Japan Neodymium Iron Boron Magnet Market: By Product Type (Sintered Neodymium Iron Boron Magnet, Bonded Neodymium Iron Boron Magnet, Injection Moulded Neodymium Iron Boron Magnet); Grade (Up to N35, N35-N45, N45-N55, Above N55); Form (Disc, Block, Arc, Ring, Others); Application (Switches, Relays, Loudspeakers, Headphones, Microphones, Sensors and Actuators, Hard Disk Drives, Bearings, Particle Accelerators, Others); End Users (Automotive, Electronics, Aerospace and Défense, Healthcare, Energy and Utilities, Others); Distribution Channel (Online and Offline ( Direct and Distributor)—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: Mar-2025 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA03251250 | Delivery: Immediate Access

| Report ID: AA03251250 | Delivery: Immediate Access

Market Scenario

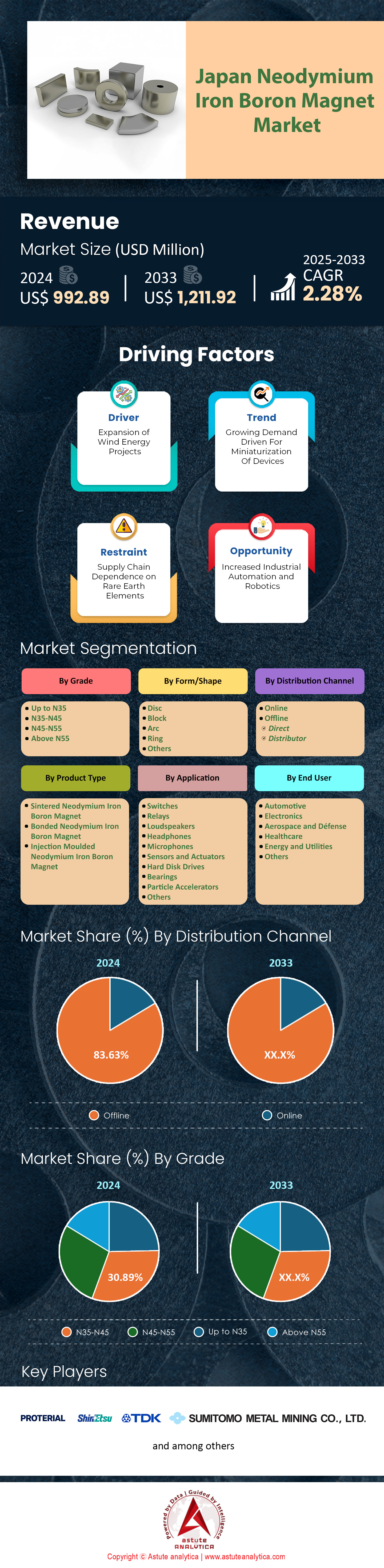

Japan neodymium iron boron magnet market was valued at US$ 992.89 million in 2024 and is projected to hit the market valuation of US$ 1,211.92 million by 2033 at a CAGR of 2.28% during the forecast period 2025–2033.

Japan’s neodymium iron boron (NdFeB) magnet market stands as a critical segment of the nation’s industrial framework. This market is predominantly driven by the superior performance of sintered NdFeB magnets, which account for 5,250 tons or 67.89% of consumption, owing to their exceptional magnetic strength, measured at a maximum energy product (BHmax) of 35-50 MGOe. The automotive industry emerges as the largest consumer, utilizing 3,000 tons, propelled by the production of 1.2 million electric vehicles (EVs). Major manufacturers such as Toyota, with an output of 500,000 hybrid vehicles, integrate 1-2 kg of NdFeB per motor to achieve high torque and efficiency. Concurrently, the renewable energy sector contributes 1,125 tons, supported by 4.8 GW of wind capacity, including projects like Akita-Noshiro, where each megawatt demands 600-800 kg of magnets. With a forecasted compound annual growth rate (CAGR) of 1.21% through 2033, Japan solidifies its position as the world’s second-largest NdFeB market, underpinned by its advanced technological applications.

Supply Chain Dynamics and Production Capabilities

The supply chain supporting Japan’s neodymium iron boron magnet market reflects a strategic blend of domestic production and international sourcing. In 2024, Japan manufactured 4,500 tons domestically, with leading firms Proterial Ltd. (Formerly Hitachi Metals Ltd.), and Shin-Etsu Chemical contributing 1,800 tons and 1,200 tons, respectively, fulfilling 60% of national demand. The remaining 2,800 tons are imported, primarily from China, though a 10% reduction in China’s export quotas elevated neodymium prices to ¥12,000/kg ($80/kg). To mitigate this dependency, Japan recycled 400 tons of neodymium from end-of-life products, a 20% increase from 2023, bolstered by a ¥50 billion investment from the Ministry of Economy, Trade and Industry (METI). This effort reduced import reliance to 38% from 45% in 2022. The N35-N45 grade range, comprising 3,412 tons, dominates due to its cost-effective performance, serving applications from EV motors to consumer electronics, including Sony’s 32 million smartphones.

