Japan Data Annotation Tools Market: By Data Type (Text, Image, Video, and Audio; By Technology – Supervised, Semi-supervised, and Automatic); Device Type (Mac OS, Windows, Linux, and Others); End Users (Automotive, Healthcare, Retail, Transportation & Logistics, and Others)—Industry Dynamics, Market Size and Opportunity Forecast for 2024–2032

- Last Updated: Oct-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA0322158 | Delivery: 2 to 4 Hours

| Report ID: AA0322158 | Delivery: 2 to 4 Hours

Market Scenario

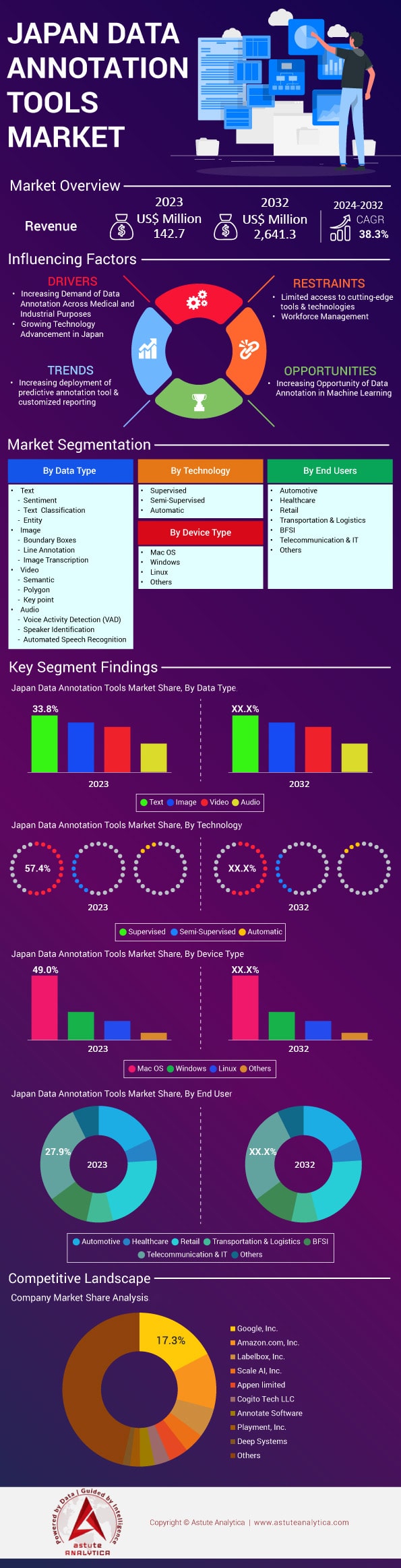

Japan data annotation tools market is estimated to make a major leap forward in its revenue from US$ 142.7 million in 2023 to US$ 2,641.3 million by 2032. The market is registering a CAGR of 38.3% during the forecast period 2024-2032.

Data annotation is the process of labeling data—such as images, videos, text, and audio—to make it recognizable to machine learning models. In Japan, the demand for data annotation tools is on the rise due to the country's rapid advancements in artificial intelligence (AI) and machine learning technologies. As of 2023, Japan data annotation tools market has become a global leader in AI research, with over 20,000 researchers dedicated to the field. The nation's focus on automation and smart technologies has led to increased investments in AI, reaching $12 billion in funding this year alone.

Prominent data annotation tools used across Japan include Labelbox, CVAT (Computer Vision Annotation Tool), and RectLabel. Labelbox, in particular, has gained significant traction and is considered the most prominent tool in the country, having been adopted by over 1,500 companies as of 2023. Key end users of these tools are industries such as automotive, healthcare, retail, and robotics. For instance, the autonomous vehicle sector, which has produced over 5,000 prototype self-driving cars this year, relies heavily on annotated data for training machine learning models.

