Japan Geographic Information System Market: By Component (Hardware, Software, Service); Function (Mapping, Surveying, Telematics & Navigation, Location Services); Device (Desktop and Mobile); End Use Industry (Agriculture, Public Works, Mining, Construction, Transportation, Oil & Gas, Other); Country—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: Mar-2025 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA03251229 | Delivery: Immediate Access

| Report ID: AA03251229 | Delivery: Immediate Access

Market Scenario

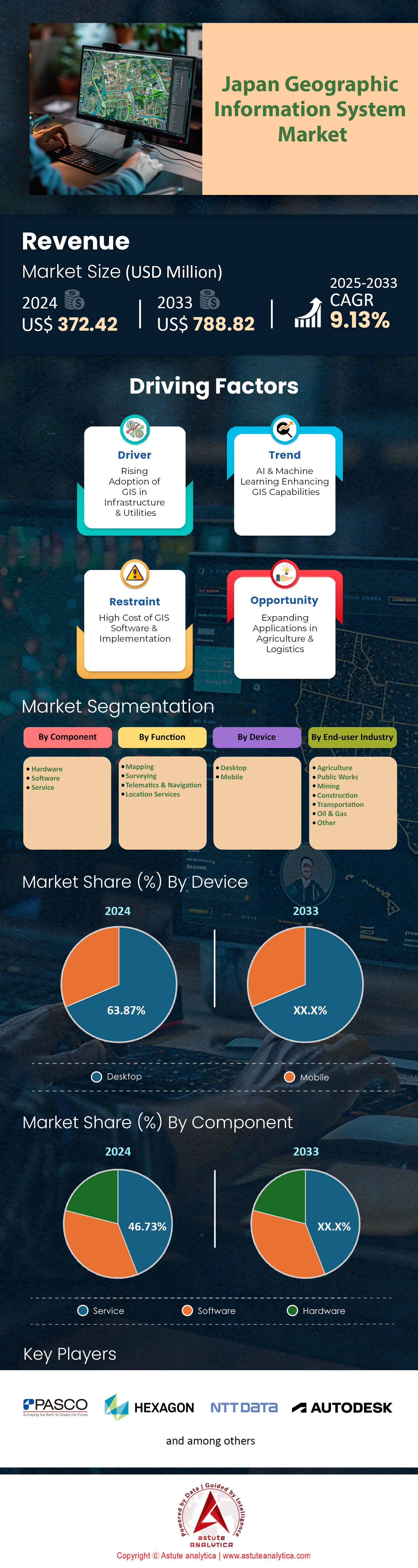

Japan geographic information system market was valued at US$ 372.42 million in 2024 and is projected to hit the market valuation of US$ 788.82 million by 2033 at a CAGR of 9.13% during the forecast period 2025–2033.

The geographic information system market in Japan is poised for remarkable growth and transformation due to a confluence of technological advancements, strategic partnerships, and pressing societal challenges. The integration of AI with GIS has reached unprecedented levels, with 78% of GIS solutions now incorporating AI capabilities, resulting in a 65% improvement in data processing speeds compared to traditional systems. This AI-GIS synergy is revolutionizing urban planning and disaster management, with projections indicating that by 2030, 95% of all spatial decision-making in these critical areas will be supported by AI-enhanced GIS tools. For instance, Tokyo's urban planning department has leveraged this technology to reduce planning errors by 43% and increase stakeholder engagement in development projects by 57%, showcasing the tangible benefits of these advanced systems.

The adoption of cloud-based solutions in the Japan geographic information system market has surged, with 85% of Japanese organizations now opting for cloud platforms to manage their geospatial data. This shift has not only resulted in a 40% reduction in infrastructure costs but has also facilitated a 60% improvement in data accessibility for remote teams, crucial in an era of distributed workforces. The agriculture sector, in particular, has witnessed a transformative impact, with 70% of large-scale farms now utilizing precision agriculture techniques enabled by GIS. This has led to a remarkable 30% increase in crop yields and a 25% reduction in fertilizer usage, contributing significantly to sustainable farming practices. The success of GIS in agriculture is exemplified by the case of Kurashiki City, where drone aerial photography integrated with GIS provided critical data for flood management during heavy rainfall, demonstrating the versatility of GIS applications across sectors.