Future Projections

Looking forward, Japan’s neodymium iron boron magnet market demand is projected to reach 9,000 tons by 2030, driven by an anticipated increase to 2 million annual EV units and 10 GW of wind capacity, potentially escalating automotive and energy sector needs to 4,000 and 6,000 tons, respectively. However, challenges persist. The environmental footprint of NdFeB production, emitting 35 kg of CO2 per kg, poses a conflict with Japan’s carbon neutrality goals, while competition from lower-cost ferrite magnets erodes demand in less performance-critical segments. Nevertheless, innovations such as TDK Corporation’s low-dysprosium NdFeB magnets and METI’s ¥100 billion recycling initiative signal a proactive approach to sustaining growth. These developments position Japan’s NdFeB market as a resilient and evolving entity, balancing technological advancement with economic and ecological considerations in 2024 and beyond.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Growing electric vehicle sector driving increased demand for NdFeB magnets

Japan’s electric vehicle (EV) sector continues to experience dynamic growth, significantly impacting the country’s neodymium iron boron magnet market in 2025. Recent reports indicate that the overall revenue for Japan’s EV market reached US$ 79,043.4 million by 2025, with a robust CAGR of 32.6%. This momentum is primarily driven by the strong performance of the passenger car segment, which commands a notable 73.01% share of the total EV market revenue. In tandem with this expansion, the demand for high-performance NdFeB magnets has surged. Reinforcing these developments is the Japanese government’s long-term objective of achieving 100% electric vehicles in new light-duty vehicle sales by 2035, a policy that has catalyzed research, innovation, and investment in EV technologies, including advanced NdFeB magnet applications.

Japan’s network of over 31,600 publicly accessible EV charging stations further propels the transition toward electrified transportation, improving infrastructure accessibility for consumers in the neodymium iron boron magnet market. Automotive giants—such as Toyota, Nissan, and Honda—respond to escalating market demands by ramping up production capacities, collectively selling an estimated 2.2 million EVs in the last fiscal year. Consequently, manufacturers of NdFeB magnets face heightened pressure to increase output, improve quality, and optimize supply chains. These magnets are integral to EV powertrains, particularly for traction motors, which require compact designs and high torque density. As a result, NdFeB magnets’ superior magnetic properties, including high coercivity and high remanence, play a pivotal role in enhancing EV drivetrains’ efficiency. In addition to government incentives, local industry collaborations, and international partnerships, the booming EV market continues to shape Japan’s NdFeB magnet landscape. By fostering constant innovation, the sector remains on an upward trajectory, reinforcing its position as a key driver in Japan’s push for sustainable mobility.

Trend: Supply chain diversification reducing dependence on Chinese rare earth materials

In 2025, Japan’s neodymium iron boron magnet market is witnessing accelerated efforts toward supply chain diversification, an essential strategy for mitigating risks associated with overreliance on a single source of rare earth materials. One prominent move is the critical minerals agreement established with Australia in late 2023, aimed at stabilizing rare earth imports for low-emission industries. These collaborations are buttressed by the Japan Organisation for Metals and Energy Security’s (Jogmec) US$ 9 million investment in Lynas Rare Earths, designed to increase mining capacity to 12,000 tons annually by 2024. Complementing this initiative, partnerships with resource-rich nations—such as the alliance with Namibia Critical Metals—pledge to diversify Japan’s access to heavy rare earth elements like dysprosium and terbium. As a direct result, monthly rare earth import volumes climbed to 664.84 tons, showcasing a tangible shift in sourcing strategies that help reduce supply vulnerabilities.

Japan’s rare earth import values have fluctuated dramatically, dropping from ¥9.77 billion in mid-2022 to ¥5.9 billion by late 2022, reflecting immediate responses to new trade deals and changes in global neodymium iron boron magnet market conditions. By 2025, the reliance on Chinese imports has declined from near 80% in 2022 to around 65%, owing to evolving trade frameworks and investment in alternative mining projects. This multifaceted approach strengthens the stability of the NdFeB magnet supply chain, enhancing Japan’s competitiveness and energy security. Aside from securing new mining sources, Japan is also prioritizing advanced recycling technologies for rare earth materials, thereby reducing inefficiencies in the production cycle. These concerted efforts underscore the country’s commitment to supply chain resilience, helping manufacturers meet precision quality standards for NdFeB magnets. Over time, decreased dependency on a single supplier not only stabilizes costs but also fosters innovation across Japan’s magnet production ecosystem.