Several factors are enabling the strong growth momentum of the data annotation tools market in Japan. The government's "Society 5.0" initiative aims to create a super-smart society by integrating cyberspace with physical space, driving the need for advanced AI technologies. Additionally, Japan is facing a labor shortage, with the working-age population decreasing by 800,000 people in 2023, prompting companies to adopt AI solutions to maintain productivity. On the micro level, over 300 AI startups have been established in Japan since the beginning of the year, each requiring high-quality annotated data. Macro-level aspects include international collaborations, such as Japan's partnership with ASEAN countries on AI development, involving investments totaling $2 billion in 2023.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Rapid AI Integration Across Japanese Industries Boosting Tool Demand

In 2023, Japan has seen a remarkable acceleration in the integration of artificial intelligence (AI) across various industries, significantly boosting the demand for data annotation tools. The country's manufacturing sector, for instance, has implemented AI technologies in over 65,000 factories to optimize production processes and improve quality control. The automotive industry, a cornerstone of Japan's economy, has deployed AI in the development of autonomous vehicles, with over 15,000 AI-powered cars tested on public roads this year. This widespread adoption of AI necessitates vast amounts of accurately annotated data, propelling the data annotation tools market forward.

The healthcare industry has also embraced AI solutions, with over 500 hospitals utilizing AI for diagnostic imaging and patient data analysis in 2023. These applications require meticulously annotated medical data to train machine learning models effectively. Additionally, the retail sector has deployed AI-driven customer service bots in over 2,000 stores nationwide, enhancing customer experience through personalized interactions. The finance industry follows suit in the data annotation tools market, with more than 100 banks implementing AI for fraud detection and risk assessment, all relying heavily on high-quality annotated datasets. Government initiatives further amplify this trend. The Japanese government's "Society 5.0" vision promotes the fusion of cyberspace and physical space, leading to increased investments in AI. In 2023, the government allocated approximately $4 billion towards AI research and development, including substantial funding for data annotation technologies. Collaborations between academia and industry have produced over 1,200 AI-related patents this year, emphasizing the critical role of data annotation in advancing AI capabilities across sectors.

Trend: Adoption of Automated Annotation Tools with AI Capabilities

The Japanese data annotation tools market in 2023 is witnessing a significant shift towards automated annotation tools enhanced with AI capabilities. These tools have been adopted by over 70% of AI-focused companies in Japan, reflecting their effectiveness in handling large datasets with increased efficiency. For instance, a leading tech company reported that implementing automated annotation reduced their data processing time by 60%, allowing them to annotate over 1 million images in just three months.

Advancements in AI algorithms have enabled these tools to achieve accuracy levels comparable to manual annotation. In natural language processing, automated tools can now accurately annotate complex Japanese text, with error rates dropping below 2% in 2023. The automotive industry benefits from automated video annotation, processing over 500,000 hours of driving footage to improve autonomous driving systems. Similarly, the medical field utilizes automated tools to annotate vast amounts of imaging data, aiding in the early detection of diseases. The surge in big data analytics has driven the need for scalable annotation solutions. Japan's data generation reached an estimated 800 exabytes in 2023, necessitating more efficient annotation methods. Investments in automated annotation technologies have exceeded $1 billion this year, with over 150 startups entering the market to offer innovative solutions. Educational institutions have also integrated automated annotation into their AI curricula, preparing a workforce proficient in these advanced tools.

Challenge: Data Privacy Concerns Impacting Data Sharing and Usage

In 2023, data privacy concerns have emerged as a significant challenge impacting the data annotation tools market in Japan. With the introduction of stricter regulations under the amended Act on the Protection of Personal Information (APPI), companies face heightened scrutiny over data handling practices. There have been over 100 reported cases of data breaches this year, leading to increased public awareness and concern regarding personal data usage in AI applications. These privacy concerns have prompted companies to adopt more secure data annotation practices. Over 500 firms have invested in privacy-preserving technologies such as federated learning and differential privacy to protect sensitive information during the annotation process. The financial sector, dealing with highly confidential data, has seen a 40% increase in spending on secure annotation tools in 2023. Healthcare institutions are also affected, with over 200 hospitals implementing stringent data anonymization protocols before engaging in data annotation.

