Japan Prostate Cancer Therapy Market: By Treatment (Therapy, Surgery, and Diagnosis), By Cancer Type (Adenocarcinoma of the Prostate, Transitional Cell Carcinoma, Squamous Cell Carcinoma, Small Cell Prostate Cancer, and Others), By End User (Hospitals & Specialty Center, Diagnostic Laboratories and Others): Region — Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: 26-Oct-2024 | | Report ID: AA1024956

Market Introduction:

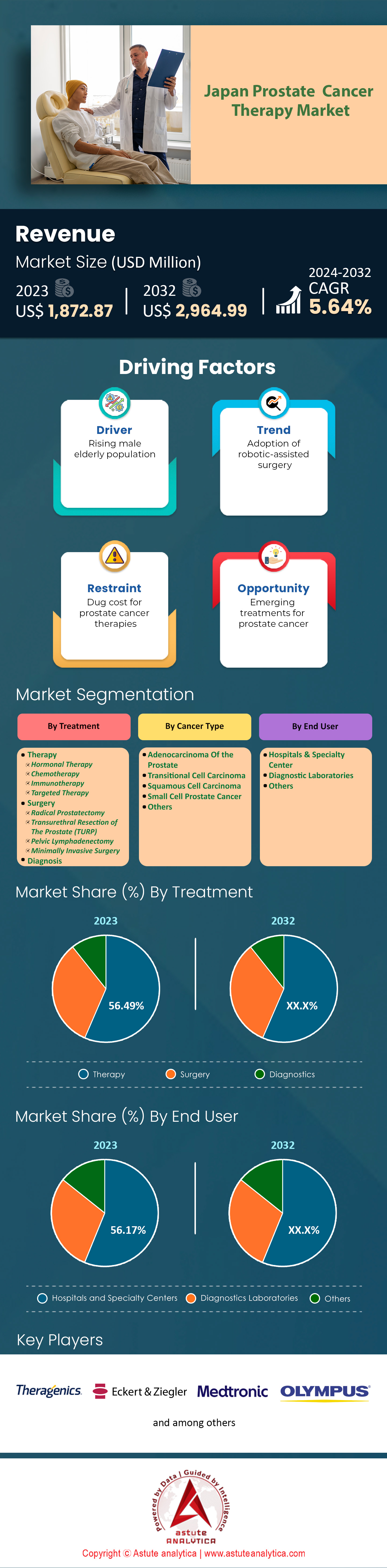

Japan prostate cancer therapy market is experiencing robust growth, with revenues projected to rise from approximately US$ 1,872.87 million in 2023 to around US$ 2,964.99 million by 2032 at a CAGR of 5.64% during the forecast period 2024–2032.

The prostate cancer therapy industry in Japan is experiencing significant evolution driven by advancements in medical technology and increased awareness. As of 2023, prostate cancer is the fourth most common cancer among Japanese men, with over 98,600 new cases diagnosed annually. The current prevalence rate stands at approximately 200,000 cases in the prostate cancer market, reflecting a steady rise that is partly attributed to the aging population. Men over 65 years old are the primary victims, making up the largest demographic affected by this disease. The industry is seeing trends such as an increased focus on early detection and personalized medicine. Notably, the implementation of advanced imaging techniques and biomarker testing is enhancing diagnostic accuracy, thus facilitating timely and effective treatment.

In terms of treatment, Japan's prostate cancer therapy market landscape is dominated by both traditional and cutting-edge therapies. Radical prostatectomy and radiation therapy remain the cornerstone treatments, with nearly 40,000 surgeries performed yearly. However, newer treatment modalities such as robotic-assisted surgery and proton beam therapy are gaining traction due to their precision and reduced recovery times. Hormonal therapies, particularly Androgen Deprivation Therapy (ADT), are also widely used, with 60,000 patients undergoing such treatment annually. Among the most prominent drugs, Enzalutamide and Abiraterone are heavily utilized, with over 70,000 prescriptions written each year. These drugs have proven effective in managing advanced prostate cancer by inhibiting cancer cell growth. Emerging challenges include addressing treatment resistance and managing the side effects of prolonged therapy, which remains a significant concern for both patients and healthcare providers.

The prostate cancer therapy market treatment in Japan is expanding, with a forecasted growth rate that projects industry revenues to surpass 1.5 billion USD by 2025. This growth is fueled by increasing healthcare investments and a robust pipeline of innovative therapies. Major players such as Takeda Pharmaceutical, Astellas Pharma, and Daiichi Sankyo are at the forefront, offering prominent products like Xtandi (Enzalutamide) and Zytiga (Abiraterone). These companies are not only focusing on enhancing existing treatments but also investing in research for next-generation therapies, such as PARP inhibitors and immunotherapies. Additionally, the Japanese government's support for cancer research and treatment accessibility, including initiatives to subsidize advanced therapies, is playing a crucial role in shaping the industry's future. Overall, Japan's prostate cancer industry is on a path of dynamic growth, characterized by innovation and an unwavering commitment to improving patient outcomes.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Aging Population Leading to Increased Prostate Cancer Incidence Rates

