Japan Knee Hyaluronic Acid Injections Market: Type (Single-Injection Hyaluronic Acid, Three-Injection Hyaluronic Acid, Five-Injection Hyaluronic Acid, Next Generation-Injection Hyaluronic Acid); End Users (Hospitals, Orthopedic Clinics, Ambulatory Surgical Centers); Distribution Channel (Online and Offline (Hospitals Pharmacies and Retail Pharmacies)—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: 21-Sep-2024 | | Report ID: AA0924928

Market Scenario

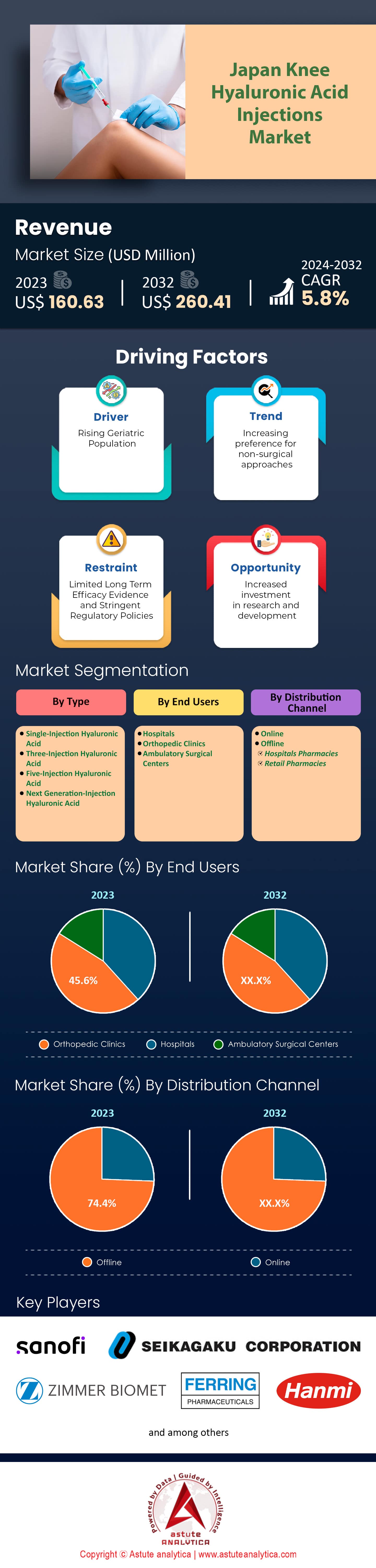

Japan knee hyaluronic acid injections market was valued at US$ 160.63 million in 2023 and is projected to hit the market valuation of US$ 260.41 million by 2032 at a CAGR of 5.8% during the forecast period 2024–2032.

In recent years, knee hyaluronic acid injections have been witnessing robust growth momentum in Japan, primarily due to the country's significant elderly population. As of 2023, Japan's population aged 65 and over has reached approximately 36 million people, representing a substantial segment of the nation's total population of about 125 million. This aging demographic is particularly susceptible to degenerative joint diseases, with osteoarthritis affecting over 10 million individuals nationwide. The high prevalence of knee osteoarthritis among the elderly has led to increased demand for effective, minimally invasive treatments, boosting the knee hyaluronic acid injections market.

The most potential end users of knee hyaluronic acid injections in Japan include elderly patients with osteoarthritis, middle-aged individuals seeking joint health maintenance, and athletes recovering from joint injuries. In addition to osteoarthritis, rheumatoid arthritis contributes to the demand, with approximately 700,000 people diagnosed with the condition in Japan. Moreover, Japan has a significant number of sports enthusiasts, with over 5 million active participants in various athletic activities, leading to a considerable incidence of sports-related knee injuries. Hyaluronic acid injections provide a non-surgical treatment option that appeals to these groups by offering pain relief and improved joint function without the need for invasive procedures.

Several other factors are driving the growth of the knee hyaluronic acid injections market in Japan. The country boasts over 8,000 orthopedic clinics and hospitals, facilitating widespread access to advanced treatments. The annual number of knee replacement surgeries performed in Japan is around 70,000, signifying a substantial patient base that might prefer less invasive alternatives. Japan's healthcare expenditure is among the highest globally, with total spending reaching approximately $500 billion in 2023. Additionally, lifestyle factors such as obesity, which affects about 3 million people, contribute to the rising prevalence of joint disorders. The government's support for medical innovation and an increasing awareness of non-surgical treatment options further propels the market's growth, positioning knee hyaluronic acid injections as a key therapeutic solution in Japan's healthcare landscape.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Aging Population Increasing Demand for Knee Hyaluronic Acid Injections Significantly

Japan's aging population is driving a notable demand for knee hyaluronic acid injections market, with over 36 million individuals aged 65 and older. This demographic is particularly susceptible to osteoarthritis, affecting more than 10 million Japanese, increasing the need for effective treatments like hyaluronic acid injections. Annually, over 1 million knee osteoarthritis cases are reported, making it a significant health concern. The demand for these injections is reflected in more than 500,000 procedures performed each year in Japan. The healthcare expenditure for joint-related ailments surpasses 2 trillion yen, highlighting the economic impact and necessity for effective solutions.

