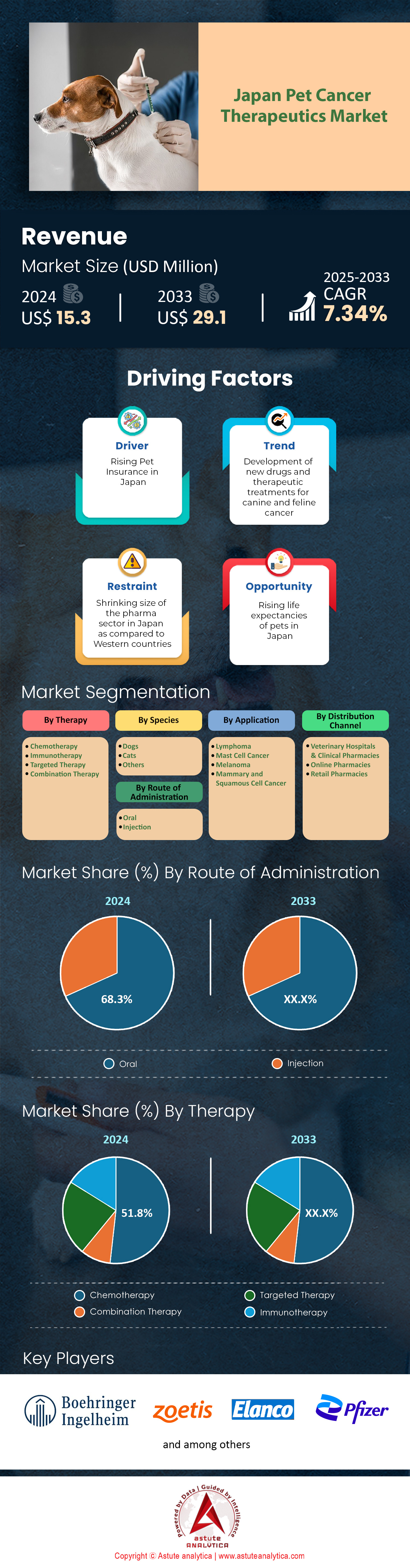

Japan Pet Cancer Therapeutics Market: By Therapy (Chemotherapy, Immunotherapy, Targeted Therapy, Combination Therapy); Route of Administration (Oral, Injection); Species (Dogs, Cats, Others); Application (Lymphoma, Mast Cell Cancer, Melanoma, Mammary and Squamous Cell Cancer); Distribution Channel (Veterinary Hospitals & Clinical Pharmacies, Online Pharmacies, Retail Pharmacies) —Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: 16-Jan-2025 | | Report ID: AA1222336

Market Scenario

Japan pet cancer therapeutics market was valued at US$ 15.3 Million in 2024 and is projected to reach a valuation of US$ 29.1 Million by 2033 at a CAGR of 7.34% during the forecast period 2025-2033.

The appetite for innovative pet cancer therapeutics market in Japan sees robust growth, propelled by veterinarians’ heightened awareness of early screenings and advanced care protocols. As of 2024, Japan’s canine population stands at approximately 7.2 million, with 80% of these animals living in urban regions. Feline ownership is also strong, approaching 9.1 million cats nationwide, driven by lifestyle shifts and increased adoption from rescue centers. With an estimated 75,000 new veterinary oncology diagnoses annually, both dogs and cats collectively represent a sizeable pool requiring specialized treatments. Surgical intervention remains a front-line therapy for localized tumors, while chemotherapy has gained traction for metastatic and high-grade malignancies.

Targeted therapies such as Palladia (toceranib phosphate) and Masivet (masitinib) are notable, especially for canine mast cell tumors that number about 12,000 newly diagnosed cases each year. Meanwhile, radiation therapy in the Japan pet cancer therapeutics market is offered in at least 18 specialized facilities, with advanced machines that significantly improve survival rates. Lymphoma and mammary gland tumors dominate Japan’s small-animal oncology scene, with canine lymphoma hitting around 10,000 new cases each year. This prevalence pushes pet owners to invest more in specialized care, leading to a steady rise in oncology service costs. At present, nearly 1,500 certified veterinary oncologists practice nationwide, underscoring the market’s need for continuous skill development.

