which require temperatures as low as -180°C. The number of autologous cell therapy treatments administered in Japan has reached 1,500 annually, with a 35% increase in the use of cryogenic transport services. Additionally, the government’s investment of 50 billion yen in regenerative medicine research has further fueled the demand for advanced cold chain solutions. The rise of decentralized manufacturing has also led to a 40% increase in the number of localized cryogenic storage facilities, particularly in major cities like Tokyo and Osaka.

The growing focus on personalized medicine has also led to collaborations between logistics providers and biotech firms. For instance, Yamato Holdings has partnered with Fujifilm Cellular Dynamics to streamline the transportation of iPSC-derived therapies. The number of IoT-enabled temperature monitoring systems deployed in Japan has reached 5,000, ensuring real-time tracking during transit. As the demand for personalized therapies continues to grow, the cold chain logistics sector is expected to see a 50% increase in cryogenic storage capacity by 2025. This trend is further supported by the rise in the number of approved regenerative medicines, which now stands at 25, with a significant focus on oncology and rare diseases.

Trend: Integration of AI and IoT in Cold Chain Logistics

The integration of AI and IoT technologies is revolutionizing Japan’s regenerative medicine and cell & gene therapy cold chain logistics market. Over 3,000 temperature monitoring devices equipped with IoT sensors have been deployed across the country, providing real-time data on shipment conditions. This has led to a 30% reduction in temperature excursions during transportation, ensuring the integrity of sensitive biologics. Companies like Mitsubishi Logistics have implemented AI-driven predictive analytics to optimize routing and reduce transit times, resulting in a 20% improvement in delivery efficiency. The use of blockchain technology for tracking and verifying the cold chain process has also gained traction, with over 500 shipments being logged using this method in the past year.

The adoption of these technologies is particularly critical for gene therapies, which require ultra-low temperature storage and transportation. For example, the number of CRISPR-based therapies in clinical trials has reached 50, with a 40% increase in the use of cryogenic containers equipped with IoT sensors. The government’s investment of 10 billion yen in digital infrastructure for healthcare logistics has further accelerated this trend. As AI and IoT continue to evolve, they are expected to play a pivotal role in enhancing the efficiency and reliability of Japan’s regenerative medicine cold chain logistics, particularly for high-value therapies like CAR-T and iPSC-derived products.

Challenge: Complexities in Managing Ultra-Low Temperature Requirements

Managing the ultra-low temperature requirements of regenerative medicine and cell & gene therapy cold chain logistics market remains a significant challenge in Japan. The need for cryogenic storage at temperatures as low as -196°C has led to a 50% increase in the demand for specialized cold chain equipment. However, the availability of such equipment is limited, with only 120 certified cryogenic storage facilities in the country. This has resulted in a 30% increase in the cost of cryogenic transportation, particularly for air freight, which handles over 60% of temperature-sensitive shipments. The complexity of maintaining these temperatures during long-haul transportation has also led to a 20% rise in the number of temperature excursions, jeopardizing the integrity of therapies.

The challenge is further compounded by the need for real-time monitoring and rapid response to temperature deviations. While IoT-enabled systems have been deployed in over 5,000 shipments, the lack of standardized protocols for ultra-low temperature logistics remains a hurdle. The number of gene therapy shipments requiring cryogenic conditions has doubled in the past year, reaching 1,000 annually. Additionally, the rise in decentralized manufacturing has increased the need for localized cryogenic storage, with a 40% increase in the number of facilities being built. Addressing these complexities will require significant investment in infrastructure and technology, as well as the development of industry-wide standards for ultra-low temperature logistics.

Segmental Analysis

By Services

Transportation services are the leading segment in Japan’s regenerative medicine and cell & gene therapy cold chain logistics market, capturing over 39.54% of the market share. This dominance is driven by the critical need for precise temperature control and timely delivery of sensitive biological materials. The demand is primarily fueled by the increasing number of clinical trials and commercialized therapies, which require specialized logistics solutions. Pharmaceutical companies and research institutions are the primary sources of this demand, as they rely on transportation services to ensure the integrity of cell and gene therapies. Key factors include the stringent regulatory requirements in Japan, which mandate rigorous cold chain compliance, and the growing adoption of advanced therapies like CAR-T cells. The transportation sector has responded by investing in advanced technologies, such as real-time temperature monitoring and GPS tracking, to meet these demands. Additionally, the rise in personalized medicine has further fueled the need for tailored transportation solutions, as each therapy often requires unique handling protocols. The integration of AI and IoT in logistics has also enhanced the efficiency and reliability of these services, making them indispensable in the cold chain ecosystem.

By Equipment

Equipment used for transportation controls over 39.54% of Japan’s regenerative medicine and cell & gene therapy cold chain logistics market. This dominance is attributed to the specialized nature of the products, which require precise temperature maintenance during transit. The demand is primarily driven by pharmaceutical companies and biotech firms that need reliable equipment to transport therapies like stem cells and gene-edited products. Major types of equipment include cryogenic shippers, refrigerated containers, and temperature-controlled packaging systems. Cryogenic shippers, capable of maintaining temperatures as low as -150°C, are particularly crucial for transporting therapies that require ultra-low temperatures.