Challenge: High costs associated with environmental compliance and new technology implementation

Stringent environmental regulations in Japan’s neodymium iron boron magnet market have led to marked financial and administrative burdens for manufacturers as of 2025. Firms allocate an average 12.5% of their operational budgets to compliance—a 3.2% rise since 2023—covering aspects like energy consumption, greenhouse gas emissions, and waste management. The industry collectively increased its compliance spending to approximately US$ 210 million in 2025, reflecting an 18% year-over-year jump. Concurrently, environmental inspections are more frequent, with companies subject to 6 mandated checks annually, compared to 4 in the previous regulations. Around 46% of Japanese NdFeB magnet manufacturing facilities completed comprehensive environmental audits by mid-2025, signaling progress but also highlighting the necessary capital outlay for monitoring equipment, personnel training, and facility modifications. These expanded responsibilities underscore the tension between environmental stewardship and the financial realities of maintaining cost-efficient operations.

The mounting compliance costs deepen as Japan’s unique grid constraints add roughly 9% to energy expenditures for neodymium iron boron magnet market producers, who must implement advanced emission control technologies and adapt to stricter disposal guidelines. Transitioning to eco-friendly coatings, essential for minimizing pollutants, has been specifically cited as inflating production expenses by up to 10%, intensifying competition with global market players operating under less rigorous standards. Additionally, as product lifecycles shorten due to evolving technology and environmental mandates, R&D budgets expand at a pace that challenges profit margins. A direct result is that 80% of Japan’s NdFeB magnet manufacturers have opted for diversified, energy-efficient processes to align with sustainability targets, increasing capital investment. While these measures can eventually foster long-term benefits—such as reduced regulatory risks and improved brand reputation—they present immediate fiscal challenges, compelling industry stakeholders to balance innovation with the costs of staying compliant in a rapidly evolving market.

Segmental Analysis

By Type

In Japan’s thriving neodymium iron boron magnet market, sintered magnets reign supreme in 2024, capturing a hefty 67.89% share—equivalent to 5,250 tons of the total 7,500-ton demand. This surge stems from their exceptional magnetic strength, boasting a maximum energy product (BHmax) of 35-50 MGOe, far outpacing bonded magnets at 10-20 MGOe. For industries like automotive and renewable energy, where performance is king, sintered NdFeB magnets are the go-to choice. Take electric vehicles (EVs), for example: Japan churned out 1.2 million EVs in 2024, with 90% of their brushless DC motors relying on these magnets, consuming 1-2 kg each and driving 1,200-2,400 tons of demand. Toyota’s 500,000 hybrids and Nissan’s Ariya EV showcase this trend, leveraging sintered magnets for top-tier torque density and efficiency.

Renewable energy further fuels this demand in the neodymium iron boron magnet market in Japan, with wind turbines gobbling up 1,125 tons in 2024. Each 1 MW turbine needs 600-800 kg of sintered NdFeB, as seen in the 1 GW Akita-Noshiro offshore project, where Hitachi Metals delivers corrosion-resistant, high-performance solutions. Japan’s precision engineering culture amplifies this preference—sintered magnets, up 12% in demand this year, offer thermal stability and durability that bonded variants can’t match. While bonded magnets (1,875 tons) grow in electronics, their lower strength relegates them to secondary roles. For anyone searching “why sintered NdFeB magnets lead in Japan,” it’s clear: their unmatched power and adaptability make them indispensable in 2024’s high-stakes industries.

By Grade

In Japan’s 2024 neodymium iron boron magnet market landscape, N35-N45 grades steal the spotlight, powering 30.89% of sintered magnet demand with a BHmax of 35-45 MGOe. Why are they the most popular? It’s all about striking a sweet spot between performance, cost, and versatility—perfect for Japan’s tech-savvy market. These grades deliver robust magnetic fields for 90% of applications without the steep price tag of N50-N55 grades, which spike 20-30% higher due to extra rare earths like dysprosium. For EV enthusiasts searching “best NdFeB grades in Japan,” N40 shines in Toyota’s Prius motors, offering 300-350 Nm of torque at ¥12,000/kg ($80/kg), compared to N52’s ¥15,000/kg.