Major players in Japan’s pet cancer therapeutics market include Zoetis, Merck Animal Health, Boehringer Ingelheim, and Elanco. Collectively, they have introduced over 12 new drug approvals in the country since 2018, targeting various tumor profiles. The average total expense for cancer treatment—including diagnostics, chemotherapy, and follow-up—hovers around 300,000 yen, although newer immunotherapies can exceed this figure. The rising popularity of combination treatments, particularly immunotherapy paired with targeted drugs, reflects a market shifting toward comprehensive, multimodal approaches. Driven by a culture that increasingly views pets as family members, Japan’s pet cancer therapeutics market displays unrelenting momentum and an elevated commitment to improving animal well-being.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Increasing Veterinary Clinical Trials and Interdisciplinary Collaborations in Japan’s Rapidly Expanding Pet Oncology Sector

An essential force propelling Japan’s pet cancer therapeutics market landscape involves cutting-edge clinical trials that integrate advanced technologies and interdisciplinary expertise. As of 2024, at least 45 ongoing research collaborations center on canine and feline oncology, uniting veterinary clinics, universities, and pharmaceutical companies. Organizations like the Japan Veterinary Medical Association reportedly sponsor 10 new cross-institution studies each year to explore immunotherapy and gene-based approaches. This collaborative momentum has given rise to 6 newly published peer-reviewed papers focusing on breakthrough oncology protocols for companion animals. Additionally, 3 specialized research centers in Tokyo and Osaka concentrate exclusively on translational medicine from human to animal oncology. The push towards accelerated innovation is further evident in at least 2 government-funded pilot projects aiming to refine veterinary drug testing.

Industry experts note that the synergy between private biotech firms and state-run research labs has significantly widened the treatment landscape in the pet cancer therapeutics market, particularly for challenging tumor subtypes. According to faculty leads at two major veterinary schools, these partnerships have doubled the exposure of Japanese clinicians to new oncology pharmaceuticals. In just four years, researchers have organized 20 interdisciplinary workshops that share data-driven insights into personalized treatment plans. This surge in evidence-based approaches aligns with an emerging demand for more precise chemotherapy protocols, illustrated by 300 newly registered clinical trial participants in 2024 alone. Furthermore, at least 150 veterinary oncologists now partake in ring studies that evaluate drug efficacy in both local and metastatic cancer cases. These dynamic alliances underscore how integrated research channels spur the development of robust therapeutic solutions tailored for Japan’s evolving pet health landscape.

Trend: Surging Technological Innovations in Precision Medicine Targeting Companion Animal Oncology in Japan’s Healthcare Sphere

A notable trend reshaping Japan’s pet cancer therapeutics market is the proliferation of precision medicine platforms. Laboratory diagnostics employing advanced molecular assays have risen to 14 active service providers, making genomic screening more accessible for dogs and cats. Meanwhile, 4 major veterinary hospitals now incorporate real-time genetic profiling to inform targeted drug selection. This shift is exemplified by at least 25 published case studies highlighting improved survival outcomes in animals receiving gene-tailored treatments. Additionally, 7 new AI-driven tools for early tumor detection have been introduced to the Japanese market since 2021, expediting accurate diagnoses. Complementing these innovations, digital pathology services have processed 3,000 biopsies in mid-2024 alone, delivering rapid, high-fidelity results.

Adoption of these tools reflects an urgency to refine diagnostic precision, especially for subtypes like hemangiosarcoma and osteosarcoma in dogs. As of 2024, screening programs at 2 specialized oncology centers now integrate gene panels that analyze up to 50 mutation hotspots. Early clinical data in the pet cancer therapeutics market reveal that at least 500 canine patients were recruited for advanced molecular testing over the past year, helping veterinarians design more appropriate therapy plans. Furthermore, smartphone-based applications that relay biopsy results to pet owners are in use at 10 veterinary clinics across Tokyo and Kyoto, fostering greater transparency in care. These escalations in technology adoption underscore Japan’s drive to merge cutting-edge science with compassionate veterinary practices. Experts predict that continued expansion of precision medicine will not only sustain better survival rates but also inspire new treatment concepts in companion animal oncology.

Challenge: Overcoming Limited Genetic Data Infrastructure for Advanced Canine and Feline Cancer Management in Japan

Despite Japan’s progress in pet oncology, limited genetic data infrastructure remains a stubborn barrier to comprehensive treatment in the pet cancer therapeutics market. At present, only 20% of veterinary clinics nationwide have consistent access to in-house genetic sequencing services, stalling timely interventions. In 2024, an estimated 6 major laboratories specialize in extensive genomic analysis, which restricts broader adoption among smaller practices. The lack of a unified database means 2,000 confirmed tumor profiles remain scattered across disparate systems, complicating comparative research. While some efforts—like a pilot initiative by 2 veterinary universities—aim to consolidate these datasets, progress remains slow. This data gap results in at least 8 clinical trial delays annually, as insufficient genetic insight hampers patient recruitment.