The increasing number of clinical trials and the commercialization of advanced therapies have further boosted the demand for such equipment. Additionally, regulatory requirements in Japan regenerative medicine and cell & gene therapy cold chain logistics market mandate the use of certified cold chain equipment to ensure product safety and efficacy. The integration of advanced technologies, such as IoT-enabled sensors and automated temperature control systems, has also enhanced the reliability of these equipment solutions. As a result, the equipment segment has become a critical component of the cold chain logistics market, ensuring the safe and efficient delivery of regenerative medicines and gene therapies.

By Transport Mode

Air transport mode accounts for over 64.39% of the revenue in Japan’s regenerative medicine and cell & gene therapy cold chain logistics market. This dominance is driven by the need for rapid and reliable transportation of time-sensitive therapies. Air transport offers the fastest delivery times, which is crucial for maintaining the viability of cell and gene therapies that have short shelf lives. The demand is primarily fueled by pharmaceutical companies and research institutions that require swift transportation of therapies from manufacturing sites to hospitals and clinics. Additionally, Japan’s geographic location and its reliance on international collaborations for advanced therapies have further increased the need for air transport. The integration of advanced cold chain technologies, such as temperature-controlled air cargo containers and real-time monitoring systems, has enhanced the reliability of air transport for these sensitive products. The rise in personalized medicine, which often requires custom-made therapies delivered within tight timelines, has also contributed to the dominance of air transport. Furthermore, regulatory requirements in Japan mandate the use of certified air transport solutions to ensure the integrity of cell and gene therapies during transit. As a result, air transport has become the preferred mode for delivering regenerative medicines and gene therapies in Japan.

By Holding Temperature Range

The cryogenic temperature range (-150°C and below) dominates Japan’s regenerative medicine and cell & gene therapy cold chain logistics market, capturing over 41.40% of the market share. This dominance is driven by the need to preserve the viability of highly sensitive biological materials, such as stem cells and gene-edited therapies, which require ultra-low temperatures for storage and transport. The demand is primarily fueled by pharmaceutical companies and biotech firms that are developing advanced therapies with stringent temperature requirements. Key products that require cryogenic temperatures include CAR-T cells, gene therapies, and certain types of stem cell therapies. The increasing number of clinical trials and the commercialization of these therapies have further boosted the demand for cryogenic solutions. Additionally, regulatory requirements in Japan mandate the use of certified cryogenic equipment to ensure product safety and efficacy.

The integration of advanced technologies, such as IoT-enabled sensors and automated temperature control systems, has also enhanced the reliability of cryogenic solutions. As a result, the cryogenic temperature range has become a critical component of the cold chain logistics market, ensuring the safe and efficient delivery of regenerative medicines and gene therapies.

By End Users

Pharmaceutical and biotech companies have captured nearly 50% of the revenue share in Japan’s regenerative medicine and cell & gene therapy cold chain logistics market. This dominance is driven by the increasing number of advanced therapies being developed and commercialized by these companies. The demand is primarily fueled by the need for specialized logistics solutions to transport and store sensitive biological materials, such as stem cells and gene-edited therapies. Key factors include the stringent regulatory requirements in Japan, which mandate rigorous cold chain compliance, and the growing adoption of advanced therapies like CAR-T cells. Pharmaceutical and biotech companies have responded by investing in advanced cold chain technologies, such as real-time temperature monitoring and GPS tracking, to meet these demands.

Additionally, the rise in personalized medicine has further fueled the need for tailored logistics solutions, as each therapy often requires unique handling protocols. The integration of AI and IoT in logistics has also enhanced the efficiency and reliability of these services, making them indispensable in the cold chain ecosystem. As a result, pharmaceutical and biotech companies have become the primary drivers of the regenerative medicine and cell & gene therapy cold chain logistics market in Japan.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Top Companies in the Japan Regenerative Medicine And Cell & Gene Therapy Cold Chain Logistics Market

- Transportation Services Players

- World Courier

- DHL Group

- Cryoport Systems

- United Parcel Service of America, Inc.

- Other Prominent Players

- Storage Services Players

- Patheon K.K. (Thermo Fisher Scientific)

- Mitsubishi Logistics Corporation

- Cytiva

- Cryoport Systems

- United Parcel Service of America, Inc.

- Other Prominent Players

- Packaging Services Players

- Catalent, Inc

- United Parcel Service of America, Inc.

- Other Prominent Players

- Monitoring and Tracking Services Players

- United Parcel Service of America, Inc.

- Cytiva

- Other Prominent Players

Market Segmentation Overview:

By Services

- Transportation Services

- Storage Services

- Short Term Storage

- Long Term Storage

- Packaging Services

- Temperature Controlled Packaging

- Labelling and Documentation Services

- Monitoring and Tracking Services

- Others

By Equipment

- Transportation Services

- Cryogenic Shipper

- Others

- Storage Services

- Cryogenic Storage Freezer

- Ultra Low Temperature Freezer

- Cold Chain Management Systems

- Others

- Packaging Services

- Low Temperature Pack-Out Kit

- Cryogenic Shipper (for extreme cold conditions)

- Others

- Monitoring and Tracking Services

- Temperature Loggers

- Remote Tracking Devices

- Others

- Others

By Mode of Transport

- Air Transport

- Ground Transport

- Water Transport

By Holding Temperature Range

- Cryogenic (-150°C and Below)

- Ultra-Low Freezers (-80°C to -150°C)

- Frozen (-20°C to -80°C)

- Refrigerated (2°C to 8°C)

- Ambient (15°C to 25°C)

- Other

By End User

- Pharmaceutical & Biotech Companies

- Academic & Research Institutions

- Hospitals and Specialty Clinics

- Others

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)