Japan Powered Suit Market: Component (Hardware, Software, Services); Category (Static and Dynamic); Technology (Hydraulic, Electric, Pneumatic, Others); Application (Health Management, Military Affairs & Activities, Industry); End Use Sector (Medical, Military, Media & Entertainment, Manufacturing, Agriculture, Healthcare & Home care, Public services, Construction, Logistics, Personal); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: Nov-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA1124977 | Delivery: 2 to 4 Hours

| Report ID: AA1124977 | Delivery: 2 to 4 Hours

Market Scenario

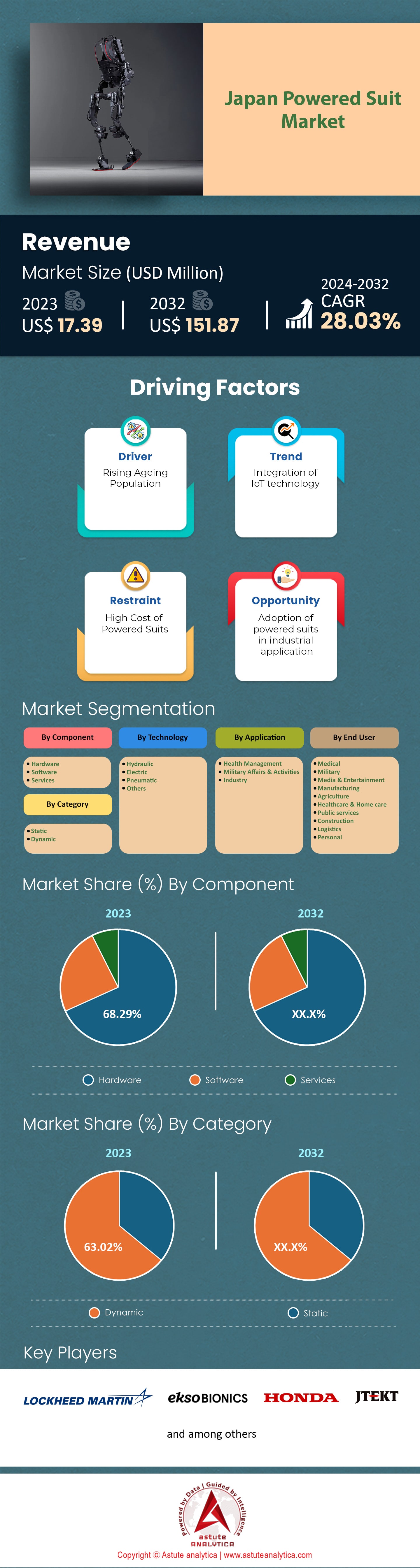

Japan powered suit market was valued at US$ 17.39 million in 2023 and is projected to hit the market valuation of US$ 151.87 million by 2032 at a CAGR of 28.03% during the forecast period 2024–2032.

Powered suits, commonly known as exoskeletons, are wearable devices that augment human capabilities by providing mechanical support and enhancing physical strength. In Japan, the demand for powered suits is on the rise due to an aging population and labor shortages. As of 2023, Japan has over 36 million people aged 65 and above, intensifying the need for assistive technologies. Leading manufacturers like Cyberdyne Inc., known for their HAL (Hybrid Assistive Limb) suit, and Panasonic, with their Power Assist Suit, have become prominent in powered suit market. These suits are designed to support movement, reduce physical strain, and improve efficiency in various tasks.

The most popular powered suits in Japan are employed in healthcare, caregiving, and industrial sectors. In healthcare, exoskeletons assist patients in rehabilitation; over 1,000 patients at the University of Tsukuba Hospital have utilized HAL suits for recovery from spinal injuries as of 2023. In the caregiving sector, powered suits help staff lift and transfer patients safely, with more than 500 eldercare facilities nationwide adopting this technology. Industrial applications in the powered suit market are extensive; companies like Toyota have integrated over 1,500 exoskeletons into their assembly lines to aid workers in heavy lifting and reduce fatigue. Logistics firms such as Yamato Transport have equipped 2,000 employees with powered suits to handle increased package volumes efficiently.

Key factors driving demand include addressing labor shortages due to a shrinking workforce—Japan’s working-age population has declined to 74 million in 2023—and the government's investment of ¥15 billion in robotics and wearable technology. The integration of AI and IoT in powered suit market is a significant trend, enhancing adaptability and user interaction. Developments in battery technology have extended operational hours up to 12 hours per charge, and advances in materials science have reduced suit weights to under 10 kilograms, improving user comfort. The market is projected to reach a value of ¥50 billion by 2025, indicating robust growth potential as industries seek innovative solutions to enhance productivity and address demographic challenges.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Aging Workforce Necessitates Robotic Assistance

Japan's demographic crisis, marked by an aging population and declining birth rates, has led to a shrinking workforce now at 74 million in 2023. Labor shortages are acute in sectors like construction, manufacturing, and caregiving. Over 30% of construction workers are aged 55 or older, prompting companies in the powered suit market to seek powered suits to reduce physical strain and extend workers' careers. Powered suits enable older employees to perform demanding tasks safely. Obayashi Corporation introduced exoskeletons allowing workers to lift materials up to 40 kilograms without undue stress. As of 2023, over 10,000 exoskeletons are in use at construction sites nationwide. In manufacturing, Toyota employs over 1,500 powered suits in factories to maintain productivity amid workforce declines.