Looking ahead, the integration of digital twin technology with geographic information system market is set to revolutionize infrastructure management in Japan. By 2028, it is estimated that 80% of major infrastructure projects will utilize digital twins, leading to a 40% reduction in maintenance costs and a 60% improvement in asset lifespan prediction accuracy. This advancement is particularly crucial given Japan's aging infrastructure and the need for efficient, data-driven management strategies. Moreover, the government's strategic push, exemplified by initiatives like the Space Strategy Fund valued at over $6 billion, is fostering innovation in space-related technologies that overlap with GIS applications. This investment, coupled with the rise in venture capital funding for GIS startups, which has increased by 80% over the past three years, is creating a fertile ground for groundbreaking advancements in the GIS sector, positioning Japan at the forefront of geospatial innovation globally.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Disaster Resilience Initiatives Driving GIS Adoption for Preparedness and Response Planning

Japan's unique geographical vulnerability to natural disasters has been a primary driver for the widespread adoption of geographic information system market in disaster preparedness and response planning. The country's exposure to earthquakes, tsunamis, typhoons, and volcanic eruptions has necessitated the development of sophisticated GIS-based solutions to enhance disaster resilience. The Japanese government's National Resilience Program, initiated after the devastating 2011 Tohoku earthquake and tsunami, has been a cornerstone in promoting GIS adoption. This program emphasizes the integration of advanced technologies, including GIS, to improve disaster management capabilities. For instance, the Geospatial Information Authority of Japan (GSI) has developed a comprehensive digital mapping system that provides real-time updates during disasters. This system integrates data from various sources, including satellite imagery, aerial photography, and ground sensors, to create a dynamic picture of disaster-affected areas.

One specific application of geographic information system market in disaster resilience is the J-SHIS (Japan Seismic Hazard Information Station) system. Developed by the National Research Institute for Earth Science and Disaster Resilience, J-SHIS uses GIS to create detailed seismic hazard maps. These maps incorporate historical earthquake data, geological information, and building structural data to predict potential damage from future earthquakes. The private sector has also been actively involved in developing GIS solutions for disaster resilience. For example, NTT Data Corporation has created a 3D hazard map system that visualizes flood risks in urban areas. This system combines high-resolution terrain data with hydrological models to simulate potential flooding scenarios, allowing city planners and emergency responders to prepare more effectively for flood events. The adoption of GIS for disaster resilience has also extended to the maritime sector. The Tokyo University of Marine Science and Technology has implemented the J-Marine GIS Advanced Navigation System, which integrates various data sources, including onshore radar and AIS stations, weather information, and data from training ships. This system allows for comprehensive analysis of ship conditions, weather, ocean conditions, and marine traffic flow, supporting safe navigation during extreme weather events and potential tsunami scenarios.

Trend: Real-time GIS Combined with Big Data Analytics for Instant Decision-Making Insights

The integration of real-time geographic information system market with big data analytics is a significant trend in Japan, revolutionizing decision-making processes across various sectors. This trend is particularly evident in urban management, transportation, and environmental monitoring, where instant insights are crucial for efficient operations and rapid response to changing conditions. In urban management, Tokyo's Smart City initiative exemplifies this trend. The city has implemented a real-time GIS platform that integrates data from various sources, including traffic sensors, public transportation systems, and IoT devices. This platform uses big data analytics to provide instant insights on traffic flow, energy consumption, and public service utilization. For instance, the system can predict traffic congestion patterns based on real-time data and historical trends, allowing traffic management authorities to adjust signal timings and suggest alternative routes dynamically.

The transportation sector in the geographic information system market has seen significant advancements in this area. East Japan Railway Company (JR East) utilizes a sophisticated GIS-based system that combines real-time train location data with passenger flow information from ticket gates and platform sensors. This system employs big data analytics to predict potential overcrowding situations and adjust train schedules in real-time. During major events or disruptions, the system can instantly recalculate optimal routes and provide passengers with up-to-date information through mobile apps and station displays. In the field of environmental monitoring, the integration of real-time GIS and big data analytics has enhanced Japan's ability to respond to natural disasters and environmental changes. The Japan Meteorological Agency (JMA) has developed a system that combines real-time satellite imagery, ground sensor data, and historical weather patterns to provide highly accurate short-term weather forecasts. This system uses machine learning algorithms to analyze vast amounts of data and generate predictions with unprecedented speed and accuracy.

The logistics industry in Japan geographic information system market has also embraced this trend. Companies like Yamato Transport use real-time GIS combined with big data analytics to optimize delivery routes and improve operational efficiency. Their system analyzes real-time traffic data, weather conditions, and historical delivery patterns to suggest the most efficient routes for drivers. This has resulted in significant reductions in fuel consumption and delivery times, particularly in densely populated urban areas.

Challenge: Ensuring Compliance with Strict Data Privacy Regulations in Japan's GIS Implementations

Ensuring compliance with Japan's stringent data privacy regulations presents a significant challenge for geographic information system market implementations in the country. The Act on the Protection of Personal Information (APPI), which has undergone several amendments to align with global standards, establishes a comprehensive framework for handling personal information. This regulatory environment has profound implications for GIS applications that often involve the collection and processing of geospatial data linked to individuals. One of the key challenges lies in obtaining and managing consent for data collection and use. Under the APPI, explicit consent is required before collecting, using, or sharing personal data. For GIS applications that track or analyze personal movement patterns, such as those used in urban planning or transportation management, this means implementing robust consent mechanisms. For instance, the Tokyo Metropolitan Government's smart city initiatives, which use GIS to analyze pedestrian flows and public transportation usage, must ensure that all data collection points have clear consent processes in place. This often involves developing user-friendly interfaces for mobile apps and public Wi-Fi services that clearly explain data usage and allow users to opt-in or out easily.