Consumer trust is at stake, as surveys indicate that 85% of Japanese citizens in the data annotation tools market are cautious about how their data is utilized, especially in AI systems. This sentiment affects data availability, as individuals are more reluctant to consent to data sharing. Consequently, the volume of accessible data for annotation purposes has decreased by approximately 20% compared to the previous year. Companies are now challenged to find a balance between leveraging data for AI development and respecting privacy regulations, which adds complexity to the data annotation process and may slow down AI project timelines.

Segmental Analysis

By Technology

Supervised technology maintains its dominance in Japan's data annotation tools market in 2023 due to its reliability and the high accuracy it offers in training AI models. The technology captured over 57.4% revenue share of the market in 2023. Industries such as automotive and robotics require precise annotations to ensure the safety and functionality of AI systems. For example, Japan's robotics industry, which produced over 500,000 units this year, relies on supervised learning for tasks ranging from assembly line automation to elderly care robots. These applications necessitate accurately labeled datasets to perform complex functions in real-world environments.

The higher demand for supervised technology over semi-supervised and automatic methods is driven by the critical nature of applications in sectors like healthcare, where diagnostic accuracy can impact patient outcomes. Over 600 medical AI devices approved in Japan data annotation tools market use supervised learning models trained on meticulously annotated data. Financial institutions, numbering over 400 major entities, utilize supervised models for fraud detection and risk management, where errors can have significant financial repercussions. Wherein, some of the primary end users of supervised technology include large corporations and research institutions that prioritize precision over cost and time savings. Factors influencing this demand include Japan's cultural emphasis on quality and perfection, coupled with regulatory standards that mandate high accuracy levels in AI applications. Furthermore, government support through funding and policies encourages the use of supervised learning. In 2023, the Japanese government allocated approximately $2.5 billion to AI projects that primarily utilize supervised technologies, reinforcing their dominance in the market.

By Type

Text has established itself as the most prominent type in Japan's data annotation tools market as of 2023 with revenue share of more than 33.8%, driven by several key factors. One primary driver is the exponential growth of natural language processing (NLP) applications within the country. Japan's unique linguistic characteristics, including the use of Kanji, Hiragana, and Katakana scripts, require specialized text annotation efforts to train AI models effectively. The Japanese NLP market reached a value of approximately 400 billion yen in 2023, highlighting the substantial investment in text-based AI technologies. Furthermore, the proliferation of AI-powered customer service chatbots in industries such as retail and finance necessitates extensive text annotation. For example, over 70,000 chatbots are estimated to be in use across Japan's service sectors, all relying heavily on accurately annotated text data to function seamlessly.

Key primary end-users in the data annotation tools market driving this demand include technology companies, financial institutions, and e-commerce platforms. Major corporations like NTT Data and Fujitsu are investing in AI research that predominantly focuses on text data processing. The banking sector, managing assets worth over 1,000 trillion yen, utilizes text annotation for fraud detection and compliance. Additionally, Japan's e-commerce industry, with sales exceeding 20 trillion yen in 2023, leverages annotated customer reviews and feedback for sentiment analysis and personalized marketing. Another influencing factor is the significant amount of textual data generated from social media and messaging platforms. With over 85 million social media users in Japan, companies are utilizing AI to analyze text-based user interactions for market insights, necessitating extensive annotation efforts. The telecommunications industry, serving over 180 million mobile subscriptions, generates vast quantities of text messages and logs that require annotation for network optimization and customer service improvement.

By End Users

The telecommunication industry in Japan commands a significant portion of the data annotation tools market revenue, accounting for over 27.9% as of 2023. This dominance is driven by the industry's aggressive adoption of artificial intelligence (AI) and machine learning (ML) technologies, which are integral for advancing communication networks, enhancing customer experiences, and optimizing operational efficiency. The sector generates massive volumes of data from various sources such as user interactions, service usage patterns, and network performance metrics. To harness this data effectively, companies require sophisticated data annotation tools to label and categorize information, enabling AI algorithms to learn and make informed decisions. For instance, leading telecom companies like NTT Docomo and SoftBank are heavily investing in AI-powered services, necessitating extensive use of data annotation tools to develop applications like virtual assistants, fraud detection systems, and predictive maintenance solutions.