In healthcare, the sector anticipates a shortage of 370,000 caregivers by 2025. Powered suits like the HAL suit assist staff in lifting and transferring patients, with over 500 eldercare facilities utilizing this technology. Government subsidies totaling ¥15 billion in 2023 have facilitated the adoption of exoskeletons by over 2,000 SMEs, enhancing accessibility and addressing labor shortages.

Trend: AI Integration Enhances Exoskeleton Functionality

Artificial intelligence is revolutionizing powered suit market by making them more responsive to users' needs. Cyberdyne's HAL suits in 2023 incorporate machine learning to interpret bioelectrical signals, allowing intuitive movement assistance. The University of Tsukuba Hospital has treated over 1,000 patients with AI-enhanced exoskeletons, reducing average recovery times by six months. In industrial settings, Panasonic's 2023 Power Assist Suits feature AI modules predicting user movements, decreasing cognitive load. Over 500 units have been sold to logistics firms like Sagawa Express, where workers handle an additional 50 packages per shift. Daiwa House Industry equipped 200 exoskeletons with AI sensors, reducing musculoskeletal injuries by 150 cases annually.

The government's "Society 5.0" initiative, with ¥5 billion allocated in 2023, supports AI integration in robotics, giving a must needed boost to the powered suit market. This investment fosters advancements in exoskeletons, enhancing adaptability, data collection, and preventive maintenance capabilities, solidifying Japan's position at the forefront of wearable robotics innovation.

Challenge: High Costs Limit Adoption Among SMEs

The high cost of powered suits, ranging from ¥1 million to ¥5 million, poses a significant barrier for SMEs in the powered suit market. Cyberdyne's HAL suit, priced at ¥4 million in 2023, is beyond the reach of many small businesses. Maintenance fees of ¥200,000 per suit annually and training costs up to ¥100,000 per employee exacerbate financial constraints. Out of 600,000 SMEs surveyed by the Japan External Trade Organization in 2023, only about 30,000 plan to adopt powered suits in the next two years. This limited adoption hinders market growth and the potential benefits to productivity and worker safety.

To mitigate this, the government introduced a leasing program in 2023, allowing SMEs to rent exoskeletons for ¥50,000 monthly. Despite such initiatives, fewer than 5,000 exoskeleton units are deployed among SMEs as of 2023. Without significant cost reductions, broader adoption remains a challenge, potentially stalling the powered suit market's expansion.

Segmental Analysis

By Category

In 2023, dynamic powered suits have solidified their position as the most sought-after category in Japan's powered suit market, accounting for over 63% of the market share. This dominance is largely attributed to their advanced capabilities in augmenting human strength and endurance, which are crucial in sectors facing labor shortages and demanding physical tasks. Unlike static powered suits that offer passive support, dynamic suits actively enhance the wearer's movements through powered actuators and sophisticated control systems. This active assistance is essential in industries such as manufacturing and construction, where workers are required to handle heavy materials and perform repetitive tasks.

The high popularity of dynamic powered suits over static counterparts is driven by Japan's demographic challenges and technological advancements. With an aging population—over 35 million people aged 65 and above—there is an increasing need for solutions that enable older workers to remain active in the workforce. Dynamic powered suit market address this need by reducing physical strain and preventing injuries. In 2022, the Ministry of Health, Labour and Welfare reported a significant reduction in work-related musculoskeletal disorders in companies that adopted dynamic exoskeletons. Additionally, advancements in robotics have made dynamic suits more efficient and accessible, further boosting their adoption.

Key consumers of dynamic powered suits in Japan include the manufacturing, healthcare, and logistics sectors. In manufacturing, companies like Toyota have integrated over 1,000 dynamic exoskeletons to enhance worker productivity and safety. The healthcare industry utilizes these suits for patient rehabilitation, with hospitals reporting improved recovery times in patients using robotic assistive devices. Logistics companies are also significant users; for instance, Yamato Transport implemented dynamic powered suits across 100 distribution centers to assist with heavy lifting, leading to a 15% increase in operational efficiency. The government's investment of ¥5 billion in robotics research in 2023 underscores the importance of dynamic powered suits in Japan's economic and social landscape.

By Technology

Electric technology leads Japan's powered suit market, holding over 54.32% of the market share in 2023. This preference is due to several key factors, including efficiency, ease of integration, and technological advancements. Electric powered suits offer smoother and more precise movements compared to hydraulic and pneumatic technologies. They are also quieter and require less maintenance, which is essential in settings like hospitals and elderly care facilities. In 2022, the National Institute of Advanced Industrial Science and Technology reported that electric exoskeletons improved patient mobility by 40% compared to non-electric models.