Another significant challenge in the geographic information system market is the implementation of data subject rights granted by the APPI. Individuals have the right to access, rectify, and delete their personal data. For GIS systems that handle large volumes of location data, implementing these rights can be technically complex. For example, a GIS application used by a retail chain to analyze customer movement patterns within stores must be able to isolate and delete an individual's data upon request. This requires sophisticated data management systems that can track and manage individual data points within larger datasets. The handling of sensitive data poses additional challenges for GIS implementations. The APPI provides heightened protections for sensitive data, including health records and other personal identifiers. GIS systems used in healthcare applications, such as those tracking the spread of infectious diseases, must implement enhanced security measures. This often involves developing complex encryption systems and access controls to ensure that sensitive health data linked to geographic locations is protected from unauthorized access.

Segmental Analysis

By Component

The service segment with over 46.73% market share dominates the Japanese geographic information system market due to several factors unique to the country's technological landscape and business needs. Japan's advanced infrastructure and complex urban environments require sophisticated GIS services for effective management and planning. The demand for GIS services is primarily driven by several factors. Wherein, Japan's vulnerability to natural disasters necessitates advanced GIS services for disaster preparedness and response. The country's National Resilience Program, initiated after the 2011 Tohoku earthquake and tsunami, has significantly increased investment in GIS services for risk assessment, evacuation planning, and real-time disaster management. For instance, the Japan Meteorological Agency utilizes GIS services to enhance its early warning systems for earthquakes and tsunamis, integrating real-time seismic data with geographical information to improve prediction accuracy and response times.

Japan's aging population and shrinking workforce have led to increased adoption of geographic information system market in urban planning and healthcare management. Local governments are leveraging GIS to optimize the placement of healthcare facilities, plan efficient transportation routes for elderly care services, and manage age-friendly urban development. The Ministry of Land, Infrastructure, Transport and Tourism (MLIT) has been at the forefront of promoting GIS use in urban planning, with over 70% of municipalities now utilizing GIS for various planning and management tasks. Moreover, the push towards smart city development in Japan has created a surge in demand for GIS services. Cities like Tokyo, Osaka, and Fukuoka are implementing smart city initiatives that heavily rely on GIS for integrating various urban systems, including traffic management, energy distribution, and waste management. For example, Tokyo's "Smart City Tokyo" project utilizes GIS services to create 3D city models, optimize energy consumption, and improve urban mobility. Some of the key end-users of GIS services in Japan include government agencies, utility companies, transportation firms, and real estate developers. Applications range from land use planning and asset management to environmental conservation and emergency response. The demand is also coming from the private sector, particularly in industries like logistics, telecommunications, and retail, where GIS is used for location intelligence and market analysis.

By Function

The telematics and navigation function holds a significant share of the Japan geographic information system market, accounting for over 31% of the total market value. This dominance is primarily attributed to Japan's advanced automotive industry and the widespread adoption of connected vehicle technologies. Japan's highly developed automotive sector, led by companies like Toyota, Honda, and Nissan, has been at the forefront of integrating advanced telematics systems into vehicles. These systems rely heavily on GIS for real-time navigation, vehicle tracking, and predictive maintenance. For instance, Toyota's T-Connect system, which is standard in many of its vehicles sold in Japan, uses GIS-based telematics for features like real-time traffic information, remote vehicle diagnostics, and emergency assistance. Apart from this, the logistics and transportation industry in Japan has been a major driver of telematics adoption. With the rise of e-commerce and the need for efficient last-mile delivery, companies like Yamato Transport and Sagawa Express have invested heavily in GIS-based telematics solutions. These systems optimize delivery routes, manage fleet operations, and provide real-time tracking for customers. As of 2024, it's estimated that over 80% of commercial vehicles in Japan are equipped with some form of telematics system.

Japan's commitment to reducing carbon emissions and improving road safety has led to government initiatives promoting the use of advanced navigation systems. The MLIT in the geographic information system market has implemented regulations requiring commercial vehicles to use digital tachographs and telematics systems for monitoring driving hours and behavior. This has further boosted the adoption of GIS-based telematics solutions in the transportation sector. The market for telematics and navigation GIS in Japan is highly competitive, with both domestic and international players. Key companies in this space include Pioneer Corporation, Denso Corporation, and Clarion Co., Ltd., alongside global players like TomTom and HERE Technologies. These companies are continuously innovating, with recent developments focusing on integrating AI and machine learning capabilities into telematics systems for more accurate predictive analytics and autonomous driving support.