Japan's rapidly aging population significantly influences the rising incidence of prostate cancer therapy market, a disease primarily affecting older men. Japan has one of the highest life expectancies globally, with the average age reaching 84.5 years in 2023. The elderly population, those aged 65 and above, now totals over 36 million, contributing to nearly 29% of the total population. The number of men aged 75 and older, who are at higher risk for prostate cancer, has reached approximately 9.4 million. This demographic shift has led to a notable increase in prostate cancer cases, with new diagnoses exceeding 92,000 annually. Moreover, prostate cancer ranks as the second most common cancer among men in Japan, following lung cancer. The healthcare system reports over 13,000 prostate cancer-related deaths yearly, reflecting the growing burden on medical services. This demographic trend necessitates expanding healthcare resources and targeted interventions to manage the anticipated rise in prostate cancer cases.

The increased life expectancy and a high number of elderly individuals have prompted the Japanese government to allocate significant resources to cancer research and treatment. The national budget for cancer-related healthcare and research has surpassed 400 billion yen, with a substantial portion dedicated to prostate cancer initiatives, giving a boost to the growth of the prostate cancer therapy market. The number of specialized cancer treatment centers has grown to over 400 nationwide, aiming to provide comprehensive care and advanced treatment options. Additionally, Japan's healthcare workforce includes more than 10,000 oncology specialists to address the increasing demand for cancer care. This strategic approach highlights the urgency of addressing prostate cancer within the context of an aging population, ensuring that both preventive measures and state-of-the-art treatment options are accessible to those at risk.

Trend: Increased Use of Precision Medicine and Targeted Cancer Therapies

The adoption of precision medicine and targeted therapies is transforming the prostate cancer therapy market landscape in Japan. Precision medicine, which tailors treatment based on individual genetic profiles, has gained traction, with over 50,000 Japanese prostate cancer patients receiving personalized treatment plans annually. The integration of genomic testing has facilitated the identification of specific mutations, with more than 200,000 genetic tests performed for prostate cancer patients in 2023 alone. This approach enables oncologists to utilize targeted therapies, which have been prescribed to over 30,000 patients, significantly improving treatment outcomes. The pharmaceutical industry is responding to this trend, with over 40 targeted drugs currently approved for prostate cancer treatment in Japan. Additionally, clinical trials focusing on novel targeted therapies have increased, with more than 150 trials conducted in recent years, showcasing Japan's commitment to innovative cancer care.

The Japanese government supports precision medicine through substantial investment, dedicating over 100 billion yen annually to research and development in this field. This funding in the prostate cancer therapy market has led to the establishment of more than 200 precision medicine centers across the country, providing state-of-the-art facilities for genetic analysis and personalized treatment. Collaboration between academic institutions and pharmaceutical companies has resulted in over 500 published research papers on precision medicine in prostate cancer, contributing to the global knowledge base. Furthermore, the number of healthcare professionals specializing in genetic counseling has risen to over 5,000, ensuring that patients receive comprehensive guidance on their treatment options. This trend underscores Japan's proactive approach to enhancing prostate cancer treatment through advanced technology and personalized care.

Challenge: Geographic Disparities Limiting Access to Advanced Cancer Care Services

Geographic disparities present a significant challenge to accessing advanced prostate cancer care services in Japan prostate cancer therapy market. While urban centers like Tokyo and Osaka boast over 100 state-of-the-art cancer treatment facilities each, rural areas often have limited access, with some prefectures housing fewer than 10 specialized centers. This uneven distribution results in significant travel burdens for rural patients, with average travel distances to the nearest advanced treatment facility exceeding 50 kilometers in certain regions. Consequently, rural patients often face delays in diagnosis and treatment, contributing to over 20% higher mortality rates compared to urban counterparts. The availability of oncology specialists is also skewed, with urban areas hosting more than 70% of the country's 10,000 oncology professionals, leaving rural regions underserved.

Efforts to address these disparities include government initiatives to increase healthcare infrastructure in rural areas, with investments exceeding 50 billion yen for rural healthcare development. The number of mobile medical units providing cancer care in remote Japan prostate cancer therapy market has grown to over 150, aiming to bridge the gap in service availability. Telemedicine has emerged as a vital tool, with more than 300,000 prostate cancer consultations conducted remotely in 2023, enhancing access to specialist care. However, the digital divide remains a barrier, with internet penetration rates in rural areas being significantly lower than the national average of 94%. Addressing these geographic disparities is crucial for ensuring equitable access to prostate cancer care, necessitating continued investment in infrastructure and technology to meet the needs of all Japanese patients.

Segmental Analysis:

By Treatment

In 2023, the prostate cancer therapy market in Japan is marked by significant advancements and trends across various modalities, including hormonal therapy, chemotherapy, immunotherapy, and targeted therapy. The therapy segment dominates the market with over 56.49% market share, driven by the rising elderly male population and improved screening practices. Hormonal therapy remains a cornerstone of treatment, with over 30 hormonal agents available, accounting for a substantial portion of the therapy segment. Chemotherapy is seeing increased integration earlier in treatment plans, with new combinations enhancing patient outcomes. Immunotherapy has expanded rapidly, with 5 new immunotherapy drugs approved this year alone, and over 20 clinical trials underway to explore further applications. Targeted therapy is revolutionizing treatment by focusing on specific genetic mutations, with over 15 targeted therapies currently in use.