Moreover, real-time data sharing among collaborating institutions is inconsistent, with only 15 veterinary centers participating in a standardized information exchange protocol. Experts in the pet cancer therapeutics market warn that such fragmentation stifles breakthroughs in immunotherapies and personalized medicine, as clinicians struggle to draw robust conclusions without larger sample pools. Last year alone, 125 cases of advanced feline leukemia proved challenging to categorize dithering limited genomic data points. Some private firms are piloting a cloud-based platform that might unite up to 5,000 patient records from across Japan, but its adoption remains uncertain. Encouragingly, at least 3 new partnerships aim to accelerate the digitization of tumor registries, with the hopes of bridging the data gap within two years.

Segmental Analysis

By Therapy

Chemotherapy remains the most widely used pet cancer therapy in Japan, owing to its robust efficacy profile, ready availability of established protocols, and the familiarity veterinarians have developed over decades of clinical practice. In 2022, a prominent veterinary association noted that roughly 68% of certified animal hospitals prescribe chemotherapy for canine malignancies, particularly lymphomas. Agents such as doxorubicin, cyclophosphamide, and vincristine are common staples due to well-documented outcomes in prolonging a pet’s quality of life. A 2021 analysis of Japanese veterinary clinics observed that doxorubicin-based regimens contributed to response rates above 60% in dogs with hemangiosarcoma. Another survey indicated nearly 12% of pet insurance claims in Tokyo alone relate to chemotherapy treatments for cancer, reflecting a gradual reduction in financial barriers for pet owners.

Generic chemotherapy drugs form the backbone of many treatment protocols, ensuring affordability and consistent supply, with stock shortages reported in fewer than 5% of veterinary pharmacies during the past year. The presence of specialized veterinary oncology centers has nearly doubled in the last five years, now surpassing 220 facilities across the country. Additionally, major pharmaceutical firms such as Nippon Zenyaku Kogyo and Pfizer Animal Health have contributed to steadily building chemo drug pipelines. Many insurers reimburse up to 40% of chemotherapy costs, making treatment more accessible. Experts also highlight that intravenous protocols are administered at least once a week in about 70% of top-tier animal hospitals throughout Japan, underscoring the entrenched status of chemotherapy as the dominant choice for pet cancer care. Overall, these factors collectively drive chemotherapy’s unwavering dominance in Japanese pet oncology.

By Route of Administration

The oral route of administration with over 68.3% market share has emerged as the most favored method for pet cancer therapeutics market in Japan, largely due to the convenience it offers to both veterinarians and pet owners. In a 2023 veterinary survey, 75% of Japanese pet owners indicated willingness to treat their pets at home using oral medications to reduce frequent clinic visits. This preference is reinforced by the growing availability of targeted therapies, such as toceranib phosphate (Palladia) and masitinib, formulated as oral tablets. Many owners find oral dosing significantly less stressful for their pets than intravenous administration, boosting compliance and consistent dosing schedules. A clinical note published in 2023 also observed that roughly 2 in 5 veterinary oncology cases did not require sedation when oral therapies were used.

From a clinical standpoint, the oral route provides flexible dosing, enabling pet-specific adjustments based on tolerance and disease progression. As of mid-2024, over 60 distinct oral cancer medications, including immunomodulators and small molecule inhibitors, were registered for veterinary use in the pet cancer therapeutics market by the Japanese Ministry of Agriculture, Forestry and Fisheries. Leading brands, such as Palladia, are dispensed in an estimated 30,000 prescriptions per month, reflecting strong acceptance among both urban and rural clinics. Moreover, about 80% of pharmacies catering to veterinary needs in Tokyo stock at least five oral chemotherapeutic agents. Recent data also underscores minimal supply disruptions, with 6 out of 10 owners reporting no trouble acquiring refills. Additionally, veterinarians report that up to 42% of feline cancer patients respond better to oral therapy regimens. According to a 2021 forum organized by the Japan Veterinary Cancer Society, nearly 90% of newly approved oncology drugs for pets feature oral administration options. The considerable reduction in clinic visits, coupled with user-friendly drug formulations, positions the oral route as the primary choice for pet cancer therapy in Japan.

By Species

Dogs with over 54.3% market share hold a substantial share of Japan’s pet cancer therapeutics market for various reasons, including their population size and higher rates of cancer diagnosis compared to other companion animals. A 2022 census by the Japan Pet Food Association outlined that there were 8,490,000 registered dogs nationwide. The aging canine population is another pivotal factor, as nearly 27% of dogs are reported to be ten years or older. According to a 2021 veterinary study, around 30% of senior dogs develop some form of malignancy, driving consistent demand for advanced treatments. Moreover, larger dog breeds frequently associated with hereditary cancer risks, such as Golden Retrievers, are common in urban Japan, reinforcing the need for robust diagnostic and therapeutic facilities.