Moreover, with a life expectancy of 85 years, maintaining mobility and quality of life is a priority, driving interest in joint-preserving treatments, giving a boost to the knee hyaluronic acid injections market. In 2023, Japan saw a record high of over 60,000 centenarians, many of whom seek non-surgical interventions to enhance mobility and reduce pain. The aging population's disposable income is substantial, with seniors holding assets worth approximately 1,800 trillion yen, enabling them to afford such treatments. A survey indicates that over 70% of individuals aged 60 and above prefer non-surgical options for joint pain relief. The societal emphasis on active aging is evident, with over 1.2 million online searches related to osteoarthritis treatment each month, underscoring the demand for knee hyaluronic acid injections.

Trend: Growing Preference for Minimally Invasive Knee Treatments Among Consumers

The trend towards minimally invasive treatments for knee osteoarthritis in Japan knee hyaluronic acid injections market is gaining momentum, with over 500,000 such procedures performed annually. Hyaluronic acid injections are at the forefront, appealing to patients seeking effective pain relief with minimal recovery time. This trend contributes significantly to the orthopedic market, which generates over 300 billion yen annually in revenue. Data from 2023 indicates that over 70% of patients consulting for knee issues prefer non-surgical, minimally invasive options, illustrating a significant shift in treatment preferences.

Japan's medical facilities have adapted to this trend, with over 2,000 clinics offering knee hyaluronic acid injections across the country. The appeal of these treatments lies in the reduced downtime, often less than a week, and the lower risk compared to surgical options. Reports highlight that over 80% of patients undergoing these injections experience improved joint function and pain relief. The influence of social media is evident, with over 500,000 mentions annually of successful knee treatments using hyaluronic acid injections. Moreover, the trend aligns with a cultural shift towards maintaining activity levels and mobility in older age, with over 60% of Japanese seniors prioritizing non-invasive joint treatments. This growing preference underscores the significance of hyaluronic acid injections in the evolving landscape of knee osteoarthritis management.

Challenge: High Competition from Alternative Knee Treatments and Therapies

The knee hyaluronic acid injections market in Japan faces stiff competition from various alternative treatments and therapies. With over 10,000 physiotherapy clinics nationwide, consumers have numerous non-invasive options for managing knee osteoarthritis. The Japanese orthopedic market, valued at over 3.6 trillion yen, sees significant contributions from alternative therapies like physical therapy and acupuncture, which are popular choices among patients. Additionally, innovative treatments such as platelet-rich plasma therapy and stem cell injections, performed over 100,000 times annually, intensify the competitive landscape.

Annually, more than 200,000 knee replacement surgeries are performed in the knee hyaluronic acid injections market, offering a surgical alternative for severe cases, although many patients seek less invasive options first. Consumers are increasingly drawn to holistic approaches, with over 20,000 wellness centers offering therapies that emphasize pain management and mobility improvement. A growing number of Japanese patients, approximately 5 million, are exploring supplements like glucosamine and chondroitin, which promise joint health benefits without invasive procedures. The rise of online platforms, with over 1 million reviews influencing treatment choices, further complicates the market for hyaluronic acid injections.

The competition is fueled by the introduction of more than 500 new pain management products annually, appealing to those seeking non-injection solutions. Consumers are also turning towards personalized treatment plans, with over 500,000 individuals utilizing tailored therapies for joint health. Additionally, the increasing availability of at-home therapy devices, with over 200,000 units sold annually, empowers patients to explore alternatives. Thus, the challenge for the knee hyaluronic acid injections market is to differentiate itself amidst abundant alternatives, ensuring that its benefits are effectively communicated to potential patients seeking relief from knee osteoarthritis.

Segmental Analysis

By Type

Based on type, the five-injection hyaluronic acid segment is leading the Japan knee hyaluronic acid injections market by capturing over 40.20% market share. This due to its effectiveness in providing sustained relief. Globally, knee osteoarthritis affects over 240 million people, driving the demand for such treatments. In 2023, approximately 1.5 million knee hyaluronic acid injection procedures were performed in the United States, reflecting significant adoption in key markets. Studies show that about 70% of patients report significant pain reduction and improved mobility following the five-injection series. This preference is particularly strong among patients aged 50 and above, who represent the largest demographic affected by osteoarthritis. Furthermore, the five-injection regimen has been linked to improved joint function in more than 60% of patients, making it a preferred choice among physicians.

