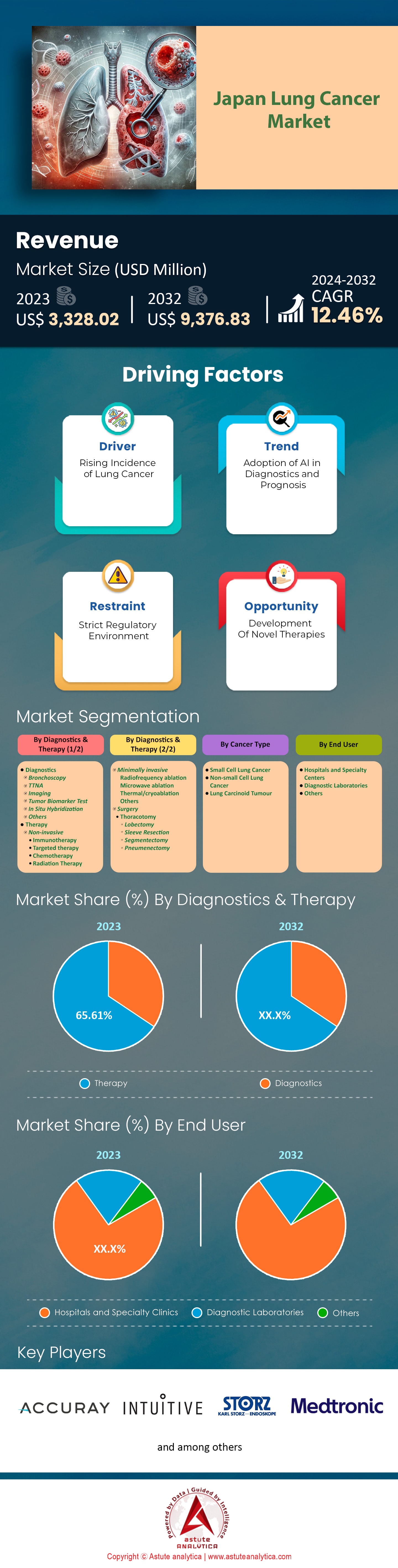

Japan Lung Cancer Market: By Treatment (Therapy and Diagnosis), Cancer Type (Small Cell Lung Cancer, Non-small Cell Lung Cancer and Lung Carcinoid Tumor), End User (Hospitals & Specialty Center, Diagnostic Laboratories and Others)—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: 28-Oct-2024 | | Report ID: AA1024958

Market Introduction:

Japan lung cancer market is witnessing significant growth, with revenues expected to increase from approximately US$ 3,328.02 million in 2023 to US$ 9,376.83 million by 2032 at a CAGR of 12.46% during the forecast period 2024-2032.

Lung cancer remains a formidable health challenge in Japan, with projections indicating 132,000 new cases in 2023, thus cementing its position as one of the most common cancer types alongside colorectal and stomach cancers. The projected death toll of 78,700 underlines its impact, ranking it as the leading cause of cancer-related mortality. This disparity is pronounced across genders, with lung cancer accounting for 55,200 male and 23,500 female deaths. The persistent prevalence and mortality rates underscore the critical need for effective prevention, early detection, and treatment strategies tailored to the Japanese population, giving a boost to the lung cancer market.

The role of early detection through imaging techniques is pivotal in combating lung cancer. Since 1993, low-dose CT (LDCT) screening has been instrumental in Japan, significantly enhancing early-stage detection rates. Remarkably, 51.7% to 57.5% of cases develop in never-smokers, challenging the traditional focus on smokers and advocating for broader screening inclusivity. The cumulative detection rate via CT screening stands at 1.1%, with most cases identified at the early stage IA, predominantly adenocarcinomas. This early-stage detection is crucial for improving survival rates and highlights the importance of continuing and expanding such screening programs.