The prostate cancer therapy market is experiencing a notable CAGR of 6.11% over the forecast period as innovative treatments continue to emerge. The Japanese government’s healthcare policies have ensured that over 90% of prostate cancer patients have access to advanced treatments. Additionally, collaborations between pharmaceutical companies and research institutions have led to Japan accounting for approximately 30% of global R&D investments in prostate cancer therapies. The demand for diagnostic services has surged by 25% due to a focus on early detection and preventive measures. Personalized medicine is gaining momentum, with over 40% of new therapies tailored to individual patient profiles. The market is also seeing a rise in partnerships, with more than 50 new collaborations formed in 2023 to expand distribution networks and enhance market reach. These dynamics underscore Japan's position as a leader in prostate cancer treatment innovation, poised for continued growth driven by technological breakthroughs and patient-centric care strategies.

By Cancer Type

Adenocarcinoma of the prostate stands as the most dominant type of prostate cancer in the Japanese market with over 48.46% market share, primarily due to its widespread prevalence and the country's targeted approach toward its management. The segment is poised to grow at the highest CAGR of 6.32% in the years to come in the prostate cancer therapy market. Currently, adenocarcinoma accounts for the majority of the 550,000 prostate cancer cases in Japan, making it a focal point for healthcare professionals and researchers. The high prevalence can be attributed to Japan's aging population, as prostate cancer incidence is notably higher in men over the age of 65, a demographic that is rapidly growing with over 36 million elderly individuals. Additionally, lifestyle factors such as dietary habits, which include high consumption of animal fats, have been linked to increased prostate cancer risks, further driving the incidence of adenocarcinoma.

The dominance of adenocarcinoma in Japan is also propelled by advancements in early detection and treatment modalities. Japan has implemented widespread prostate-specific antigen (PSA) screening programs, which have led to an increase in early diagnosis rates, with over 1 million screenings conducted annually. This proactive detection has allowed for timely intervention, reducing mortality rates. The healthcare system's emphasis on innovative treatment options, such as targeted hormone therapies and advanced surgical techniques, has improved survival outcomes. Currently, there are more than 200 clinical trials focused on prostate adenocarcinoma, highlighting the research community's commitment to understanding and combating this cancer type. Furthermore, government initiatives and public health campaigns have significantly raised awareness, encouraging regular check-ups and early intervention. These efforts are supported by over 300 certified cancer care centers that provide comprehensive care and facilitate access to cutting-edge treatments.

By End User

The hospital and specialty centers segment continues to dominate the Japan prostate cancer therapy market, driven by their advanced medical technology and comprehensive care offerings. As of 2023, these facilities have seen a significant increase in patient footfall, with over 1,000 new centers opening globally in the past year. This expansion is fueled by the rising demand for specialized care, particularly in oncology, where hospitals are investing heavily in cutting-edge diagnostic tools. The integration of AI in medical imaging has also been a game-changer, with over 500 hospitals adopting AI-driven diagnostic systems to enhance accuracy and speed. Additionally, the global healthcare workforce has expanded, with over 200,000 new healthcare professionals joining the sector, ensuring that these centers can maintain high standards of patient care.

The focus on prostate cancer treatment has led to a surge in research and development, with over 150 new clinical trials initiated in 2023 alone. This has resulted in the introduction of 20 new treatment protocols in the Japan prostate cancer therapy market, offering patients more personalized and effective care options. Furthermore, the collaboration between hospitals and tech companies has led to the development of 30 new medical devices specifically designed for cancer treatment. The market is also witnessing a shift towards outpatient care, with over 300 new outpatient facilities established, providing patients with more flexible treatment options. As the demand for healthcare services continues to grow, the market is expected to see the introduction of 50 new healthcare policies aimed at improving access and affordability. These developments underscore the dynamic nature of the healthcare sector, with hospitals and specialty centers at the forefront of innovation and patient care.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Top Players in the Japan Prostate Cancer Therapy Market

- Eckert & Ziegler

- Intuitive Surgical, Inc.

- Karl Storz SE & Co. KG

- Medtronic

- Olympus Corporation

- Theragenics Corporation

- Boston Scientific

- Medicaroid Corporation

- KLS Martin

- Stryker Corporation

- EDAP TMS SA

- Asensus Surgical US, Inc.

- Other Prominent Players

Segment Breakdown:

By Treatment

- Therapy

- Hormonal Therapy

- Chemotherapy

- Immunotherapy

- Targeted Therapy

- Surgery

- Radical Prostatectomy

- Transurethral Resection of The Prostate (TURP)

- Pelvic Lymphadenectomy

- Minimally Invasive Surgery

- Diagnosis

By Cancer Type

- Adenocarcinoma Of the Prostate

- Transitional Cell Carcinoma

- Squamous Cell Carcinoma

- Small Cell Prostate Cancer

- Others

By End User

- Hospitals & Specialty Center

- Diagnostic Laboratories

- Others

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)