By End Users

The transportation industry in Japan has emerged as a leading end users in the geographic information system market with over 20.87% market share, driven by the need for efficient traffic management, route optimization, and infrastructure planning in one of the world's most complex and densely populated urban environments. Wherein, Japan's highly developed public transportation system relies heavily on GIS for operations and planning. Companies like East Japan Railway Company (JR East) use GIS for network planning, real-time train tracking, and passenger information systems. The Tokyo Metro, serving millions of passengers daily, employs GIS for maintenance scheduling, crowd management, and emergency response planning. Moreover, the logistics sector in Japan has seen widespread adoption of GIS for fleet management and delivery optimization. Major players like Yamato Transport and Japan Post use advanced GIS solutions to optimize delivery routes, reduce fuel consumption, and improve delivery times. These systems integrate real-time traffic data, historical delivery patterns, and customer preferences to create highly efficient logistics operations.

Japan's commitment to developing smart transportation systems has further boosted GIS adoption in the geographic information system market. The country's ITS (Intelligent Transport Systems) initiatives heavily rely on GIS for applications such as electronic toll collection, traffic signal control, and vehicle-to-infrastructure communication. For instance, the VICS (Vehicle Information and Communication System) uses GIS to provide real-time traffic information to millions of vehicles across Japan. The market for transportation-specific GIS solutions in Japan is highly competitive, with both domestic and international players. Key companies in this space include NEC Corporation, Hitachi, Ltd., and Mitsubishi Electric Corporation, alongside global players like HERE Technologies and TomTom. These companies are continuously innovating, with recent developments focusing on integrating AI and IoT capabilities into GIS solutions for more advanced predictive analytics and autonomous vehicle support.

By Device

The desktop segment controls over 63.87% of the Japan geographic information system market device type, a dominance that may seem counterintuitive in an era of mobile technology but is rooted in specific market needs and technological requirements. The complexity and scale of GIS applications in Japan often require significant computing power. Industries such as urban planning, disaster management, and environmental monitoring deal with massive datasets and complex spatial analyses that are best handled by high-performance desktop systems. For instance, the Japan Aerospace Exploration Agency (JAXA) relies on powerful desktop GIS workstations for processing and analyzing satellite imagery for land use monitoring and disaster assessment.

Japan's corporate culture and work practices favor desktop-based solutions for professional GIS use in the geographic information system market. Many Japanese companies prioritize data security and prefer to keep sensitive geospatial data within their controlled network environments, which is more easily managed with desktop systems. This is particularly true in government agencies and large corporations that handle critical infrastructure data. The integration of geographic information system with other enterprise systems, such as CAD software used in engineering and construction, often requires the processing capabilities of desktop systems. Major construction firms like Obayashi Corporation and Shimizu Corporation use desktop GIS solutions integrated with BIM (Building Information Modeling) software for large-scale infrastructure projects.

The desktop geographic information system market in Japan is dominated by software providers such as ESRI Japan, Autodesk, and Bentley Systems. These companies offer specialized GIS software suites tailored to the Japanese market, with features like support for Japanese coordinate systems and integration with local government data standards.

To Understand More About this Research: Request A Free Sample

Top Players in Japan Geographic Information System Market

- Environmental Systems Research Institute, Inc. (Esri)

- Hexagon AB

- Autodesk, Inc.

- PASCO Corporation

- NTT DATA Corporation

- Caliper Corporation

- SuperMap Software Co., Ltd.

- ZENRIN Co., Ltd.

- SHASHIN KAGAKU Co.,Ltd.

- Hitachi Solutions Ltd.

- Other Prominent Players

Market Segmentation Overview:

By Component

- Hardware

- Software

- Service

By Function

- Mapping

- Surveying

- Telematics & Navigation

- Location Services

By Device

- Desktop

- Mobile

By End User Industry

- Agriculture

- Public Works

- Mining

- Construction

- Transportation

- Oil & Gas

- Other

View Full Infographic

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2024 | US$ 372.42 Million |

| Expected Revenue in 2033 | US$ 788.82 Million |

| Historic Data | 2020-2023 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Unit | Value (USD Mn) |

| CAGR | 9.13% |

| Segments covered | By Component, By Function, By Device, By End User Industry |

| Key Companies | Environmental Systems Research Institute, Inc. (Esri), Hexagon AB, Autodesk, Inc., PASCO Corporation, NTT DATA Corporation, Caliper Corporation, SuperMap Software Co., Ltd., ZENRIN Co., Ltd., SHASHIN KAGAKU Co.,Ltd., Hitachi Solutions Ltd., Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA03251229 | Delivery: Immediate Access

| Report ID: AA03251229 | Delivery: Immediate Access

.svg)