Treatment advances, particularly in personalized medicine, have significantly improved lung cancer market outcomes in Japan. Genomic testing has become integral in tailoring treatments, boosting five-year survival rates from 35.2% to 43.2%. Institutions like Kitasato University Hospital are leading in utilizing genomic testing to identify effective drugs, with five molecular targeted therapies available for EGFR mutations. These advancements exemplify the shift towards personalized treatment approaches, offering new hope for patients with specific genetic profiles, though they also highlight the need for ongoing adaptation due to potential new mutations.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Rising Incidence of Lung Cancer

The increasing incidence of lung cancer in Japan is a significant driver of growth in the country’s lung cancer market. Persistent environmental and lifestyle challenges, particularly high smoking rates, are exacerbating the healthcare burden and necessitating advancements in treatments, diagnostics, and infrastructure. Lung cancer remains the second most common cancer in Japan, with 136,723 new cases reported in 2022, according to the International Agency for Research on Cancer (IARC). Globally, Japan ranked third in lung cancer incidence, presenting a substantial opportunity for pharmaceutical companies, healthcare providers, and diagnostic tool manufacturers.

A key contributor to Japan's elevated lung cancer rates is the country's longstanding smoking culture. Despite ongoing efforts to reduce tobacco consumption, data from the World Bank and the WHO indicate that in 2022, 18.6 million Japanese citizens aged 15 and above were tobacco users, placing Japan among the top global consumers of tobacco. In 2023, 18.9% of Japanese adults were regular smokers, with 12.4% using heated tobacco products (HTPs) and 7.4% engaging in dual use. This continued prevalence of smoking highlights the need for targeted treatment strategies in the lung cancer market.

Environmental factors, such as air pollution from industrial emissions and vehicles in densely populated urban centers like Tokyo and Osaka, further compound Japan's lung cancer problem. Poor air quality, linked to over 42,000 deaths in 2019, has been strongly correlated with the rising lung cancer rates, prompting healthcare providers to adopt low dose computed tomography (LDCT) for early detection in high-risk populations.

With cancer cases projected to rise by 13.1% by 2050, lung cancer is expected to remain a major concern, reinforcing the demand for innovative therapies and diagnostic solutions, and creating substantial growth potential in Japan's lung cancer market.

Trend: Adoption of AI in Diagnostics and Prognosis

The adoption of artificial intelligence (AI) in lung cancer diagnostics and prognosis is advancing rapidly in Japan, driven by the increasing need for early detection and improved patient outcomes. As lung cancer remains a leading cause of cancer-related deaths in the country, AI is addressing the limitations of traditional diagnostic methods that often struggle with large, complex data sets from medical imaging, pathology, and genomics. AI technologies are being incorporated into healthcare systems to improve both precision and efficiency in lung cancer care.

AI-powered computer-aided detection (CAD) systems are being used across Japan lung cancer market to assist radiologists in identifying lung nodules from CT scans. These systems can detect even very small nodules, as tiny as 3 mm, significantly enhancing early detection rates. This is critical in Japan, where the rising incidence of lung cancer demands more accurate screening methods. Convolutional neural networks (CNNs) are also utilized for lung cancer classification and risk assessment, providing high accuracy and reducing the need for invasive biopsies and repeated scans, ultimately lowering healthcare costs. AI is also enhancing prognostic capabilities in lung cancer care. Algorithms such as extreme gradient boosting (XGBoost) are used to predict lung cancer risk through analysis of electronic medical records.

In 2023, Japan reported over 81,000 new lung cancer cases. The country's healthcare infrastructure includes more than 8,400 hospitals, many of which are integrating AI tools. Recent studies in the lung cancer market indicate that AI can reduce diagnostic times from an average of several days to just a few hours. Japan's National Cancer Center has implemented AI systems in over 50% of its facilities. AI-driven systems can process over 10,000 CT scans per day across Japan. The average size of detected nodules has decreased from 8 mm to 3 mm due to AI advancements. AI has contributed to a 20% increase in early-stage lung cancer detection cases. Over 100 clinical trials in Japan are currently exploring AI applications in oncology. AI-based diagnostics have reduced the need for biopsies by approximately 30,000 annually in Japan. There are more than 200 AI startups in Japan, with a focus on healthcare innovations.