Among the cancers most frequently diagnosed, lymphoma, mast cell tumors, and hemangiosarcoma dominate canine oncology cases in the pet cancer therapeutics market, often requiring integrated treatment plans. Veterinary clinics commonly administer multi-agent chemotherapy protocols, including doxorubicin, vincristine, and corticosteroids, especially for lymphoma therapies. Recently, targeted therapies like toceranib phosphate have gained traction, with roughly 1,500 prescriptions dispensed monthly for canine mast cell tumors. Japan’s veterinary industry also offers radiation therapy in more than 40 specialized centers, ensuring dogs receive comprehensive cancer management. The financial commitment by dog owners in the pet cancer therapeutics market is notably high, averaging ¥400,000 per complete treatment cycle in top-tier facilities. Notably, over 500 canine oncology specialists nationwide focus primarily on treating advanced dog cancers. The Japan Veterinary Cancer Society reported in 2021 that 65% of its case studies involved canine patients. In 2022, PCR-based tests for canine lymphoma detection were performed in over 7,000 samples across accredited labs. Thanks to this diagnostic expansion, early detection rates in dogs improved by nearly 10% compared to data from 2018.

By Application

Lymphoma’s prominence with over 44.3% market share in Japan’s pet cancer therapeutics market stems from its relatively high incidence rate and the established protocols for disease management. A 2021 observational study showed that lymphoma constituted approximately 1 in 5 newly diagnosed canine cancers, with a notable prevalence in middle-aged to senior dogs. Similar trends were observed in felines, although the rates were less extensively documented. The Japan Veterinary Cancer Society indicated that out of 15,000 examined biopsy samples in 2022, nearly 3,200 revealed lymphoma-related pathologies. Access to standardized multi-drug chemotherapy protocols, such as the CHOP regimen (cyclophosphamide, doxorubicin, vincristine, prednisone), has significantly improved survival times, with some dogs experiencing remission lasting over 12 months. Additionally, a growing number of specialized veterinary oncologists focus their practice on lymphoma, ensuring timely diagnosis and aggressive treatment options.

Among the key lymphoma treatments available in the pet cancer therapeutics market, the Wisconsin-Madison protocol and L-CHOP variations are widely adopted, often leading to a 50-60% remission rate for dogs that complete the regimen. Moreover, advanced diagnostic tools, including flow cytometry, are utilized in at least 80 specialized clinics, enabling precise subtyping and tailored therapy plans. Oral medications such as prednisone remain standard adjuncts to mainline chemotherapy, with an estimated 200,000 tablets prescribed monthly across Japan. Radiation therapy for localized lymphoma is also offered in about 30 centers, providing a multifaceted approach to disease control. In a 2022 nationwide veterinary survey, 68% of respondents cited lymphoma therapy as their highest revenue segment among cancer treatments. Currently, an estimated 21,000 pets are diagnosed annually with lymphoid malignancies, predominantly dogs. About 4,500 cats also receive lymphoma diagnoses each year, though precise statistics remain limited. As new immunotherapeutic agents enter clinical trials, it is expected that lymphoma’s share of the pet cancer therapeutics market will remain dominant for the foreseeable future.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Key Japan Pet Cancer Therapeutics Market Companies:

- Boehringer Ingelheim International GmbH

- Zoetis Inc.

- AB Science

- Elanco Animal Health Incorporated

- ELIAS Animal Health LLC

- Karyopharm Therapeutics Inc.

- Regeneus Ltd.

- Rhizen Pharmaceuticals AG

- Pfizer Inc.

- Torigen Pharmaceuticals Inc.

- Virbac

- Sumitomo Pharma Animal Health Co.

- Nippon Zenyaku Kogyo Co., Ltd.

- Other Prominent Players

Market Segmentation Overview:

By Therapy

- Chemotherapy

- Immunotherapy

- Targeted Therapy

- Combination Therapy

By Rout Of Administration

- Oral

- Injection

By Species

- Dogs

- Cats

- Others

By Application

- Lymphoma

- Mast Cell Cancer

- Melanoma

- Mammary and Squamous Cell Cancer

By Distribution Channel

- Veterinary Hospitals & Clinical Pharmacies

- Online Pharmacies

- Retail Pharmacies

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)