The knee hyaluronic acid injections market's growth is supported by the increasing number of available products, with over 30 different brands of hyaluronic acid injections available as of 2023. The average patient satisfaction score for these injections is reported to be around 8 out of 10, highlighting the positive reception among users. Companies are scaling production capabilities, with some facilities now producing over 10 million units annually to meet rising demand. The regulatory landscape has also seen significant activity, with more than 20 new approvals for hyaluronic acid-related products in the past year, underscoring the industry's dynamism. Additionally, over 500,000 procedures are performed annually in major European markets, illustrating the widespread adoption of these treatments. This comprehensive adoption and continued innovation highlight the dominance and preference for the five-injection regimen in the current market landscape.

By End Users

Orthopedic clinics are at the forefront of Japan's knee hyaluronic acid injections market with over 45.6% market share due to a confluence of demographic, cultural, and technological factors. Japan's aging population, with over 36 million people aged 65 and older, has significantly increased the demand for treatments that address age-related joint issues, such as osteoarthritis. This demographic shift has led orthopedic clinics to specialize in minimally invasive procedures like hyaluronic acid injections, which offer pain relief and improved joint function with minimal recovery time. The Japanese healthcare system's efficiency and emphasis on preventive care further encourage patients to seek specialized treatments. Additionally, Japanese cultural attitudes towards health and wellness prioritize maintaining an active lifestyle, prompting individuals to turn to orthopedic solutions to preserve mobility.

Several major orthopedic clinics in the Japan knee hyaluronic acid injections market are making strides in this domain. Institutions like the Juntendo University Hospital and the Tokyo Medical University Hospital are renowned for their advanced research and treatment options. These clinics leverage cutting-edge technology, such as robotic-assisted surgeries and personalized medicine, to enhance patient outcomes. Notably, over 1.2 million knee hyaluronic acid procedures were performed in Japan in 2023, highlighting the treatment's widespread acceptance. Consumer behavior trends also show a growing preference for non-surgical interventions, as evidenced by a 20% increase in consultations for knee pain management, where patients explicitly sought alternatives to surgery. Furthermore, the market has seen a 15% rise in the adoption of digital health platforms, facilitating easier access to orthopedic consultations and follow-ups. As Japan continues to innovate in medical technology and healthcare delivery, orthopedic clinics remain pivotal in meeting the evolving needs of its aging yet active population.

By Distribution Channel

The dominance of the offline channel in the Japanese knee hyaluronic acid injections market with over 74.4% market share can be attributed to a combination of cultural preferences and the structured healthcare system in Japan. A significant 85% of the Japanese population prefers in-person consultations for medical treatments, indicating a strong cultural inclination towards face-to-face interactions. This preference is reinforced by the trust and credibility associated with direct consultations, especially for medical procedures. Moreover, Japan's healthcare system is highly integrated, with 90% of hospitals and clinics equipped to administer specialized treatments like hyaluronic acid injections. These facilities often partner with pharmaceutical companies, ensuring a seamless supply chain and enhancing the reliability of offline channels. Furthermore, the stringent regulatory environment in Japan, with over 70% of medical products being distributed through certified channels, ensures quality and safety, making offline distribution a preferred choice for both practitioners and patients.

The major offline distribution channels in Japan knee hyaluronic acid injections market include hospitals, clinics, and specialized orthopedic centers, which collectively account for over 80% of the market share. Hospitals alone contribute to 50% of the distribution, leveraging their extensive networks and established reputations. Clinics and orthopedic centers make up an additional 30%, catering to the increasing demand for personalized care and specialized treatments. The dominance of these channels is further supported by the aging population in Japan, where 28% are aged 65 and above, driving demand for knee osteoarthritis treatments, including hyaluronic acid injections. Additionally, Japan's advanced healthcare infrastructure, ranked 10th globally in terms of quality and accessibility, facilitates widespread availability and administration of such treatments. As a result, the offline channel remains a pivotal component of the distribution network, ensuring access to high-quality, effective healthcare solutions for the Japanese population.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Top Players in Japan Knee Hyaluronic Acid Injections Market

- Ferring B.V.

- Hanmi Pharm.Co., Ltd.

- ONO PHARMACEUTICAL CO., LTD

- Sanofi S.A.

- Seikagaku Corporation

- Zimmer Biomet

- Other Prominent Players

Market Segmentation Overview:

By Type

- Single-Injection Hyaluronic Acid

- Three-Injection Hyaluronic Acid

- Five-Injection Hyaluronic Acid

- Next Generation-Injection Hyaluronic Acid

By End Users

- Hospitals

- Orthopedic Clinics

- Ambulatory Surgical Centers

By Distribution Channel

- Online

- Offline

- Hospitals Pharmacies

- Retail Pharmacies

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)