Restraint: Strict Regulatory Environment

The lung cancer market in Japan faces considerable challenges due to the country’s stringent regulatory environment, which governs the approval of new therapies and treatments. Japan’s regulatory framework is designed to ensure the highest standards of safety and efficacy for medical interventions. However, this rigorous system often results in lengthy approval processes, which can limit the timely availability of innovative lung cancer therapies, negatively impacting patient care and the overall market dynamics.

For example, Roche’s anti-cancer drug Tecentriq (atezolizumab) recently received approval from Japan’s Ministry of Health, Labour, and Welfare for the adjuvant treatment of PD-L1-positive non-small cell lung cancer (NSCLC). While this approval represents a significant advancement, it highlights the extended timelines typically associated with Japan’s regulatory processes. Even therapies that have been successfully launched in global markets can face significant delays in Japan due to the country’s additional regulatory requirements.

Similarly, AstraZeneca’s Tagrisso (osimertinib) was approved for first-line treatment in combination with chemotherapy for patients with locally advanced or metastatic EGFR-mutated NSCLC in the Japan lung cancer market. However, such regulatory delays hinder patient access to critical therapies that could improve their prognosis. Additionally, MSD’s KEYTRUDA has received multiple new approvals from the Pharmaceuticals and Medical Devices Agency (PMDA) for expanded indications, including advanced NSCLC and melanoma. Despite these developments, the protracted regulatory processes continue to slow the introduction of essential treatments.

Segmental Analysis

By Diagnostics & Therapy

In Japan, the lung cancer market is experiencing significant growth, primarily driven by the increasing adoption of advanced treatment options and a strong emphasis on personalized medicine. As of 2023, Japan's lung cancer therapy market is reflecting the nation's commitment to incorporating cutting-edge medical technologies. Immunotherapy has gained substantial traction, with over 20,000 patients in Japan receiving these innovative treatments, highlighting its importance in the current therapeutic landscape. Targeted drug therapies are also playing a crucial role, with more than 15,000 patients benefiting from these personalized approaches that tailor treatments to specific genetic mutations. The Japanese Ministry of Health, Labour and Welfare has approved multiple new drugs for lung cancer in 2023, further demonstrating the country’s proactive approach to expanding treatment options.

The Therapy segment's growth in Japan lung cancer market is further supported by a robust investment in research and development, which reached $1.5 billion in 2023. This investment underpins the development of novel therapies and precision medicine strategies that are crucial for improving patient outcomes. Japan's healthcare system has made significant strides in early diagnosis, with over 70,000 cases detected at an early stage, enhancing the effectiveness of available treatments. The prevalence of lung cancer remains a significant health concern, with an estimated 120,000 new cases diagnosed in 2023, underscoring the need for effective therapeutic interventions. Access to advanced therapies has improved, with a large proportion of patients receiving state-of-the-art treatments, although challenges remain in ensuring these innovations reach all demographics. These factors collectively contribute to the robust growth of the Therapy segment in Japan, characterized by a notable CAGR of 12.72%, as the country continues to lead in adopting and integrating advanced therapeutic solutions.

By Cancer Type

In 2023, the Non-Small Cell Lung Cancer (NSCLC) segment continues to dominate the lung cancer market, holding a substantial 80.53% share. This dominance is largely due to the high prevalence of NSCLC, which constitutes the majority of lung cancer cases worldwide. NSCLC encompasses subtypes such as adenocarcinoma, squamous cell carcinoma, and large cell carcinoma, which are more prevalent than small cell lung cancer (SCLC). The demand for diagnostics and therapeutic treatments in this segment is significant, positioning it as the largest in the lung cancer market. The NSCLC segment is experiencing the highest CAGR due to continuous advancements in treatment options. Precision therapies targeting specific genetic mutations, such as EGFR and ALK, along with the increasing adoption of immunotherapy, have shown significant efficacy in improving survival rates, thereby driving higher demand for NSCLC-specific therapies.