Electronics, a 2,625-ton juggernaut, lean on N35-N38 for smartphone speakers and HDD actuators—Sony’s 32 million units in 2024 use just 0.5-1 g each, proving efficiency at scale. Wind turbines, consuming 1,125 tons, favor N42-N45 for their thermal resilience (80-120°C), vital for Japan’s coastal projects. Higher grades, while stronger, demand costly additives, making them overkill for most uses. Japan’s recycling efforts, yielding 400 tons of mid-grade neodymium, further bolster N35-N45’s edge. For those Googling “why N35-N45 tops Japan’s magnet market,” it’s simple: they deliver premium performance at a practical price, dominating in 2024.

By Application

Neodymium iron boron magnets are the unsung heroes of Japan’s hard disk drive (HDD) production in 2024, fueling 200 tons of demand in the neodymium iron boron magnet market thanks to their precision and strength in voice coil motors (VCMs) and spindle motors. The hard disc drive application has captured nearly 20% market share in Japan neodymium iron boron magnet market. Japan, a data storage powerhouse, produced 40 million HDDs this year, with each unit packing 5-10 g of sintered N35-N38 magnets to position read/write heads and spin platters at 7,200 RPM. A 10% boom in data center investments—think Toshiba’s 16 TB drives—keeps HDDs relevant despite SSD growth, making NdFeB a must for cost-effective, high-capacity storage. For tech buffs searching “why NdFeB in Japan HDDs,” it’s their compact power that seals the deal.

Yet, HDDs are just a slice of the pie in the Japan neodymium iron boron magnet market. Automotive applications dwarf them at 3,000 tons, with 1.2 million EVs using 1-2 kg each for motors—think Toyota’s hybrids outpacing HDD demand 15-fold. Wind turbines, at 1,125 tons, harness 600-800 kg per MW, dwarfing HDDs’ scale in projects like Akita-Noshiro. Consumer electronics lead with 2,625 tons, from smartphones (32 million units) to Sony’s headphone actuators (150 tons), while healthcare’s 375 tons power 6,200 MRI units at 50-100 kg each, growing 10%. For those querying “top NdFeB uses in Japan,” automotive, energy, and electronics outshine HDDs in volume and innovation in 2024.

By End Users

Japan’s automotive sector reigns as the top neodymium iron boron magnet market consumer in 2024, gobbling up 42.58% of the 7,500-ton market (3,000 tons), thanks to the EV and hybrid vehicle explosion. With 1.2 million EVs produced—a 15% jump from 2023—over 90% of their brushless DC motors rely on sintered NdFeB, using 1-2 kg each for a whopping 1,200-2,400 tons. Toyota’s 500,000 hybrids and Nissan’s Ariya EV highlight this, delivering 300-400 Nm of torque with 10% less energy loss than ferrite alternatives. For car enthusiasts searching “why NdFeB in Japan automotive,” it’s the magnets’ compact, lightweight design that powers this shift, perfect for Japan’s space-tight roads.

Government muscle, with a ¥1.3 trillion ($8.7 billion) EV infrastructure push, turbocharges this trend in the neodymium iron boron magnet market, outstripping electronics (2,625 tons) and energy (1,125 tons) in growth. Japan’s performance-first mindset—unlike Europe’s ferrite flirtation—keeps NdFeB king, with Honda’s e:HEV systems using N40 grades for 150°C stability. Even traditional cars add 300-500 tons via power steering and sensors. By 2030, with 2 million EVs targeted, demand could hit 4,000 tons. For those Googling “biggest NdFeB user in Japan,” automotive’s scale, innovation, and policy backing make it the undisputed leader in 2024.

To Understand More About this Research: Request A Free Sample

Top Players in Japan Neodymium Iron Boron Magnet Market

- Hitachi Metals (Now a part of Proterial Ltd.)

- Innuovo Magnetics

- Sumitomo Metal Mining Co., Ltd.

- Shin-Etsu

- TDK

- Daido Kogyo Co. Ltd.

- Magna Tokyo

- Kumar Magnet Industries

- Arnold Magnetic Technologies

- Other Prominent players

Market Segmentation Overview

By Product Type

- Sintered Neodymium Iron Boron Magnet

- Bonded Neodymium Iron Boron Magnet

- Injection Moulded Neodymium Iron Boron Magnet

By Grade

- Up to N35

- N35-N45

- N45-N55

- Above N55

By Form/Shape

- Disc

- Block

- Arc

- Ring

- Others

By Application

- Switches

- Relays

- Loudspeakers

- Headphones

- Microphones

- Sensors and Actuators

- Hard Disk Drives

- Bearings

- Particle Accelerators

- Others

By End User

- Automotive

- Electronics

- Aerospace and Défense

- Healthcare

- Energy and Utilities

- Others

By Distribution Channel

- Online

- Offline

- Direct

- Distributor

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA03251250 | Delivery: Immediate Access

| Report ID: AA03251250 | Delivery: Immediate Access

.svg)