The demand for electric powered suits is driven by Japan's emphasis on clean energy and sustainability. Electric systems produce no direct emissions, aligning with the country's goals to reduce carbon footprints. Furthermore, the advancement of battery technology in the powered suit market has extended the operational time of electric suits, making them more practical for long-term use. For example, Panasonic's latest electric exoskeleton can operate continuously for up to 8 hours on a single charge, a 50% improvement from models released in 2020. This increased efficiency makes electric suits more competitive and appealing than hydraulic and pneumatic alternatives.

Electric technology has overcome competition from hydraulic and pneumatic systems due to its adaptability and user-friendly nature. Electric suits are generally lighter, enhancing user comfort—a critical factor in healthcare and personal mobility applications. In 2023, an industry survey indicated that over 70% of powered suit users preferred electric models for their ergonomic benefits. Key sectors adopting electric powered suits include healthcare, manufacturing, and logistics. Companies like CYBERDYNE Inc. have experienced a 25% increase in sales of their electric Hybrid Assistive Limb (HAL) suits, evidencing the market's tilt towards electric technology. The integration of artificial intelligence and IoT capabilities in electric suits further enhances their functionality, solidifying their widespread acceptance in Japan.

By End User

In 2023, the medical industry emerged as the largest end user of powered suit market in Japan, accounting for over 32.72% of the market's revenue share. This leading position is due to the industry's pressing need for innovative solutions to manage an aging population and a shortage of medical professionals. Powered suits offer significant benefits inpatient rehabilitation, elderly care, and assistance for individuals with disabilities. For example, rehabilitation centers using powered exoskeletons have seen a 25% improvement in patient mobility outcomes, enhancing the quality of care provided.

The medical industry's adoption of powered suit market is supported by key factors such as government initiatives, technological innovation, and proven efficacy in clinical settings. The Japanese government has invested heavily in medical robotics, with a funding boost of ¥15 billion in 2022 dedicated to healthcare technology development. Technological advancements have led to the creation of more sophisticated and user-friendly powered suits, making them more accessible to medical practitioners and patients alike. Clinical trials conducted by the University of Tokyo Hospital demonstrated that powered suits could reduce patient recovery times by up to 35%.

The demand for powered suits in the medical industry is further strengthened by partnerships between healthcare institutions and technology companies. Collaborations have resulted in the deployment of over 3,500 powered suits in hospitals nationwide. The integration of data analytics and remote monitoring features in powered suits has also enhanced patient care, allowing for personalized treatment plans. The alignment of powered suit capabilities with the medical industry's needs has solidified its position as the largest end user in Japan's market, driving both innovation and growth in the sector.

By Application

Studies in 2023 indicate that over 50.25% of powered suits in Japan powered suit market are employed in health management applications. This significant utilization stems from the vital role powered suits play in enhancing patient care and supporting the elderly and individuals with mobility impairments. Powered suits assist in rehabilitation by providing necessary support and resistance, enabling patients to rebuild strength and improve motor functions. Hospitals utilizing powered suits have reported a 30% faster recovery rate in stroke patients compared to traditional therapy methods.

The growth of powered suit market in health management is driven by Japan's aging population and the associated increase in demand for elderly care services. With over 28% of the population aged 65 or older, there is an urgent need for technologies that can support health management. The government has recognized this need, allocating ¥10 billion in 2023 towards integrating robotics into healthcare. Additionally, the scarcity of healthcare workers has prompted institutions to adopt powered suits to alleviate the physical burden on staff. Nurses using powered exoskeletons have experienced a 20% reduction in work-related injuries, according to a 2022 report by the Japan Nursing Association.

Key end users of powered suit market in health management include hospitals, rehabilitation centers, elderly care facilities, and home care providers. The dominance of health management applications is enabled by factors such as technological advancements, government support, and positive patient outcomes. Companies like ATOUN Inc. have deployed over 2,000 units of their Model Y powered suits in healthcare settings across Japan. The integration of sensors and AI in these suits allows for real-time monitoring of patients' progress, enhancing the effectiveness of treatments. The synergy between technology and healthcare needs has firmly established powered suits as an indispensable tool in Japan's health management sector.

To Understand More About this Research: Request A Free Sample

Top Players in Japan Powered Suit Market

- Cyberdyne Inc.

- Honda

- Mitsubishi Heavy Industries (MHI) Group

- Mizuno Corporation

- JTEKT Corporation

- Sarcos Robotics

- Lockheed Martin Corporation

- Ekso Bionics

- Other Prominent Players

Market Segmentation Overview:

By Component

- Hardware

- Software

- Services

By Category

- Static

- Dynamic

By Technology

- Hydraulic

- Electric

- Pneumatic

- Others

By Application

- Health Management

- Military Affairs & Activities

- Industry

By End User Sector

- Medical

- Military

- Media & Entertainment

- Manufacturing

- Agriculture

- Healthcare & Home care

- Public services

- Construction

- Logistics

- Personal

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA1124977 | Delivery: 2 to 4 Hours

| Report ID: AA1124977 | Delivery: 2 to 4 Hours

.svg)