In addition to the market share and growth rate, several other factors contribute to the prominence of the NSCLC segment. Lung cancer remains the leading cause of cancer death globally, with an estimated 1.8 million deaths annually. The global incidence of lung cancer is high, with millions of new cases diagnosed each year. NSCLC accounts for approximately 85% of these cases. The development of targeted therapies has revolutionized treatment approaches in the lung cancer market, offering personalized medicine options that improve patient outcomes. Furthermore, the integration of artificial intelligence in diagnostic processes enhances early detection and treatment planning, contributing to better management of NSCLC. Air pollution, a significant risk factor, affects 9 out of 10 people worldwide and is linked to lung cancer. The increasing investment in research and development by pharmaceutical companies is also a critical factor, as it leads to the introduction of innovative drugs and therapies. Additionally, public health initiatives aimed at reducing smoking rates, a major risk factor for lung cancer, are expected to impact the incidence of NSCLC positively.

By End User

Based on end users, the Hospitals and Specialty Clinics segment holds the largest share in the lung cancer market, accounting for 73.41% in 2023. This is due to their comprehensive approach to care that spans from diagnosis to advanced treatment. As of 2023, there are approximately 1,500 hospitals and specialty clinics across Japan that specialize in lung cancer, reflecting the country's commitment to addressing this critical health issue. These facilities have increasingly adopted cutting-edge diagnostic technologies, such as AI-driven imaging systems and molecular profiling tools, to enhance accuracy and efficiency in diagnosis. The use of minimally invasive surgical procedures has become more prevalent, significantly improving patient recovery times and outcomes. Furthermore, targeted therapies and immunotherapies are gaining traction within these healthcare settings, enabling more personalized and effective treatment plans tailored to individual patient needs.

The growth of the Hospitals and Specialty Clinics segment in Japan is driven by several factors, including the rising incidence of lung cancer, with around 130,000 new cases estimated in 2023. Lung cancer remains a leading cause of cancer-related deaths in Japan, with approximately 80,000 fatalities recorded this year. In response, these institutions have expanded their multidisciplinary teams, incorporating a wide array of specialists such as oncologists, thoracic surgeons, and radiologists to provide comprehensive care. Japanese hospitals and clinics are also participating in over 200 clinical trials focused on innovative lung cancer therapies, reflecting their active role in advancing research and treatment options. Additionally, Japan’s robust lung cancer screening programs have contributed to earlier detection and improved prognoses, emphasizing the proactive measures taken by these facilities. Collectively, these efforts position hospitals and specialty clinics as central players in Japan's lung cancer market, continually striving to meet the evolving needs of patients through innovation and specialized care.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Key Players in Japan Lung Cancer Market

- Accuray Incorporated

- Intuitive Surgical Inc

- Karl Storz SE & Co. KG

- Medtronic plc

- Olympus Corporation

- Teleflex Incorporated

- AngioDynamics Inc.

- Dunlee

- Amoy Diagnostics Co., Ltd.

- Medicaroid Corporation

- Other Prominent Players

Segment Breakdown:

By Diagnostics & Therapy

- Diagnostics

- Bronchoscopy

- TTNA

- Imaging

- Tumor Biomarker Test

- In Situ Hybridization

- Others

- Therapy

- Non-invasive

- Immunotherapy

- Targeted therapy

- Chemotherapy

- Radiation Therapy

- Minimally invasive

- Radiofrequency ablation

- Microwave ablation

- Thermal/cryoablation

- Others

- Surgery

- Thoracotomy

- Lobectomy

- Sleeve Resection

- Segmentectomy

- Pneumenectomy

- Non-invasive

By Cancer Type

- Small Cell Lung Cancer

- Non-small Cell Lung Cancer

- Lung Carcinoid Tumour

By End User

- Hospitals and Specialty Centres

- Diagnostic Laboratories

- Others

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)