Several factors contribute to the IT and telecommunication industry's higher consumption of data annotation tools compared to other sectors like BFSI, healthcare, and retail. Firstly, the complexity and scale of data in this industry are unparalleled, with billions of data points generated daily from internet usage, call records, and messaging services. Japan data annotation tools market, being one of the world's most technologically advanced countries, has over 100 million mobile subscribers, each contributing to the data pool that requires annotation. Moreover, the nationwide rollout of 5G networks has accelerated the deployment of Internet of Things (IoT) devices, increasing the demand for annotated data to support advanced analytics and automation. The government’s initiatives, such as the "Society 5.0" program, aim to integrate cyberspace and physical space, further propelling the need for AI and, consequently, data annotation tools. Additionally, the IT and telecommunication industry's commitment to innovation drives continuous investment in AI research and development, solidifying its dominance in the data annotation tools market.

By Device Type

Based on device type, the Mac OS operated devices currently leading the market by accounting for over 49% market share. The preference for Mac OS in Japan's data annotation tools market is significantly influenced by its seamless integration with advanced AI development environments. Mac OS offers robust support for popular AI and machine learning frameworks such as TensorFlow and PyTorch, which are extensively used by Japan's thriving AI industry. According to the Ministry of Economy, Trade and Industry (METI), Japan's AI market is projected to reach 2.1 trillion yen by 2025, highlighting the rapid growth in this sector. In 2023, there are over 10,000 AI-focused companies operating in Japan, many of which prefer Mac OS for its UNIX-based architecture that facilitates compatibility with various development tools. Additionally, the number of data scientists and AI specialists in Japan has surpassed 50,000, with a significant segment favoring Mac devices for their performance and reliability.

Furthermore, Apple's M1 and M2 chipsets have attracted significant attention in Japan data annotation tools market due to their superior performance and energy efficiency. Benchmark tests conducted by tech firms in Tokyo demonstrated that Mac devices with M1 chips can process machine learning tasks up to three times faster than previous models. This performance boost is crucial for handling large-scale data annotation projects, which often involve datasets of several terabytes. In 2023, Japanese enterprises invested over 500 billion yen in upgrading their IT infrastructure, with a substantial portion allocated to Mac OS devices equipped with these advanced chipsets. Leading Japanese tech companies, such as Preferred Networks and SoftBank Robotics, have adopted Mac OS devices for their AI research teams, collectively deploying thousands of Mac units to enhance their data annotation capabilities.

To Understand More About this Research: Request A Free Sample

Top Companies in Japan Data Annotation Tools Market

- Annotate.com

- Appen Limited

- Cloud Factory Limited

- CloudApp

- Cogito Tech LLC

- Deep Systems

- Google Inc.

- Labelbox, Inc

- LightTag

- Lionbridge Technologies, Inc.

- Lotus Quality Assurance

- Playment Inc.

- Tagtog Sp.zo.

- Other Prominent Players

Market Segmentation Overview:

By Data Type:

- Text

- Sentiment

- Text Classification

- Entity

- Image

- Boundary Boxes

- Line Annotation

- Image Transcription

- Video

- Semantic

- Polygon

- Key point

- Audio

- Voice Activity Detection (VAD)

- Speaker Identification

- Automated Speech Recognition

By Technology:

- Supervised

- Semi-Supervised

- Automatic

By Device Type:

- Mac OS

- Windows

- Linux

- Others

By End Users:

- Automotive

- Healthcare

- Retail

- Transportation and logistics

- BFSI

- Telecommunication and IT

- Others

View Full Infographic

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2023 | US$ 142.7 Mn |

| Expected Revenue in 2032 | US$ 2,641.3 Mn |

| Historic Data | 2019-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Unit | Value (USD Mn) |

| CAGR | 38.3% |

| Segments covered | By Data Type, Technology, Device Type, and End Users. |

| Key Companies | Google, Inc., Amazon.com, Inc., Labelbox, Inc., Scale AI, Inc., Appen limited, Cogito Tech LLC, and other prominent players. |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA0322158 | Delivery: 2 to 4 Hours

| Report ID: AA0322158 | Delivery: 2 to 4 Hours

.svg)